Treasury Market Faces Supply Squeeze as New Buyers Replace Fed and Foreigners

-

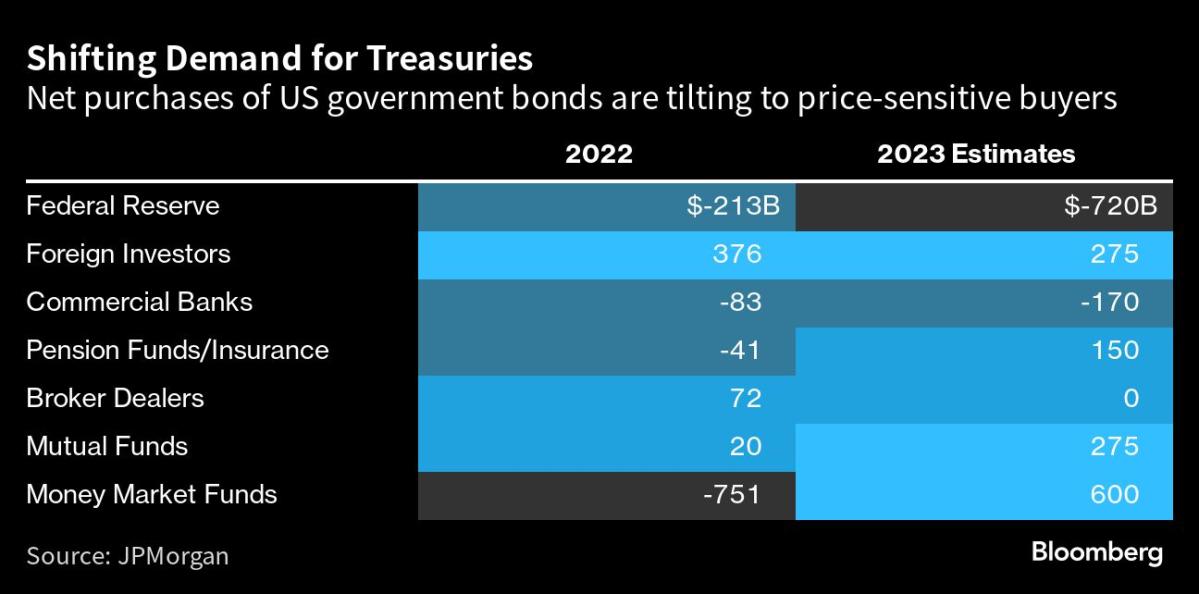

Foreign governments, US commercial banks, and the Federal Reserve are increasingly absent as steady Treasury bond buyers.

-

In their place, hedge funds, mutual funds, insurers and pensions are piling into Treasuries, likely demanding higher yields.

-

This new buyer base may add volatility and spur further losses in Treasuries, impacting borrowing costs economy-wide.

-

With debt sales surging amid swollen deficits, the changing demand dynamics come at an inopportune time.

-

The Fed's quantitative tightening is also reducing its role in the Treasury market just as supply pressures mount.