Applied Materials Q3: ICAPS And Service Revenues Drive Surprising Resiliency (NASDAQ:AMAT)

The article mentions the stock of Applied Materials, Inc. (NASDAQ: AMAT). The author gives a recommendation to buy the stock.

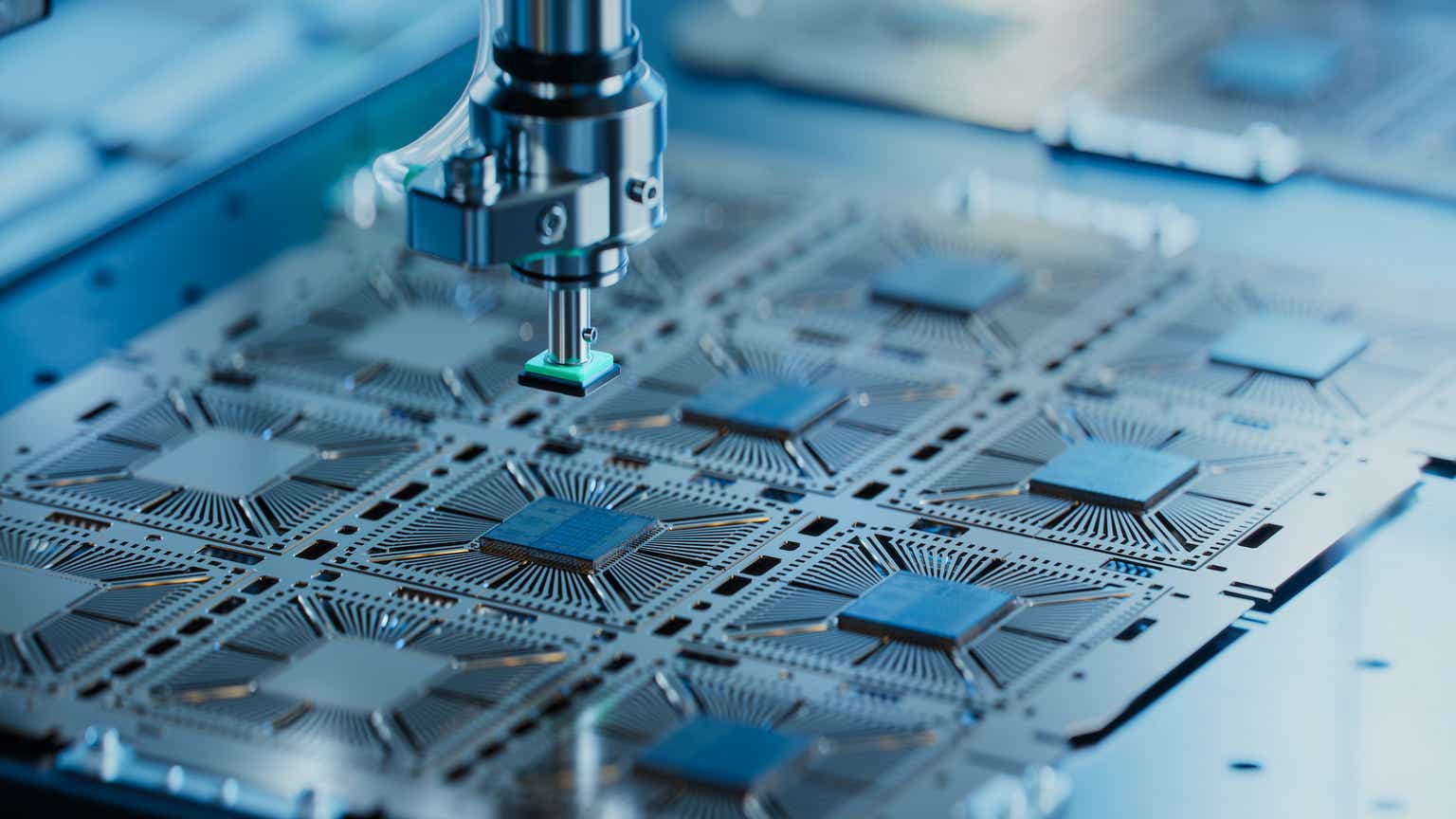

The author's core thesis is that Applied Materials has shown resilience in the semiconductor equipment industry and is expected to continue reporting resilient YoY growth rates. The author mentions that the company has a strong market position, comprehensive product portfolio, and revenue driven primarily by the semiconductor systems segment. They also highlight the company's commitment to research and development and its potential for long-term growth.

The key information and data mentioned in the article include Applied Materials' Q3 financial results, which beat Wall Street consensus and the author's own estimates. The company reported revenue of $6.43 billion, down 1.4% YoY but better than expected. The article also discusses the company's margin profile, earnings per share, cash flows, and dividend growth history. The author highlights the company's exposure to the ICAPS (IoT, communications, automotive, power, and sensors) segment, which has been driving its outperformance, and the growing importance of the services segment in stabilizing its revenue stream. The article also mentions the company's future outlook, guidance for Q4, and updated financial projections. The author provides a target price for the stock of $177, based on a forward P/E multiple of 20x and improved financial estimates.