The government of Ghana has been unable to reach an agreement with international bondholders for the restructuring of its $13 billion external debt, posing challenges to the country's debt sustainability.

India's wholesale price-based inflation increased to its highest level in three months in March, primarily driven by food and primary articles, according to government data.

Ageing demographics and rising protectionism are predicted to lead to sustained high inflation, impacting governments with increased debt levels and causing challenges in maintaining debt at higher funding levels, according to fund managers.

Despite €500B remaining unspent from the EU's Covid recovery fund, there are concerns that a significant amount of money may never be used, leading some capitals to urge the European Commission to reduce bureaucracy.

Buy now, pay later (BNPL) services have gained popularity in the UAE, offering consumers a more user-friendly payment method with transparent terms and no additional fees for early repayment, leading to the growth of the BNPL market, especially among millennials and Generation Z, which is projected to reach $576 billion in transaction values by 2026.

Persistent high inflation and tight monetary policy in the US could pose new risks to the global economy, potentially hindering the ongoing expansion and causing a "bumpy ride" if interest rate cuts are postponed or rate hikes are implemented; however, it remains uncertain whether the strong US economic growth is driven by constructive forces or outsized fiscal deficits.

The South African Reserve Bank (SARB) is committed to reaching the midpoint of its inflation target despite rising oil and food prices posing a challenge.

The recent escalation in the Middle East is expected to raise the prices of petrol and high-speed diesel by approximately Rs2.50 and Rs8.50 per litre, respectively, due to higher international market prices, despite a decline in import premium and a slightly improved exchange rate.

The United States' sanctions on Russia's oil industry have led to increased pressure on Russian oil firms, causing banks in China, Turkey, and the UAE to request extra documentation and training to ensure compliance with the price caps, resulting in delays and rejection of money transfers; however, Asian imports of Russian crude oil hit a 10-month high in March, particularly in China, impacting oil market prices and potentially pushing the price of oil to $100 a barrel later this year.

Pakistan's low labour productivity, influenced by political instability, low exports, and a lack of research and development (R&D), calls for immediate structural reforms and a policy overhaul to achieve sustainable growth and improve living standards.

China withdrew cash from the banking system for a second consecutive month, signaling caution towards monetary easing as currency depreciation pressures mount.

Finance ministers and central bankers are gathering for the IMF and World Bank Spring Meetings to address weak productivity, rising debt levels, and geopolitical uncertainties that threaten the global economic outlook in the "Tepid Twenties."

Emerging countries face the challenge of servicing a record $400 billion in external debt this year, leaving them unable to invest in climate adaptation and sustainable development without risking default in the next five years, according to a report by Boston University. The report highlights the need for debt forgiveness, an increase in affordable finance, and an overhaul of the global financial architecture to address this issue.

As New Zealand's government implements substantial job cuts and reduces public sector expenditure, the country's job market has become the worst ever, with job vacancies falling by nearly 30% in the past year, creating uncertainty and caution among businesses.

Investors view India as a better investment opportunity than Japan or China due to its ability to turn economic growth into corporate profits, according to a Bloomberg survey.

WalletHub's report reveals that Honolulu, Miami, and the Riverside-San Bernadino metro area are experiencing the worst effects of inflation, while Anchorage has the least impact; factors such as rising rent and gasoline costs, a strong economy, and supply-side policies are contributing to the inflationary pressures. Additionally, the Mountain West states have the highest inflation rates, surpassing 10%, compared to California, Hawaii, and New York, which have relatively modest rates of 7% to 8%.

A new report suggests that Universal Credit will need to adapt to an aging and more vulnerable population, as the number of benefit claimants out of work due to ill health has nearly doubled since 2013. The government recently made changes to Universal Credit to encourage people with ill health to seek employment, but the Resolution Foundation indicates that both the benefit system and the country have significantly changed since the introduction of Universal Credit in 2013. The report also highlights winners and losers in the system, with working families renting their homes benefiting the most, while out-of-work claimants with disabilities are likely to be worse off.

Global interest rates are expected to continue falling, with 20 of the 23 major central banks tracked by Bloomberg projected to lower borrowing costs; however, the pace of easing is likely to be slower than the aggressive tightening experienced in recent years, and the lag in transmission means that the effects of rate cuts will take more time to impact the economy.

Nigeria's annual inflation rate has reached its highest level in nearly three decades, with food and energy costs being the main drivers, while the country's currency, the naira, has strengthened but prices have yet to reflect this improvement.

Thai Prime Minister Srettha Thavisin has been pressuring the Bank of Thailand Governor, Sethaput Suthiwartnarueput, to lower interest rates in order to address the country's slowing economy.

