- Aidan Gomez, CEO of Cohere, and Edo Liberty, CEO of Pinecone, will be participating in a live audio chat with subscribers to discuss the future of AI.

- The discussion will be led by Stephanie Palazzolo, author of AI Agenda, and will cover the rapidly developing field of AI.

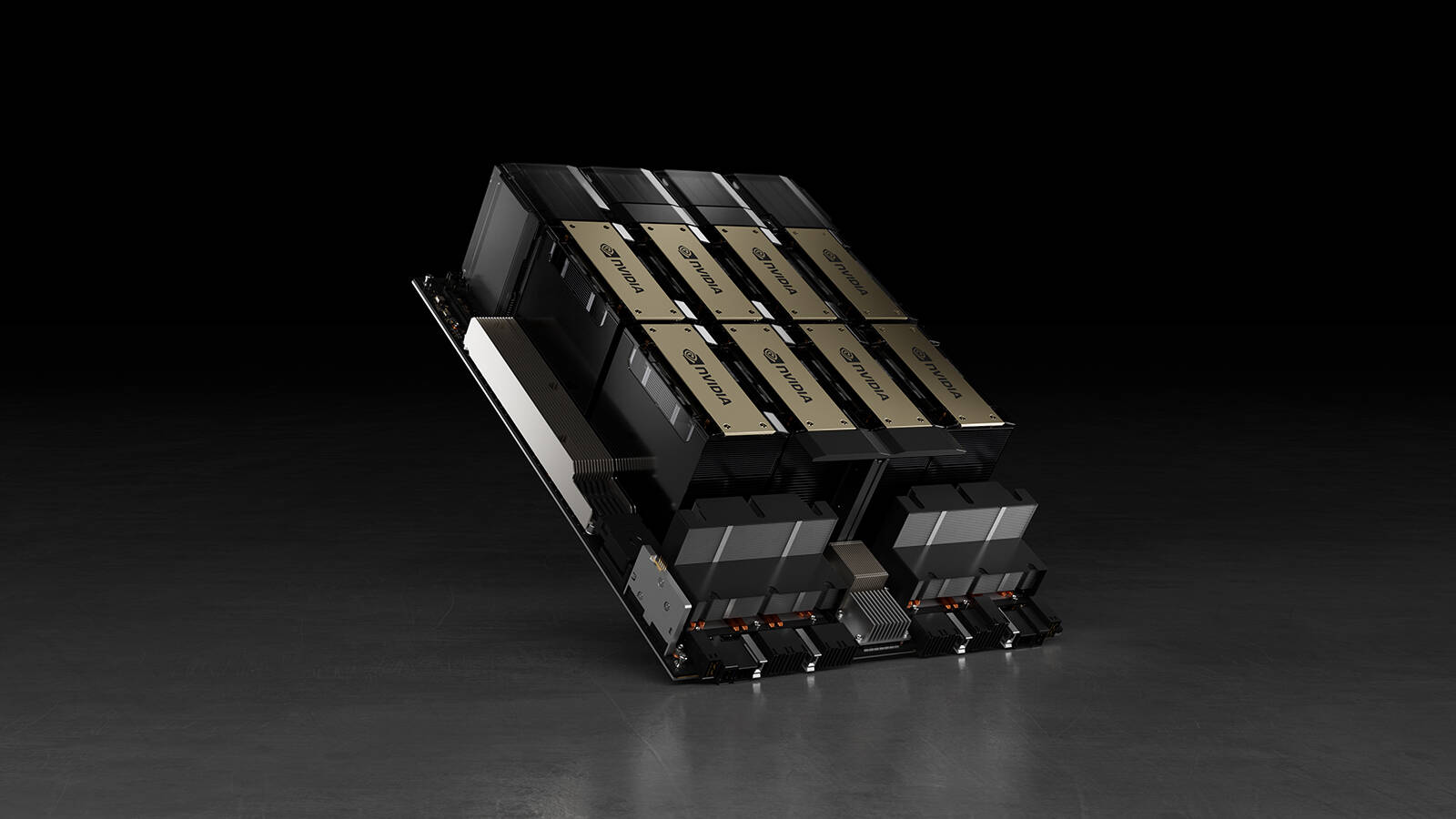

- The article mentions the ongoing shortage of Nvidia's cloud-server chips and the competition between Nvidia and cloud providers like Amazon Web Services.

