Experts are divided on whether the US Federal Reserve should raise its interest rate target to 3% to combat inflation and cushion against recessions, with some arguing that raising inflation targets would be futile.

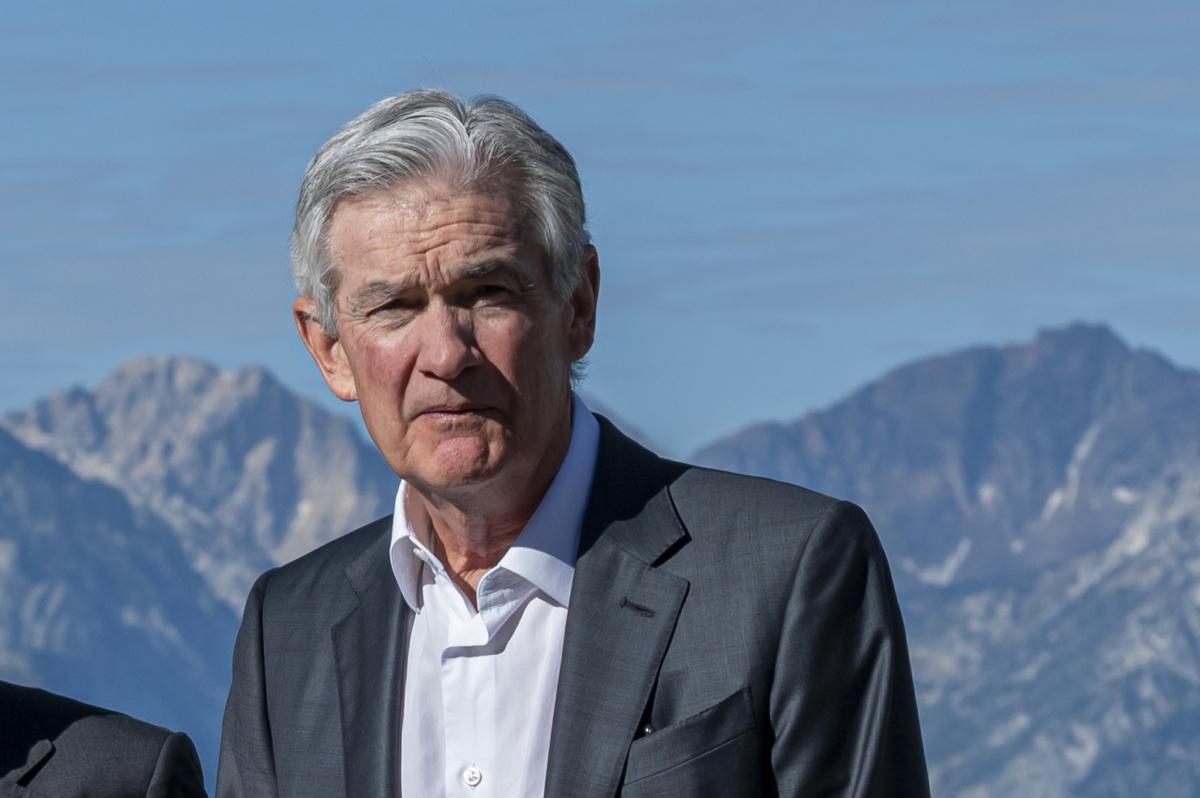

Federal Reserve Chairman Jerome Powell will likely provide updates on the central bank's stance on interest rates in the US during the Jackson Hole meeting, although an announcement regarding the end of interest rate hikes is less likely due to positive economic data and the potential risk of triggering another crisis.

The US Federal Reserve must consider the possibility of the economy reaccelerating rather than slowing, which could have implications for its inflation fight, according to Richmond Fed President Thomas Barkin. He noted that retail sales were stronger than expected and consumer confidence is rising, potentially leading to higher inflation and a need for further tightening of monetary policy.

Federal Reserve Chair Jerome Powell aims to bring inflation back down to its 2 percent target while avoiding causing a recession, as he addresses the uncertain economic outlook at the annual conference in Jackson Hole, Wyoming.

Federal Reserve Chair Jerome Powell's keynote speech at the Jackson Hole symposium will be closely watched for clues about the Fed's future actions on inflation, with expectations that Powell may leave the door open for another rate hike and express concerns about inflation not falling fast enough.

Two officials at the Federal Reserve have expressed differing views on whether or not the central bank should raise its benchmark interest rate again to combat inflation, highlighting the uncertainty surrounding future rate hikes, with more clarity expected from Federal Reserve Chair Jerome Powell's upcoming speech at a Fed conference in Jackson Hole.

Federal Reserve Chair Jerome Powell is expected to signal in his upcoming speech that the Fed plans to maintain its benchmark interest rate at a peak level for a longer period than anticipated, suggesting that any rate cuts are unlikely until well into next year, as the central bank aims to further slow borrowing and spending to reduce inflation.

As Jerome Powell, the chair of the U.S Federal Reserve, prepares to speak at the Jackson Hole symposium, the big question is whether he will signal a major shift in how central banks deal with inflation, particularly regarding interest rates and inflation targets. Some economists are suggesting moving the inflation target range from 2-3 percent, while others argue for higher targets to give central banks more flexibility in combating recession. The debate highlights the challenges of setting and changing formal inflation targets and the ongoing changes in the factors that drive growth and inflation.

U.S. Federal Reserve Chairman Jerome Powell stated that restrictive monetary policy will continue until inflation slows, and the central bank is prepared to raise rates cautiously; the price of Bitcoin briefly dipped before recovering, while traditional markets saw modest gains.

Federal Reserve Chair Jerome Powell stated that the strength of the U.S. economy may require further interest rate hikes to reduce inflation, despite uncertainties surrounding the economic outlook.

