- China currently dominates the electric vehicle, battery, and critical metals industries.

- However, other countries, such as Australia, India, and the US, have started pushing back against Chinese investment in these industries.

- There is suspicion and concern about Chinese EV companies in countries like France, which is calling for an investigation into unfair subsidies by the Chinese government.

- This could potentially lead to new tariffs on Chinese EV imports to the EU.

- China's recent actions, such as threatening to curb exports of important materials and banning coal imports from Australia, have further fueled concerns about dependence on China.

The article discusses the potential for the West to use China's economic slowdown to gain an advantage in the electric car race, highlighting the need for a different approach to counter China's advantage. The author suggests welcoming Chinese investment and immigration of skilled Chinese scientists to strengthen the American EV industry and potentially weaken China.

BMW and Mercedes are intensifying their efforts in the electric vehicle market, unveiling new platforms and concept cars in response to competition from Chinese automakers and Tesla, although they may still lag behind in certain aspects.

Chinese companies have increased their presence in cutting-edge materials and electric vehicles, making it challenging for other countries to reduce their dependence on Chinese supply chains, despite protectionist measures.

European car manufacturers face an unwinnable battle with China as the EU proceeds with its ban on petrol cars, according to the CEO of BMW.

Europe's automakers are showcasing their latest electric vehicles at the IAA Mobility car show in an attempt to compete with Tesla and counter the increasing competition from Chinese companies such as BYD and Xpeng.

Europe's carmakers are facing a tough battle to catch up with China in the development of affordable and consumer-friendly electric vehicles, with Chinese EV makers already a generation ahead, according to industry analysts and executives at Munich's IAA mobility show.

Chinese electric car firms, including BYD and Xpeng, are expanding their presence in Europe and challenging traditional automakers in the EV market, capitalizing on Europe's attractive market and stringent regulations pushing towards EV adoption.

European manufacturers, such as Volkswagen, have an advantage over Chinese EV makers due to their vehicle know-how, quality, and brand legacy, according to VW CEO Oliver Blume.

China's passenger vehicle sales experienced growth in August, driven by discounts and tax breaks on environmentally friendly and electric cars, despite a weak economy, and Tesla's share of the Chinese electric vehicle market nearly doubled.

China's automobile and component exports have doubled in 2021, leading to an investigation by the European Commission into subsidies given to Chinese electric vehicle makers, as European automakers express concern over competition from China in the growing electric vehicle sector.

Tesla is expected to benefit from European protectionist measures as regulators crack down on Chinese electric vehicle (EV) competition, causing stocks of Chinese EV companies like NIO and XPeng to plunge.