Canada is facing a staggering productivity gap compared to other developed countries, with its productivity deficit worsening year after year, resulting in a decline in standard of living and missed opportunities for Canadian workers. The country is in dire need of bold regulatory and policy changes to increase competition, promote innovation, and dismantle barriers to interprovincial trade.

Salt Lake City, Utah is ranked as the top US job market due to its status as a tech hub known as the "Silicon Slopes."

China's consumer price index rose by 0.1% in March, lower than expected, indicating ongoing challenges in stimulating domestic demand and a persistent property crisis.

US Treasury Secretary Janet Yellen has warned that the US is considering additional tariffs on Chinese goods to counter China's manufacturing capacity and the influx of cheap goods into the US market. Yellen also criticized China for unfair economic practices and alleged mistreatment of foreign companies operating in China.

Increased tension in the Middle East, particularly after Iran's attack on Israel, may deter the Federal Reserve from rate cuts due to the potential disruption of oil prices and the central bank's fight against inflation.

Inflation rates remain higher than anticipated, signaling that interest rate cuts may be delayed, leading to market volatility and uncertainty; CEOs are advised to be transparent with employees and consider alternative compensation strategies. Additionally, tech giants Amazon and Alphabet experienced stock market highs, while Disney's streaming service, Disney+, continues to post significant losses. However, KPMG's latest survey reveals that CEOs remain optimistic about the economy and the growth prospects of their own companies.

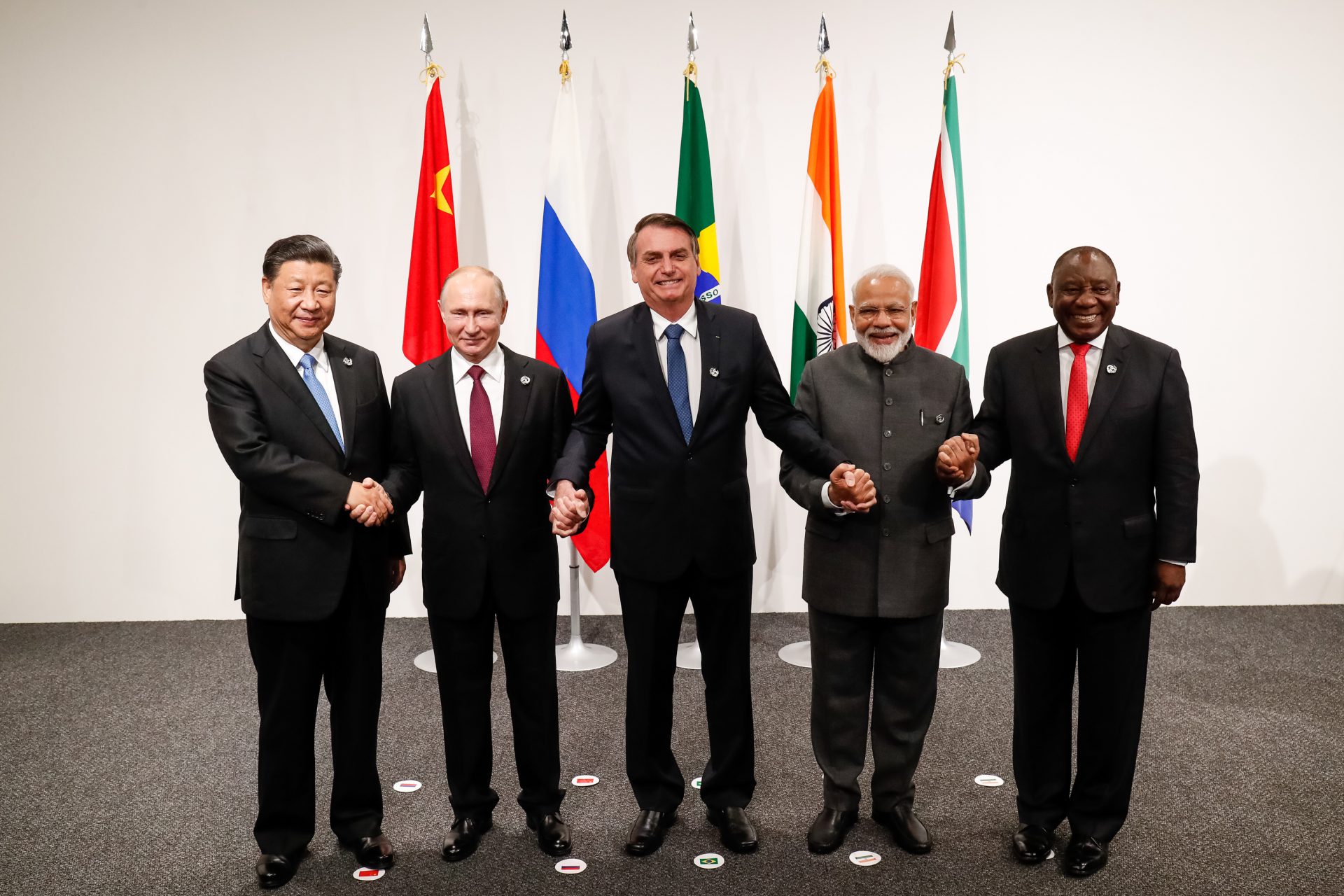

BRICS is gaining control over trade, commerce, and payment settlements in developing countries, challenging the dominance of the US dollar and filling the power vacuum left by the US, as developing nations fear sanctions, US debt, and the decline of local currencies.

