Consumer Reports tests find Lunchables and similar lunch kits contain high levels of lead, cadmium, and sodium, making them an unhealthy option for regular consumption, the group warns.

Walmart is removing self-checkout lanes at a store in Greenville, South Carolina, in response to customer feedback and to improve the in-store shopping experience.

FCC Rolls Out Nutrition Labels for Internet Plans to Boost Transparency, But Full Compliance Lacking

The Federal Communications Commission's new requirement for internet service providers to display standardized information labels, similar to nutrition labels, on their websites has provided consumers with greater transparency regarding the costs and quality of home internet service.

Instagram is deploying new tools, including an automatic nudity blurring feature, to protect young people from sextortion and combat sexual scams and "image abuse."

Big banks such as JPMorgan, Wells Fargo, and Citigroup are warning of an uncertain year ahead due to geopolitical clashes, persistent inflationary pressures, and high levels of government spending.

Fuzzy Panda Research, an anonymous activist short-selling group, has experienced a successful streak of wins with its reports causing significant drops in targeted companies' stocks, including a 53% slump in Globe Life Inc., making it one of the most impressive performers in the community of activist short sellers.

A significant number of CEOs at major US companies are considering cutting down the workweek to 4 or 4.5 days as a solution to combat employee burnout and address the ongoing labor shortage in the US.

Celebrity chef David Chang faces backlash from fellow Asian food producers for sending cease-and-desist letters to smaller businesses using the terms "chili crunch" and "chile crunch," claiming trademark infringement on his company's product.

JPMorgan, Citigroup, and Wells Fargo reported better-than-expected first-quarter results, but their stocks have since declined as investors remain cautious about the outlook for net interest income and pressure on deposit pricing.

US Senator Sherrod Brown has urged President Joe Biden to ban Chinese electric vehicles (EVs), claiming they are an "existential threat" to the US automotive industry and inconsistent with a pro-worker industrial policy, as government subsidies for green technology companies in China continue to support EV growth and raise concerns about unfair advantages in established markets.

Consumer sentiment about the U.S. economy has slightly decreased but remains near a recent high, as Americans' outlook for the trajectory of the economy is influenced by the upcoming election and concerns over inflation and gas prices.

Former US Federal Reserve chair Ben Bernanke has suggested that the Bank of England publish its own outlook for UK interest rates, as part of a major review of the central bank's forecasting and communication methods. Bernanke also recommended that the BOE scrap its fan charts and be clearer about its views on market expectations for borrowing costs. The BOE has said it will take action on all 12 of Bernanke's recommendations.

Consumers' inflation expectations in the United States are rising, with a survey showing an expected increase to 3.1% in the next year, signaling concern about the potential slowdown in inflation.

Oil surged to its highest level since October on reports of Israel preparing for an imminent attack on government targets from Iran, causing an escalation of tensions and indicating a potential tightening of the supply/demand picture.

The upcoming halving event in Bitcoin, which reduces mining rewards, may not have the same negative impact on miners as previous halvings due to the increased demand for assets like Runes and the implementation of new protocols like BRC-20, driving up network fees and compensating for reduced block rewards. However, fundamental changes at the Layer 1 level are needed to improve efficiency and interoperability on Bitcoin and avoid potential problems with high fees and limited adoption.

Drug shortages in the U.S. have reached a record high, with over 300 active shortages reported in the first quarter of this year, including life-saving chemotherapy drugs and emergency medications stored in hospitals, according to pharmacists and industry data.

Nearly one-third of large US companies are considering implementing shorter workweeks, such as four-day or four-and-a-half-day workweeks, in an effort to address burnout and retain talent in a competitive job market.

Despite being considered more financially stable than smaller banks, JPMorgan Chase, Wells Fargo, and Citigroup have all experienced a decline in their net interest income in the first quarter of the year due to deposit margin compression and rising deposit costs stemming from the migration of depositor's funds into higher-yielding products such as certificates of deposits.

Over 54 brands showcased new watches at Watches & Wonders 2024, with GQ's Cam Wolf and British GQ's Mike Christensen selecting their top 27 favorites, including timepieces from Montblanc, Rolex, Chopard, Patek Philippe, Tudor, Zenith, TAG Heuer, Vacheron Constantin, Ressence, Cartier, Alpina, Grand Seiko, H. Moser & Cie., IWC, Piaget, Hermès, Oris, Gerald Charles, Chanel, Gucci, F.P. Journe, Nomos Glashuette, Hublot, Panerai, Bulgari, and A. Lange & Söhne.

Roku has announced that 576,000 user accounts were affected in a recent data breach, with unauthorized purchases made in fewer than 400 cases, prompting the company to implement two-factor authentication and advise users to update their passwords and remain vigilant.

