US consumer-price data expected to show a slow increase in underlying inflation, supporting the Federal Reserve's cautious approach to interest rate cuts.

The total solar eclipse on Monday is expected to generate a $6 billion boost to the US economy, with businesses along the eclipse path preparing for an influx of visitors and charging premium prices for accommodations and services. The event is attracting visitors from around the world, providing a significant economic activity for cities and towns across the country.

:max_bytes(150000):strip_icc()/SolarEclipseCouldGiveU.S.EconomyCosmic6BillionBoost-Recirc2-2eaf97052689441fb3bf4a15c4cdc55f.jpg)

A majority of the US population has more faith in Donald Trump than in President Joe Biden when it comes to the economy, according to a survey by YouGov; however, the survey results do not align with US economic data, as there has not been an economic boom under either Trump or Biden and the economy has stabilized under Biden with a predicted growth rate of 2.1% for 2024. Additionally, the national debt increased proportionally more under Trump's presidency than under Biden's, and the rising inflation in the United States is not solely due to Biden's economic policy but rather influenced by the COVID-19 pandemic and the Russian invasion of Ukraine. Finally, the boom in the US stock market is more attributed to the Federal Reserve's interest rate policy and other factors, rather than Trump's poll ratings or economic competence.

Southern European economies, including Spain, Italy, Portugal, and Greece, are driving growth in the euro area due to factors such as a surge in tourism, booming exports, lower energy prices, and improved macroeconomic conditions, marking a shift from their previous debt crisis.

The number of Americans with side hustles has increased as many people are struggling to make ends meet in the current economy, with 66% of Americans living paycheck to paycheck and 57% adding extra jobs to supplement their income. Younger generations, particularly Gen Zers, are more likely to have two jobs, but they still face financial discomfort, with little discretionary income to show for their efforts. Despite taking on extra work, overworked Americans still feel financially insecure due to high living costs and inadequate income.

In an election year, public opinion about the strength of the economy and the impact of government policies can override empirical data and influence politicians and economists, despite indicators such as GDP growth, job gains, and stock market records that suggest a strong economy.

The cost of necessities like housing, healthcare, education, and child care has risen significantly over the past 30 years, while the prices of luxury items like electronics and clothing have either remained stable or decreased, leading to a situation where many people feel poorer despite overall inflation being kept low and steady.

The Institute of Economic Affairs (IEA) in Ghana urges the country to take ownership of its natural resource wealth and sign new contracts to ensure more benefits for the nation, while also advocating for the development of local refineries and processing factories for various commodities such as cocoa, oil, bauxite, and lithium. Additionally, the IEA criticizes the proliferation of taxes in the country and calls for an equal effort to reduce government expenditure.

Vietnam is projected to be the sixth fastest growing economy in Asia by 2024, with a real GDP growth of 5.8% and per capita GDP growth of 7.41%.

Chinese revenue from engineering and construction projects in Africa has declined by over 30% since 2015, signaling a "new normal" as lenders become more cautious, leading to a drop in Chinese lending to the continent. However, Africa still remains an attractive market for Chinese companies due to higher returns and opportunities in sectors facing crises in China's domestic market.

Investors are becoming more skeptical about the possibility of interest rate cuts in 2024, as strong economic data and inflation reports make the Federal Reserve hesitant to lower rates, potentially impacting stock market valuations.

Sri Lanka and its creditors are in final negotiations to suspend debt repayments until 2028, in an attempt to limit China's expanding influence in the country.

The US economy's surprising strength has led to uncertainty over whether the Federal Reserve will cut interest rates three times this year as initially predicted, with some arguing that the economy doesn't need further stimulus and suggesting that rates should remain higher for longer.

The solar eclipse is expected to generate a significant economic boost, with estimated spending on hotels, restaurants, and travel reaching up to $6 billion, as millions of tourists flock to cities in the eclipse's path, such as Texas, Vermont, Indiana, and New York.

President Biden's approval ratings are being affected by high inflation and interest rates, despite positive economic growth and job numbers. The rising costs of consumer goods, such as housing and cars, are making it difficult for many families to afford major purchases. Biden's hope for improvement lies in a decrease in inflation rates and a moderation of interest rates, which will be influenced by the actions of the Federal Reserve.

Delays caused by a labor dispute at Brazil's environmental regulator, Ibama, are negatively impacting major oil and mining projects and leading to a backlog of imported cars at ports, posing a threat to President Lula's efforts to slow deforestation in the Amazon and boost the country's green transition.

India's diesel exports to Asia experienced a significant decline in March, down 63%, due to strong competition from Chinese and South Korean suppliers, resulting in diminished profit margins.

