European Central Bank policymakers are increasingly concerned about deteriorating growth prospects and there is growing momentum for a pause in rate hikes as major economic indicators come in below expectations, suggesting a recession is now a distinct possibility.

European policymakers are increasingly concerned about stagflation, as evidence of slowing growth and persistent inflation weighs on their economies, prompting reassessment of interest-rate settings.

Private debt fundraising and deals in Europe are slowing down, indicating that aggressive interest rate rises may be causing funding stress and exacerbating economic pain. The European private credit industry has seen a 34% drop in new investment compared to the same period last year, and direct lenders are closing fewer transactions, leading to concerns about defaults and tighter liquidity in the future.

The European Central Bank is facing a dilemma on whether to raise its key interest rate to combat inflation or hold off due to economic deterioration, with investors split on the likelihood of a rate hike.

The European Central Bank is expected to raise interest rates, but traders believe that any immediate risk to the euro is likely to be on the downside, and if there is a hike, it will likely be the last.

The rise of Europe's hard right poses a real threat, and the EU's liberals must find better ways to counter their influence.

The European Central Bank's decision to signal its last rate hike has further weakened the euro, causing hedge funds and speculators to anticipate potential parity with the dollar.

The European Central Bank's handling of monetary policy under Christine Lagarde, including unnecessary interest rate hikes, risks pushing the Eurozone into a recession.

The European Central Bank should focus on persisting with high interest rates rather than testing the economy to breaking point, according to Governing Council member Francois Villeroy de Galhau.

Europe's economy is facing trouble as interest rates rise and debt servicing costs increase, particularly in the eurozone where the European Central Bank will struggle to provide support due to the constraints of the euro; fiscal deficits and breaches of budget deficit limits persist, with countries like Italy and France openly defying spending cuts, while Germany's reluctance to break from balanced budgets and increase investment spending exacerbates the contracting economy.

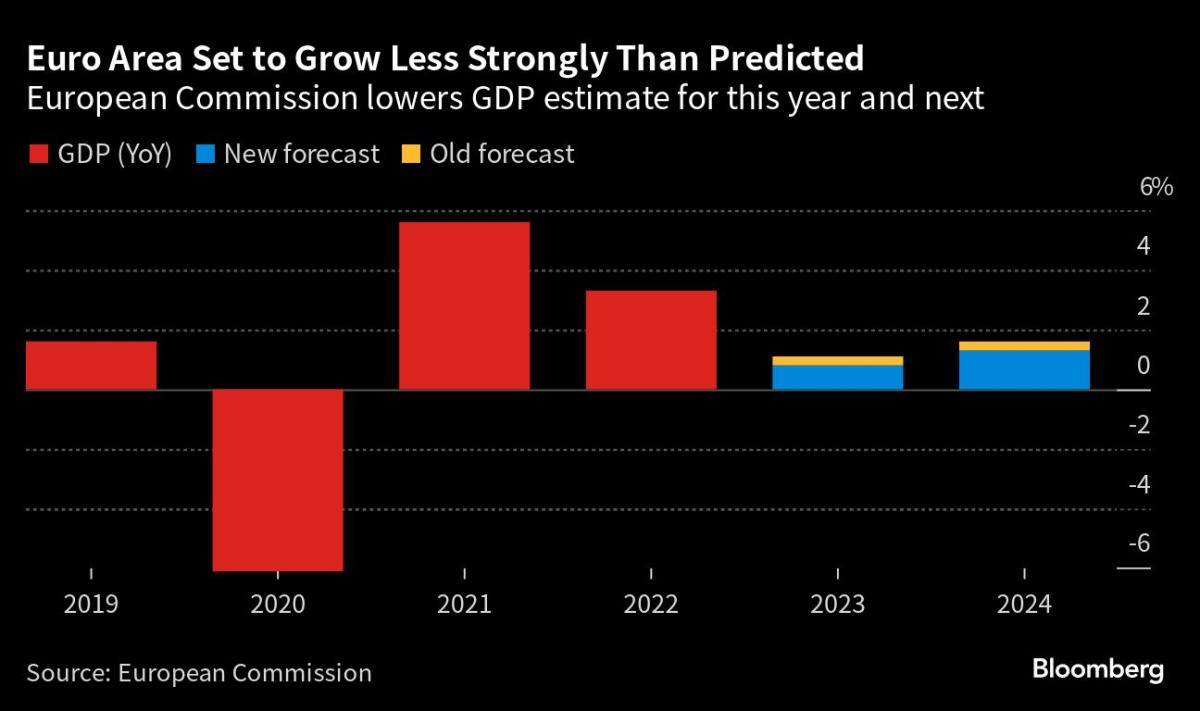

The euro area is experiencing stagnated economic activity and weakening growth, leading the European Central Bank (ECB) to adjust its monetary policy by raising interest rates to combat inflation; however, uncertainties remain regarding the transmission of monetary policy and potential risks to economic growth.

The recent rise in interest rates and bond market rebellion against America's debt politics is causing concern, impacting the real economy with higher mortgage rates and a slump in stocks, leading to voters expressing discontent with the Biden economy.

Europe faces the risk of bailouts as governments grapple with the consequences of a decade of cheap money, with the International Monetary Fund warning that central banks in the bloc could incur significant losses and require recapitalization.

The European Central Bank (ECB) has raised its key interest rates for the tenth consecutive time in response to a series of crises and the need for price stability, although the rise has caused concerns about the level of interest rates and their impact on growth; ECB President Christine Lagarde emphasizes the need to make inflation projections more robust and to communicate effectively with the public to counter misinformation.