### Summary

The Chinese economy has slipped into deflationary mode, with retail sales, industrial production, and exports all missing forecasts. Shrinking domestic demand and a debt-fueled housing crisis are the main causes behind this slowdown.

### Facts

- 📉 Retail sales in July grew by 2.5% year-on-year, compared to 3.1% in June.

- 🏭 Value-added industrial output expanded by 3.7% y-o-y, slowing from 4.4% growth in June.

- 📉 China's exports fell by 14.5% in July compared to the previous year, and imports dropped 12.4%.

- 💼 Overall unemployment rate rose to 5.3% in July, with youth unemployment at a record 21.3% in June.

- 📉 Consumer Price Index-based inflation dropped to (-)0.3%, indicating a deflationary situation.

- 🏢 China's debt is estimated at 282% of GDP, higher than that of the US.

### Causes of the slowdown

- The debt-fueled housing sector collapse, which contributes to 30% of China's GDP.

- Stringent zero-Covid strategy and lockdown measures that stifled the domestic economy and disrupted global supply chains.

- Geopolitical tensions and crackdowns on the tech sector, resulting in revenue losses and job cuts.

### Reaction of global markets

- The S&P 500 fell 1.2% following the grim Chinese data.

- US Treasury Secretary warns China's slowing economy is a risk factor for the US economy.

- Japanese stocks and the Indian Nifty were also impacted.

- China's central bank cut its benchmark lending rate, but investors were hoping for more significant stimulus measures.

### Global market concerns

- China's struggle to achieve the 5% growth target may impact global demand.

- China is the world's largest manufacturing economy and consumer of key commodities.

- A slowdown in China could affect global growth, with the IMF's forecast of 35% growth contribution by China seeming unlikely.

### Impact on India

- India's aim to compete with China in the global supply chain could benefit if Chinese exports decline.

- However, if China cuts back on commodity production due to slowing domestic demand, it may push commodity prices higher.

### Summary

The global economy is showing signs of decoupling, with the US economy remaining strong and China's economy disappointing at the margin. The recent data suggests that the US economy is resilient, with consumption and other indicators pointing in a positive direction. However, there are concerns about the bear steepening of the US curve and the repricing of the long end of the curve. In contrast, China's economy continues to struggle, with weak data and monetary policy easing. Japan has surprised with positive data, but there are questions about whether the current inflation shift will lead to tighter monetary policy. Overall, there are concerns about a potential global economic recession and its impact on various economies.

### Facts

- 💰 Despite the decoupling of the US and China economies, concerns remain about the negative impact of a China slowdown on global growth.

- 💹 Recent data show that the US economy, particularly consumption, remains resilient.

- 🔒 The bear steepening of the US curve and the repricing of the long end of the curve are causing concerns.

- 🇨🇳 In China, weak data on consumption and investment and declining house prices continue to affect the economy. The PBoC has eased monetary policy.

- 🇯🇵 Japan's 2Q data surprised with strong export growth, but there are concerns about the impact of a potential inflation shift on global yields.

- 🌍 The global economy is at risk of recession, with concerns about the impact on emerging market economies and the US economy.

### Summary

Last week, Moody's warned that China's aging population will impact demand for homes, reduce the labor pool, and have an impact on competitiveness. Age dependency ratios in China are increasing, indicating a higher need for healthcare services and pension payouts.

### Facts

- Moody's warned that China's aging population will be a drag on economic potential if policy measures fail to boost the birthrate and promote productivity.

- China's aging population will impact demand for homes and reduce the labor pool, leading to higher wages and a negative impact on competitiveness.

- Demographics will support housing demand in Indonesia and Vietnam over the next decade, while China experiences the opposite trend.

- The age dependency ratio in China has been increasing, indicating a higher need for healthcare services and pension payouts.

- India's growth trajectory has not been significantly impacted by demographic factors historically, but efforts to maximize productivity and create opportunities can change that.

- Technological and institutional innovations can ameliorate the effects of population aging.

- India has an opportunity to tap into China's worsening demographic and seize the moment, potentially surpassing Vietnam and Indonesia.

