Nvidia investors expect the chip designer to report higher-than-estimated quarterly revenue, driven by the rise of generative artificial intelligence apps, while concerns remain about the company's ability to meet demand and potential competition from rival AMD.

Nvidia's upcoming earnings report, expected to show a 65% increase in revenue, could have a significant impact on global stock markets and sentiment around the AI industry.

Nvidia's upcoming earnings report could impact AI-related crypto tokens, such as FET, GRT, INJ, RNDR, and AGIX, as well as crypto mining stocks like APLD, IREN, HUT, and HIVE.

Nvidia's strong earnings report has implications for other chip and AI stocks, leading to a potential rally attempt in the market, while Dow Jones and S&P 500 futures are mostly flat.

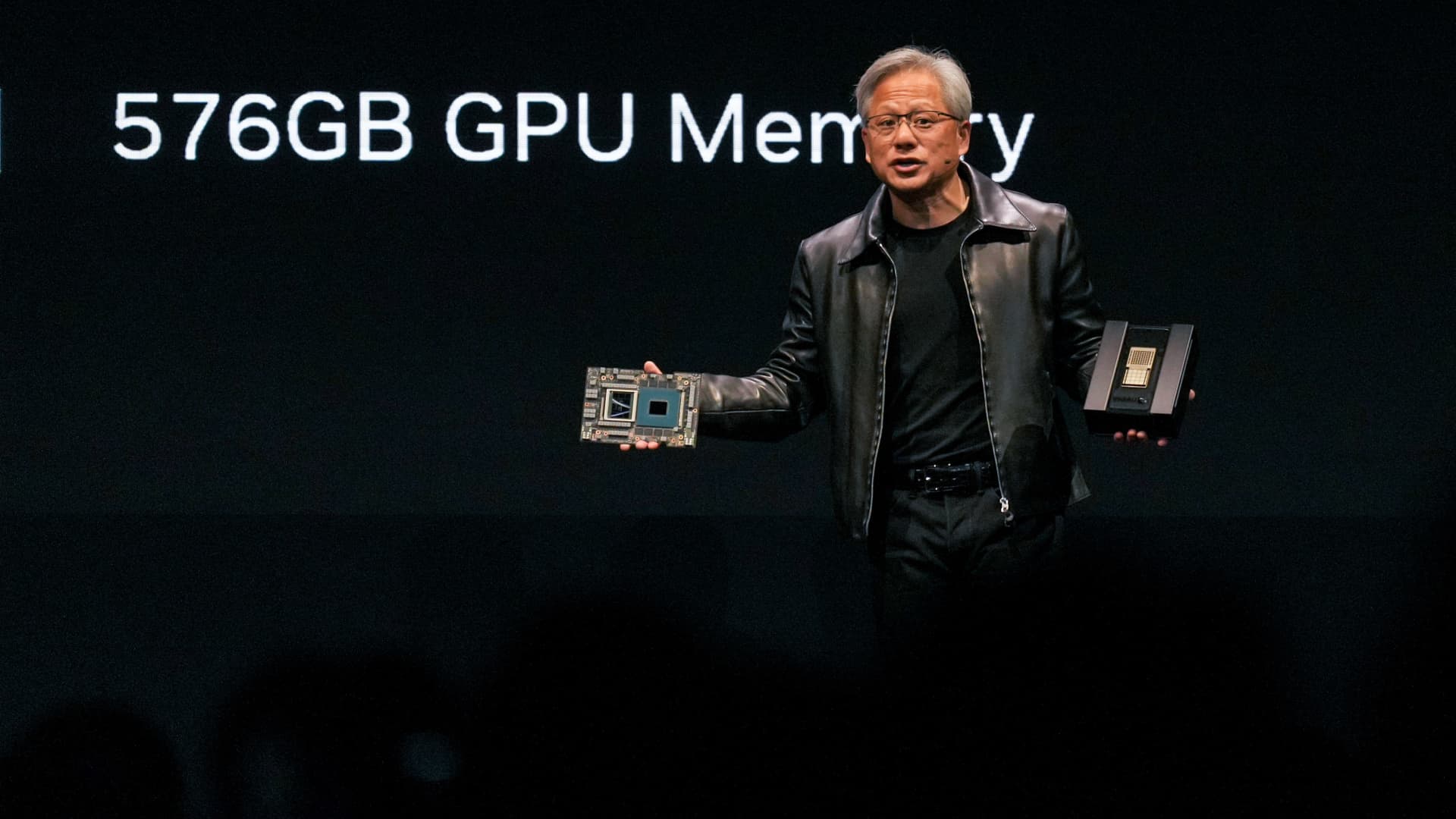

Nvidia's sales continue to soar as demand for its highest-end AI chip, the H100, remains extremely high among tech companies, contributing to a 171% annual sales growth and a gross margin expansion to 71.2%, leading the company's stock to rise over 200% this year.

Nvidia, the AI chipmaker, achieved record second-quarter revenues of $13.51 billion, leading analysts to believe it will become the "most important company to civilization" in the next decade due to increasing reliance on its chips.

Nvidia stock hits all-time highs with another strong earnings report, and analysts believe the rise won't end like the tech boom bust of the 1990s, as AI is changing business outlooks and demand for Nvidia's products is expected to continue.

Nvidia's Q2 earnings exceeded expectations, suggesting the company may be gaining a stronger foothold in the chip market.

Chip stocks, including Nvidia, experienced a selloff in the technology sector despite Nvidia's strong performance, leading to concerns that spending on AI hardware may be affecting traditional chip companies like Intel.

Semiconductor giant Nvidia has reported impressive Q2 2024 earnings, with record revenues of $13.5 billion, up 101% YoY, and earnings per share surging 854% YoY; however, despite beating analyst predictions and providing positive future forecasts, investors have sold off Nvidia shares.

Nvidia's earnings beat Wall Street estimates by 29.7%, but investors were not rewarded as the stock price declined, highlighting the difficulty of making money from actual events.

