Bank of Canada Likely to Keep Rates Unchanged But Signal Further Hikes Possible

-

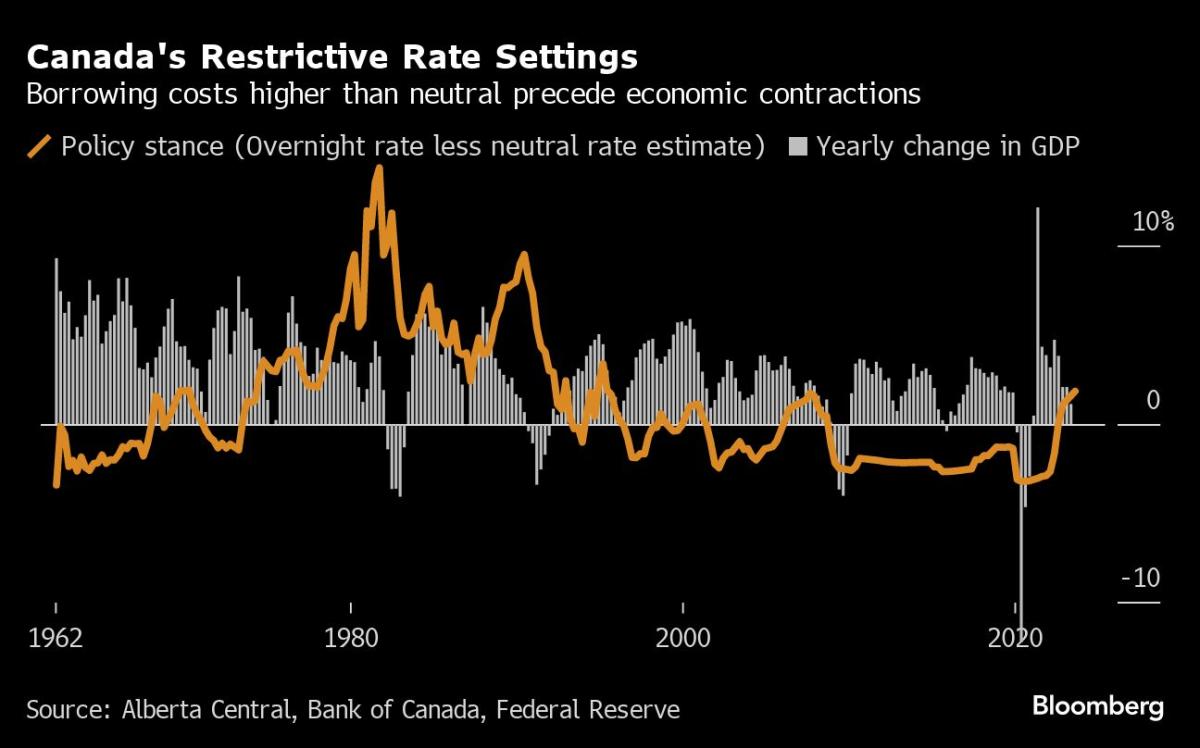

Bank of Canada expected to hold rates steady at 5% on Wednesday, but keep hawkish bias and leave door open for future hikes.

-

Growth is flatlining, unemployment rising, and inflation slowing, but core inflation still above target.

-

Bank wants to maintain flexibility for more hikes if needed, avoid constraining policy.

-

Forecasts likely to show very slow growth ahead, but bank's mandate is getting inflation to 2% target.

-

Higher long-term yields contributing to tighter conditions, but bank may need to hike more if inflation expectations become unanchored.