Connecticut homebuyers are facing some of the highest mortgage rates in decades, with the average rate on a 30-year fixed mortgage reaching the highest level since 2000, driving up monthly costs and prompting buyers to consider different programs and grants, while lenders advise staying in the market and thinking about refinancing in the future.

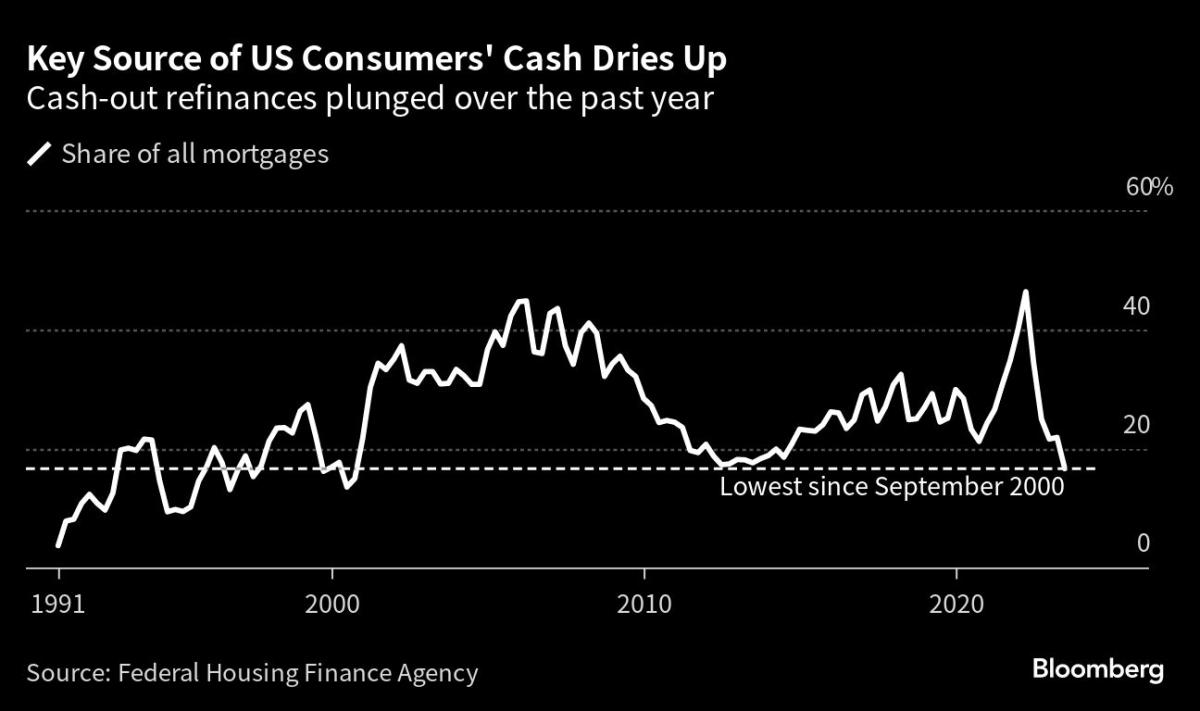

US mortgage applications for home purchases fell to their lowest level in 28 years, while refinancing also declined, as mortgage rates reached a 23-year high, according to data from the Mortgage Bankers Association.

The recent increase in the average interest rate for refinancing has been influenced by the Federal Reserve's interest rate hikes and the effects of inflation.

US mortgage rates have slightly decreased after five consecutive weeks of increases, but still remain above 7% due to inflation concerns. The combination of high rates and low housing inventory is making it more difficult for potential homebuyers to enter the market, leading to lower home sales.

The US economy may face disruption as debts are refinanced at higher interest rates, which could put pressure on both financial institutions and the government, according to Federal Reserve Bank of Atlanta President Raphael Bostic.

US mortgage rates have decreased slightly for the second consecutive week, but they remain above 7%, causing home affordability to reach its lowest level in nearly four decades.

Credible Operations offers tools and information to help individuals improve their finances, including mortgage rates for home purchases and refinancing, with rates varying for different terms and showing a mix of increases and decreases from the previous day. The lowest mortgage purchase rate is for a 10-year term at 6.25%, while the lowest refinance rate is for a 15-year term at 6.375%. It is important to consider closing costs when evaluating mortgage options, and mortgage rates can fluctuate due to factors such as employment patterns, the bond market, the Federal Reserve System, and the global economy.

Mortgage rates for home purchases and refinancing have fluctuated, with rates for 30-year terms increasing and rates for 10-year and 15-year terms decreasing. Borrowers have the option to choose a term that aligns with their financial goals and preferences.

Refinancing demand for home loans increased despite rising mortgage rates, as borrowers are likely concerned about further rate hikes and the limited inventory of homes for sale.