- Nvidia is providing its latest GPU, the H100, to cloud-server startups like CoreWeave, Lambda Labs, and Crusoe Energy to promote competition and showcase its capabilities.

- The article is written by Anissa Gardizy, who is filling in for Stephanie as the cloud computing reporter for The Information.

- Nvidia is giving its newest AI chips to small cloud providers that compete with major players like Amazon Web Services and Google.

- The company is also asking these small cloud providers for the names of their customers, allowing Nvidia to potentially favor certain AI startups.

- This move highlights Nvidia's dominance as a major supplier of graphics processing units (GPUs) for AI, which are currently in high demand.

- The scarcity of GPUs has led to increased competition among cloud providers and Nvidia's actions could further solidify its position in the market.

- This move by Nvidia raises questions about fairness and competition in the AI industry.

The main topic of the article is the strain on cloud providers due to the increased demand for AI chips. The key points are:

1. Amazon Web Services, Microsoft, Google, and Oracle are limiting the availability of server chips for AI-powered software due to high demand.

2. Startups like CoreWeave, a GPU-focused cloud compute provider, are also feeling the pressure and have secured $2.3 billion in debt financing.

3. CoreWeave plans to use the funds to purchase hardware, meet client contracts, and expand its data center capacity.

4. CoreWeave initially focused on cryptocurrency applications but has pivoted to general-purpose computing and generative AI technologies.

5. CoreWeave provides access to Nvidia GPUs in the cloud for AI, machine learning, visual effects, and rendering.

6. The cloud infrastructure market has seen consolidation, but smaller players like CoreWeave can still succeed.

7. The demand for generative AI has led to significant investment in specialized GPU cloud infrastructure.

8. CoreWeave offers an accelerator program and plans to continue hiring throughout the year.

Main Topic: The high demand for Nvidia's H100 chips in the AI industry

Key Points:

1. Tech giants like Microsoft and Google, as well as server manufacturers and venture capital investors, are all seeking Nvidia's H100 chips for their AI applications.

2. The demand for H100 chips has led to a buying frenzy, with companies and even countries like Saudi Arabia and the UAE acquiring thousands of these chips.

3. The scarcity of Nvidia's chips has caused challenges for companies like Tesla, who had to invest $1 billion in building their own supercomputer called Dojo due to the lack of GPU orders from Nvidia.

Main topic: The scarcity of graphics processing units (GPUs) in the tech industry and the desperate measures taken by start-ups and investors to obtain them.

Key points:

1. The shortage of GPUs has been caused by the increased demand for artificial intelligence (A.I.) applications and the excitement over A.I. chatbots.

2. Nvidia, a dominant provider of GPUs, is struggling to meet the overwhelming demand.

3. Start-ups and investors are resorting to various strategies, such as government grants, sharing clusters of GPUs, and forming partnerships to access GPUs and avoid long waitlists.

Main topic: Performing AI tasks on affordable AMD APUs

Key points:

1. The AI boom has created a high demand for Nvidia's expensive GPUs.

2. A modder discovered a method to use AMD APUs costing around $100 for AI tasks.

3. The APUs offer a cost-effective solution and can perform well compared to higher-end cards.

Index Ventures, a global investor, has partnered with Oracle to provide its portfolio companies with access to graphics processing units (GPUs) for their artificial intelligence (AI) startups, addressing the challenge of compute power shortage faced by early-stage companies in the field. The partnership aims to remove the access barrier and allow startups to focus on building their products. The agreement involves pre-commitments made by Index on behalf of its startups, paying the cloud bill in advance, and granting free access to Oracle-managed GPU clusters.

Main topic: The demand for computer chips to train AI models and its impact on startups.

Key points:

1. The surge in demand for AI training has created a need for access to GPUs, leading to a shortage and high costs.

2. Startups prefer using cloud providers for access to GPUs due to the high costs of building their own infrastructure.

3. The reliance on Nvidia as the main provider of AI training hardware has contributed to the scarcity and expense of GPUs, causing startups to explore alternative options.

