Main topic: Coinbase's motion to dismiss SEC lawsuit

Key points:

1. Coinbase claims it does not offer "investment contracts" and therefore the SEC has no authority over its operations.

2. Coinbase cites a separate SEC case involving Ripple Labs' XRP, where a judge ruled that it was not considered a security when sold on exchanges.

3. A different judge disagreed with the Ripple ruling in a case against Terraform Labs, allowing the SEC to proceed with claims involving sales made on exchanges and allegations of fraud.

Former SEC attorney, John Reed Stark, believes that the chances of the SEC approving a Bitcoin spot ETF are slim due to the lack of regulatory oversight and transparency in the crypto market, citing a CNBC report that shows the industry is rigged and susceptible to manipulation.

Crypto traders are eagerly awaiting a ruling on the Grayscale Trust vs SEC case, which may require the SEC to re-review the application for a spot Bitcoin ETF, potentially leading to a 240-day delay.

The US Court of Appeals has once again delayed its decision on whether Grayscale can convert its Bitcoin Trust into a spot Bitcoin exchange-traded fund (ETF), causing uncertainty and leaving investors waiting for clarity.

The US SEC has filed lawsuits against Binance and Coinbase, accusing them of various regulatory violations, leading to intense discussions about cryptocurrency classification as securities and causing a negative impact on the prices of many altcoins mentioned in the lawsuits.

The US Securities and Exchange Commission (SEC) has taken its first enforcement action against a company for selling unregistered securities in the form of non-fungible tokens (NFTs), with Impact Theory settling with the SEC for over $6.1 million and decommissioning its Founder's Key NFTs.

The U.S. District of Columbia Court of Appeals will soon rule on whether the SEC wrongly rejected Grayscale Investments' application to list a bitcoin exchange-traded fund, which could impact the approval of other bitcoin ETFs.

Bitcoin (BTC) surged to near two-week highs after news broke that Grayscale won a lawsuit against U.S. regulators, with the court ruling that the SEC was wrong to reject Grayscale's Bitcoin ETF application.

Bitcoin and other cryptocurrencies experience a surge in value as Grayscale Investments wins a court decision that increases the likelihood of a spot Bitcoin exchange-traded fund being approved.

The U.S. Court of Appeals has criticized the Securities and Exchange Commission (SEC) for acting "capriciously" and "arbitrarily" in denying a spot market bitcoin exchange-traded fund (ETF), potentially leading to a review of the previously rejected application and challenging the SEC's authority over cryptocurrencies.

The crypto markets experienced their largest outflows since March, with digital assets losing $168 million last week, primarily due to negative sentiment surrounding the delay in the approval of a spot Bitcoin ETF in the US by the SEC. However, Grayscale won its lawsuit against the SEC, which rejected its ETF application, and while BTC took the brunt of the outflows, other altcoin products saw some inflows.

The SEC is facing deadlines to decide on seven new Bitcoin spot ETF applications, with analysts stating that the best-case scenario is approval, but the SEC may also exercise its right to appeal.

Bitcoin rallied after a U.S. court ruled against the SEC's denial of Grayscale's request to convert its bitcoin trust into an ETF, resulting in a surge in bitcoin prices and a significant increase in coins moved to centralized exchanges.

Grayscale Investments CEO Michael Sonnenshein believes that the recent court decision in favor of Grayscale could lead to a new and unprecedented environment for cryptocurrencies, potentially expanding mainstream acceptance of digital assets and boosting the chances for other asset managers to win approval for their bitcoin products.

Bitcoin led the cryptocurrency market higher following Grayscale's victory in the lawsuit against the SEC, but analysts caution that the victory does not guarantee the approval of a spot Bitcoin ETF.

Presidential candidate Vivek Ramaswamy praised Grayscale's victory over the SEC, stating that the decision will help keep Bitcoin and blockchain innovation within the United States, and he promised to rescind federal regulations that fail the Supreme Court's test, potentially limiting the SEC's influence.

United States District Court Judge Katherine Polk Failla dismissed a class-action lawsuit against Uniswap, stating that Ether (ETH) and Bitcoin (BTC) are "crypto commodities," not subject to the Exchange Act. This comes as other judges have made conflicting rulings on the legal classification of cryptocurrencies in the US.

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on spot bitcoin ETF applications until October, causing a 4.1% drop in bitcoin's value.

