- Jensen Huang, CEO of Nvidia, is heavily involved in the day-to-day operations of the company, including reviewing sales representatives' plans for small potential customers.

- Huang has an unusually large number of direct reports, with about 40 individuals reporting directly to him.

- This is significantly more than most CEOs in the technology industry and surpasses the combined number of direct reports for Mark Zuckerberg and Satya Nadella.

- Huang's deep involvement in the company's operations reflects his hands-on approach and commitment to the success of Nvidia.

- This level of involvement may contribute to Nvidia's success in the artificial intelligence industry.

### Summary

Nvidia's weakened processors, designed for the Chinese market and limited by US export controls, are still more powerful than alternatives and have resulted in soaring Chinese orders worth $5 billion.

### Facts

- The US imposed restrictions to limit China's development of AI for military purposes, including blocking the sale of advanced US chips used in training AI systems.

- Despite being deliberately hobbled for the Chinese market, the latest US technology available in China is more powerful than before.

- Chinese internet companies have placed $5 billion worth of orders for Nvidia's chips, which are used to train large AI models.

- The global demand for Nvidia's products is likely to drive its second-quarter financial results.

- There are concerns that tightening export controls by the US may make even limited products unavailable in the future.

- Bill Dally, Nvidia's chief scientist, anticipates a growing gap between chips sold in China and those available elsewhere in the world, as training requirements for AI systems continue to double every six to 12 months.

- Washington set a cap on the maximum processing speed and data transfer rate of chips sold in China.