(Source: Hindustan Times)

### Summary

Commerce and Industry Minister Piyush Goyal believes that India will become the engine of global growth, with its economy projected to reach $35 trillion by 2047. India's young population and vibrant democracy are key factors contributing to its sustainable and inclusive growth.

### Facts

- India is expected to become the growth engine of the world, according to Commerce and Industry Minister Piyush Goyal.

- The country's GDP is projected to reach $35 trillion by 2047, offering significant business opportunities.

- With a population of 1.4 billion people, India recently surpassed China as the world's most populous country.

- India's young population, with over 600 million people aged between 18 and 35, is expected to continue for at least the next few decades.

- India is estimated to provide 24.3% of the incremental global workforce over the next decade.

- The country's digital economy has grown rapidly, with initiatives like the Aadhaar program and the Skill India program promoting digital literacy and skills development.

- India aims to create sustainable and inclusive growth, focusing on value creation and becoming a matter of pride and envy.

🇮🇳💼🌍📈🌱

China is facing a severe economic downturn, with record youth unemployment, a slumping housing market, stagnant spending, and deflation, which has led to a sense of despair and reluctance to spend among consumers and business owners, potentially fueling a dangerous cycle.

China's economy, which has been a model of growth for the past 40 years, is facing deep distress and its long era of rapid economic expansion may be coming to an end, marked by slow growth, unfavorable demographics, and a growing divide with the US and its allies, according to the Wall Street Journal.

China's economy is facing challenges with slowing growth, rising debt, tumbling stock markets, and a property sector crisis, and some analysts believe that heavy-handed government intervention and a lack of confidence are underlying causes that cannot be easily fixed. However, others argue that China's problems are solvable and that it remains a superpower despite its considerable problems.