Graphics processing unit (GPU) manufacturer Nvidia has reported impressive financial results for its second quarter of fiscal 2024, with revenues more than doubling to $13.51 billion, operating income rising 13.6 times to $6.8 billion, and net income multiplying by a factor of 9.4 times to $6.19 billion, largely driven by the explosive interest in generative AI.

Main topic: Shortage of GPUs and its impact on AI startups

Key points:

1. The global rush to integrate AI into apps and programs, combined with lingering manufacturing challenges, has resulted in shortages of GPUs.

2. Shortages of ideal GPUs at main cloud computing vendors have caused AI startups to use more powerful and expensive GPUs, leading to increased costs.

3. Companies are innovating and seeking alternative solutions to maintain access to GPUs, including optimization techniques and partnerships with alternative cloud providers.

Nvidia has reported explosive sales growth for AI GPU chips, which has significant implications for Advanced Micro Devices as they prepare to release a competing chip in Q4. Analysts believe that AMD's growth targets for AI GPU chips are too low and that they have the potential to capture a meaningful market share from Nvidia.

Nvidia's CEO, Jensen Huang, predicts that upgrading data centers for AI, which includes the cost of expensive GPUs, will amount to $1 trillion over the next 4 years, with cloud providers like Amazon, Google, Microsoft, and Meta expected to shoulder a significant portion of this bill.

Nvidia's impressive earnings growth driven by high demand for its GPU chips in AI workloads raises the question of whether the company will face similar challenges as Zoom, but with the continuous growth in data center demand and the focus on accelerated computing and generative AI, Nvidia could potentially sustain its growth in the long term.

Chinese GPU developers are looking to fill the void in their domestic market created by US restrictions on AI and HPC exports to China, with companies like ILuvatar CoreX and Moore Threads collaborating with local cloud computing providers to run their LLM services and shift their focus from gaming hardware to the data center business.

Major technology firms, including Microsoft, face a shortage of GPUs, particularly from Nvidia, which could hinder their ability to maximize AI-generated revenue in the coming year.

The transformation of data servers to be AI-ready is consuming significant energy and natural resources, raising the question of whether AI can revolutionize technology's carbon footprint responsibly.

GPUs are well-suited for AI applications because they efficiently work with large amounts of memory, similar to a fleet of trucks working in parallel to hide latency.

The article discusses the potential of investing in AI stocks, specifically comparing Advanced Micro Devices (AMD) and Nvidia. While Nvidia has a proven track record and dominance in the GPU market, AMD is an up-and-coming competitor with significant growth potential. The choice between the two stocks depends on the investor's risk tolerance and long-term goals.

The ongoing shortage of compute GPUs for AI and HPC applications is caused by constraints in chip-on-wafer-on-substrate packaging capacity, which is expected to persist for 18 months due to rising demand for generative AI applications and slow expansion of CoWoS capacity at TSMC.

Advanced Micro Devices (AMD) has been downgraded to a sell due to concerns about high expectations for A.I. revenue and the belief that AMD's A.I. GPU offerings will lag behind Nvidia, leading to underperformance and a recommendation to sell.

Nvidia's success in the AI industry can be attributed to their graphical processing units (GPUs), which have become crucial tools for AI development, as they possess the ability to perform parallel processing and complex mathematical operations at a rapid pace. However, the long-term market for AI remains uncertain, and Nvidia's dominance may not be guaranteed indefinitely.

Despite a decline in overall revenue, Dell Technologies has exceeded expectations due to strong performance in its AI server business, driven by new generative AI services powered by Nvidia GPUs, making it a potentially attractive investment in the AI server space.

Despite a significant decline in PC graphics card shipments due to the pandemic, Advanced Micro Devices (AMD) sees a glimmer of hope as shipments increase by 3% from the previous quarter, indicating a potential bottoming out of demand, while its data center GPU business is expected to thrive in the second half of the year due to increased interest and sales in AI workloads.

Nvidia's data center graphics cards continue to experience high demand, leading to record-high shares; however, investors should be aware of the risk of AI chip supply shortages. Microsoft and Amazon are alternative options for investors due to their growth potential in AI and other sectors.

The CEO of semiconductor firm Graphcore believes that their advanced AI-ready processors, called IPUs, can emerge as a viable alternative to Nvidia's GPUs, which are currently facing shortages amidst high demand for AI development.

