The U.S. economy is forecasted to be growing rapidly, which is causing concern for the Federal Reserve and those hoping for low interest rates.

The US economy has exceeded the Federal Reserve's estimate of its growth potential in recent years, with growth averaging 3% under President Joe Biden, but concerns about rising public debt and inflation, as well as the Fed's efforts to control them, may lead to slower growth in the future and potentially a recession. However, there are hints of improving productivity that could support continued economic growth.

The U.S. economy and markets seem to be in good shape for now, but there are concerns about the potential for problems in the future due to factors such as rising interest rates, supply and labor shocks, and political uncertainties.

Despite initial predictions of a recession, the U.S. economy has experienced unexpected growth, with high consumer spending and continued borrowing and investment by businesses being key factors.

The Federal Reserve faces new questions as the U.S. economy continues to perform well despite high interest rates, prompting economists to believe a "soft landing" is possible, with optimism rising for an acceleration of growth and a more sustainable post-pandemic economy.

The US economy continues to perform well despite the Federal Reserve's interest rate hikes, leading to questions about whether rates need to be higher and more prolonged to cool inflation and slow growth.

Despite the optimism from some economists and Wall Street experts, economist Oren Klachkin believes that elevated interest rates, restrictive Federal Reserve policy, and tight lending standards will lead to a mild recession in late 2023 due to decreased consumer spending and slow hiring, although he acknowledges that the definition of a recession may not be met due to some industries thriving while others struggle.

Consumer spending growth is slowing as the economy stabilizes, with consumers prioritizing essential purchases and adjusting their spending habits in response to rising interest rates and financial pressures.

Despite predictions of a slowdown, the American economy continues to show strong growth, with recent data suggesting annualized growth of nearly 6% in the third quarter; however, concerns about overheating and potential inflation, as well as increasing bond yields, raise doubts about the sustainability of this growth.

The US Federal Reserve must consider the possibility of the economy reaccelerating rather than slowing, which could have implications for its inflation fight, according to Richmond Fed President Thomas Barkin. He noted that retail sales were stronger than expected and consumer confidence is rising, potentially leading to higher inflation and a need for further tightening of monetary policy.

Despite the inverted yield curve, which traditionally predicts an economic downturn, the US economy has remained strong due to factors such as fiscal and monetary stimulus efforts and a lag time before interest rate hikes impact the economy, but some bond market experts believe the yield curve will eventually prove to be a good indicator for the market and the economy.

The Central Bank of Turkey is expected to continue its policy tightening, but doubts remain as to whether the pace of tightening will be sufficient, given the high inflation rate; meanwhile, the focus in the US is on the jobs market and the unemployment rate's impact on inflation, and pessimism reigns for the euro due to concerns about the ECB's ability to raise interest rates.

The US economy is expected to slow in the coming months due to the Federal Reserve's efforts to combat inflation, which could lead to softer consumer spending and a decrease in stock market returns. Additionally, the resumption of student loan payments in October and the American consumer's credit card addiction pose further uncertainties for the economy. Meanwhile, Germany's economy is facing a contraction and a prolonged recession, which is a stark contrast to its past economic outperformance.

The U.S. economy expanded at a 2.1% annual pace in the second quarter, downgraded from the initial estimate of 2.4%, but still demonstrating resilience in the face of higher borrowing costs and inflation concerns.

The US job market shows signs of slowing but remains resilient, with 187,000 jobs added in August and a rise in the unemployment rate to 3.8%, as more people actively look for work. Wage gains are easing, signaling a potential slowdown in inflation, and the Federal Reserve may decide against further interest rate hikes.

US labor market remains strong despite signs of better balance, with future interest rate decisions dependent on incoming data, says Federal Reserve Bank of Cleveland President Loretta Mester.

The U.S. economy may achieve a soft landing, as strong labor market, cooling inflation, and consumer savings support economic health and mitigate the risk of a recession, despite the rise in interest rates.

