Chip stocks, including Nvidia, experienced a selloff in the technology sector despite Nvidia's strong performance, leading to concerns that spending on AI hardware may be affecting traditional chip companies like Intel.

Intel Corporation's stock has increased by 50% since reaching a bottom below $25, but it is still in a downtrend and must surpass the $40 to $42 resistance level to enter an uptrend; despite its negative sentiment, the company is expecting higher earnings per share in the future and offers a cheap valuation compared to its competitors.

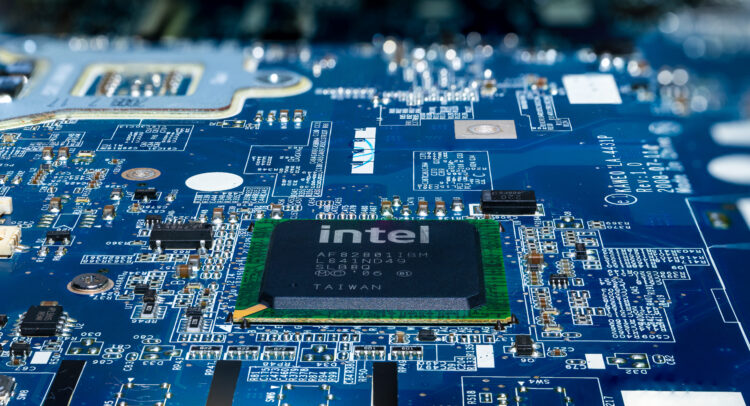

Intel's stock rose nearly 2% after CEO Pat Gelsinger expressed optimism about the company's current quarter and announced the launch of a new data center chip.

Shares of Intel rose nearly 3% after CEO Pat Gelsinger announced that the chip maker had exceeded its revised Q3 revenue guidance, with a resumption in demand for personal computer processors driving the boost. Gelsinger also expressed optimism about Intel's entry into the foundry business, highlighting the potential for substantial growth and the prepayment received from a major customer for its manufacturing capacity. The company's emphasis on advanced packaging capabilities is expected to significantly benefit the foundry business, while analysts currently hold a consensus rating of "Hold" on Intel stock.

Advanced Micro Devices (AMD) stock is rising as investors recognize its potential in the artificial intelligence (AI) hardware market, making it a strong competitor to Nvidia, especially with the launch of its M1300X AI chip in the third quarter of 2023.

Intel stock is performing well despite concerns about the U.S.-China chip war.

Intel's stock is rising as an analyst suggests investors should pay attention to the company's efforts in artificial intelligence.

Intel showcased its upcoming processors, including Arrow Lake, Lunar Lake, and Panther Lake, at its Innovation conference, signaling a renewed focus on engineering-led innovation in an effort to compete with Apple's M series processors and regain chipmaking leadership.

Intel's stock drops as analysts express skepticism about the company's ability to compete with Nvidia in artificial intelligence.

The rise of artificial intelligence is creating attractive investment opportunities in chip stocks, according to Truist Securities.

Shares of Intel rose amid a market sell-off due to positive commentary from a Wall Street analyst and a semiconductor-focused Asian news publication, suggesting that Intel's turnaround plans are on track and its new server chip, Sapphire Rapids, is ramping up in volume. Investors are cautiously optimistic about Intel's potential upside but should monitor new product execution announcements and earnings calls.

Intel plans to operate its programmable chip unit as a standalone business and hold a public offering for stock in the business within the next few years, with the goal of creating more value for investors and focusing on core competencies.

Intel announces plans for an IPO of its programmable chip unit, resulting in a rise in Intel stock.