A strong U.S. jobs report and comments from Federal Reserve Chair Jerome Powell have dashed hopes of early rate cuts, causing a sell-off in Asian stocks and leading to a rise in bond yields.

Indonesia's economy grew 5.05% in 2023 due to weaker growth in exports and lower commodity prices.

Core inflation in Kenya increased to 3.6% in January 2024, its highest rate in three months, triggering concerns about pressure on interest rates as the Central Bank of Kenya prepares to set its new indicative lending rate. This increase in core inflation is accompanied by higher prices for general goods and services, excluding food and fuel.

India's public debt, which is set to exceed 80% of GDP at the end of the current government's second term, has been driven up by factors such as Covid-induced disruptions and increased government borrowing for public health and social safety net expenditures, highlighting the need for a combination of fiscal consolidation and economic growth to address the country's debt issues.

The federal government in Pakistan has signed agreements with the provinces to generate a fiscal surplus of at least Rs600 billion and avoid further debt in the operations of key commodities, as part of efforts to recover lost fiscal space, with increased fiscal coordination reported to the IMF.

Chinese banks are expected to have ample funds to lend during the upcoming Lunar New Year holiday, as Beijing plans to inject 1 trillion yuan ($139 billion) into the financial system to support the economy, leading to a smaller liquidity shortage compared to previous years, according to estimates from ANZ.

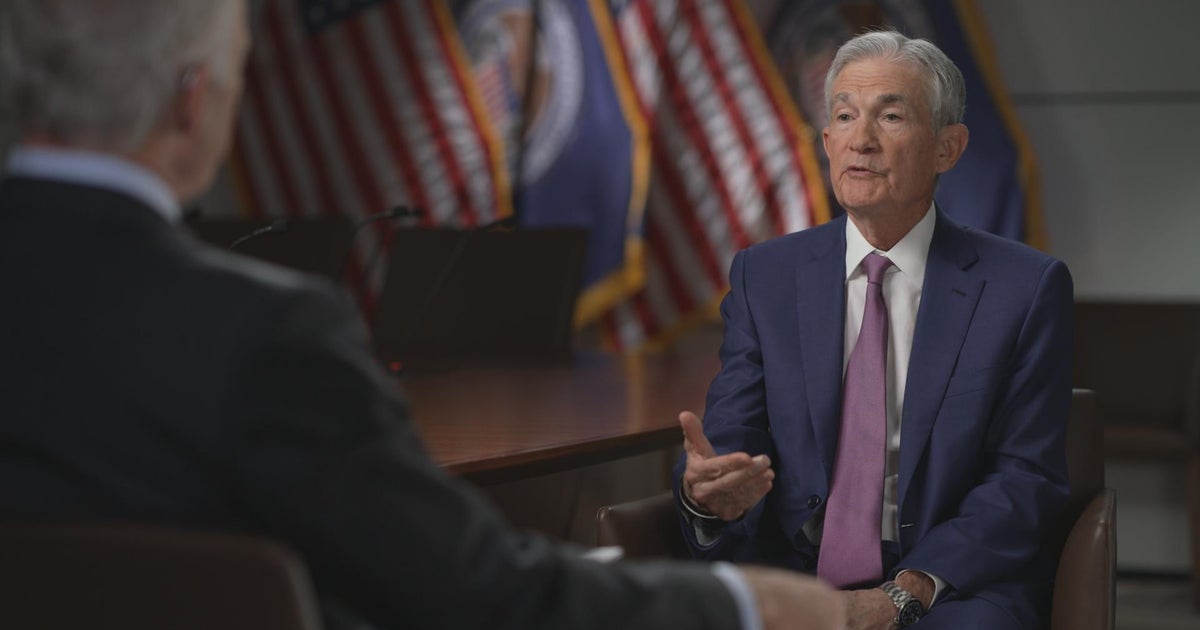

The Federal Reserve Chair, Jerome Powell, stated in an interview that the Fed plans to cut interest rates three times this year starting as early as May, while also affirming the strength of the economy and job market with no signs of a recession.

Pubs, clubs, and bottle shops in Australia are set to increase prices on beers, spirits, and pre-mixed drinks due to a rise in alcohol taxes imposed by the federal government.

