This article discusses two covers of The Economist magazine. One cover focuses on the dangers of persistent inflation and the dilemma facing central bankers, while the other cover discusses Ukraine's future as a prosperous and democratic country.

The G20 warns of significant headwinds and potential crises impacting the global economy, with concerns over tightening financial conditions, debt vulnerabilities, inflation, and geopolitical tensions.

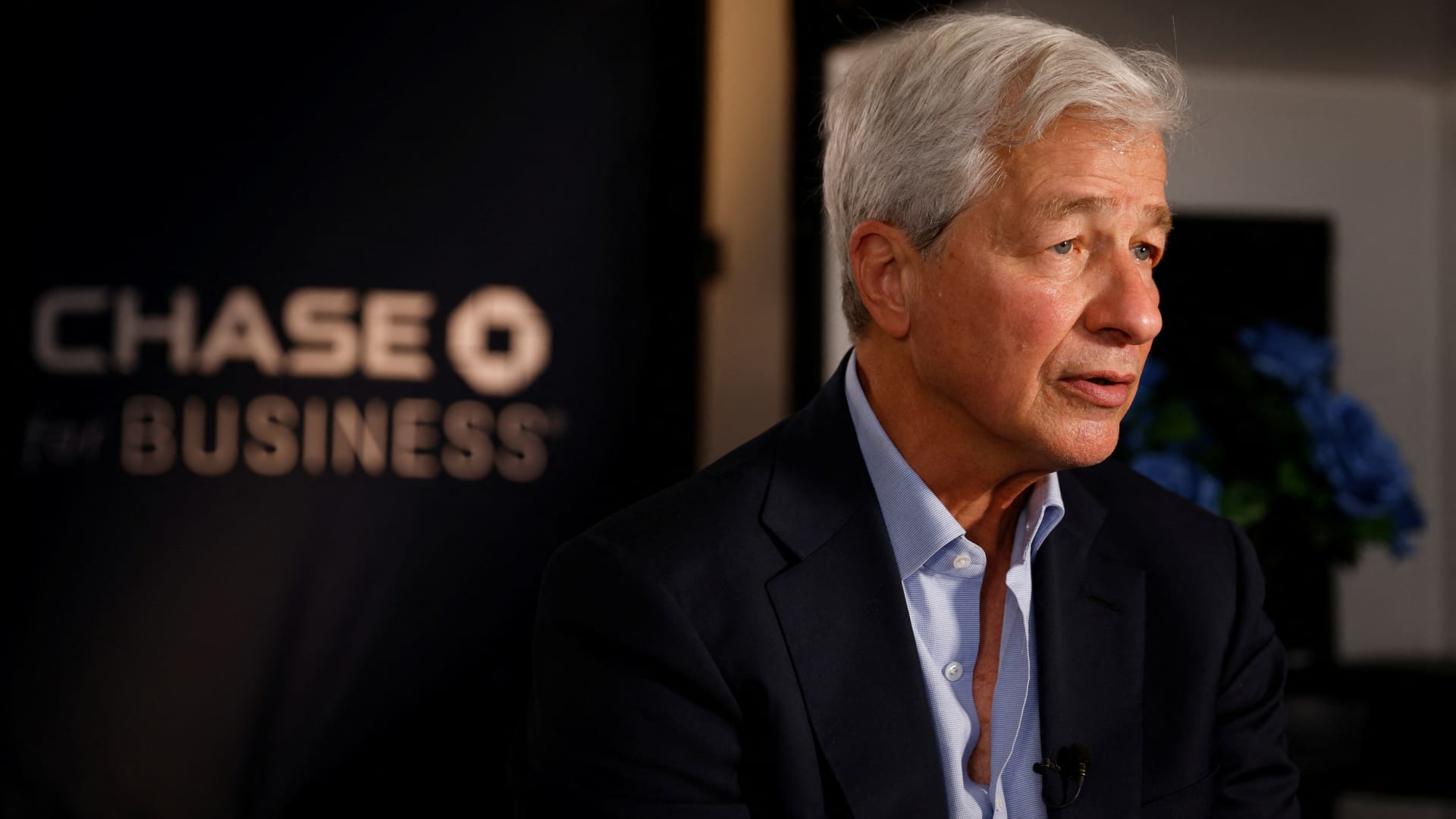

JPMorgan Chase CEO Jamie Dimon warns that while the U.S. economy is currently strong, it would be a mistake to assume it will sustain long-term due to risks such as central bank actions, the Ukraine war, and unsustainable government spending.

The global financial crisis of 2008 and subsequent events such as the covid-19 pandemic and the Ukraine war have created a more complex and volatile world, with challenges including a potential debt crisis, shifting growth engines, slowing globalization, new rules for technology, and a volatile and uncertain macro environment.

JPMorgan CEO Jamie Dimon warns of risks to the US economy despite its current strength, citing quantitative tightening, consumer spending fueled by asset prices and COVID-era savings, and the potential normalization of these factors as causes for concern.

The global economy is expected to be influenced by three key factors in the next five years, including increased labor bargaining power, potential conflicts between central banks and governments over borrowing costs, and the power struggle between the US and China, which will lead to higher risk-free rates and lower expected equity risk premiums for investors.

The war in Ukraine has significantly impacted European economic growth and increased inflation, with the Swiss National Bank stating that the consequences are likely to worsen in the medium-to-long term, according to a study.

The Ukraine war has led to a decrease in global trade between geopolitical blocs, as sanctions and blockades hinder trade flows and countries seek to diversify their sourcing.

Wall Street is concerned about the potential stress on the horizon as the Federal Reserve plans to keep interest rates higher for longer, and JPMorgan CEO Jamie Dimon warns that the world is unprepared for this scenario.

Geopolitical tensions are identified as the biggest threat since World War II, while JPMorgan CEO Jamie Dimon argues that China is not as significant a threat to the U.S. as commonly believed.