The price of BTC dropped significantly following the SEC's delay of seven pending spot Bitcoin ETF applications, erasing the gains it made from Grayscale Investment's court victory.

The U.S. SEC has delayed a decision on all spot bitcoin ETF applications, causing Bitcoin and major tokens to lose weekly gains, while a New York court classified bitcoin and ether as commodities, dismissing a proposed class-action lawsuit against Uniswap.

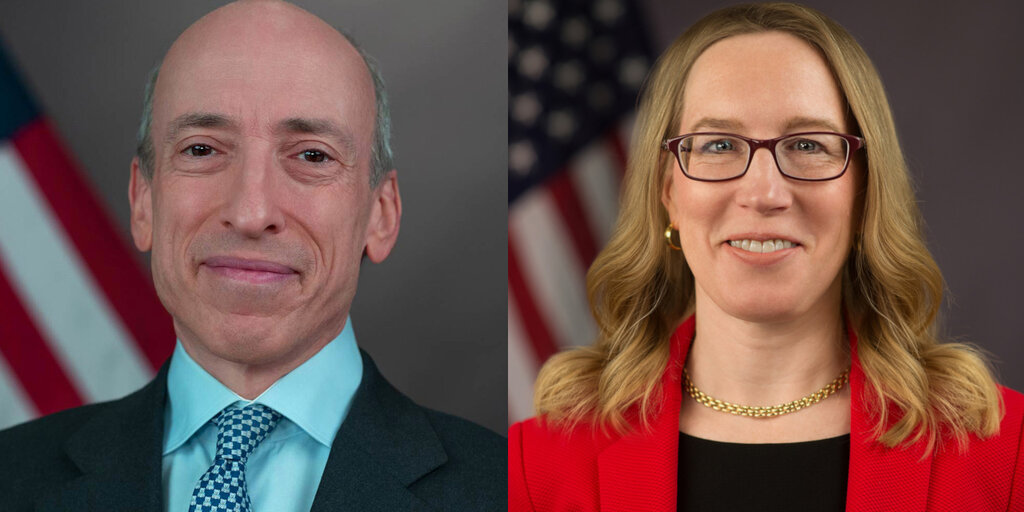

The Securities and Exchange Commission (SEC) may have suffered setbacks in its regulation-by-enforcement approach to the cryptocurrency industry, with the latest ruling in favor of Grayscale Investments potentially paving the way for the emergence of a bitcoin spot exchange-traded fund (ETF); however, the SEC could appeal the decision or find new ways to deny similar applications, and the lack of a regulated exchange for the bitcoin spot market remains a challenge. Despite court challenges, SEC Chair Gary Gensler is expected to continue pursuing his regulation tactics, while Congress and a potential Republican president in 2024 may play a role in shaping the regulatory environment for digital assets.

Grayscale wins a victory in its battle against the SEC as a judge allows a second review of its Bitcoin ETF application, Ben Armstrong is removed as the public face of BitBoy Crypto due to substance abuse and financial damage, and the SEC delays its decision on six spot Bitcoin ETF applications.

The recent court ruling regarding Grayscale Investments has brought the U.S. a step closer to having its first bitcoin exchange traded fund, leading to excitement and speculation in the cryptocurrency industry.

Blockchain-based file-sharing and payment network LBRY is appealing a federal judge's ruling in favor of the Securities and Exchange Commission (SEC), claiming the decision is unjust and aims to harm the cryptocurrency industry, marking a reversal from their previous decision to wind down.

Despite recent losses in court, SEC Chair Gary Gensler remains firm in his belief that his agency should regulate cryptocurrencies as securities, stating that most crypto assets meet the Howey Test and should comply with securities laws. The SEC's defeats in cases against Ripple and Grayscale have not deterred Gensler's stance, and he plans to convey this to lawmakers during a Senate Banking Committee hearing.

A court victory for Grayscale Bitcoin Trust may lead to its transformation into an exchange-traded fund, potentially providing a profitable opportunity for investors. However, the approval of the US Securities and Exchange Commission (SEC) remains uncertain, despite a recent favorable ruling.

Summary: The United States SEC's Crypto Enforcement Chief, David Hirsch, has warned that more punishment and charges will be brought against crypto exchanges and De-Fi projects that do not comply with the law, targeting not just the top players but the entire industry. The SEC will continue conducting investigations and taking action in the space.