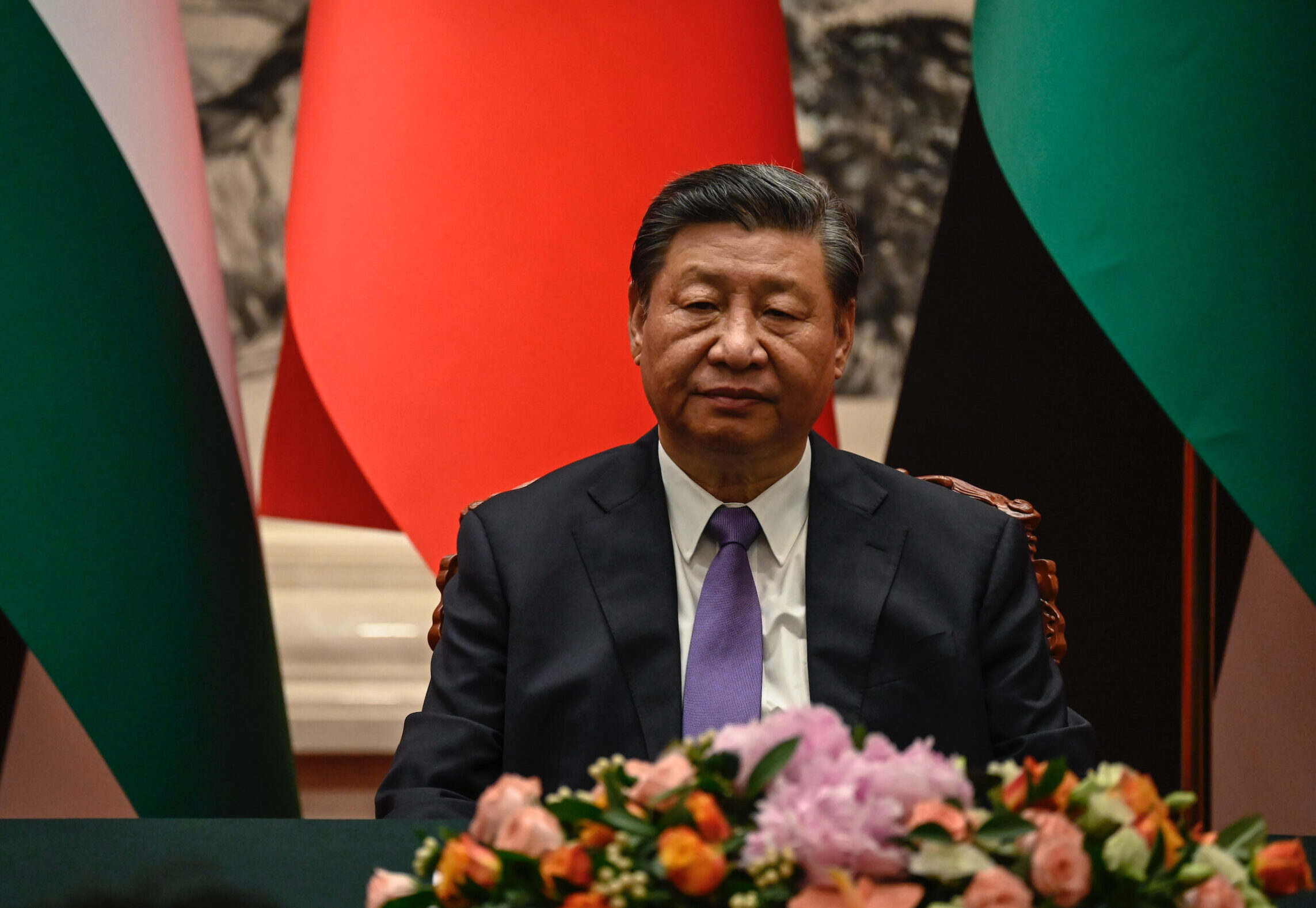

China's economy is struggling and facing a lurching from one economic challenge to the next due to failures in economic policy and the centralization of power under President Xi Jinping, which is causing bad decision-making and a decline in living standards.

China's economic model, driven by industrialization and exports, is showing weaknesses with an imbalanced economy, low demand, slumping trade, and a struggling property sector, highlighting the need for structural reforms to boost domestic consumption and confidence.

India's economy is experiencing consistent growth, and is predicted to become the fourth-largest economy within 18 months and the third-largest by 2028, driven by strong fundamentals and infrastructure development, while successfully reducing poverty; however, further reforms in areas such as patents, judicial, administrative, and process reforms are needed to boost economic growth.

India, China, and Indonesia are predicted to have the largest working-age populations among G20 countries by 2030, indicating a shift in economic geography towards Eastern nations, according to a report by McKinsey, which also highlights the varying trends of sustainability and inclusion among G20 economies.

China's economic slowdown is causing alarm across the world, as it is expected to have a negative impact on global economic growth, leading to reduced imports and trade, falling commodity prices, a deflationary effect on global goods prices, and a decline in tourism and luxury spending.

China's economy is facing multiple challenges, including tech and economic sanctions from the US, structural problems, and a decline in exports, hindering its goal of becoming a top global exporter and tech power, which could have long-lasting effects on its status in international relations and the global economy.

The global economy may face slow growth due to record levels of government debt, geopolitical tensions, and weak productivity gains, which could hinder development in some countries even before it begins.

China's economy is facing challenges, with youth unemployment at a record high, mismatched skills in the job market, and the risk of falling into the middle-income trap, jeopardizing President Xi Jinping's goal of turning China into a high-income nation.

China's economy is facing significant challenges, including a property crisis, youth unemployment, and a flawed economic model, but the government's limited response suggests they are playing the long game and prioritizing ideology over effective governance.

The global economy is expected to slow down due to persistently high inflation, higher interest rates, China's slowing growth, and financial system stresses, according to Moody's Investors Service, although there may be pockets of resilience in markets like India and Indonesia.

India's recent achievements and economic growth have positioned it as a rising global power, but the country must address its challenges in poverty, job creation, education, and inequality in order to fully realize its potential.

The prospect of a prolonged economic slump in China poses a serious threat to global growth, potentially changing fundamental aspects of the global economy, affecting debt markets and supply chains, and impacting emerging markets and the United States.

China's economy is showing signs of slowing down, including a decrease in GDP growth rate, declining exports, deflationary consumer price index, high youth unemployment, a weakening yuan, and a decrease in new loans, which could have global implications.

China's economic growth has slowed but has not collapsed, and while there are concerns about financial risks and a potential property crisis, there are also bright spots such as the growth of the new energy and technology sectors that could boost the economy.

