Main topic: VinFast's remarkable debut on the Nasdaq public exchange and its ambitious plans to break into the U.S. marketplace.

Key points:

1. VinFast's stock price soared 68% on its debut, giving it a valuation of $86 billion, surpassing established automakers like Ford, GM, and Stellantis.

2. Despite a subsequent drop in stock price, VinFast still maintains a market cap ahead of other automakers.

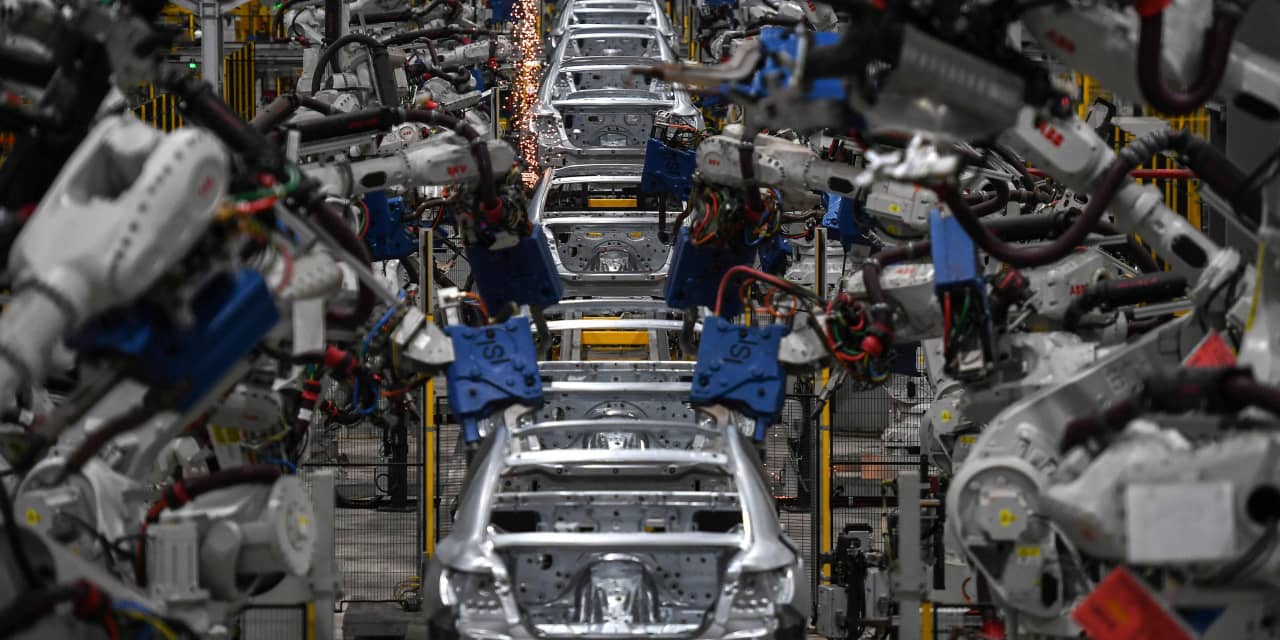

3. VinFast aims to enter the U.S. market by building a $2 billion EV factory in North Carolina and opening showrooms in California and other states.

Hint on Elon Musk: Elon Musk is the CEO of Tesla, a prominent electric vehicle manufacturer, and the search for the next Tesla may be driving investor interest in VinFast.

The main topic is the stock rally of EV startup VinFast, which has pushed its value higher than GM and Ford.

Key points:

1. VinFast's stock rally has resulted in a higher market value than that of GM and Ford.

2. The EV startup's success is attributed to its strong performance in the Vietnamese market.

3. VinFast's rise in value reflects the growing interest and potential of the electric vehicle industry.

The main topic is the stock rally of EV startup VinFast, which has pushed its value higher than GM and Ford.

Key points:

1. VinFast's stock rally has resulted in a higher market value than that of GM and Ford.

2. The EV startup's success is attributed to its strong performance in the Vietnamese market.

3. VinFast's rise in value reflects the growing interest and potential of the electric vehicle industry.

The main topic is the valuation of EV startup VinFast compared to Ford and GM.

The key points are:

1. VinFast's valuation surpasses that of Ford and GM.

2. VinFast's success contrasts with the troubled rollout of EVs in the US by Ford and GM.

3. VinFast's growth potential and market strategy contribute to its high valuation.

VinFast Auto, an electric-vehicle start-up, had a hot debut in the stock market. However, the stock price is considered indefensible due to being too expensive.

VinFast's shares more than doubled after it was reported that South Korea's Star Group Industrial plans to open a factory in Vietnam, boosting the Vietnamese electric vehicle maker's market capitalization to $95 billion.

VinFast Auto stock experiences a 109% surge, attracting traders, but it remains a puzzling phenomenon.

VinFast, a Vietnamese electric vehicle maker, has seen a significant increase in its market cap, surpassing that of major firms such as Walgreens Boots Alliance, Goldman Sachs, and 3M, leading to concerns about its valuation. One factor that may have justified the rising prices is the potential construction of a factory by one of VinFast's key suppliers, Star Group Industrial, which would provide easier access to magnets and facilitate faster production of vehicles. However, there are doubts about the sustainability of VinFast's recent sharp rises in stock prices.

Main topic: Rise in value of Vietnamese electric-vehicle maker VinFast Auto

Key points:

1. VinFast Auto's shares are experiencing a significant increase in value.

2. The company is now the second-most valuable car stock globally, second only to Tesla.

3. The article discusses the implications of VinFast's rise in value and suggests a potential action the company should take.

VinFast Auto's stock price dropped over 31% due to a reality check after a strong rally, but it remains the third most valuable automobile stock with a market cap of around $95 billion; analysts warn of unsustainable valuation and advise against investing in it.

Vietnamese EV start-up VinFast's stock plunges, losing $90 billion in market value.

Short-selling legend Jim Chanos described VinFast Auto as a "$200 billion meme stock" just hours before its stock dropped by more than 40%, questioning its valuation and highlighting the difficulties of shorting the stock due to its limited availability.

VinFast Auto, a Vietnamese EV start-up, offers valuable lessons about the stock market through its wild trading, teaching seasoned traders in just a short period of time.

U.S. markets experienced a drop on Tuesday, with VinFast Auto seeing the largest decline.

VinFast Auto stock is experiencing a sharp decline due to a significant quarterly loss, despite a positive forecast for the full year.

Vietnamese electric-vehicle maker VinFast's revenue more than doubled in Q2 due to higher deliveries to domestic customers, although its shares have lost 54% of their value since its market debut in August.

VinFast Auto, the Vietnamese electric-vehicle maker, has been experiencing significant volatility in its stock, with an average move of 22% per trade.

VinFast stock is performing better than Polestar today as investors analyze the latest electric-vehicle data.

Vietnamese EV maker VinFast reported rising Q3 revenue, EV deliveries, and vehicle sales, but the majority of the growth was due to sales to a related company, Green and Smart Mobility.