Smaller Banks Face Risk as Commercial Real Estate Loans Sour

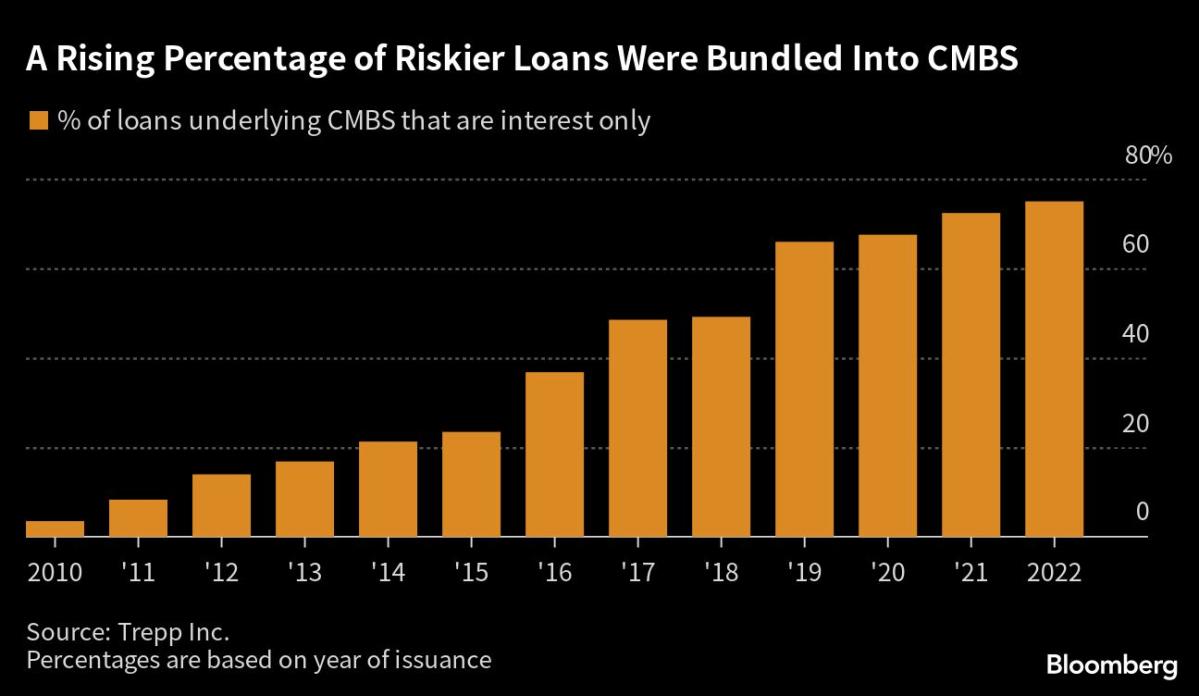

• Property losses in commercial real estate could reach $1.2 trillion, hitting smaller banks that increased exposure after the financial crisis • Regional bank shares have fallen on fears of commercial real estate loan losses, though credit markets seem less concerned • Smaller banks pushed into commercial real estate lending in recent years as large banks faced higher capital requirements • Over 40% of some lenders' loan books are in commercial real estate, concerning the Fed which is working with them on loss expectations • Beyond the US, over $220 billion in property-linked bonds and loans globally are distressed, barely budging since December when rate hike expectations eased