Banking Sector Clean-Up Freezes Pharma CEO's Savings, Strains Business Operations

-

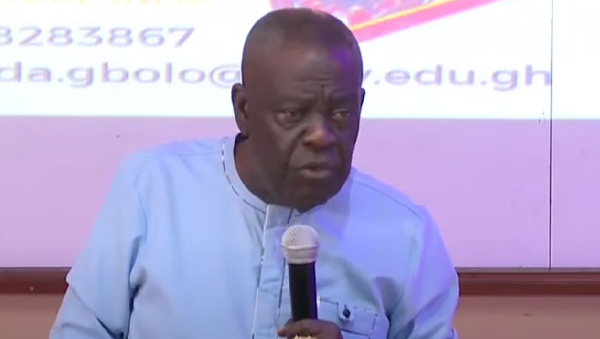

CEO of KAMA Group, Dr. Michael Agyekum Addo, lost his retirement savings due to the banking sector clean-up. He had saved for over 30 years to fund his pension.

-

One of Addo's companies, a leading pharmaceutical manufacturer in Tema, is facing operational difficulties due to his frozen funds. This has led to issues paying overhead costs.

-

Addo's story demonstrates the broader impact the banking sector clean-up has had on individuals and businesses across Ghana.

-

The clean-up, initiated in 2017, resulted in 23 banks remaining from an original 34. Additionally, hundreds of other financial institutions had their licenses revoked.

-

The total government expenditure on the banking sector clean-up reached approximately GH¢21 billion by 2020, higher than initial estimates. Affected institutions have legally challenged the license revocations.