Stock markets worldwide experience declines amid concerns over the Chinese property market, rising US bond yields, and poor economic data in China and the UK.

The stock market experienced a sharp decline as early gains turned into a selloff, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all falling; concerns over rising bond yields and inflation contributed to the sell-off.

Despite concerns over the financial health of the US consumer, projections for a stock market decline may be unfounded as consumers have the capacity to spend, with low debt levels, significant assets, untapped home equity, low mortgage rates, and solid retail spending.

U.S. stock futures decline as bond yields rise despite weak economic news from China and Europe.

Stocks on Wall Street are expected to decline as concerns about inflation raise doubts about the Federal Reserve's decision to cut interest rates, while worries about crumbling demand and falling German industrial orders add to the uncertainty.

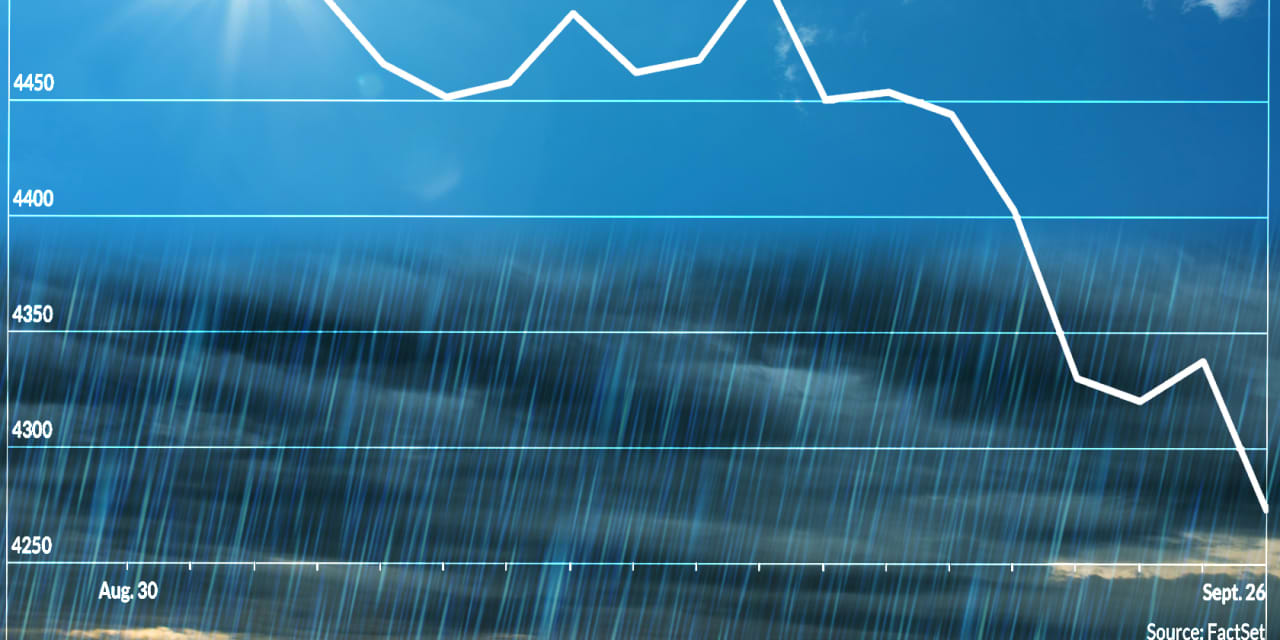

US stocks are experiencing their worst performance in September since 1928, but there are signs that the market could avoid a steep downturn this year, with indicators suggesting more stability and positive gains for the rest of the year, according to Mark Hackett, chief of research at US investment firm Nationwide. However, challenges such as elevated oil prices and inflation could put strain on the stock market and the US economy.

The US economy is facing a looming recession, with weakness in certain sectors, but investors should not expect a significant number of interest-rate cuts next year, according to Liz Ann Sonders, the chief investment strategist at Charles Schwab. She points out that leading indicators have severely deteriorated, indicating trouble ahead, and predicts a full-blown recession as the most likely outcome. Despite this, the stock market has been defying rate increases and performing well.

Stocks declined amid speculation that US inflation data will show persistent price pressures, increasing the likelihood that interest rates will remain elevated; market focus is on the US consumer price report.

U.S. stocks slumped after the Federal Reserve indicated that it may not cut interest rates next year as much as initially expected, causing concerns among investors on Wall Street.

The stock market experienced a correction as Treasury yields increased, causing major indexes to break key support levels and leading stocks to suffer damage, while only a few stocks held up relatively well; however, it is currently not a favorable time for new purchases in the market.

The stock market's decline has intensified recently, leading to concerns about how far it could fall.

US small-cap and industrial stocks are dropping, typically signaling a recession, but some investors are dismissing the moves as noise for now, with hope for stocks coming in the form of anticipated earnings season and the Federal Reserve's forecast of stronger economic growth.

Equity markets experienced a significant decline due to anticipated higher US interest rates, causing investor sentiment to be affected; meanwhile, oil prices remain within OPEC's preferred range, and the forex market is expecting a mixed performance from the pound and a strong US dollar.

Stock futures decline and Treasury yields rise as Wall Street believes the Federal Reserve will keep interest rates higher for longer.