Nvidia reported a strong quarter, with beats across three out of its four businesses, driven by strong demand for its data center segment and generative AI products, leading to record revenues and beating market consensus by 22%. However, there are concerns about the sustainability of this growth and the potential impact of competition in the future.

Nvidia's shares reached a record high after the chipmaker announced its partnership with Google, while the court ruling against the SEC's denial of Grayscale's Bitcoin ETF provided a boost to cryptocurrency markets; however, economic data, including lower consumer confidence and a decline in job openings, raised concerns.

Nvidia's stock slips after reaching a record high, but analysts suggest that the chip maker may still be a bargain.

Nvidia's dominance in the AI chip market is being challenged by rivals including AMD and Intel, as well as major tech companies like Google and Amazon, who are building their own custom AI chips to reduce dependency on Nvidia's products. While Nvidia still holds a significant market share, its competitors are working towards fielding competitive offerings and gaining market share.

Nvidia's record sales in AI chips have deterred investors from funding semiconductor start-ups, leading to an 80% decrease in US deals, as the cost of competing chips and the difficulty of breaking into the market have made them riskier investments.

Nvidia has tripled its stock so far in 2023, but it is not among the best performing stocks of the year, as Carvana, MoonLake Immunotherapeutics, IonQ, and others have outperformed it.

Nvidia's stock has been booming as it dominates the artificial intelligence market, but there are concerns about potential hype and the sustainability of its growth.

Chip stock Nvidia received a boost from Goldman Sachs, who added Nvidia stock to its conviction list and stated that Nvidia would be selling shovels in the ongoing AI gold rush due to its competitive advantage and the growing demand for AI models, while analysts still maintain a strong buy rating and a price target of $639.82.

Nvidia's investment prospects are more promising than Intel's, as Intel plans to spin out its programmable chip unit and some view it as sacrificing valuable assets for less promising ones, according to CNBC's Jim Cramer.