High mortgage rates, reaching their highest level in 21 years, are driving up costs for home buyers and creating a sluggish housing market, with little relief expected in the near term.

Connecticut homebuyers are facing some of the highest mortgage rates in decades, with the average rate on a 30-year fixed mortgage reaching the highest level since 2000, driving up monthly costs and prompting buyers to consider different programs and grants, while lenders advise staying in the market and thinking about refinancing in the future.

Canadian mortgage borrowers are increasingly opting for fixed interest terms, with a record 95% of mortgage originations in June being fixed rate, reflecting a desire to avoid short-term interest rate hikes while not missing out on potential rate cuts in the future.

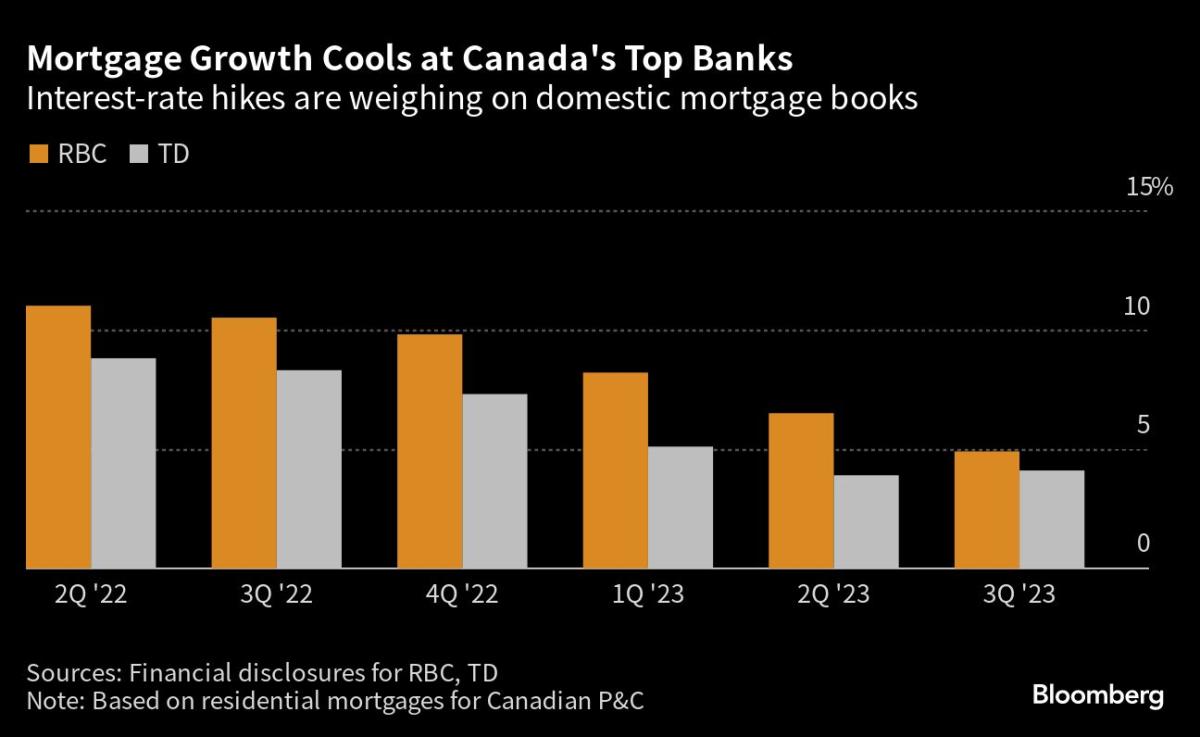

Canadian real estate and the economy are facing challenges, with slowing growth, high debt for millennials, increased fixed-rate mortgages, rising housing prices as an inflation risk, and low mortgage growth prompting concerns.

The second quarter of 2023 saw a consistent rise in borrowing among Canadians, with subprime borrowers experiencing the highest increase in credit balances due to higher spending habits and elevated interest rates on variable-rate loans. Demand for new credit also grew significantly, leading to a total Canadian household debt of $2.3 trillion.

Mortgage rates have increased recently due to inflation and the Federal Reserve's interest rate hikes, but experts predict rates will remain in the 6% to 7% range for now; homebuyers should focus on improving their credit scores and comparing lenders to get the best deal.

Summary: Rising interest rates have revealed issues in home loan markets, causing stagnation in housing markets and difficulties for borrowers in countries like the US, UK, Sweden, and New Zealand, highlighting the value of the Danish system of long-term fixed-rate mortgages with prepayable options and flexible transferability.

The Bank of Canada is set to issue an interest rate update, with experts predicting a potential rate hike that could impact mortgage payments and home values.

The Canadian government is facing higher debt servicing costs as interest rates rise, resulting in billions of additional dollars spent on interest payments and less money available for other government priorities, potentially leading to difficult decisions about cutting spending or increasing taxes.

Mortgage rates for home purchases and refinancing have fluctuated, with rates for 30-year terms increasing and rates for 10-year and 15-year terms decreasing. Borrowers have the option to choose a term that aligns with their financial goals and preferences.

Many homeowners in the UK are struggling to meet their mortgage repayments due to the Bank of England's 14 interest rate hikes since December 2021, with further increases predicted, leading to fears for the future and reliance on food banks.

Refinancing demand for home loans increased despite rising mortgage rates, as borrowers are likely concerned about further rate hikes and the limited inventory of homes for sale.

UK homeowners are feeling the strain as interest rates remain high, with many struggling to afford increased mortgage payments and considering drastic measures such as taking in lodgers or canceling expenses in order to make ends meet.

The average long-term U.S. mortgage rate has increased, posing challenges for homebuyers in an already unaffordable housing market.