China's financial system and economy are facing significant risks, resembling a "Minsky moment," as it doubles down on excessive debt, invests in nonproductive enterprises, experiences weak economic growth, and faces internal unrest and military aggression, which could have global implications.

The Economist's senior economics writer, Callum Williams, investigates the rise of protectionism among governments and explores the true costs and benefits of globalization in response to economic shocks and geopolitical tensions.

CEOs rank geopolitics and political uncertainty as the top risk to business growth in the next three years, although they express confidence in global economic growth, according to surveys conducted by KPMG.

The outbreak of conflict in the Middle East, specifically between Israel and Hamas, has the potential to create new inflationary trends and undermine economic confidence, impacting global markets and central banks' efforts to contain the price surge caused by the pandemic and Russia's invasion of Ukraine.

Geopolitical risks in the form of the Israeli-Palestinian conflict, along with inflation and surging interest rates, weigh on stock futures, exacerbating market fragility.

The global economy is facing potential risks due to the Israel-Hamas war in the Middle East, particularly regarding oil prices and inflation, with the possibility of further escalation and involvement of other countries such as Iran.

Prominent figures in the business community, including Bill Ackman and Elon Musk, shared their insights on the Israel attack, with Ackman criticizing US leadership and Musk highlighting the role of Iran. Oil traders are concerned about potential spikes in oil prices and the impact on inflation, while economists speculate on the possibility of a recession and higher interest rates. Geopolitical uncertainty adds another layer of complexity for business leaders.

The International Monetary Fund warns that the global economic recovery is slowing and faces further complications due to the outbreak of war in the Middle East, which could potentially lead to a crisis of significant proportions.

The International Monetary Fund (IMF) predicts that fears of a global recession caused by the Ukraine war and a cost of living crisis are unfounded, as global growth has shown resilience, although it warns against central banks cutting interest rates too quickly.