Federal Reserve Chair Jerome Powell stated that inflation has come down over the past year and the economy is strong, but the decision to cut interest rates will depend on further data and the goal of restoring price stability. He emphasized the importance of making the right decisions for the benefit of the economy and the American people. Powell also discussed the factors influencing inflation, the potential risks to the economy, and the need for fiscal sustainability and American leadership in the world. He acknowledged that the Fed missed the failure of the Silicon Valley Bank and highlighted the ongoing efforts to improve supervision and regulation. Powell expressed optimism for the future of the economy but acknowledged that the full understanding of the pandemic's impact will take time.

Federal Reserve Chair Jerome Powell discusses various topics in his interview with 60 Minutes, including the state of the U.S. economy, cybersecurity threats, regulation proposals to prevent bank failures, China's economy, geopolitical risks, immigration, and the impact of artificial intelligence on the economy.

The chair of the Federal Reserve, Jerome Powell, is cautious about cutting interest rates despite falling inflation and a strong economy, stating that more evidence of sustainable inflation and a move towards the 2% target is needed before taking that step.

Donald Trump plans to impose tariffs on Chinese goods exceeding 60% if reelected, potentially restarting a trade war with China.

The proposed steep rise in taxes on entertainment services in Indonesia, including spas and nightclubs, has raised concerns among workers who fear losing their jobs and salon owners who may have to close down, leading to a backlash from businesses and a court challenge by spa owners.

Prolonged factory deflation in China is threatening the survival of smaller exporters, as falling producer prices and shrinking demand squeeze profit margins and jeopardize industrial output and jobs.

Javier Milei, an "anarcho-capitalist" economist, has been elected to fix Argentina's struggling economy, but the question remains whether he will succeed.

The FT's chief economics commentator Martin Wolf discusses why China's economic growth has slowed and why it is unlikely to recover.

A program called Money for the Young aims to educate school students and young adults in Australia about finance and help them better manage their finances in response to the cost of living crisis, as Generation Z is experiencing high levels of financial stress and lacks financial literacy.

Asian markets face a wave of economic data, including PMI figures from China and Japan, Indonesian GDP, Thai inflation, and Australian trade, as investors respond to strong US employment numbers and concerns about China's economy.

Bangladesh's macroeconomic situation is improving due to rising exports and remittances, leading to increased reserves and a decrease in inflation, according to Finance Minister Abul Hassan Mahmood Ali.

Former Minister of Trade and Industry, Alan Kyerematen, criticizes Finance Minister Ken Ofori-Atta for claiming credit for the recent improvements in Ghana's economy, attributing the stability to the ongoing IMF program and emphasizing the need to address structural vulnerabilities for long-term growth.

