CNBC's Jim Cramer believes that China's market won't collapse despite its recent economic challenges, as he trusts the country's leadership to address the issues and prevent a complete downfall.

Amid a turbulent market, CNBC's Jim Cramer urges investors to stick with their own convictions, highlighting the importance of not following the wrongheaded vision of others and mentions Palo Alto Networks as an example of a company that rebounded after reporting a solid quarter despite initial skepticism from hedge funds.

Consumer weakness in the market has caused the stock of many companies to plummet, leading money managers to focus on enterprise hardware and software companies instead, with Jim Cramer recommending Apple, Amazon, and Nvidia.

CNBC's Jim Cramer lists five stocks, including American Airlines, Bank of America, Electronic Arts, Ball Corp, and Cummins, as potential buying opportunities during market downturns.

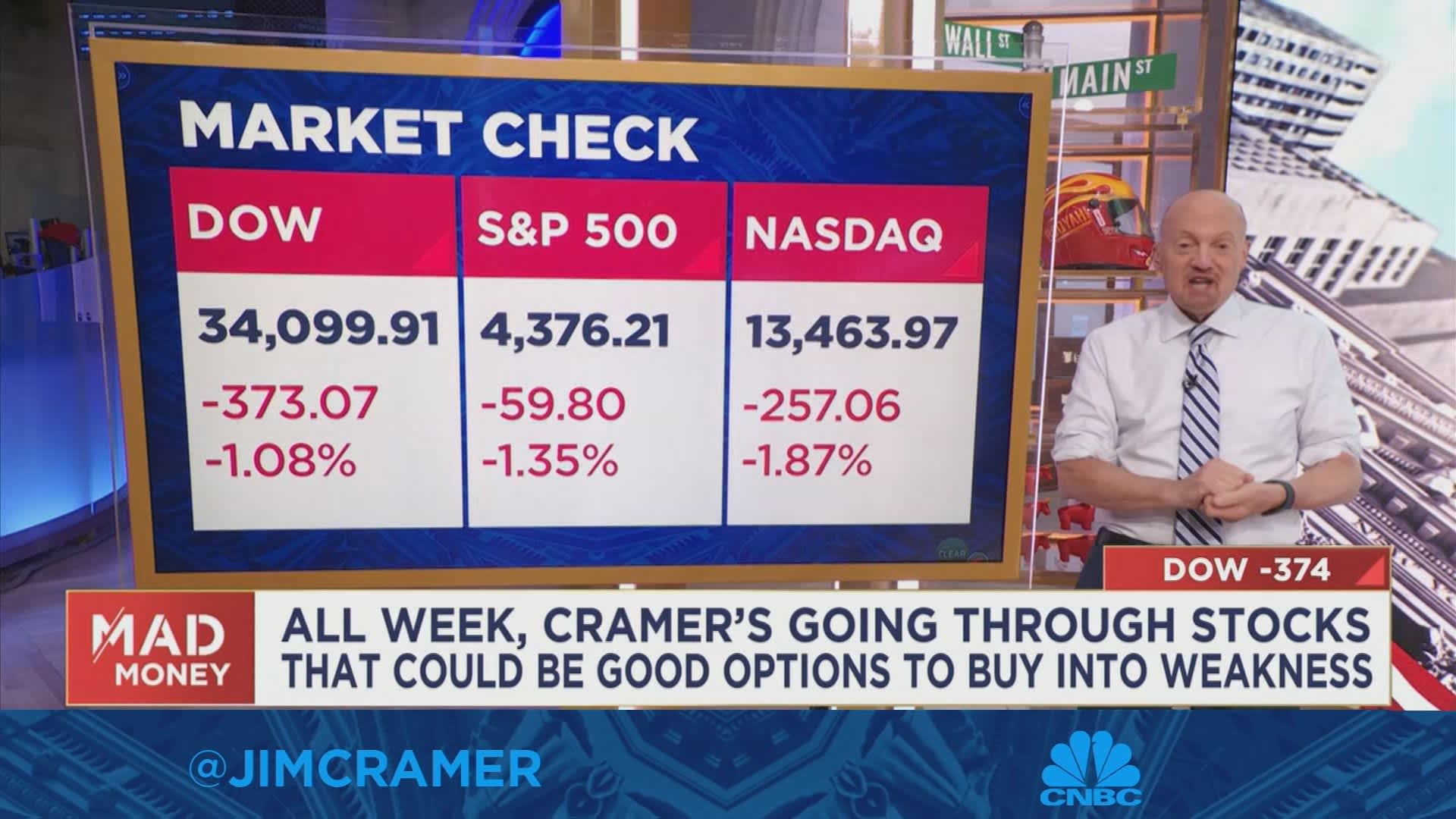

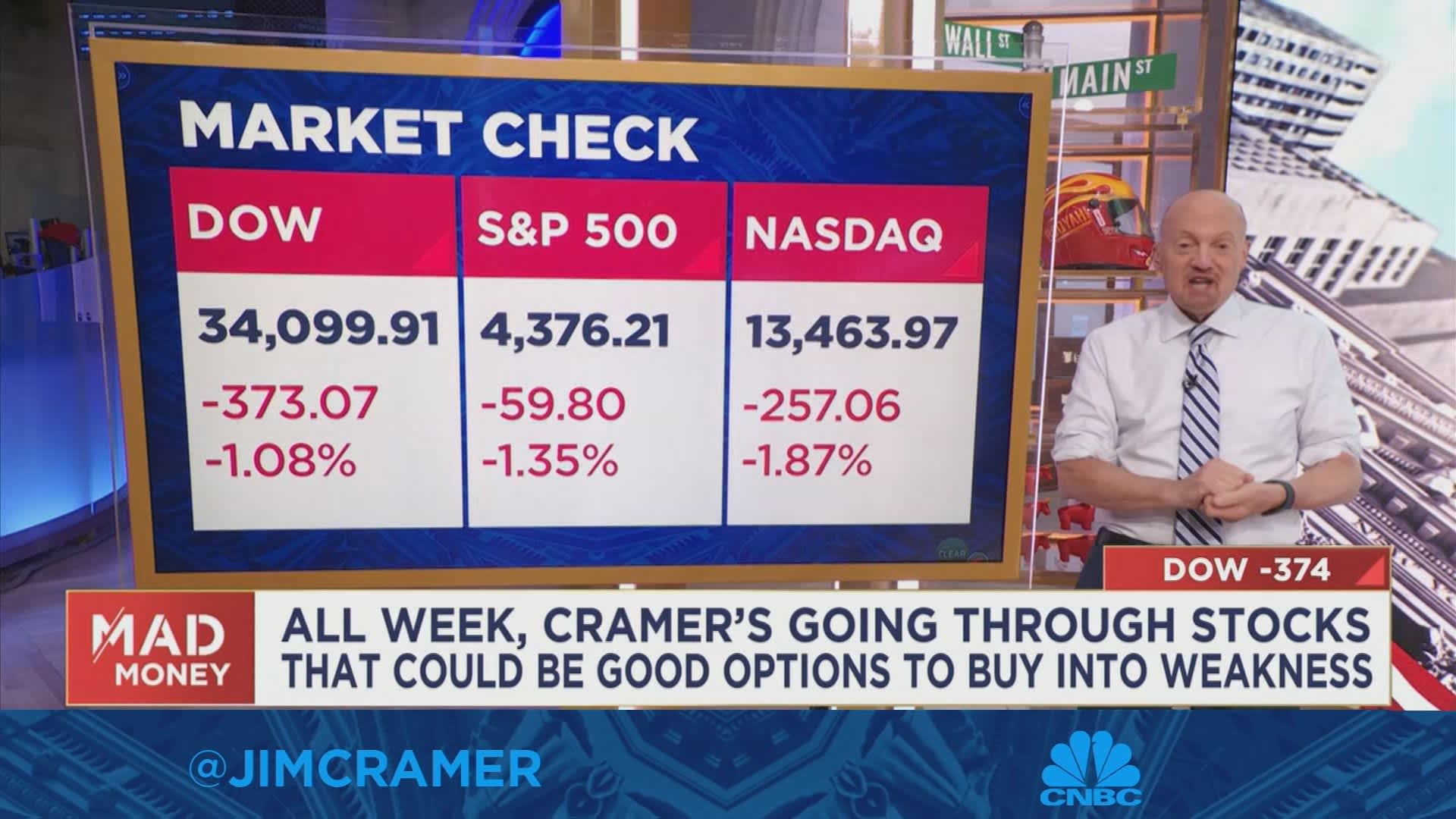

Investors should buy stocks during the August market weakness as the current pullback is just a healthy correction in a bull market, supported by economic resilience, technical analysis indicating an upward trend, insiders turning more bullish, and cautious investor sentiment.

Managing emotions can be challenging in the stock market, as CNBC's Jim Cramer advises investors not to punish themselves for mistakes and instead make rational decisions by avoiding the destructive thinking of dwelling on losses.

CNBC's Jim Cramer advises investors to believe CEOs when they preannounce an earnings shortfall or cut their forecast, suggesting that it is important to take their word for it instead of searching for justifications to keep owning the stock.

