Tight Soybean Supplies Lead to Price Volatility While Ample Corn Stocks Keep Prices Stable

-

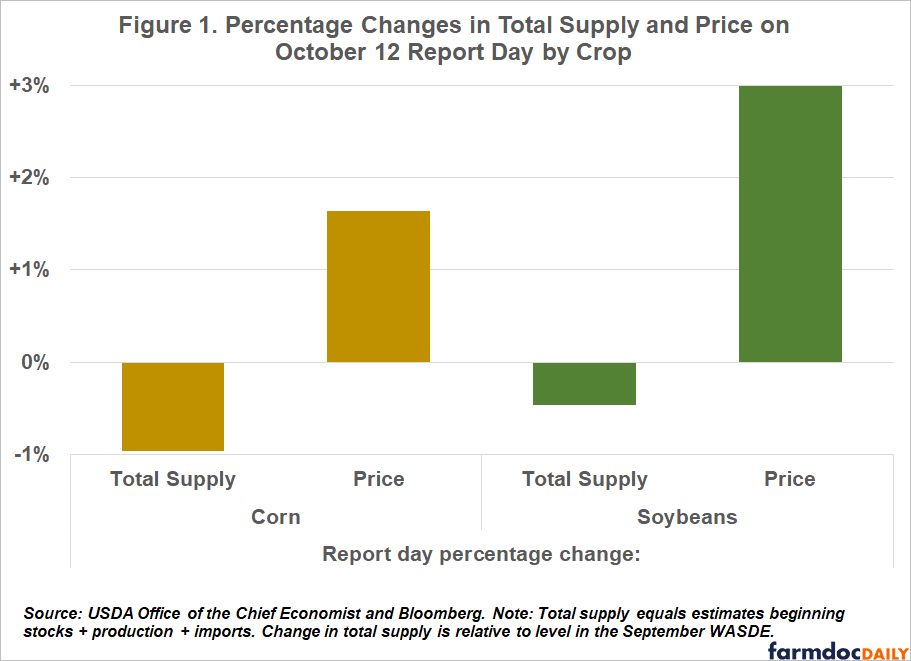

Lower corn and soybean yield estimates from USDA led to price increases, but the soybean price reaction was much larger than corn. This shows differing market conditions.

-

The corn market is adequately supplied with stable, comparatively low prices. The soybean market is tight with high, volatile prices.

-

The corn stocks-to-use ratio remains historically high at 14.7%. Soybean stocks-to-use is tight around 5%. This explains the differing price reactions.

-

Corn futures prices have been stable between $4.70-$5.00/bu since summer. Soybean futures have fluctuated widely between $12.50-$14.00/bu.

-

Current market fundamentals suggest modest corn rallies but continued volatility in soybeans. Farmers must weigh risks of selling vs. storing.