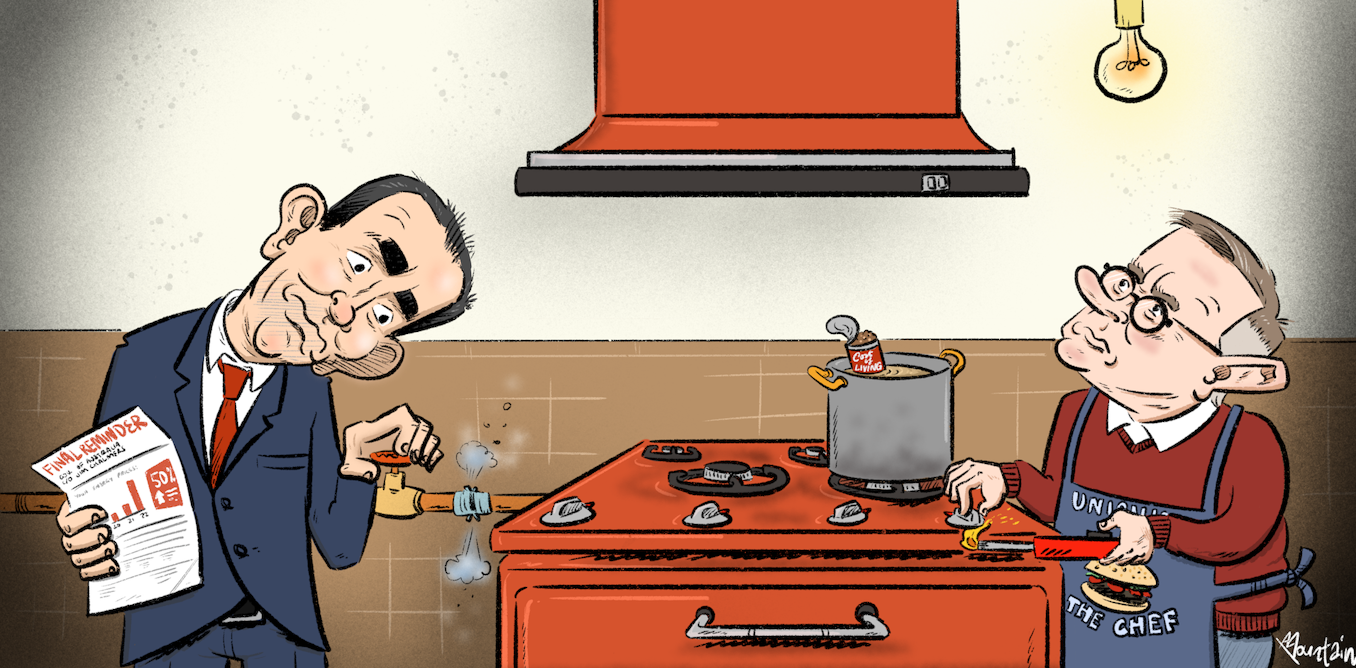

Over five million households face potential energy bill increases as the UK government plans to expand heat networks, which currently lack price caps and regulations, leaving consumers vulnerable to price fluctuations and higher costs.

Robust US economic data has raised the question of whether strong growth can continue to drive stocks higher even if the Federal Reserve provides less monetary-policy easing than expected.

The Director of Research at the Institute of Economic Affairs has called for the CEO of Ghana Cocoa Board to be fired if he approved the import of cocoa from Cote d'Ivoire and Nigeria, as the country's struggling cocoa processing firm is being starved of funds.

The Director of Research at the Institute of Economic Affairs has called for the CEO of the Ghana Cocoa Board to be fired if he approved the import of cocoa from Cote d'Ivoire and Nigeria while the country's cocoa processing firm is struggling, with another think tank noting that the state-owned cocoa trader is on the verge of bankruptcy.

The UK government is considering scrapping the tourist tax following pressure from business leaders and MPs, as changes to the policy have cost retailers £1.5bn and driven international shoppers away from the country. The Office for Budget Responsibility will publish the findings of its review alongside the Chancellor’s Spring Budget next month. However, it is uncertain whether the measure will be a priority for the Chancellor.

The Cabinet of the Government of Ghana has unanimously agreed to cancel the 15% Value Added Tax (VAT) on a section of electricity consumers as part of measures to raise government revenue, although the final decision on completely cancelling the VAT on electricity will be reached after engaging with the International Monetary Fund (IMF).

The Canadian economy regains momentum, with real GDP growth in November and December, suggesting a good sign of growth in the fourth quarter; Leon's Furniture plans to build new homes in Toronto; public sector workers took more sick days than private sector workers in 2023; Air Canada takes a couple to court over flight delay compensation; owning a dog or cat in Canada becomes more expensive due to various factors; and a guide on planning for CPP benefits.

The US economy is defying predictions of a recession as it continues to show strength, with a strong jobs report and factors such as improving purchasing power, low debt burdens, and excess savings among high-income households contributing to its resilience, according to Wall Street experts.

The Baby Boomer generation, reaching their "peak burden" years, is expected to place a significant strain on the US economy and resources in the coming decades, affecting housing, labor, the stock market, and social security payments.

The average monthly wage in Israel rose by 9.5% in November 2023 compared to November 2022, reaching a record high, but this increase may be artificial due to the decrease in the number of jobs caused by the war.

Latin America faces challenges in terms of innovation and technological advancements, such as lack of equitable access to technology and skill development, but it has shown resilience and potential for growth, with a surge in technology adoption and the presence of innovative companies in sectors like fintech and e-commerce. However, the region still lags behind in research and development investment, patent applications, and AI adoption compared to other regions.

The Consumer Price Index (CPI) experienced a significant decline in 2023, similar to previous instances in 2009 and 1982, which marked the start of prolonged bull markets for the S&P 500. This decline in inflation, coupled with predicted falling interest rates, suggests that the stock market could see a new multiyear winning streak.