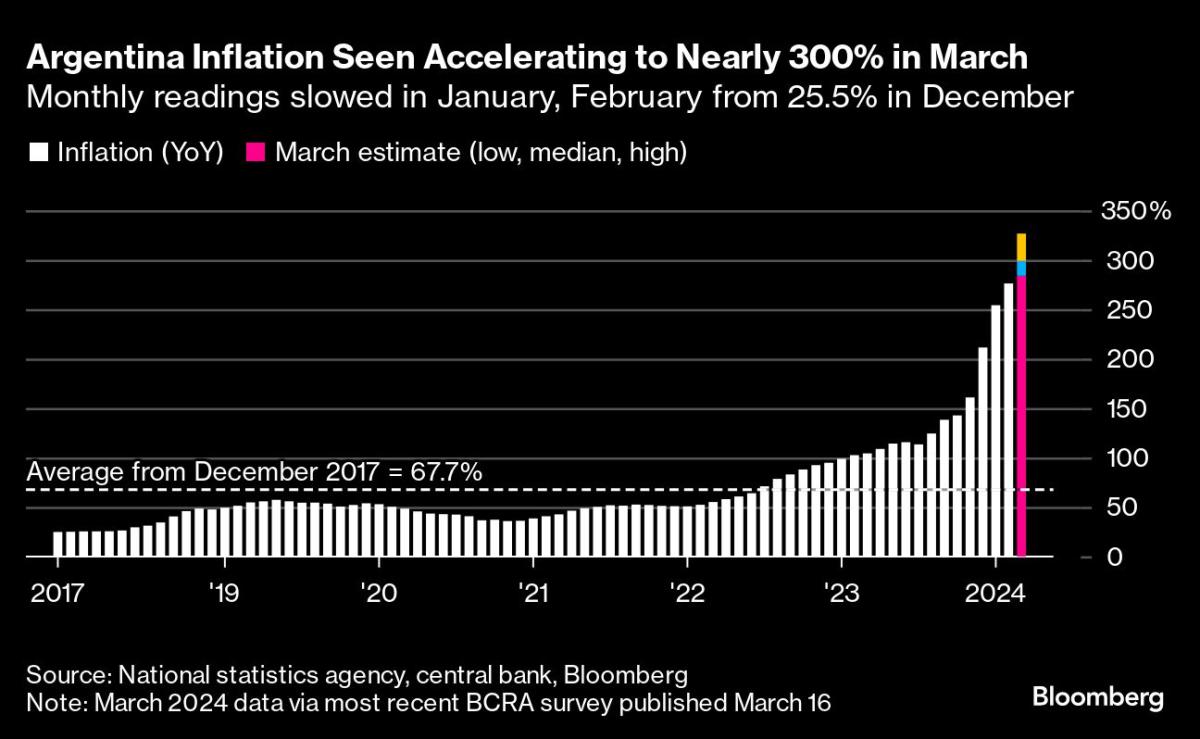

The US labor market saw a significant increase in payrolls, potentially leading to a delay in interest-rate cuts by the Federal Reserve; Taiwan's semiconductor industry quickly recovered from the worst earthquake in 25 years with minimal damage; Argentina's President Javier Milei faces the challenge of reducing inflation while maintaining popularity; Europe's inflation rate slowdown suggests an interest-rate cut by the European Central Bank; labor markets in developed countries continue to exceed expectations, pushing back expectations for interest-rate cuts.

The U.S. and China have agreed to hold talks and create two new economic groups to address American concerns about China's economic model, particularly unfair trade practices and industrial strategy, according to Treasury Secretary Janet Yellen.

Saudi Arabia is reportedly scaling back its ambitions for the desert development of Neom, with officials now expecting fewer residents and a much smaller completion of The Line project by 2030.

The Executive Director at the International Monetary Fund, Krishnamurthy Subramanian, claims that his predictions of India's GDP growth have been accurate, while criticizing the IMF's consistently inaccurate forecasts for India.

The national chain of 99 Cent Only Stores is closing all 371 locations due to unmanageable inflation and theft.

Former CEA Krishnamurthy Subramanian and the International Monetary Fund (IMF) are in disagreement over India's growth outlook, with Subramanian claiming that the IMF's growth projections for India have consistently been inaccurate during his tenure at the organization. Subramanian predicts that India could achieve 8% growth until 2047, while the IMF projects a growth rate of 6.5% for India in 2024 and 2025.

The government of Ghana has increased the producer price of cocoa by 58.26% in order to improve the income of cocoa farmers, aligning with its commitment to their welfare.

Despite the appreciation of the naira against the dollar, the prices of food commodities in Nigeria have remained high due to factors such as high input costs, insecurity, lack of workers, and lack of funds, emphasizing the need for mechanized farming to address the country's food crisis.

India aims to attract $100 billion a year in foreign direct investment as it courts investors looking to diversify away from China, with the target expected to be achieved in the current fiscal year, according to Rajesh Kumar Singh, secretary in the Department for Promotion of Industry and Internal Trade, who also pledged that the government will take more steps to ease FDI rules.