JPMorgan Chase's profits surge in the third quarter, surpassing expectations and reinforcing the bank's dominance despite the challenges faced by the industry; CEO Jamie Dimon warns of economic risks, including inflation, rising interest rates, and global conflicts in Ukraine and Israel.

Global financial markets have responded to the conflict between Israel and Hamas with volatility, with world stocks rising, oil and gas markets being nervous, gold rising, the Israeli shekel weakening, and an increase in the cost of insuring Israel's government debt.

JPMorgan CEO Jamie Dimon warned investors that geopolitical threats and high government debt levels could lead to prolonged inflation and higher interest rates.

Jamie Dimon, CEO of JP Morgan, warns that the escalating conflict in Gaza and Ukraine could have far-reaching impacts on energy prices, food costs, international trade, and diplomatic relations, making it the most dangerous time the world has seen in decades.

JPMorgan CEO Jamie Dimon warns that the world is facing the most dangerous time in decades due to geopolitical turmoil, the Fed's quantitative tightening, and soaring debts.

JPMorgan CEO Jamie Dimon warns that conflicts in Ukraine and the Middle East are creating the most dangerous time the world has seen in decades, as the bank reports a 35% increase in profit in the third quarter of the year.

JPMorgan Chase CEO Jamie Dimon warns that the world is facing unprecedented dangers due to military conflicts, a tight labor market, high government debt levels, and the uncertainty of the Federal Reserve's quantitative tightening campaign.

JP Morgan CEO Jamie Dimon warns that ongoing geopolitical tensions, including the Russia-Ukraine conflict and violence between Hamas and Israel, could have far-reaching impacts on the global economy, from energy to food markets.

The U.S. economy's strength poses a risk to the rest of the world, leading to higher interest rates and a stronger dollar, while global trade growth declines and inflation persists, creating challenges for emerging markets and vulnerable countries facing rising debt costs.

The CEO of JPMorgan Chase, Jamie Dimon, has warned that the world is currently facing a dangerous time, urging caution for investors due to uncertainties such as geopolitical conflicts, inflation, government debt levels, and a potential government shutdown.

JPMorgan Chase CEO Jamie Dimon warns that the world is experiencing one of the most dangerous times in decades and highlights the potential impact of geopolitical tensions on the global economy; here are four ways to hedge your portfolio against inflation and a possible recession: consider high-yield savings accounts, invest in treasury bonds, explore real estate opportunities, and consider alternative assets such as fine art or precious metals.

The global economy faces the risk of inflation due to the conflict between Israel and Hamas, which could worsen an already fragile global outlook and contribute to rising oil prices, warns Standard & Poor's.

Investor Paul Singer warns that global markets are not appropriately concerned about the current geopolitical conflicts involving Russia, China, and Iran, and that the world is in a more dangerous state than markets indicate, also expressing concerns about private credit and recommending receiver options.

Top bank executives express pessimism about the global economy's trajectory due to ongoing Middle East conflicts and geopolitical tensions.

Wall Street leaders shared pessimistic outlooks for the global economy at an event in Saudi Arabia, citing concerns such as political tensions, inflation, recession, and conflicts such as the Israel-Hamas war.

Head of the International Monetary Fund, Kristalina Georgieva, emphasizes the importance of international cooperation in combating slow global growth and high interest rates, citing the need for governments to implement strong buffers through tax policies and expenditure policies that invest in human capital. Additionally, Georgieva highlights the costs of fragmentation and the responsibility of global leaders to address the concerns of those who have not benefited from globalization.

The Israel-Hamas war is expected to have a negative impact on the economies of Egypt, Lebanon, and Jordan, including lower tourism, increased costs for goods transportation, and more cautious investment, according to the IMF's managing director, Kristalina Georgieva. The economic fallout from the war is likely to continue to grow, despite current market stability. The UNCTAD also warned of severe consequences for the Palestinian economy, estimating damage in the tens of billions of dollars, with persistent challenges including poverty and declining foreign aid.