The current stock market decline, driven by a "confluence of factors," does not indicate a financial crisis and presents an opportunity for investors to buy stocks, according to DataTrek Research.

Investors are concerned about the recent stock market decline due to surging oil prices, rising bond yields, and worries about economic growth, leading to a sell-off even in major tech companies and potentially impacting President Biden's approval ratings.

U.S. stocks and bonds are falling due to another surge in Treasury yields, leading to anxiety among investors who fear that the Fed will hold interest rates higher for longer if the labor market remains strong.

U.S. equity markets declined for a fourth-straight week while benchmark interest continued an unabating resurgence to fresh multi-decade highs as a looming government shutdown added complications to existing "higher-for-longer" concerns.

US stocks fell as investors worried about the impact of higher interest rates, with the Dow down nearly 1.5% and the S&P 500 and Nasdaq indexes also dropping. Concerns about the Federal Reserve's policy and its effect on the housing market and potential recession led to the market decline.

The stock market is currently dependent on the bond market, as stocks can only soar once bond prices increase and yield rates decrease, according to CNBC's Jim Cramer.

Utility stocks in the US experienced a sharp decline due to higher bond yields and the Federal Reserve's plan for elevated interest rates, causing investors to find utility dividends less attractive compared to risk-free Treasury yields.

The recent downturn in the stock market has investors concerned due to rising bond yields, political dysfunction, geopolitical risks, and the historical association of market crashes in October.

Stocks fell sharply in response to an increase in long-term Treasury yields, driven by misguided rhetoric from Fed officials and fears of higher inflation, despite economic data showing slowing growth, low job growth, and declining wage growth.

The U.S. stock market may not deserve to fall due to higher interest rates alone, as the belief that stock prices decline when interest rates rise can lead to erroneous assumptions, and the correlation between interest rates and inflation is crucial in determining stock market behavior.

The stock market is currently experiencing the most significant U.S. Treasury bond bear market in history, while JPMorgan's Chief Market Strategist predicts potential turbulence and a recession on the horizon; meanwhile, stocks opened lower on Friday morning after the September non-farm payrolls data, and U.S. futures are shaky as traders await the release of the Non-Farm Payrolls report, with experts predicting lower job additions and a potential fall in the unemployment rate.

Stock markets are wavering as investors anticipate another rate hike by the US Federal Reserve, fearing its impact on the global economy, however, recent inflation data suggests that inflation is declining and consumer spending is rising.

The US stock market experienced losses in the third quarter, driven by rising US Treasury yields, leading to a surge in the US dollar and a hostile environment for gold and silver; the fourth quarter may see a continuation of this trend if US yields continue to rise.

Stocks are defying factors that would normally cause them to fall, such as war in the Middle East and economic uncertainty, due to a decrease in bond yields and investors seeking safety in Treasuries.

Stocks are up and U.S. interest rate expectations are lower as a result of several Fed officials suggesting that rising yields may be helping their fight against inflation.

U.S. stocks are drifting lower and bond yields are rising following mixed economic reports, which provide no clear indication of future interest rate changes.

Stocks plummeted as Treasury yields rose, consumer prices increased, and a disappointing bond auction caused a decline in the broader stock market.

Stocks declined and bond yields surged after an underwhelming Treasury auction and higher-than-expected inflation reading raised concerns about higher interest rates.

US stocks fall as fears of war in the Middle East and hopes for stronger profits at big US companies collide in financial markets; oil prices rise and Treasury yields fall, creating uncertainty in the market.

Asian and European stock markets experienced sharp declines due to weak economic indicators from China and concerns about potential interest rate hikes in the United States.

The U.S. stock markets decreased due to rising Treasury yields and investor evaluations of corporate earnings, while Asian markets, including Japan's Nikkei 225 and Australia's S&P/ASX 200, also experienced declines; the European STOXX 600 index and Germany's DAX also decreased, while crude oil, gold, and silver prices fell.

Despite the current strong rally, the American stock market is not expected to reclaim its previous peak in the near future due to geopolitical risks, uncertainty about inflation and interest rates, and political dysfunction in Washington, resulting in a slow grind lower, leaving room for both bullish and bearish sentiments.

The surge in bond yields is causing losses for investment funds and banks, pushing up borrowing costs globally and impacting stock markets, while the dollar remains stagnant and currency traders predict a recession on the horizon.

U.S. stock markets ended lower as treasury yields continued to climb, with the 10-year note reaching its highest level in 16 years, while Asian markets also saw declines.

US stock futures declined as the benchmark 10-year Treasury yield surpassed 5%, causing investors to anticipate higher interest rates for a longer period and adding to concerns over escalating Middle East tensions, as the market awaits earnings reports from Big Tech companies.

World shares and oil prices are declining ahead of an update on the US economy, with high interest rates taking a toll on stocks and the housing market, and uncertainty over the economic outlook impacting global markets.

Global stocks fall and US Treasury yields retreat as investors analyze mixed US economic and corporate signals, with weaker-than-expected US inflation and disposable income data pushing down Treasury yields and sparking concerns of further interest rate hikes by the Fed.

Despite positive economic news, the stock market experienced a decline due to the realization that interest rates are likely to remain high, resulting in a decrease in stock valuations; however, the market is expected to rebound in the long term due to strong earnings growth and a solid economic foundation.