The promotion of Pakistani brands and the boycott of foreign products is gaining traction in Pakistan, leading to increased sales of local brands and a boost in production capacity, but more efforts are needed to meet the demands of the local market and improve product quality. A long-term policy and government support are necessary to achieve import substitution and self-sufficiency.

The Pakistani government's borrowing from banks has reached Rs4.7 trillion, severely impacting the private sector and hindering economic growth.

The Economic Coordination Committee (ECC) of Pakistan's cabinet has failed to approve a cash credit limit for wheat procurement, despite expectations of a bumper harvest and confusion over the government's role in approving credit covers.

The price of food and non-alcoholic beverages in Saskatchewan increased by 0.7% in 2023 due to the carbon tax, which affects fuel and manufacturing costs and indirectly impacts food prices.

India-based pipe manufacturing company, Global Seamless Tubes and Pipes, plans to establish its first U.S. production facility in Louisiana, bringing economic growth and job opportunities to the area.

The government's plan to scrap the pension scheme for new civil servants is facing resistance from those who value the guaranteed pension in their retirement years.

Japan experienced an economic miracle in the 1980s but then fell into a prolonged period of stagnation, known as the Lost Decades, which changed our understanding of economic struggles in a modern economy.

A new survey by Policygenius reveals that 46% of Americans expect to pass on some form of debt to their loved ones when they die, with 58% of people earning at least $150,000 per year expecting their debts to be inherited, while among those who earn less, the number drops to 47%.

China is working to improve payment options for foreign visitors attending the Canton Fair, aiming to offer greater acceptance of cash, bank cards, and mobile payments in an effort to attract global tourists and businesses.

The slowdown in home construction in California is causing concern as experts warn that limited supply will further increase the already high housing prices, exacerbating the state's affordability crisis.

The Bureau of Labor Statistics shared more information about inflation with Wall Street "super users" than previously disclosed, raising concerns about how the government shares economic data with investors.

Haitian economist Kesner Pharel emphasizes the importance of engaging with the Haitian diaspora, which contributes nearly $4 billion in remittances to Haiti, in order to rebuild the country's economy after the ongoing crisis and seeks to attract investments from Haitians living abroad.

Despite differing interpretations of the March jobs report, the Federal Reserve is unlikely to cut its interest rate target due to rising inflation and the overall strength of the economy, which is supported by a low unemployment rate and steady growth.

The ongoing violence in Haiti's capital of Port-au-Prince poses challenges for economic recovery, but some Haitians believe that there are opportunities amid the crisis.

California-based retail chain 99 Cents Only Stores is closing all of its 371 stores due to inflationary pressures and economic challenges, including the impact of the COVID-19 pandemic and shifting consumer demand.

Larry Summers, former Treasury secretary and OpenAI board member, predicts that artificial intelligence (AI) will eventually replace almost all forms of human labor, which he believes could be the biggest economic change since the Industrial Revolution.

A series of extreme market moves, including a drop in stocks and bonds, were triggered by robust economic data and doubts over the Federal Reserve's ability to cut interest rates, raising concerns about the impact of markets on the economy and prompting a shift in investor behavior.

The FDI strategies adopted by the current government in Pakistan can harm the future economy by increasing foreign debt and exacerbating the foreign currency deficit.

Fox Business host Maria Bartiromo faced criticism for downplaying positive news about the U.S. economy, with Bartiromo suggesting that the strong job report was due to the potential of a new president in November, rather than crediting President Joe Biden.

Traders expect the annual headline CPI rate of U.S. inflation to remain above 3% for more than a year, despite the lack of progress in bringing inflation back to its 2% target.

The US job market continues to thrive with 303,000 jobs created in March, but Americans are still skeptical due to stubborn inflation, causing a risk to President Biden's reelection campaign.

Investor sentiment in the U.S. stock market has reached "euphoria" according to Citigroup's Levkovich Index, indicating a potential bumpier ride ahead for investors due to mixed economic signals such as job growth, declining temp workers, shrinking commercial loans, and increasing delinquency rates on consumer credit.

The Dow Jones and other major U.S. stock indexes rose after better-than-expected jobs data sparked hope of falling inflation and potential interest rate cuts, with GE Aerospace, Meta, and Cinemark seeing positive performance while Tesla faced struggles and Teladoc Health experienced a CEO departure. Trump Media & Technology Group stock also dropped significantly.

Federal Reserve officials Michelle Bowman and Lorie Logan have downplayed the urgency to cut rates, noting that inflation has not abated enough and warning that failure to do so may even result in raising rates again; the strong job market data and limited progress on inflation in recent months have reinforced the need for patience in deciding when to cut rates.