Home insurers are increasingly pulling out of California and Florida due to rising construction costs, growing catastrophe exposure, a challenging reinsurance market, and insurance companies facing higher costs from extreme events, leading to concerns over homeowners insurance availability and costs and potentially impacting housing markets in both states.

Insurance companies are struggling to keep up with the rising prevalence of natural disasters and the potential for catastrophic losses.

Skipping home insurance due to rising premiums is a risky proposition, as homeowners may face financial devastation in the event of a disaster that damages or destroys their property.

More Americans are choosing not to buy home insurance due to rising premiums, putting them at significant risk of losing their homes and belongings in case of a disaster, with factors such as inflation and climate change being blamed, and those with lower incomes being more likely to go without coverage.

Frequent weather catastrophes, fueled by climate change, are causing disruptions in the home insurance market, with insurers pulling out of high-risk areas, raising prices, and reducing coverage, leading to tougher choices and higher costs for consumers.

The increasing risks of extreme weather events from climate change are causing insurance companies to raise rates and pull back from high-risk areas, which could potentially lead to losses for banks that rely on insurance-backed collateral for loans.

Florida-only insurers like Citizens Property Insurance expect less damage and fewer claims from Hurricane Idalia compared to previous storms, easing concerns of further market pullback, but industry experts still predict challenges for the insurance market and the possibility of increased premiums for customers.

More than 80 percent of prospective homebuyers nationwide consider climate risks when shopping for a home, with millennials being the most considerate generation, according to data from Zillow.

Rising insurance premiums, caused by climate change and insurers pulling out of coverage areas, will disproportionately affect low-income policyholders and hinder disaster recovery efforts in heavily affected regions.

Deadly wildfires in Hawaii and a historic hurricane in Florida have caused significant damage and brought insurance risks to homeowners' attention, leading insurers to reconsider their risk exposure and potentially leave certain markets, creating an affordability crisis for insurance.

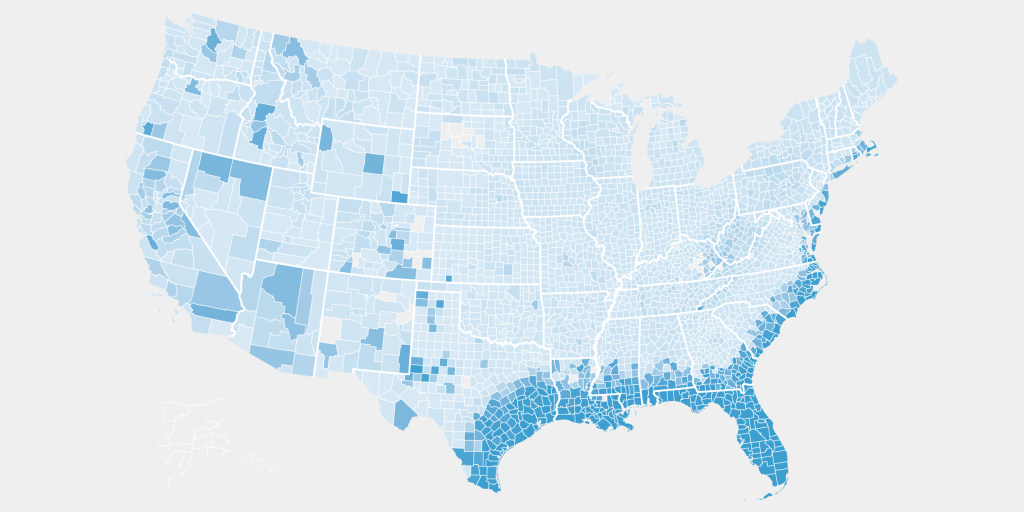

Millions of American homeowners are facing increasing insurance costs and reduced coverage due to climate change-related risks, with properties in high-risk areas potentially becoming overvalued as insurance underprices the risk, according to a new analysis from the First Street Foundation.

A new study warns of a looming "climate insurance bubble" in Florida, which could result in rising insurance rates and declining property values due to the increasing risks of hurricanes and other climate-driven disasters.

The increase in hazardous areas, climate change, and bad policy have led to a growing number of properties in America becoming uninsurable, with insurers pulling out of vulnerable areas and homeowners facing rising rates and canceled policies.

Climate change is posing risks to the construction of upscale homes in Hong Kong's Redhill Peninsula, as heavy rainfall caused landslides and buildings to be perilously close to the edge, demonstrating that even costly and well-constructed homes can be vulnerable to extreme weather events.

A climate-risk intelligence firm has warned that some of the most overvalued housing markets in the US, particularly in California and Florida, are at high risk of climate-related damage from extreme weather events, leading to potential losses of $1.3 trillion to $2.2 trillion in a market rationalization.

A non-profit research group has found that nearly a quarter of all properties in the continental United States are overvalued due to a climate-insurance bubble inflated by government subsidization, with private insurers leaving risky markets and homeowners turning to state-backed insurers of last resort; policymakers should allow private insurers to set actuarially sound rates to deter reckless building and ensure the financial burden of living in high-risk areas is shouldered by those who enjoy the benefits.

Insurers are struggling to make a profit in parts of the US due to climate change exacerbating the losses caused by disasters such as fires and floods.

The increasing frequency of extreme weather events and natural disasters is driving more travelers to purchase travel insurance to protect against trip cancellations, lost luggage, and delays, leading to a boost in the travel insurance market.

The U.S. home insurance market is facing a crisis as policy premiums skyrocket and private insurers withdraw from high-risk states, leaving millions of homeowners at risk of inadequate coverage.

Despite years of reforms, insurance experts and analysts do not expect homeowners insurance premiums in Florida to decrease in the foreseeable future, potentially leaving residents struggling to afford sky-high rates.