Federal Reserve chair Jerome Powell warns that the fight against inflation in the US is not over and that interest rates may have to rise further to bring it down.

Traders interpret Federal Reserve Chairman Jerome Powell's speech as an indication that the Fed will continue to raise interest rates and that the US economy remains strong.

Federal Reserve Chair Jerome Powell addressed the Jackson Hole Economic Symposium and discussed the potential risks of raising interest rates too high in order to combat inflation, stating that there could be "unfortunate costs" if the Fed's actions are excessive.

Federal Reserve Chairman Jerome Powell signaled at a conference of central bankers that more rate hikes could be on the way as the economy continues to run hot, despite a series of policy tightening measures, in an effort to combat persistent inflation.

Cleveland Federal Reserve Bank President Loretta Mester believes that beating inflation will likely require one more interest-rate hike in the U.S. and then pausing for a while, although she may reassess her previous view of rate cuts starting in late 2024, and she aims to set policy so that inflation reaches the Fed's 2% goal by the end of 2025 to prevent further economic harm.

Top central bankers, including Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde, emphasized the importance of keeping interest rates high until inflation is under control while also grappling with economic challenges and uncertainties at the annual Federal Reserve gathering in Jackson Hole, Wyoming.

Federal Reserve Chair Jerome Powell warned that inflation and economic growth remain too high and interest rates may continue to rise and remain restrictive for longer, while U.S. stocks rebounded and European markets closed slightly higher. Meanwhile, U.S. Trade Representative Katherine Tai highlighted China's dominance in rare earth metals and the vulnerability of U.S. supply chains. Grocery delivery company Instacart filed paperwork for an IPO, and upcoming PCE and jobs data will provide insights into the Fed's rate decisions. Powell's ambiguous remarks at the Jackson Hole symposium led markets to focus on the prospect of a stronger economy rather than interest rate warnings.

Asia-Pacific markets started the final trading week of August higher after U.S. Federal Reserve chair Jerome Powell said that inflation remains "too high" and that the central bank is "prepared to raise rates further if appropriate."

The Federal Reserve meeting in September may hold the key to the end of the tightening cycle, as markets anticipate a rate hike in November, aligning with the Fed's thinking on its peak rate. However, disagreement among Fed policymakers regarding the strength of the economy and inflation raises questions about the clarity and certainty of the Fed's guidance. Market skeptics remain uncertain about the possibility of a "soft landing," with sustained economic expansion following a period of tightening.

The Federal Reserve's primary inflation rate showed a decrease in core price pressures in July, but Fed Chair Jerome Powell is now focusing on price changes for services excluding housing and energy, which surged last month, potentially contributing to the gains in the stock market.

Atlanta Federal Reserve Bank President Raphael Bostic argues against further U.S. interest rate hikes, stating that current monetary policy is already tight enough to bring inflation back down to 2% over a reasonable period and cautioning against the risk of tightening too much.

Traders believe that the US Federal Reserve will not raise interest rates further this year, as the latest jobs report showed an increase in unemployment and a cooling wage growth, prompting the Fed to potentially halt rate hikes and keep policy on hold.

The Federal Reserve's preferred inflation gauge increased slightly in July, suggesting that the fight against inflation may be challenging, but the absence of worse news indicates that officials are likely to maintain interest rates.

Boston Federal Reserve President Susan Collins advocates a patient approach to policymaking and believes that more evidence is needed to determine if inflation has been tamed, stating that the Fed may be "near or even at the peak" for interest rates but further increases could be necessary depending on data outcomes.

The Federal Reserve faces a critical decision at the end of the year that could determine whether the US economy suffers or inflation exceeds target levels, according to economist Mohamed El-Erian. He suggests the central bank must choose between tolerating inflation at 3% or higher, or risking a downturn in the economy.

Economist Campbell Harvey warns that the Federal Reserve should not raise rates later this year, as he believes a recession may occur in 2024 due to an inverted yield curve and potential distortions in Bureau of Labor Statistics and GDP figures.

The upcoming U.S. Federal Reserve meeting is generating less attention than usual, indicating that the Fed's job of pursuing maximum employment and price stability is seen as successful, with labor market data and inflation trends supporting this view.

Fed Chair Jerome Powell faces the challenge of managing market expectations of interest rate hikes and addressing rising energy costs leading to inflation, while also leaving room for rate cuts if necessary.

The Federal Reserve is expected to keep its benchmark lending rate steady as it waits for more data on the US economy, and new economic projections suggest stronger growth and lower unemployment; however, inflation remains a concern, leaving the possibility open for another rate increase in the future.

The Federal Reserve is leaving its key interest rate unchanged as it moderates its fight against inflation, but plans to raise rates once more this year, as policymakers remain concerned about inflation not falling fast enough.

The U.S. Federal Reserve kept interest rates steady but left room for potential rate hikes, as they see progress in fighting inflation and aim to bring it down to the target level of 2 percent; however, officials projected a higher growth rate of 2.1 percent for this year and suggested that core inflation will hit 3.7 percent this year before falling in 2024 and reaching the target range by 2026.

The Federal Reserve's measure of inflation is disconnected from market conditions, increasing the likelihood of a recession, according to Duke University finance professor Campbell Harvey. If the central bank continues to raise interest rates based on this flawed inflation gauge, the severity of the economic downturn could worsen.

Federal Reserve policymakers Governor Michelle Bowman and Boston Fed President Susan Collins expressed the need to keep interest rates elevated to combat inflation, with Bowman suggesting further rate hikes will likely be needed to bring inflation down to the Fed's 2% target and Collins stating that further tightening is not off the table as progress in battling inflation has been slow.