SoftBank shares rise after its chip unit Arm files for a Nasdaq listing, South Korea's consumer sentiment weakens for the first time in six months, Hong Kong's inflation rate slows more than expected, UBS identifies stocks that could drag the Stoxx Europe 600 down 10%, and the 10-year Treasury yield hits its highest level since 2007.

U.S. stocks surged on Wednesday, with the Nasdaq leading the way, fueled by optimism over Nvidia Corp.'s earnings and the S&P 500 ending its 36-day streak without a 1% gain.

Salesforce shares surged 6% in after-hours trading as the company exceeded Wall Street's expectations with strong quarterly results and increased guidance, driven by growth in all product categories and a focus on artificial intelligence.

Arm Holdings Ltd, owned by SoftBank Group Corp, is planning to launch its roadshow for investors after Labor Day and set a price range for its much-anticipated IPO in September, with SoftBank selling about 10% of Arm's shares at a valuation of $60 billion to $70 billion.

Arm, the chip design firm, has attracted interest from major technology companies such as Apple, Google, and Nvidia, as well as chip foundry operators Intel, Samsung, and TSMC, in its bid to go public on Nasdaq with a potential market capitalization of $52 billion and $5 billion in new cash.

Arm Holdings, owned by Softbank, has received investor demand that is six times the amount it is seeking in its $5 billion stock market debut, making it more likely to reach its targeted price range of $47 to $51 per share.

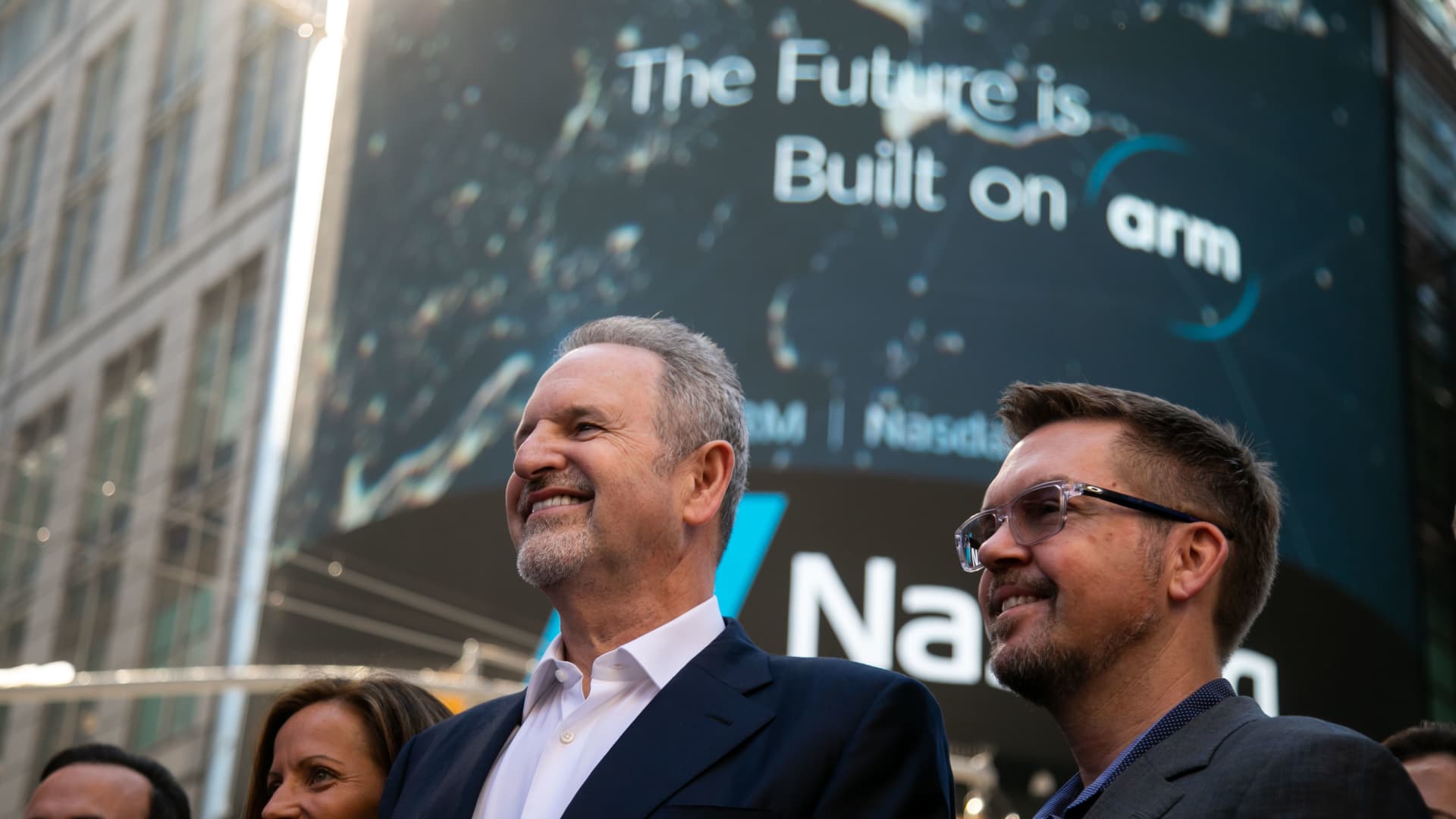

Arm Holdings stock begins trading on the Nasdaq at $51 per share, meeting expectations, while markets analyze inflation figures and the potential impact on the Federal Reserve's rate-setting policy.

UK-based chip designer Arm made its Nasdaq debut with the largest IPO since 2021, trading at $56 per share, bringing the company's market cap to nearly $60 billion, and opening the door for a wave of new IPOs.

Stocks surged as the Dow Jones Industrial Average rose, driven by strong performances from Goldman Sachs, Caterpillar, and Arm, while the tech-heavy Nasdaq and the S&P 500 also saw gains; strong consumer data and positive economic indicators contributed to the market's optimism.

SoftBank's initial public offering of Arm Holdings was a success, with the shares gaining 25% on their debut, although the company left potential profits on the table by pricing the IPO lower than it could have been.

Arm stock is experiencing a second day of gains and is currently more popular than Apple.

Arm Holdings' stock had a strong IPO, but recent sell-offs and high valuations have raised concerns about its future performance, leading to a "Sell" rating and a price target of $46 per share from Bernstein analyst Sara Russo. While Arm is a frontrunner in the semiconductor industry and has value in its architecture, investors should temper their expectations, as its exposure to AI is limited compared to companies like Nvidia. Analyst ratings on ARM stock range from "Buy" to "Sell," with an average price target of $51.67, implying a potential downside of 2.3%.