The U.S. economy continues to grow above-trend, consumer spending remains strong, and the labor market is tight; however, there are concerns about inflation and rising interest rates which could impact the economy and consumer balance sheets, leading to a gradual softening of the labor market.

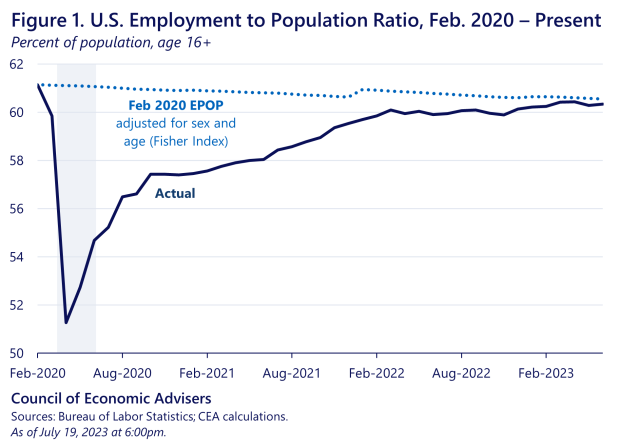

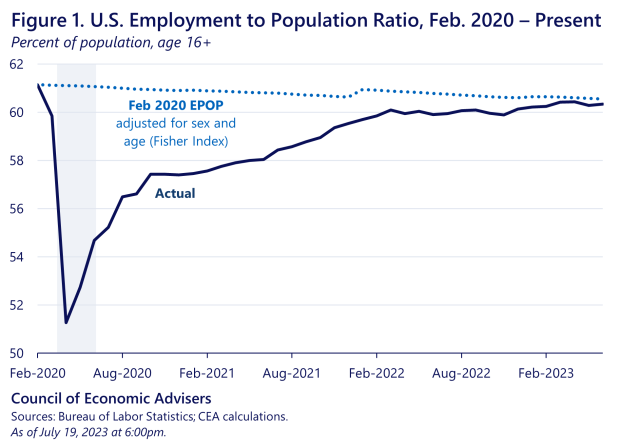

The U.S. labor market has proven resilient in the face of the pandemic, with narratives of a "she-cession," early retirements, a white-collar recession, and missing men falling apart as employment rates rebound among various demographic groups, highlighting the lesson that one should never bet against the U.S. worker.

Older workers have a real advantage in the job market due to the Great Resignation of 2021, which has left many companies in need of generational expertise, and there are three options for older candidates to start a strong second chapter in their careers: full-time employment, gig work, or becoming an entrepreneur.

Despite initial expectations of rising unemployment, the US labor market has remained robust due to pandemic-related fiscal support and increased consumer spending, preventing a hard landing for the economy.

US labor market remains strong despite signs of better balance, with future interest rate decisions dependent on incoming data, says Federal Reserve Bank of Cleveland President Loretta Mester.

The August jobs report shows a healthy labor market with steady growth, although there are signs of cooling due to higher interest rates and downward revisions to previous job numbers, but overall it is seen as a robust report, with women and immigrants playing a significant role in the labor force. There are some concerns, such as Americans spending down their savings and potential consequences of the Federal Reserve's rate hikes.

The US job market remains resilient despite lower-than-expected job growth in July, with the unemployment rate dipping to 3.5% and more Americans entering the job market, easing pressure on employers to raise wages.

Nearly half of current retirees in the US are considering reentering the workforce due to financial reasons, impact of inflation on savings, and a desire for social connections and a sense of purpose, according to a study. This trend, known as "unretirement," has been driven by a booming labor market and rising inflation, and is likely to continue as more offices reopen. However, older workers often face ageism and judgment from coworkers and hiring managers. Despite these challenges, many retirees feel happy, energized, and excited about returning to work.

The aging population in America, particularly the boomers, is driving up housing demand and prices, leading to an affordability crisis and locking out middle-income buyers in the market.

As the average population ages, a majority of older Americans are reaching retirement with limited options for affordable long-term care, as costs continue to rise and long-term care insurance remains uncommon.