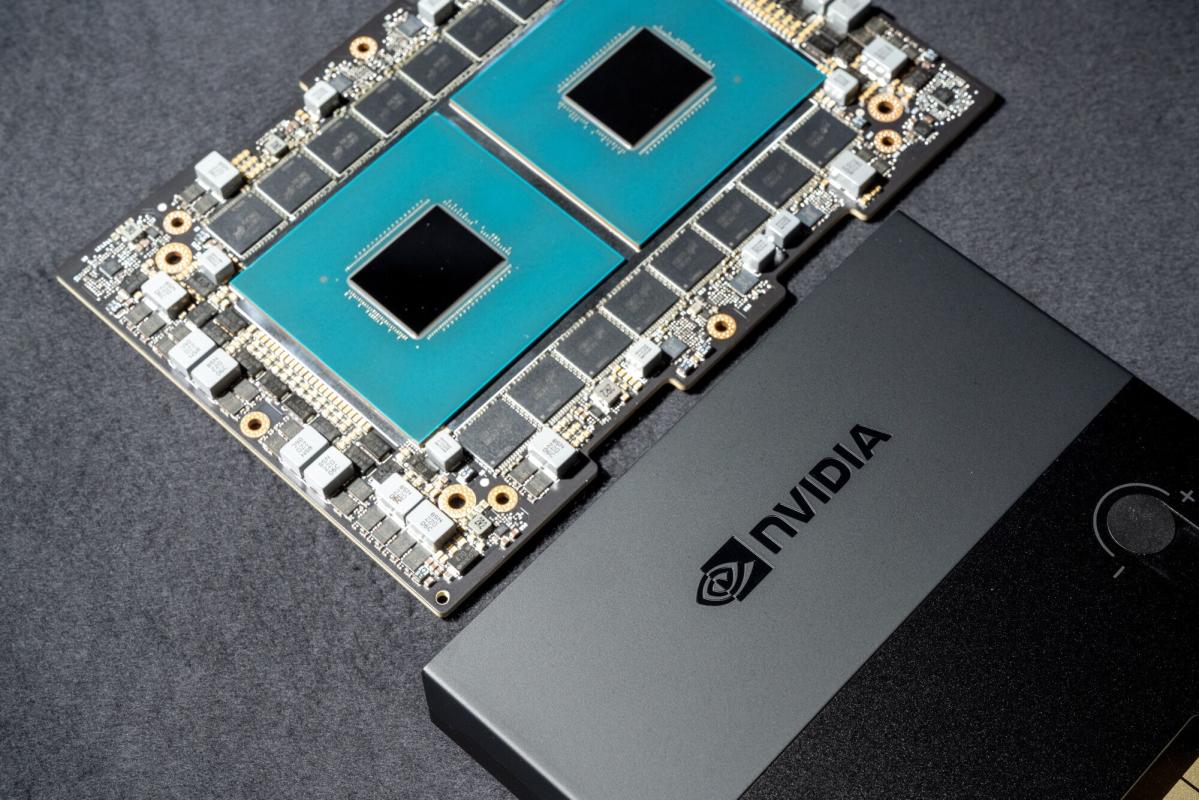

- Nvidia responded by creating processors with lower data transfer rates for the Chinese market, such as the A800 and H800.

- The H800 chips in China have a lower transfer rate of 400GB/s compared to 600GB/s set by the US, but they are still more powerful than chips available elsewhere.

- The longer training times for AI systems using these chips increases costs and energy consumption.

- Chinese tech companies rely on Nvidia's chips for pre-training large language models due to their efficiency.

- Nvidia's offering includes the software ecosystem with its computing platform, Cuda, which is part of the AI infrastructure.

- Analysts believe that Chinese companies may face limitations in the speed of interconnections between the chips, hindering their ability to handle increasing amounts of data for AI training and research.

Nvidia has established itself as a dominant force in the artificial intelligence industry by offering a comprehensive range of A.I. development solutions, from chips to software, and maintaining a large community of A.I. programmers who consistently utilize the company's technology.

Main Topic: Opportunities for semiconductor startups in the AI chip market

Key Points:

1. Nvidia is currently the leading provider of AI accelerator chips, but it cannot keep up with demand.

2. Startups focusing on AI acceleration in the data center and edge computing have the opportunity to compete with Nvidia.

3. Established companies like Cerebras Systems and Tenstorrent are gaining traction in the market with their unique AI hardware solutions.

Nvidia's CEO, Jensen Huang, predicts that the artificial intelligence boom will continue into next year, and the company plans to ramp up production to meet the growing demand, leading to a surge in stock prices and a $25 billion share buyback.

Semiconductor stocks in Asia, including Taiwan Semiconductor Manufacturing Corp and Samsung Electronics, surged following Nvidia's strong quarterly results and optimistic guidance, driven by the demand for AI chips used in data centers and artificial intelligence applications.

Nvidia, the AI chipmaker, achieved record second-quarter revenues of $13.51 billion, leading analysts to believe it will become the "most important company to civilization" in the next decade due to increasing reliance on its chips.

Nvidia's dominance in the AI chip market and its reliance on a single manufacturer, TSMC, poses potential risks due to manufacturing disruptions and geopolitical tensions with Taiwan.

The U.S. has expanded export restrictions of Nvidia artificial-intelligence chips beyond China to other regions, including some countries in the Middle East, citing national security concerns.

Nvidia's processors could be used as a leverage for the US to impose its regulations on AI globally, according to Mustafa Suleyman, co-founder of DeepMind and Inflection AI. However, Washington is lagging behind Europe and China in terms of AI regulation.

Indian Prime Minister Narendra Modi met with NVIDIA founder and CEO Jensen Huang to discuss AI technology and India's potential in the field, highlighting the growing relationship between NVIDIA and India's technology industry.

Nvidia's rapid growth in the AI sector has been a major driver of its success, but the company's automotive business has the potential to be a significant catalyst for long-term growth, with a $300 billion revenue opportunity and increasing demand for its automotive chips and software.

Reliance Industries's Jio Platforms has partnered with Nvidia to build a large language model trained on India's diverse languages, as well as an AI infrastructure that is more powerful than the fastest supercomputer in India, aiming to boost India's presence in the global AI arena.

India's Tata Group is expected to announce a partnership with U.S. chip firm Nvidia to develop AI technologies.