Rising bond yields and interest rates are a concern for CNBC's Jim Cramer, who believes that the market will struggle to advance if rates continue to climb.

Billionaire investor Ken Fisher emphasizes the importance of patience in navigating the stock market, assuring investors that the current bull market still has room to grow; two stocks in Fisher's portfolio, Charles Schwab and Intuitive Surgical, are considered strong buys by analysts.

CNBC's Jim Cramer advises investors to prepare for upcoming conferences and suggests getting more bullish on the stock market as the Federal Reserve nears the end of its tightening cycle, despite potential economic slowdown concerns.

Jim Cramer predicts that the upcoming demise of the inverted yield curve will expose all bearish investors as financial failures and that gradually increasing interest rates will not harm the economy if it remains healthy.

Jim Cramer's stock recommendations include buying Abbott and Essential Utilities, avoiding UiPath and Plug Power, and being cautious about Roku due to its lack of profitability.

CNBC's Jim Cramer advises investors not to be swayed by the gloomy sentiment on Wall Street in September, highlighting that external factors and market fluctuations can influence stock prices despite a company's solid fundamentals.

Investors are selling and bringing the market down due to reasons like interest rates, macroeconomic weakness, fear of giving up on gains, the Federal Reserve, the political climate, and potential strikes, according to CNBC's Jim Cramer.