AMD's director for the commercial client business, Justin Galton, believes that AI adoption on desktops is not yet widespread and may take some time to become apparent, with AMD's dedicated AI accelerator currently only available in one CPU model and more AI-equipped processors set to be released in 2024. Galton also mentioned that small to medium businesses may not be enthusiastic about AI, and that Intel may have more AI-ready desktop processors than AMD. Additionally, a gaming market report predicts a drop in demand for gaming PCs in 2023, while gaming monitor shipments are expected to increase. With regards to AMD's products, Galton said that buyers are currently opting for modestly priced PCs with Ryzen 5000 and 6000 models due to Intel's excess inventory. Additionally, AMD aims to expand its market share in commercial PCs to 20% in 2024.

UBS analysts have observed a rise in average prices for graphics processing units (GPUs) despite a decline in sales volumes, with AMD's products increasing by 1% and Nvidia's GPUs rising by 3%; the decrease in transaction volumes may be attributed to a lack of available GPUs, potentially signaling a slowdown in the GPU upgrade cycle.

Nvidia and Microsoft are two companies that have strong long-term growth potential due to their involvement in the artificial intelligence (AI) market, with Nvidia's GPUs being in high demand for AI processing and Microsoft's investment in OpenAI giving it access to AI technologies. Both companies are well-positioned to benefit from the increasing demand for AI infrastructure in the coming years.

AMD CEO Dr. Lisa Su believes that the field of artificial intelligence (AI) is moving too quickly for competitive moats to be effective, emphasizing the importance of an open approach and collaboration within the ecosystem to take advantage of AI advancements. While Nvidia currently dominates the AI market, Su suggests that the next 10 years will bring significant changes and opportunities for other companies.

The current market is divided between believers and skeptics of artificial intelligence, with the former viewing the recent surge in AI stocks as a long-term opportunity, while the skeptics see it as a short-term bubble; two top performers in the AI sector this year are Nvidia and Super Micro Computer, both of which have built business models optimized for AI computing over the past couple of decades, giving them a competitive edge; however, while Nvidia has a strong head start, competitors such as AMD and Intel are also aggressively pursuing the AI market; when it comes to valuation, both Nvidia and Super Micro appear cheaper when considering their potential growth in the AI industry; in terms of market share, Nvidia currently dominates the general-purpose AI GPU market, while Super Micro has made significant strides in expanding its market share in the AI server market; ultimately, choosing between the two stocks is a difficult decision, with Super Micro potentially offering better prospects for improvement and a lower valuation.

Advanced Micro Devices (AMD) is positioned to surge in the AI chip market and may offer a more affordable alternative to Nvidia, with potential for significant growth and attractive valuation.

Nvidia's dominance in the AI chip market, fueled by its mature software ecosystem, may pose a challenge for competitors like AMD who are seeking to break into the market, although strong demand for alternative chips may still provide opportunities for AMD to succeed.

OpenAI is exploring the possibility of manufacturing its own AI accelerator chips to address the shortage and high costs associated with specialized AI GPU chips, considering options such as acquiring a chipmaking company or collaborating with other manufacturers like Nvidia.

The growing use of large AI models could contribute significantly to global carbon emissions, warns researcher Alex de Vries, as the energy consumption of training and running these models is substantial and increasing. Nvidia, which supplies 95% of the GPUs used for AI, is set to ship 100,000 servers this year that collectively consume 5.7 terrawatt hours of energy. New manufacturing plants are expected to further increase production capacity, potentially consuming 85.4 terawatt hours of energy by 2027. Experts emphasize the need for responsible use of AI and transparency regarding its environmental impact.

Graphics processor supplier Nvidia is expected to see an increase in gaming sales, driven by higher graphics card sales and improvements in GPU laptops, with analysts giving the stock a Strong Buy consensus rating and a 39.67% upside potential.

The AI boom and increasing demand for AI-optimized GPUs may lead to a shortage of gaming graphics cards, causing prices to rise and availability to decrease, potentially changing the landscape of PC gaming.

Nvidia's stock may face challenges and may need a new catalyst as its high valuation and the need for consistently reliable AI output present risks, making it tactically bearish.