Nvidia investors expect the chip designer to report higher-than-estimated quarterly revenue, driven by the rise of generative artificial intelligence apps, while concerns remain about the company's ability to meet demand and potential competition from rival AMD.

Nvidia shares reach an all-time high due to high expectations for its quarterly results, driven by its dominance in the booming artificial intelligence market.

Nvidia's upcoming earnings report, expected to show a 65% increase in revenue, could have a significant impact on global stock markets and sentiment around the AI industry.

Nvidia's impressive second quarter earnings have further solidified the bullish trend for AI-related cryptocurrencies, causing tokens such as FET, GRT, INJ, RNDR, and AGIX to surge by over 4% in the past 24 hours.

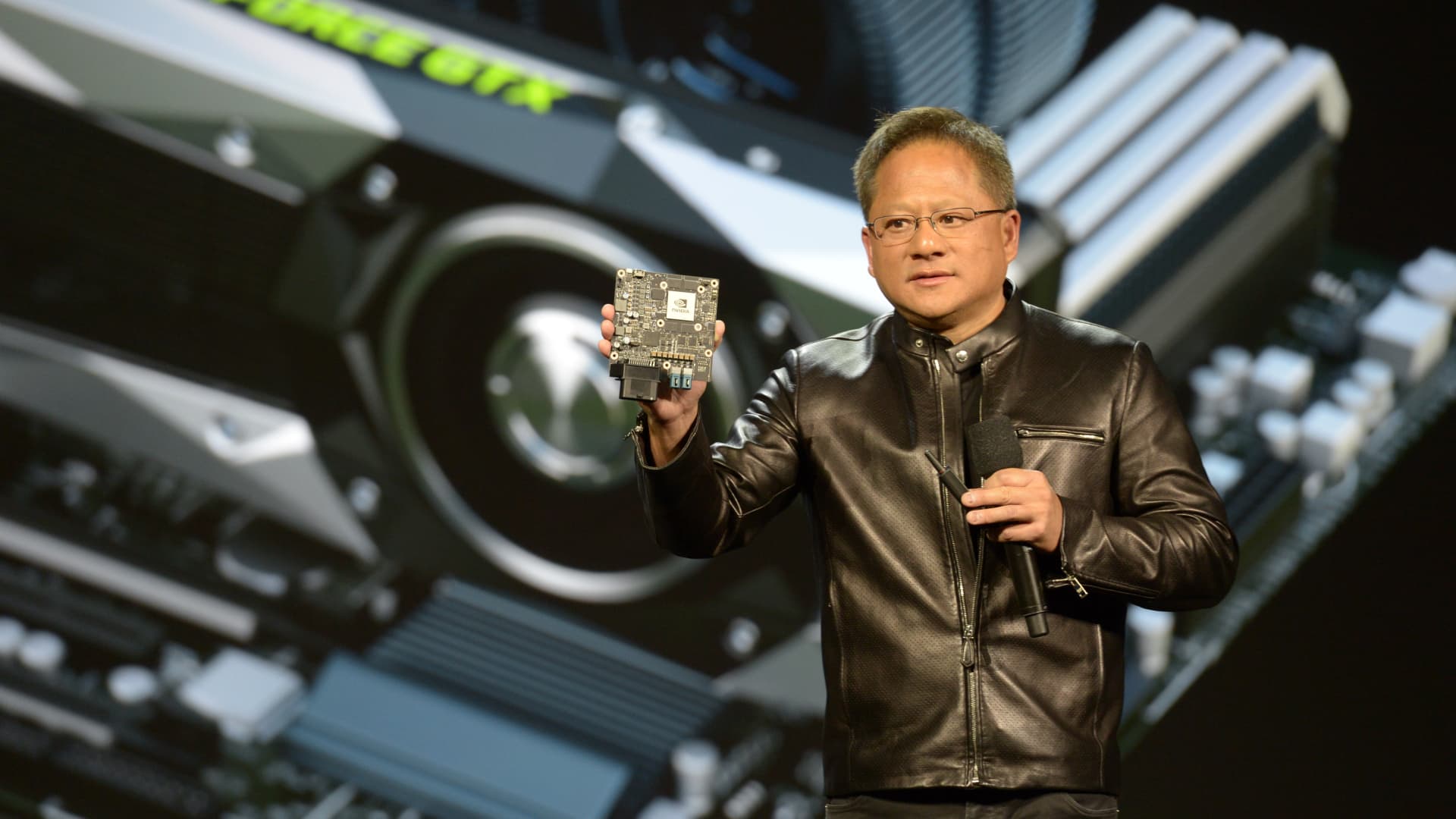

Nvidia's CEO, Jensen Huang, predicts that the artificial intelligence boom will continue into next year, and the company plans to ramp up production to meet the growing demand, leading to a surge in stock prices and a $25 billion share buyback.