Policymakers expect slower growth in China, potentially below 4%, as the country transitions to a consumption-driven economy, which could have a negative impact on the global economy and alleviate inflationary pressures.

China's middle class, which has grown significantly in the 21st century, is facing challenges as social mobility stalls and the gap between the wealthy and the rest of society widens, leading many to question if China's economic rise is coming to an end.

The global economy is expected to be influenced by three key factors in the next five years, including increased labor bargaining power, potential conflicts between central banks and governments over borrowing costs, and the power struggle between the US and China, which will lead to higher risk-free rates and lower expected equity risk premiums for investors.

China's economy has entered deflation territory and the debt crisis has worsened, while India's economy is thriving with GDP growth expected to exceed 7% and unemployment rates at a 12-year low; it is predicted that India will surpass China in per capita income by 2044 due to factors such as female education expansion, labor force growth, and higher total factor productivity growth.

Signs of improvement in China's economy, such as improving credit demand and easing deflationary pressures, may not be enough to stabilize the economy due to bigger concerns of decreasing affordability, tight wages, and rising costs that have not been addressed. A comprehensive policy revamp may be necessary for China's economy to recover.

China's economic model is in decline and will have a significant impact on global markets, according to veteran investor David Roche, who predicts long-term struggles for manufacturing-based economies and warns of potential social unrest and geopolitical problems.

China's economic slowdown is unlikely to trigger a global catastrophe, but multinational corporations and those indirectly linked to China will still feel the effects as household spending decreases and demand for raw materials drops. China's reduced investment abroad may affect developing countries' infrastructure projects, while the impact on China's foreign policy remains uncertain. However, concerns of a financial contagion similar to the 2008 crisis are deemed unlikely due to differences in China's financial infrastructure. While the extent of the impact is unclear, local concerns can still have unforeseen effects on the global economy.

The International Monetary Fund believes that China's economy can accelerate growth over the medium term through reforming its economy to shift towards consumer spending from investment, although recent data shows signs of stabilization.

China's economic growth appears to be slowing down, with issues such as an aging population and a collapsing housing sector leading to speculation that the country's economic miracle may be coming to an end, while its diplomatic strategies have also caused strain on international relationships.

China's economic slowdown, driven by a real estate crisis and prolonged Covid-19 measures, is raising doubts about its status as the largest economy in the world by 2030, while India is emerging as a promising economic powerhouse and attracting significant investments.

China's economic malaise is attributed to a failure to implement necessary reforms, with structural threats to stability increasing and growth expectations diminishing, according to a report by Rhodium Group and the Atlantic Council, which warns that the country's goal of becoming the world's largest economy may be delayed.

Asia's competitive advantage has shifted from cheap labor to industrial services, including logistics, waste management, and data centers, according to a report by KKR's heads of global and Asia macro, who believe that the demand for infrastructure and logistics in countries like India, China, Japan, and others will continue to accelerate. Japan, in particular, is experiencing a capex cycle and corporate reform that is boosting shareholder returns, making it an attractive investment opportunity. Meanwhile, India is witnessing significant growth in infrastructure investment and exports, leading to increased productivity and economic growth. China's economy is undergoing a transition, with a growing digital economy and emphasis on decarbonization.

The global economy is facing a range of challenges including climate change, food insecurity, and poverty, with the cost of achieving sustainable development goals rising to $4 trillion a year; however, with the right policies and global cooperation, productive investment in developing economies can be boosted to achieve these goals and overcome the current malaise.

The World Trade Organization has revised its forecast for global trade growth, halving its estimate due to rising interest rates and various economic challenges, with a particular impact on iron, steel, office equipment, textiles, and clothing. The slowdown in trade has raised concerns about the potential negative impact on living standards worldwide, particularly in poor countries.

The US economy is predicted to slow down by mid next year, which will have a negative impact on global GDP, according to Neelkanth Mishra, Chief Economist for Axis Bank. Mishra also mentioned that China will grow slowly but not collapse, while India will be affected through various pathways such as a decline in services growth, goods demand, dumping of products, and financial market volatility. However, he believes that India's trajectory looks good in the next 5-7 years.