A Rosenblatt Securities analyst downgraded Arista Networks' stock to sell due to the competition from chipmaker Nvidia in the artificial intelligence-driven data center network switches market.

Ford has recalled tens of thousands of Bronco vehicles on the same day that O.J. Simpson passed away, due to possible cracked fuel injectors that could lead to a fire.

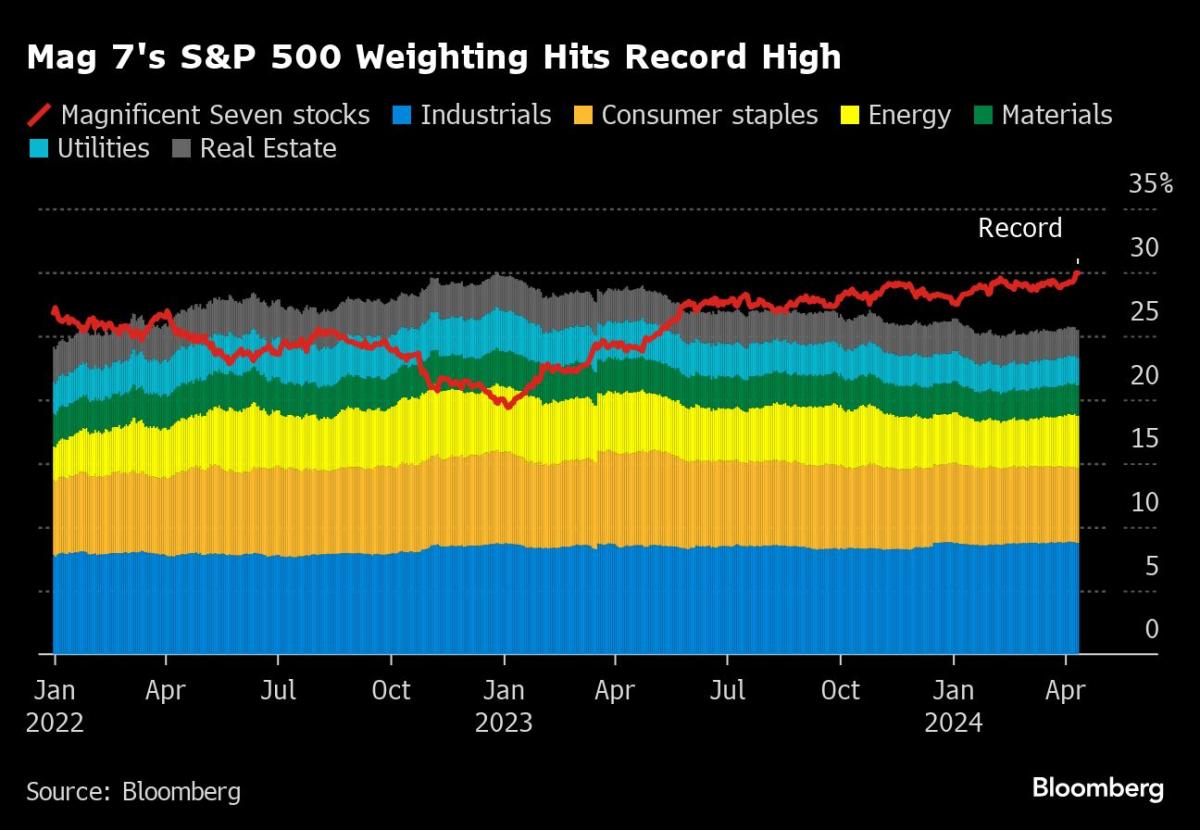

Despite some poor performances, tech stocks, including Apple, Tesla, Alphabet, Microsoft, Nvidia, Amazon, and Meta Platforms, have reached a record weighting of almost 30% in the S&P 500 Index.

Big Banks JPMorgan Chase, Citigroup, and Wells Fargo kick off the first-quarter earnings season with mixed reactions in their stocks despite beating earnings estimates, raising questions about net interest income and consumer credit.

Taiwan Semiconductor Manufacturing Company's decision to produce 2-nanometer chips in the US by 2028 is a significant step for President Biden's tech supply chain security, although the complexity of chip production may still require Asian plants for certain purposes such as AI.

Wells Fargo's profit declined by 7% in the first quarter due to higher costs of paying customers for deposits and decreased demand from borrowers, but still exceeded analysts' estimates, with adjusted profit per share coming in at $1.26; the bank's net interest income also fell by 8%.

China's Ministry of Industry and Information Technology has ordered state-owned mobile operators, including China Mobile and China Telecom, to phase out foreign chips and replace them with domestically manufactured ones, in a move that could result in heavy losses for companies like Intel and AMD and increase competition from Chinese manufacturers.

