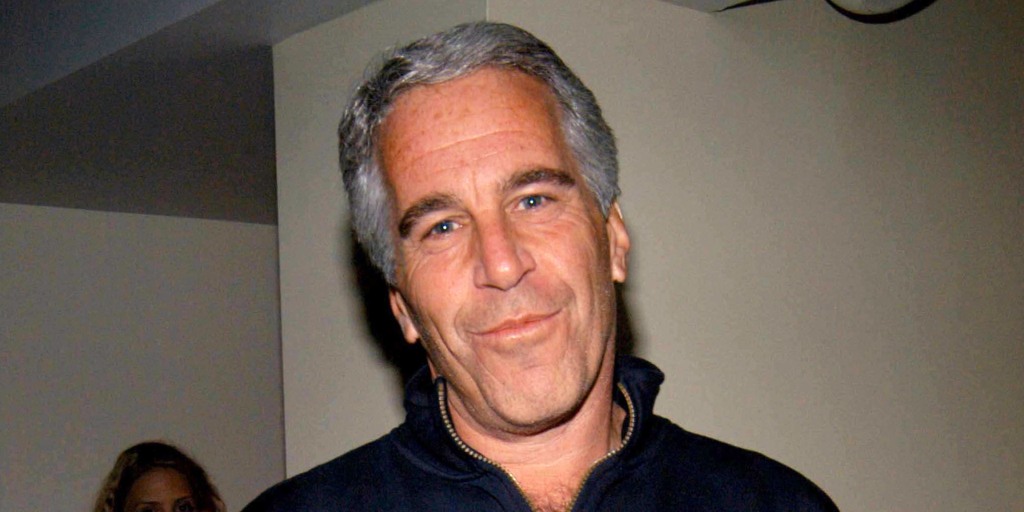

Main Topic: Jeffrey Epstein referred former Obama White House counsel Kathryn Ruemmler to JPMorgan Chase as a client in 2019.

Key Points:

1. Epstein's assistant emailed a JPMorgan Chase executive recommending Ruemmler as a customer.

2. JPMorgan Chase terminated Epstein as a client in 2013, but he referred several ultra-wealthy clients to the bank.

3. The U.S. Virgin Islands is suing the bank, alleging it facilitated Epstein's sex trafficking enterprise and failed to report suspicious financial activity.

JPMorgan Chase plans to invest $1 billion or more per year in artificial intelligence, despite anticipating a "relatively subdued" year in investment banking.

JPMorgan is developing a blockchain-based solution for cross-border transactions called deposit tokens, which will allow settlements between banks for corporate clients, pending regulatory approval.

JP Morgan Chase will pay $75 million to the US Virgin Islands to settle claims that the bank enabled Jeffrey Epstein's sex trafficking, with a majority of the settlement going towards local charities and services for Epstein's survivors.

JPMorgan agrees to pay $75 million to settle allegations that it facilitated Jeffrey Epstein's human trafficking operations, adding to the substantial costs incurred by the scandal that involved other prominent industry figures and banks, but with little long-term impact on Wall Street.

JPMorgan executes its first live blockchain-based collateral settlement transaction using its Ethereum-based Onyx blockchain and Tokenized Collateral Network, Coinbase's legal fight over the status of crypto faces new challenges, and a former CEO testifies against FTX's founder in a fraud case.