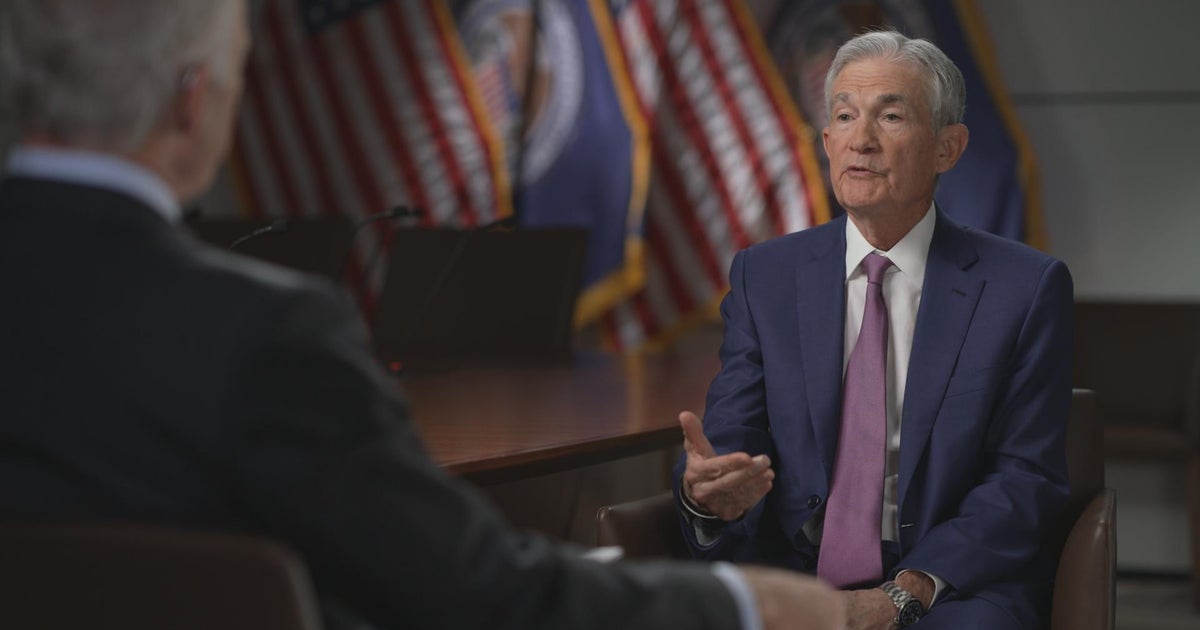

Fed Chief: Inflation Improving but Rate Cuts Not Imminent, Citing Still-Strong Economy and Labor Market

-

Inflation has come down over the past year, but the job is not done and the Fed remains committed to fully restoring price stability.

-

The Fed wants to see more evidence that inflation is moving sustainably down to 2% before cutting interest rates, likely not at the March meeting.

-

The economy and labor market remain strong, with solid growth and low unemployment, allowing the Fed to carefully approach rate cuts.

-

Geopolitical risks, including the war in Ukraine, represent the biggest near-term threat to the global economy.

-

Powell believes U.S. engagement with the world has provided enormous economic benefits and hopes American leadership continues.