India is set to become a global AI powerhouse, as companies like Reliance Industries and Tata Group partner with NVIDIA to bring AI technology and skills to the country to address its greatest challenges.

Nvidia and Amazon, both of which recently underwent stock splits, are positioned for long-term growth in the AI industry due to their focus on infrastructure and strong economic moats, with Amazon being the safer pick due to its diversified business model and cost-cutting efforts.

Nvidia's record sales in AI chips have deterred investors from funding semiconductor start-ups, leading to an 80% decrease in US deals, as the cost of competing chips and the difficulty of breaking into the market have made them riskier investments.

India's booming startup ecosystem is competing fiercely in the field of generative AI, with chipmaker NVIDIA experiencing exponential stock growth as a result.

NXP Semiconductors, a Dutch-Texan semiconductor giant, is positioned to benefit from the AI market due to its experience in automotive computing, edge computing, and smart home devices, making it an undervalued and lower-cost alternative to chip designer Nvidia.

Recent developments in generative AI have sparked a gold rush, with big tech companies like Amazon and Google announcing upgrades to their voice-controlled digital assistants, Alexa and Bard, respectively, while Nvidia sees the potential of India becoming one of the largest AI markets in the world.

Nvidia is targeting the advertising industry as one of its next big markets, providing chips and software to companies like WPP, Media.Monks, and Taboola to meet the rising demand for AI solutions.

AMD CEO Dr. Lisa Su believes that the field of artificial intelligence (AI) is moving too quickly for competitive moats to be effective, emphasizing the importance of an open approach and collaboration within the ecosystem to take advantage of AI advancements. While Nvidia currently dominates the AI market, Su suggests that the next 10 years will bring significant changes and opportunities for other companies.

NVIDIA Corp., a major player in artificial intelligence, has experienced significant growth in the AI space and has become a valuable investment opportunity, with analysts believing that its stock price of $1,000 per share is within reach.

Chipmaker Nvidia, the current leader in the AI chip market, is facing competition from rival AMD, which aims to gain a significant share of the market and potentially displace Nvidia as the industry leader, as the demand for AI-friendly processors continues to grow and the AI revolution unfolds.

The rise of artificial intelligence (AI) technologies, particularly generative AI, is causing a surge in AI-related stocks and investment, with chipmakers like NVIDIA Corporation (NVDA) benefiting the most, but there are concerns that this trend may be creating a bubble, prompting investors to consider focusing on companies that are users or facilitators of AI rather than direct developers and enablers.

Nvidia's dominance in the AI chip market, fueled by its mature software ecosystem, may pose a challenge for competitors like AMD who are seeking to break into the market, although strong demand for alternative chips may still provide opportunities for AMD to succeed.

Nvidia has established itself as the main beneficiary of the artificial intelligence gold rush, but other companies involved in data-center infrastructure and cloud services are also expected to benefit.

The US is reportedly expanding its restrictions on the export of AI-capable semiconductor chips to China, which could put pressure on chipmaker Nvidia, a company that earns nearly one-fifth of its revenue from Chinese sales.

Nvidia's high-end AI chips for the Chinese market, as well as one of its top gaming chips, will be blocked for sale due to new U.S. export restrictions aimed at preventing the transfer of cutting-edge technologies to China.

Investors are eyeing the tech sector, particularly Nvidia (NVDA), as it stands out due to its strong balance sheet, substantial cash reserves, and its position as the largest provider of chips in the AI space, making it a favorable investment option even in a slowing economy.

The Biden administration's crackdown on advanced semiconductors, including Nvidia's AI processors, threatens the company's lucrative business in China and reflects a shift in the West's attitude toward China as a potential military threat due to its actions in Ukraine and Taiwan.

The Biden administration's new restrictions on Nvidia's AI chip shipments to China have negatively impacted the country's startups and led to increased venture capital raising for costly AI endeavors, while Chinese giants like Baidu continue to pursue their AI ambitions by unveiling their own models.