US stocks may be facing further declines as Thursday's selloff, despite strong earnings from Nvidia, suggests that this year's rally may be "exhausted," according to analysts at Morgan Stanley.

The stock market sinks as a tech selloff occurs due to investors' fear of more Fed rate hikes, with Apple, Tesla, and Nvidia all experiencing significant declines.

US stocks are experiencing their worst performance in September since 1928, but there are signs that the market could avoid a steep downturn this year, with indicators suggesting more stability and positive gains for the rest of the year, according to Mark Hackett, chief of research at US investment firm Nationwide. However, challenges such as elevated oil prices and inflation could put strain on the stock market and the US economy.

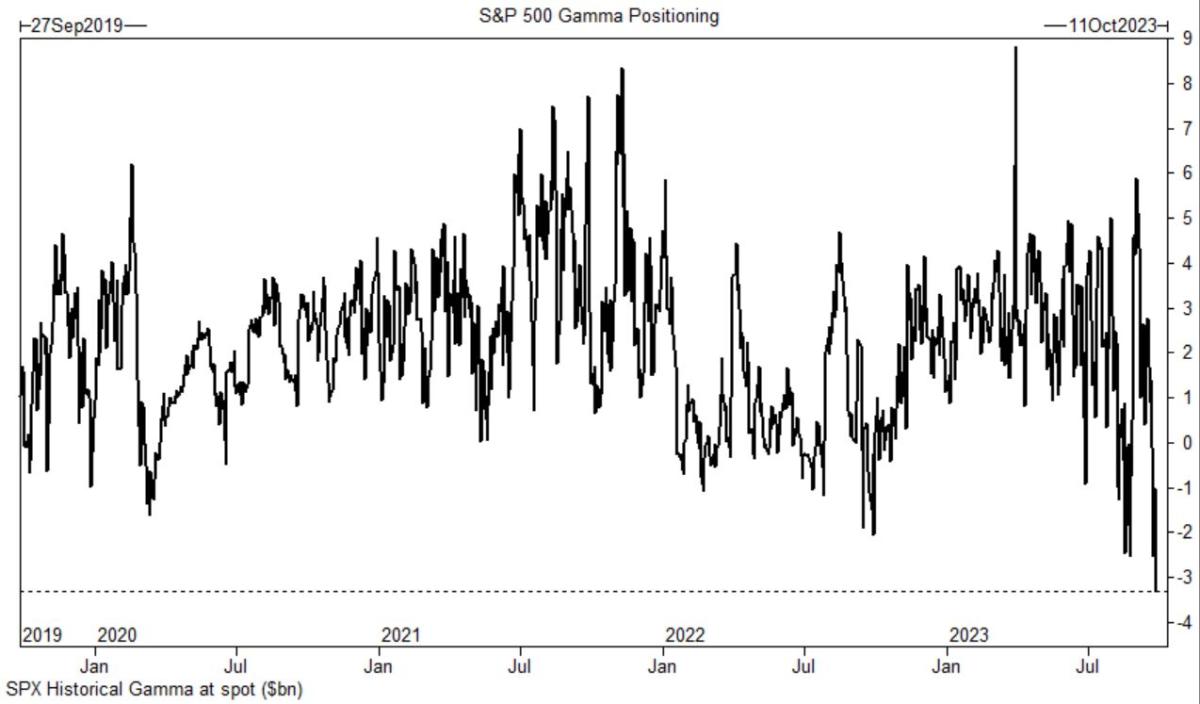

U.S. stock prices are in a danger zone that could trigger "mechanical selling" and accelerate a downward move, according to strategist Charlie McElligott, as surging Treasury yields and a hawkish Federal Reserve put pressure on growth stocks, potentially leading to options dealers selling stock futures and exacerbating the market weakness.

U.S. equity markets experienced their worst week since March as benchmark interest rates surged, causing concerns about tight monetary policy, a potential government shutdown, and trade tensions with China, resulting in losses for real estate equities and mortgage rates reaching their highest level since 2002.

US stocks are set for their worst monthly loss of 2023 as bond yields surge on fears of higher interest rates from the Federal Reserve.

Stock markets are experiencing their worst month of the year, as the Federal Reserve confirms its commitment to keeping interest rates higher for a longer period, leading to concerns about the Fed's hawkish stance continuing to weigh on stocks.

Stocks on Wall Street experienced a selloff as rising Treasury yields and hawkish comments from Federal Reserve policymakers put pressure on investors and dampened appetite for stocks, with the S&P 500 and Dow Jones Industrial Average both dropping around 1.1% and the Nasdaq Composite down over 1.5%; however, stocks somewhat recovered from their lows in midday trading as investors digested fresh comments from Cleveland Fed President Loretta Mester.

The Dow Jones Industrial Average is poised for its worst day in months as the stock market selloff continues, driven by losses in Goldman Sachs, Microsoft, and American Express.

Stocks are selling off due to concerns about a recession, but Goldman Sachs analysts have identified 24 top stock picks that they believe will provide strong risk-adjusted returns.

Investors are reducing their bets on a selloff in US stock futures, although it is uncertain if this marks the end of the downward trend.

The ongoing bond market selloff is causing the worst Treasury bear market in history, but investors are not panicking due to the orderly nature of the decline and the presence of institutional investors and shorter-term bonds as alternative options.

The selloff in Wall Street stocks accelerates as bond market turbulence and Middle East tension weigh on investor sentiment, with even megacap tech companies experiencing significant drops in stock value.

Wall Street ends its worst week in a month as the stock market struggles under the weight of high yields and the bond market, impacting borrowing costs and economic growth.