BRICS seeks to expand its membership and become a champion of the "Global South," with over 40 countries expressing interest in joining the bloc to challenge Western dominance and address grievances related to abusive trade practices and neglect of poorer nations' development needs, among others. However, observers note that BRICS has a limited track record and may struggle to deliver on expectations.

The BRICS alliance could gain control of the majority of the world's oil and gas trade by including Saudi Arabia and the United Arab Emirates, which could lead to a shift away from the USD and the de-dollarization of the oil economy.

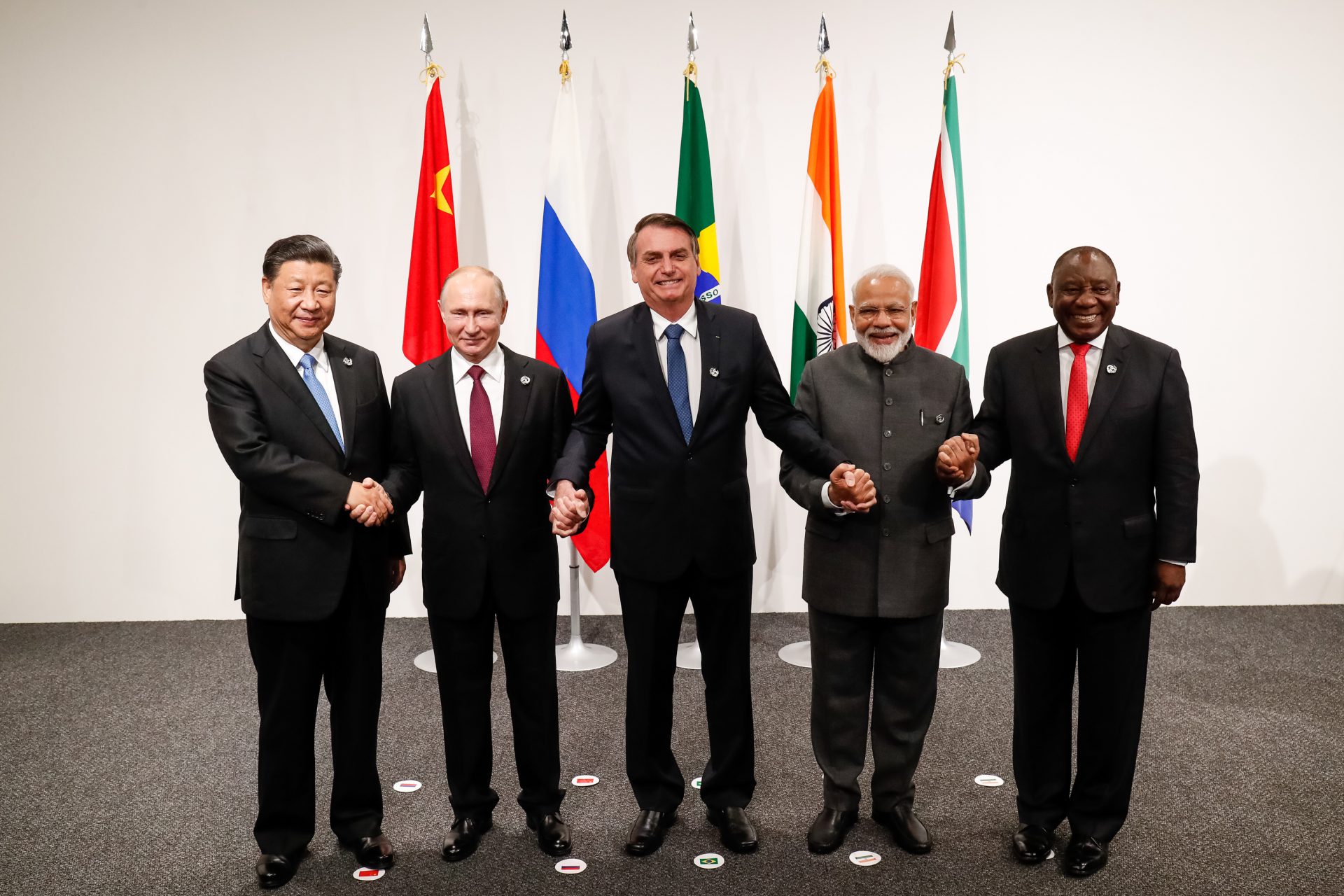

The Brics economic group, consisting of Brazil, Russia, India, China, and South Africa, is discussing the possibility of expanding its membership and promoting the use of local currencies for trade settlement, with aims to challenge the dominance of the US dollar, but analysts believe that the greenback is unlikely to lose its status as the international reserve currency.

The BRICS nations have caught up with the G7 in terms of collective GDP, but still lag behind in terms of GDP per capita, according to the IMF.

The BRICS alliance, consisting of Brazil, Russia, India, China, and South Africa, has decided to invite Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates to join their economic coalition, according to South African President Cyril Ramaphosa.

The BRICS New Development Bank is receiving applications from 15 countries to join, as it aims to lessen its dependence on the US dollar and prioritize local currency lending.

The BRICS summit is aiming to reduce reliance on the U.S. Dollar, as the coalition confirms new members including UAE, Egypt, Ethiopia, Saudi Arabia, and Argentina, and discusses the possibility of a new payment system and currency backed by gold.

BRICS is considering making local currencies the only accepted form of payment for oil and gas settlements, which could potentially shift global power from the West to the East.

South Africa is poised to expand its agricultural trade and globalize its economy as it enhances its position within the BRICS grouping, with the ZZ2 Farming Company using cutting edge technologies and tariff agreements to facilitate agricultural trade with other BRICS countries; the expansion of BRICS will create a powerful group of growth economies that will demand multilateral reforms, increase collaboration among growth economies, and enhance the use of regional currencies.

The expansion of BRICS to include Iran, Saudi Arabia, Egypt, Ethiopia, Argentina, and the United Arab Emirates will make the bloc represent 46 percent of the world population and 37 percent of global GDP, but China's economic dominance within the group raises questions about whether it will truly be an "equal partnership."

The BRICS' economic output represents over 40% of the world's population and is predicted to reach 40% of global GDP by 2040, but skepticism remains about their effectiveness as a bloc due to differences in economic policy, China's dominant role, and conflicts among member countries.

The BRICS expansion and their de-dollarization efforts have been met with a relatively calm response from the US, Germany, and the European Union, emphasizing the importance of countries choosing partnerships based on their national interests.

The BRICS bloc, which has now expanded to include 11 countries, controls 30% of the global economy, 46% of the world's population, and a significant share of commodities such as manganese, graphite, nickel, and copper, as well as 42% of the global oil supply, potentially putting pressure on the US economy and challenging the traditional world order.

The BRICS alliance is considering the creation of a 'single unit account' as an alternative currency to the US dollar, in order to settle cross-border transactions without depending on a single currency or local currencies.

The BRICS expansion, which includes countries like Saudi Arabia, the UAE, and Iran, has raised concerns in the U.S. and EU as it poses a threat to Western-dominated financial markets, while China's influence grows and the alliance aims for de-dollarization in global trade.