Nvidia's sales have doubled, reaching a record high of $13.5 billion, driven by increasing demand for its AI chips, and the company expects sales to continue to rise, with plans to buy back $25 billion of its stock.

Nvidia, the AI chipmaker, achieved record second-quarter revenues of $13.51 billion, leading analysts to believe it will become the "most important company to civilization" in the next decade due to increasing reliance on its chips.

Nvidia has reported explosive sales growth for AI GPU chips, which has significant implications for Advanced Micro Devices as they prepare to release a competing chip in Q4. Analysts believe that AMD's growth targets for AI GPU chips are too low and that they have the potential to capture a meaningful market share from Nvidia.

Nvidia Corp. has exceeded Wall Street expectations with its record earnings and blowout forecast due to skyrocketing demand for AI-chip systems, leading to a remarkable supply chain performance and impressive growth in revenues, with the company only meeting about half of the demand.

Nvidia's market capitalization surpassed that of the entire crypto market, reaching $1.18 trillion, after the chipmaker reported strong financial results, including double the net profit compared to the previous year, highlighting its leadership in AI hardware production and emphasizing the need for the crypto industry to embrace tokenization for similar growth.

Chip stocks, including Nvidia, experienced a selloff in the technology sector despite Nvidia's strong performance, leading to concerns that spending on AI hardware may be affecting traditional chip companies like Intel.

Nvidia reported a strong quarter, with beats across three out of its four businesses, driven by strong demand for its data center segment and generative AI products, leading to record revenues and beating market consensus by 22%. However, there are concerns about the sustainability of this growth and the potential impact of competition in the future.

Nvidia stock is approaching its all-time high, but there are three reasons to believe it has reached a plateau.

NVIDIA's Q2 earnings showed high growth and a positive outlook, but the AI hype may be fading, and the stock's valuation is overstretched, leading to a recommendation to sell with a potential 40% decline in the next three months.

Nvidia shares reached a record high and a $1.2 trillion market capitalization for the first time, putting them on track for their best year ever, after the company's blowout earnings report impressed investors.

Nvidia's stock slips after reaching a record high, but analysts suggest that the chip maker may still be a bargain.

Intel's Gaudi 2 AI chip outperforms Nvidia's H100 by 41% in certain AI workloads, thanks to its hardware-based decoders that offload CPU work, making it a strong competitor in the AI accelerator market despite Nvidia's dominance.

Advanced Micro Devices (AMD) stock is rising as investors recognize its potential in the artificial intelligence (AI) hardware market, making it a strong competitor to Nvidia, especially with the launch of its M1300X AI chip in the third quarter of 2023.

Nvidia's rapid growth in the AI sector has been a major driver of its success, but the company's automotive business has the potential to be a significant catalyst for long-term growth, with a $300 billion revenue opportunity and increasing demand for its automotive chips and software.

Nvidia's revenue has doubled and earnings have increased by 429% in the second quarter of fiscal 2024, driven by the high demand for its data center GPUs and the introduction of its GH200 Grace Hopper Superchip, which is more powerful than competing chips and could expand the company's market in the AI chip industry, positioning Nvidia for significant long-term growth.

Nvidia's data center graphics cards continue to experience high demand, leading to record-high shares; however, investors should be aware of the risk of AI chip supply shortages. Microsoft and Amazon are alternative options for investors due to their growth potential in AI and other sectors.

Nvidia's record sales in AI chips have deterred investors from funding semiconductor start-ups, leading to an 80% decrease in US deals, as the cost of competing chips and the difficulty of breaking into the market have made them riskier investments.

Nvidia's stock has seen a 200% gain this year, highlighting the lucrative potential of the artificial intelligence trade.

Nvidia, the leader in AI infrastructure, has experienced substantial growth and is expected to continue growing, but investors should be cautious of the stock's high valuation and potential volatility.

Nvidia's head of enterprise computing, Manuvir Das, believes that the artificial intelligence (AI) market presents a $600 billion opportunity for the company, as demand for AI technology continues to fuel its growth, leading analysts to overlook its undervalued shares and potential for exceptional growth in the years to come.

Nvidia has tripled its stock so far in 2023, but it is not among the best performing stocks of the year, as Carvana, MoonLake Immunotherapeutics, IonQ, and others have outperformed it.

Nvidia, the semiconductor giant, has experienced a 10% decline in their stock this month, leading to a $180 billion decrease in market capitalization, attributed to the "September effect," although it remains the best performer in the S&P 500 due to the rise of AI and ChatGPT.

Nvidia stock has experienced a pullback along with other chip makers, but analysts remain positive and predict a significant upside potential for the company, particularly in the AI space, with an average 12-month price target implying a 55.14% increase.