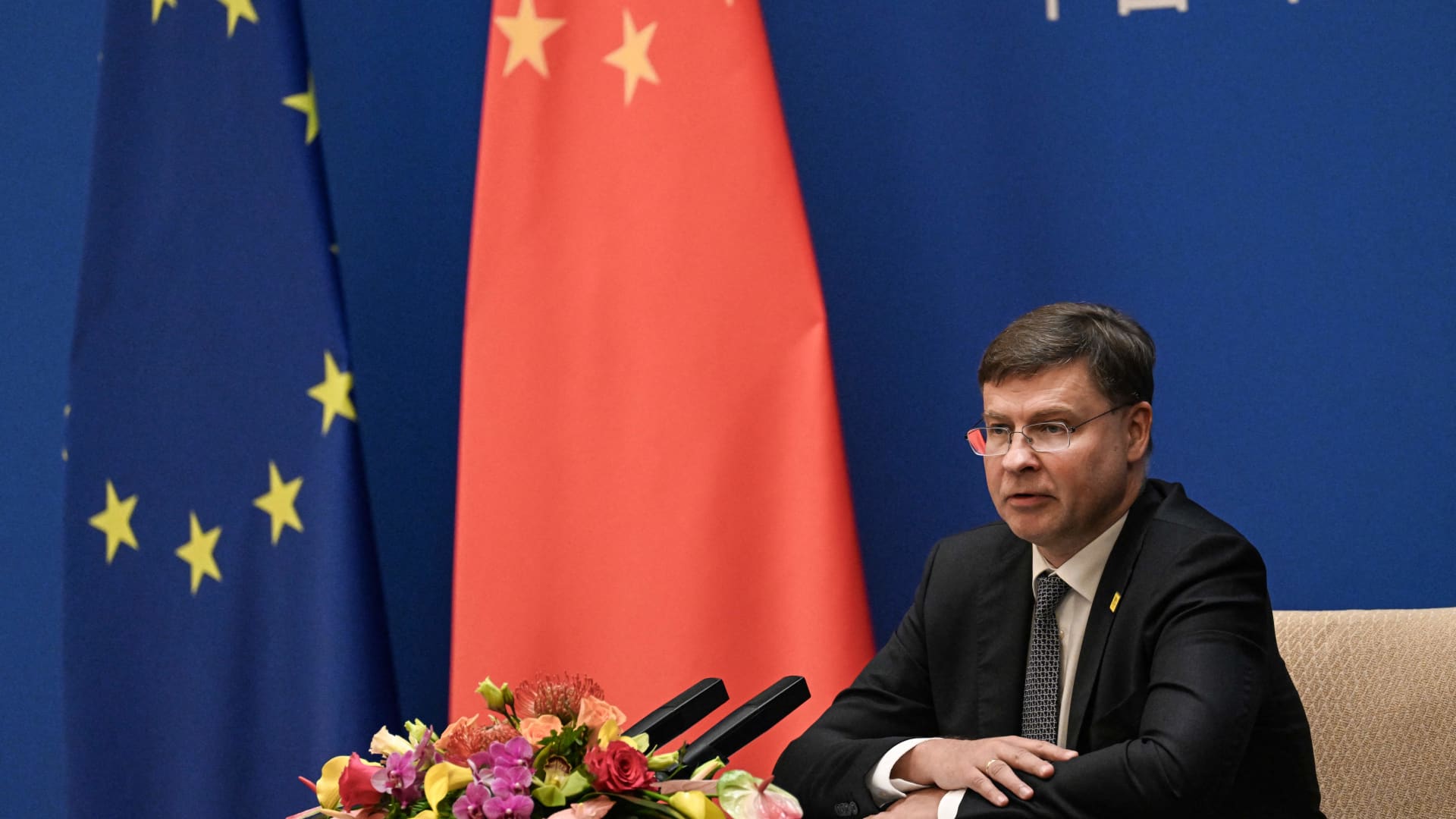

The European Commission has launched an investigation into whether to impose punitive tariffs on Chinese electric vehicle (EV) imports that it considers to be benefiting from state subsidies, as the Chinese share of the European EV market has reached 8% this year.

China accuses the European Union of "blatant protectionism" following an "anti-subsidy" investigation into China's electric vehicle makers, posing a threat to China-EU trade relations and potentially leading to tariffs on Chinese EVs.

The European Union's increasing scrutiny of Chinese electric-vehicle companies has caused tension between the two, impacting the EV space and EU-China relations.

German carmakers are concerned about potential retaliation if the EU imposes duties on Chinese electric vehicles, according to German Economy Minister Robert Habeck, who also acknowledged a Franco-German divide over the anti-subsidy probe.

The European Automobile Manufacturers’ Association is urging the EU to scrap plans for 10% tariffs on electric vehicle manufacturers who do not source all their parts from within the bloc and Britain, warning that this could result in a £3.7bn cost and drive up consumer prices.

The European Commission has launched an investigation into Chinese electric vehicle subsidies, which will be fact-based and conducted in accordance with EU and WTO rules.

China's commerce minister expressed dissatisfaction with the European Union's decision to launch an anti-subsidy investigation on China's electric vehicles, calling it a protectionist act that will affect China-EU green cooperation and the global automotive industry.

European regulators are investigating subsidies given to Chinese automakers that may be affecting European companies, including Tesla, but investors do not appear concerned.

The rise of electric vehicles in China is causing a shakeout in the auto market, with midsize automakers struggling to compete with local rivals and the government supporting select companies in its bid to become an automotive powerhouse.

Legacy carmakers like Ford are struggling to catch up with the electric vehicle (EV) revolution led by Tesla and Chinese competitors, as they face a significant technology gap and higher production costs, which hinder their ability to deliver affordable EVs while governments are planning to ban or limit gas and diesel car sales.

Chinese automaker BYD is set to surpass Tesla as the world's largest seller of electric vehicles, with sales of 431,603 fully-electric vehicles in Q3, just 3,456 units shy of Tesla's global delivery figures, driven by BYD's expansion into luxury EV brands and increased exports.

The European Commission has initiated an anti-subsidy investigation into Chinese electric vehicles, which could potentially lead to the imposition of tariffs on imports from China within the next 13 months.

The European Commission has opened an investigation into China's electric vehicle sector, citing evidence of subsidies that could harm the EU industry and potentially result in import duties on vehicles from China.

Tesla's China-made EV sales decreased by 10.9% in September, while Chinese rival BYD saw a 42.8% growth in passenger vehicle deliveries, as both companies navigate the market's changing consumer sentiment and economic stabilization.

Tesla's sales of China-made electric vehicles decreased by 10.9% in September compared to the previous year, while Chinese competitor BYD experienced a 42.8% growth in passenger vehicle deliveries.

Chinese automakers, such as BYD, are making a push into the European market with their low-cost electric vehicles, offering an attractive option for European consumers seeking affordable electric cars, but also posing a threat to Europe's traditional automakers who underestimated the electric revolution.

Major automakers, including Mercedes-Benz, are facing challenges in the electric vehicle market due to waning customer demand, high interest rates, and intense price competition with Tesla and Chinese competitors. The slow growth of EV sales and ongoing strikes in the industry are further impacting the adoption of EVs.