Mortgage rates have surged, reaching the highest level since 2000, due to concerns about high interest rates and inflation lasting longer than anticipated, causing difficulties for potential homebuyers and exacerbating the supply shortage in the housing market.

High mortgage rates, reaching their highest level in 21 years, are driving up costs for home buyers and creating a sluggish housing market, with little relief expected in the near term.

The current housing market is facing challenges due to rising interest rates and higher prices, leading to a slowdown in home sales, but the market is more resilient and better equipped to handle these fluctuations compared to the Global Financial Crisis, thanks to cautious lending practices and stricter regulations.

Mortgage rates have risen for the fourth consecutive week, reaching their highest levels since 2000, leading to decreased demand for home-purchase mortgages and a stagnant housing market.

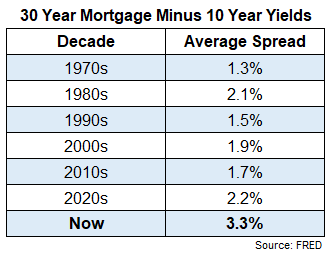

The surge in mortgage rates has caused housing affordability to reach the lowest level since 2000, leading to a slow fall in the housing market and a potential dip in home prices, although the current market differs from the conditions that preceded the 2008 crash, with low housing inventory and a lack of risky mortgage products, making mortgage rates the key lever to improve affordability.

US mortgage rates reached their highest level since 2001, with the 30-year fixed-rate mortgage averaging 7.23%, as indications of ongoing economic strength are expected to keep rates high in the short term.

The average mortgage rate in the U.S. has surpassed 7% for the first time in over two decades, leaving homeowners feeling trapped by their low interest rates.

Mortgage rates remained mostly unchanged after reaching a 22-year high earlier in the week, with only one average showing notable movement. The 30-year fixed-rate average stood at 7.67%, while other averages for different loan types also held steady or experienced minor fluctuations. It is advisable for borrowers to regularly compare rates among lenders to find the best option.

Mortgage rates have been high this month due to the Federal Reserve's rate increase and rising inflation, but they may go down if inflation calms and the Fed stops hiking rates.

The Federal Reserve's monetary tightening policy has led to a surge in mortgage rates, potentially damaging both the demand and supply in the housing market, according to Mohamed El-Erian, chief economic advisor at Allianz.

Average 30-year mortgage rates are still elevated at 6.94% in August, but they are expected to come down by the end of the year; however, a significant drop that will boost homebuying demand is not likely until 2024 or 2025, but there are advantages to buying a home even when rates are high, such as less competition.

Mortgage rates have been decreasing and could fall further this month if inflation continues to come down.

The high average rate for 30-year fixed-rate mortgages is deterring homeowners from selling, as they would face higher rates for a new mortgage and increased monthly payments, resulting in a shortage of homes for sale.

Mortgage rates for most types remained steady or experienced minimal changes, with the 30-year mortgage average dropping slightly, but still above its recent low, indicating that it's still a good idea to compare rates when seeking a mortgage.

Mortgage rates have risen significantly, but while higher-end homes have experienced price declines, lower-end homes have remained relatively unaffected, leading to a divergence in the housing market.

Mortgage rates have increased over the past week, with the average interest rates for 15-year fixed and 30-year fixed mortgages rising, while the average rate for 5/1 adjustable-rate mortgages declined; the Federal Reserve's efforts to control inflation by raising the federal funds rate may impact mortgage rates, but experts suggest that the markets have already factored in the increase.

The current housing market has defied expectations of a downturn in real estate prices caused by surging mortgage rates, with prices and demand remaining strong due to increasing household formation among baby boomers, according to a Wall Street economist.

The housing market activity remains subdued due to fluctuating mortgage rates and low housing supply, leading to decreased demand and affordability challenges for potential homebuyers.

The average 30-year fixed mortgage rate has jumped to 7.19%, the second-highest rate since November, signaling a decline in U.S. housing affordability; experts predict varying future rates, with some expecting a decline and others projecting rates to remain relatively high.

Long-term mortgage rates increased due to rising inflation and a strong economy, with 30-year fixed-rate mortgages at an average of 7.18%, according to the Freddie Mac survey.

Housing affordability is expected to worsen due to the delayed impact of higher mortgage rates, with home prices predicted to rise 0.7% year over year and reach a new record high, according to Morgan Stanley.

High mortgage rates have frozen the US housing market, but experts predict that the Federal Reserve may cut interest rates in the next 12 to 18 months, potentially leading to a decline in mortgage rates.

Mortgage rates are currently high but may level off soon, with experts predicting a potential decrease in early 2024 and rates around 5% in Q4, according to industry professionals.

UK homeowners are feeling the strain as interest rates remain high, with many struggling to afford increased mortgage payments and considering drastic measures such as taking in lodgers or canceling expenses in order to make ends meet.

US mortgage rates remain above 7% for the sixth consecutive week as inflation pressures persist, leading to cooling housing demand and a decline in builder sentiment, according to Freddie Mac's chief economist.

The average long-term U.S. mortgage rate has increased, posing challenges for homebuyers in an already unaffordable housing market.