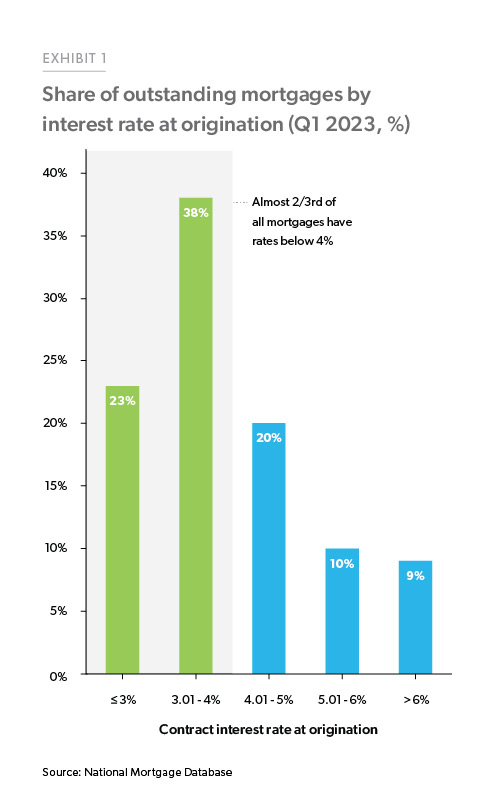

The US economy may face disruption as debts are refinanced at higher interest rates, which could put pressure on both financial institutions and the government, according to Federal Reserve Bank of Atlanta President Raphael Bostic.

U.S. consumer spending increased in July, boosting the economy and reducing recession risks, but the pace is likely unsustainable as households dip into their savings and face potential challenges from student debt repayments and higher borrowing costs.

The U.S. economy is defying expectations with continued growth, falling inflation, and a strong stock market; however, there is uncertainty about the near-term outlook and it depends on the economy's future course and the actions of the Federal Reserve.

The August jobs report shows a healthy labor market with steady growth, although there are signs of cooling due to higher interest rates and downward revisions to previous job numbers, but overall it is seen as a robust report, with women and immigrants playing a significant role in the labor force. There are some concerns, such as Americans spending down their savings and potential consequences of the Federal Reserve's rate hikes.

US inflation remains too high despite recent improvements, according to Federal Reserve Bank of Cleveland President Loretta Mester, who also states that the labor market is still strong.

The US job market is cooling down, with signs of weakening and a slowdown in momentum, which may allow the Federal Reserve to ease inflation pressure through weaker job creation and reduced demand.

Deutsche Bank strategists warn that the U.S. economy has a greater chance of entering a recession within the next year due to high inflation and the Federal Reserve's aggressive interest rate hike campaign.

The U.S. economy is expected to expand at a 2.2% annual rate in the current quarter, according to a real-time estimate from the New York Federal Reserve, which is lower than the Atlanta Fed's estimate of 5.6% growth; the strength of the economy will impact the Federal Reserve's decision on interest rates and inflation.

The US manufacturing industry is experiencing a "manufacturing boom" with increased construction spending and rising investments, but concerns remain over weakening demand and the potential impact of higher interest rates on economic growth.

Consumer spending has remained resilient, preventing the US economy from entering a recession, and this trend will likely continue due to low household debt-to-income levels.

The US economy is facing a looming recession, with weakness in certain sectors, but investors should not expect a significant number of interest-rate cuts next year, according to Liz Ann Sonders, the chief investment strategist at Charles Schwab. She points out that leading indicators have severely deteriorated, indicating trouble ahead, and predicts a full-blown recession as the most likely outcome. Despite this, the stock market has been defying rate increases and performing well.

Consumer spending in the US has supported the economy despite concerns of a recession, but rising interest rates, the resumption of student loan payments, and dwindling savings are predicted to put pressure on consumers and potentially lead to a shrinking of personal consumption.

Stronger-than-expected U.S. economic data, including a rise in producer prices and retail sales, has sparked concerns about sticky inflation and has reinforced the belief that the Federal Reserve will keep interest rates higher for longer.

The US economy shows signs of weakness despite pockets of strength, with inflation still above the Fed's 2% target and consumer spending facing challenges ahead, such as the restart of student loan payments and the drain on savings from the pandemic.

The labor markets are expected to pause on rate changes as the economy slows down, with growth in employment and capital expenditure decreasing and downside risks increasing, such as higher interest payments for the government and a potential United Auto Workers strike. However, there is hope for a rebound in 2024 with a potential pause in rate cuts and moderating inflation.

American workers are facing a decline in median annual household income due to high inflation, with 17 states experiencing a decrease while only five saw an increase, according to data from the Census Bureau. The labor market remains challenging, with wages rising but not enough to keep up with inflation.

The Federal Reserve's restrictive monetary policy, along with declining consumer savings, tightening lending standards, and increasing loan delinquencies, indicate that the economy is transitioning toward a recession, with the effectiveness of monetary policy being felt with a lag time of 11-12 months. Additionally, the end of the student debt repayment moratorium and a potential government shutdown may further negatively impact the economy. Despite this, the Fed continues to push a "higher for longer" theme regarding interest rates, despite inflation already being defeated.

Despite assurances from policymakers and economists, inflation in the US continues to rise, posing significant challenges to the economy and financial stability.