Nvidia's CEO, Jensen Huang, predicts that the artificial intelligence boom will continue into next year, and the company plans to ramp up production to meet the growing demand, leading to a surge in stock prices and a $25 billion share buyback.

Wall Street analysts are optimistic about chipmaker Advanced Micro Devices (AMD) and its potential in the AI market, despite the current focus on Nvidia, with several analysts giving a Buy rating on AMD's stock and expecting solid upside potential.

Advanced Micro Devices (AMD) is well-positioned to thrive in the artificial intelligence accelerator chip market and benefit from favorable trends in the data center, AI, and gaming, making its shares undervalued, according to Morningstar.

Nvidia's soaring stock price, driven by the booming demand for its data center graphics cards in the AI arms race, has led to a high valuation, making it an opportune time to consider investing in Advanced Micro Devices (AMD) as it could benefit from the growing demand for AI chips and potentially capture a significant share of the data center GPU market.

Nvidia has emerged as the clear leader in AI chip sales, with its Data Center revenue quadrupling over the last two years and estimated to hold over 70% of the market share, while AMD has shown slower growth and Intel has struggled to gain market share in AI chips.

AMD investors may be feeling left out as the company struggles to match the financial growth and stockholder returns of its competitor, Nvidia, but there is still potential for AMD to narrow the gap in the generative AI market and offer solid returns in the long term.

Intel's stock rose nearly 2% after CEO Pat Gelsinger expressed optimism about the company's current quarter and announced the launch of a new data center chip.

Microsoft's integration of OpenAI's AI algorithms has resulted in a 35% increase in the company's stock gains, while Alphabet and Advanced Micro Devices (AMD) are also attractive AI stocks due to their AI deployments and potential for earnings growth.

Insiders at Advanced Micro Devices (NASDAQ:AMD) have been selling a significant stake in the company, raising concerns among investors.

Intel CEO Pat Gelsinger believes that AI will extend beyond data centers and wants to put AI into everything, including PC CPUs, to bring AI processing closer to end users and enable real-time applications without relying on the cloud. Intel is positioning itself to tap into the growing demand for AI hardware and software across various sectors.

Tech companies, such as Microsoft, Amazon, and Advanced Micro Devices (AMD), are attractive investment choices due to their long-term potential in AI, e-commerce, and chip development, respectively. These companies have a history of offering reliable gains and are well-positioned to benefit from the growth and demand in the tech industry.

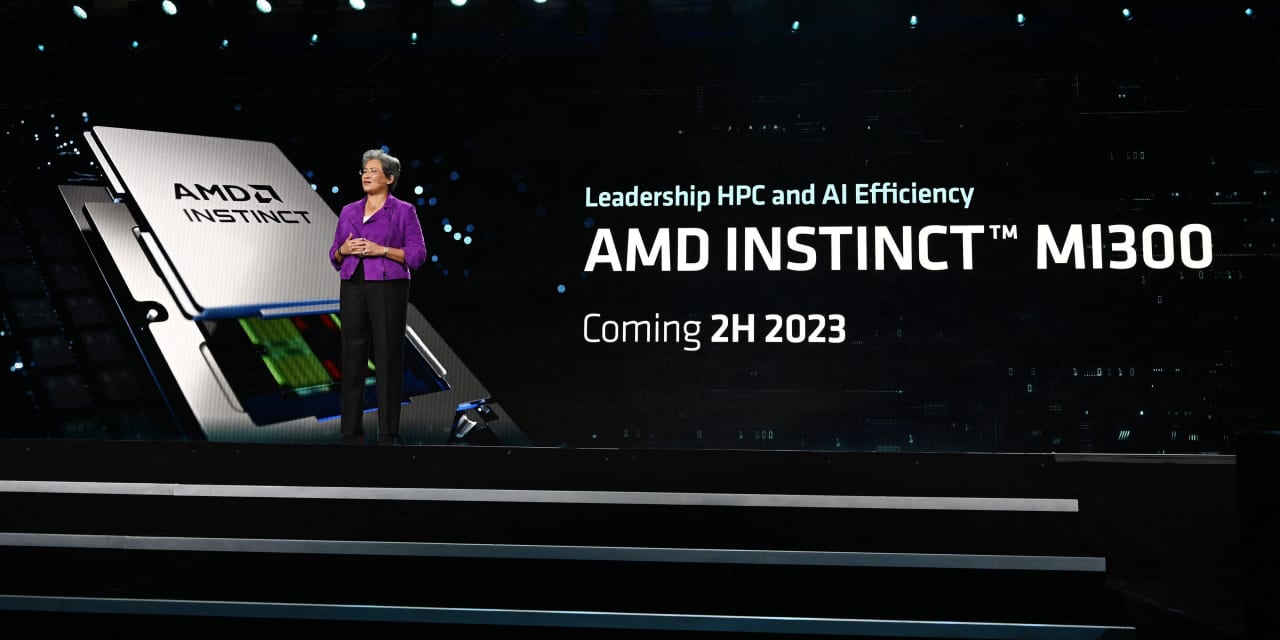

AMD has the potential to capture a significant share of the growing generative AI industry, with the company's data center guidance showing high revenue growth in the upcoming quarter and the anticipation of its upcoming MI300X processors driving continuous quarter-over-quarter growth in the data center sector.

Advanced Micro Devices (AMD) stock is rising as investors recognize its potential in the artificial intelligence (AI) hardware market, making it a strong competitor to Nvidia, especially with the launch of its M1300X AI chip in the third quarter of 2023.

Advanced Micro Devices (AMD) CEO states that the demand for artificial intelligence semiconductors is skyrocketing.

Intel Corp. is expected to see stabilization and material gains in its data-center business due to increased artificial-intelligence spending.

Artificial intelligence stocks, including C3.ai, Microsoft, Snap, and AMD, have experienced a shift in market sentiment as investors focus on the fundamentals and question whether the AI rally has reached its peak.

Despite a significant decline in PC graphics card shipments due to the pandemic, Advanced Micro Devices (AMD) sees a glimmer of hope as shipments increase by 3% from the previous quarter, indicating a potential bottoming out of demand, while its data center GPU business is expected to thrive in the second half of the year due to increased interest and sales in AI workloads.

AMD's director for the commercial client business, Justin Galton, believes that AI adoption on desktops is not yet widespread and may take some time to become apparent, with AMD's dedicated AI accelerator currently only available in one CPU model and more AI-equipped processors set to be released in 2024. Galton also mentioned that small to medium businesses may not be enthusiastic about AI, and that Intel may have more AI-ready desktop processors than AMD. Additionally, a gaming market report predicts a drop in demand for gaming PCs in 2023, while gaming monitor shipments are expected to increase. With regards to AMD's products, Galton said that buyers are currently opting for modestly priced PCs with Ryzen 5000 and 6000 models due to Intel's excess inventory. Additionally, AMD aims to expand its market share in commercial PCs to 20% in 2024.

Super Micro Computer (SMCI) is expected to benefit from the surge in data-center hardware spending for AI applications, with an analyst predicting that the company will gain market share thanks to its strong design capability and partnerships in the AI space.

The growing demand for inferencing in artificial intelligence (AI) technology could have significant implications for AI stocks such as Nvidia, with analysts forecasting a shift from AI systems for training to those for inferencing. This could open up opportunities for other companies like Advanced Micro Devices (AMD) to gain a foothold in the market.