Las Vegas is expected to receive a gross economic impact of $1.1 billion from hosting the Super Bowl for the first time, while other cities like New Orleans, Santa Clara, and Inglewood could also reap big benefits in the years to come.

Several fast fashion companies, including Ralph Lauren, Lululemon, H&M, and Zara, are facing shipping delays of up to two weeks due to attacks on shipping vessels in the Red Sea by Yemen's Houthi group, leading to higher costs and potential fashion trend delays.

January's jobs report defied expectations with the addition of 353,000 jobs, higher wage growth, and a sustained unemployment rate, indicating a more sustainable pace of job growth and a potential return to a more "normal" job market. However, workers may face challenges in finding new jobs or upgrading their current positions due to a slower hiring pace and reduced leverage.

German Economy Minister Robert Habeck and Finance Minister Christian Lindner have suggested reforming corporate taxes as a solution to alleviate pressure on companies facing challenges such as high energy costs, with Habeck highlighting the need for tax relief and incentives for investments in the future. The ministers are working together on a reform package to strengthen the economy and ensure prosperity.

The outlook for corporate America is uncertain despite a roaring jobs market and strong stock market performance, as potential challenges including rising corporate debt, stagnant profits, weakening consumer spending, and a slowdown in manufacturing growth loom ahead. However, the adoption of artificial intelligence (AI) remains a bright spot for companies, with major players like Amazon, Alphabet, and Microsoft poised to increase their investments in AI technologies.

The forces that have supported profits in America's stock market may now be weakening, with concerns over consumer spending, a slowdown in China, and a potential slowdown in manufacturing growth. However, the demand for artificial intelligence (AI) remains strong, with companies like Amazon, Alphabet, and Microsoft reporting growth in their AI divisions.

Sri Lankan President Ranil Wickremesinghe claims that the country's economic recovery has been successful due to the support of its citizens, despite facing hardships and a previous declaration of sovereign default.

The Reserve Bank of Australia (RBA) is expected to remove its mild tightening stance, although some analysts believe the tightening bias will be retained, as economic forecasts and interest rate cuts are anticipated; meanwhile, Australian shares are set to open lower due to Middle East tensions and the overbought stock market.

Australia's National Broadband Network (NBN) is expected to contribute $400 billion to the economy by 2030, despite recent customer losses and competition from alternatives like Starlink, according to a study by Accenture. The NBN's faster broadband speeds have boosted productivity, particularly in rural areas and disadvantaged communities, and have created more job opportunities, especially for women. However, price increases and criticism of the network's fixed wireless product have led to customer decline.

Indonesian businesses are protesting against recent and potential tax hikes for leisure activities, including nightclubs and spas, as the country prepares for a presidential election.

The Pakistani rupee has appreciated by 0.84% against the dollar since the start of 2024 due to improved macroeconomic conditions, including increased liquidity in the foreign exchange market and a balance of payments surplus.

A growing number of mainland Chinese are choosing to rent homes instead of buying due to the economic downturn and weakened sentiment in the housing market, leading to an increase in rental demand and a decline in prices.

Economists are facing criticism for their inability to accurately predict inflation, disruptions in supply chains, and the absence of a projected recession, prompting calls for them to step out of their comfort zone and adopt more flexible forecasting methodologies.

Currency experts have warned that the exchange rate may face shocks in March due to factors such as low inflows of dollars and a decrease in remittances and foreign direct investment.

Shwapno, the leading retail chain brand in Bangladesh, has been making operating profits but has accumulated a loss of Tk 1,661 crore over 15 years due to mammoth loans and high finance costs, leading to plans for capital restructuring and equity investment in order to turn profitable.

A panel of leading economists predicts that interest rates in Australia will remain unchanged until the middle of the year, with only a slight cut by December, resulting in a minimal reduction in mortgage costs. The forecasts also indicate weak economic growth, stagnant consumer spending, and the possibility of a per-capita recession.

Finance Minister Nirmala Sitharaman is confident in India's economic growth and believes the government's focus on comprehensive budgeting in July will address key issues more effectively than addressing them in patches. She also discusses various economic topics such as investment, privatisation, inflation management, and the country's growth potential.

The Federal Reserve resists cutting interest rates as the US economy adds 353,000 jobs in January, contradicting the initial report of 216,000 jobs in December.