Roku has experienced a second security incident, affecting an additional 576,000 user accounts, following a previous hack last month, but no sensitive personal information was compromised, according to the company.

Palo Alto Networks warns of actively exploited critical command injection vulnerability in its PAN-OS firewall, affecting specific versions of the software and requiring immediate mitigations until security updates are available.

Big banks, including JPMorgan Chase, Citigroup, and Wells Fargo, surpass quarterly earnings estimates, with investors closely watching net interest income, while stock futures decline after volatility in inflation data and Chinese officials advise telecom providers to shift away from using American-made semiconductor chips.

OpenAI is targeting corporate customers with its AI services, including ChatGPT Enterprise, as it seeks to diversify its revenue streams and achieve its projected $1 billion revenue target for 2024.

Ohio Senator Sherrod Brown called on the U.S. government to ban Chinese-made electric vehicles due to their threat to the American auto industry and national security.

The Dow Jones, S&P 500, and Nasdaq all fell due to fears of conflict in the Middle East and concerns about Iran attacking Israel, while bank earnings and a fee increase for Coupang also influenced the stock market; meanwhile, Tesla has slightly declined after a warning about the robotaxi plan from a long-time bull.

Citigroup's profit fell in the first quarter due to increased spending on severance payments and deposit insurance, but the bank expects cost savings and a cleaner management structure from its recent reorganization.

The U.S. government's attempt to manage gold prices could actually lead to an increase in the value of bullion, according to a report by Christopher Wood, Global Head of Equity Strategy at Jefferies, who suggests that the recent surge in gold prices is being driven by demand from China and warns of the risks of official price management.

Chinese stocks, including Alibaba, Baidu, and JD, faced a significant drop as confidence in sustaining the country's financial markets waned due to a decline in exports and weak domestic demand, worsened by the competition between the US and China for economic dominance.

Rite Aid is closing 53 stores in April, including 13 in New York state, as part of the company's restructuring efforts after filing for bankruptcy in October.

JPMorgan Chase reported a 6% increase in profits for the first quarter, surpassing expectations, but CEO Jamie Dimon expressed concerns about uncertain economic forces such as wars, geopolitical tensions, inflationary pressures, and quantitative tightening from the Federal Reserve.

The U.S. government's auto safety agency is investigating a Ford recall for gasoline leaks that can cause engine fires, questioning the adequacy of the remedy provided by Ford.

Taiwan Semiconductor Manufacturing Company (TSMC) receiving a $6.6 billion subsidy from the US government to build three chip fabs in Arizona is unlikely to significantly impact the company's stock value or its production capacity, but the leading chip fab company is still expected to generate strong returns for investors due to its advanced technology and large market share in the semiconductor industry.

BARK, the dog toy company, is launching BARK Air, the world's first jet charter company designed specifically for dogs, offering a first-class experience that includes skiping TSA checkpoints, socializing with other dogs, and access to calming treats and amenities.

Investing in dividend-paying stocks can provide both steady income and potential capital gains, as exemplified by companies like Fresh Del Monte Produce, Information Services Group, ACCO Brands, SpartanNash, and Ituran Location and Control.

These five dividend stocks with yields over 5% present excellent opportunities for investors to beat the market long term.

Shares of Trump Media & Technology Group have experienced significant volatility, affecting the net worth of former President Donald Trump and drawing attention from traders and short sellers.

Pfizer and Altria Group are standout dividend stocks with yields above 6% and a history of raising their payouts, making them attractive for income-seeking investors. Despite a drop in sales, Pfizer's dividend payout is expected to remain stable and potentially increase due to the development of new drugs. Altria Group faces challenges in the declining combustible cigarette market but could benefit from increased enforcement of the FDA's flavored e-cigarette ban. Investing in these stocks could provide long-term passive income.

Boeing engineer Sam Salehpour claims that the company took shortcuts during production, potentially compromising the safety of its 787 Dreamliner, but Boeing disputes the allegations and denies retaliation against whistleblowers, as the company faces increased scrutiny and the need to rebuild trust.

Two dividend growth stocks to consider for long-term investment are NextEra Energy and Enterprise Products Partners, with NextEra offering a balance of dividend yield and growth and Enterprise Products Partners providing a high-yield opportunity.

Ford is recalling nearly 43,000 small SUVs due to fuel injectors that may crack, potentially causing fuel leaks and fires, with affected models including the 2022 Escape and 2022 and 2023 Bronco Sport editions equipped with 1.5L engines.

The US aviation industry has requested the Biden administration to pause approval of additional flights to and from China, citing Beijing's "harmful anti-competitive policies" that disadvantage American airlines and workers.

Shares of EV startups Rivian and Lucid declined after Ford announced a reduction in the price of its electric vehicles, intensifying the price war among automakers.