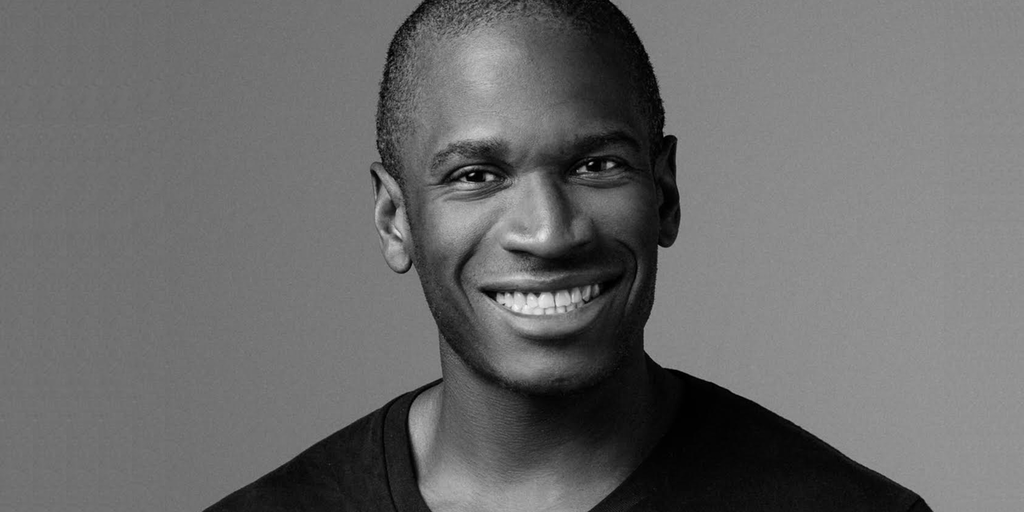

Bitcoin Wins While Fed Prints More 'Fiat Toilet Paper', Says Arthur Hayes - Decrypt

BitMEX co-founder Arthur Hayes believes that if the Federal Reserve continues its ineffective strategy to combat inflation, Bitcoin and other risk assets with finite supply will benefit in the long run.