The U.S. now has a record number of cities where the median home value is over $1 million, with California having the most million-dollar cities, according to a report from Zillow, as limited housing inventory continues to drive up prices.

Iraqi Prime Minister Mohammad Shia' Al Sudani is expected to discuss the U.S. troop presence in Iraq and strengthen economic ties with the U.S. during his meeting with President Joe Biden, as Iraq aims to separate religion from the state and be seen as an independent entity, rather than a base for U.S. operations against Syria and Iran.

Residents in Honolulu and Miami are facing the steepest increases in consumer prices, while Detroit and Anchorage have seen prices cool, according to a study by WalletHub.

Three new countries, Zimbabwe, Cameroon, and Pakistan, have expressed their interest in joining the BRICS alliance in 2024, but their chances of being inducted remain low due to their lack of significant contributions to the alliance.

Residents in several cities are experiencing higher consumer prices compared to the national average, with Honolulu and Miami seeing the greatest increases, despite the U.S. inflation rate stabilizing at 3.5%.

German industries, which previously supported environmental policies, are now criticizing the government's climate and energy policies as sales of electric vehicles plummet and they seek taxpayer subsidies to remain competitive and avoid moving production abroad.

AI-generated models could bring more diversity to the fashion industry by creating virtual counterparts of human models, offering new opportunities for representation and inclusion.

Struggling to afford basic needs, lack of savings, excessive debt, employment instability, and challenges in achieving homeownership are five indicators that suggest a shift away from the middle-class lifestyle, signaling a decline in economic status.

The personal saving rate in the US has fallen to its lowest level in more than a year, indicating a long-term trend of decreased savings and leaving households vulnerable to shocks or downturns, particularly those with low incomes.

Executives from the Monadnock Economic Development Corporation and Exeter/Seacoast Economic Development Stakeholders discuss the shared economic challenges of worker shortage, housing affordability, and childcare in the Monadnock and Seacoast regions of New Hampshire.

The head of the Business Council of Canada says that governments need to focus on both spending and growing the economy.

Adoption of four-day workweeks in the U.S. is gaining traction, with companies reporting benefits such as improved recruitment and productivity; however, some economists argue that shorter workweeks would require more jobs in an already tight labor market.

:max_bytes(150000):strip_icc()/Whatifcompaniesmovedtoa32-hourworkweek_final-4ccc03b6a2814144b8c44743680a1365.png)

The rise in remote work and decline in commercial real estate prices due to the pandemic has left cities like Boston and San Francisco facing significant budget deficits, forcing them to grapple with the challenge of delivering necessary services while balancing their budgets in a post-pandemic world.

Despite claims from Democratic Party analysts and left-leaning economists that inflation is not a concern, many Americans, particularly those in poor and working-class households, are feeling the impact of rising prices on their daily lives, including increased costs for food, fuel, housing, and borrowing.

The recent surge in inflation in the US is causing concerns for both the Federal Reserve and President Joe Biden, as they face the dilemma of addressing inflation and maintaining economic stability while avoiding a negative impact on the stock market and their popularity. Rising commodity prices and increasing pressure in the production pipeline are contributing to the inflationary pressures. However, recent polls suggest that American attitudes towards the economy are holding steady for now, although further increases in interest rates could pose a challenge for Biden's administration.

Rising oil prices pose a threat to global inflation and economic recovery, as well as political tensions and energy production, while countries like the UK face challenges in their transition to renewable energy and the replacement of oil and gas supplies.

Prime Minister Anthony Albanese delivered a landmark speech about Australia's economy, highlighting the fractured global economic architecture, the link between economic and national security, and the role of governments in economic transition and industrial transformation. The speech raises debates about industrial policy and economic nationalism, drawing parallels to a lecture by economist John Maynard Keynes in the 1930s, who advocated for economic self-sufficiency and reimagining the role of government in a rapidly changing world.

The Pakistani rupee is expected to remain stable in the coming week, as the anticipated inflow from the International Monetary Fund (IMF) is predicted to balance out the outflow from bond payments.

Global manufacturing activity is showing signs of recovery, with Chinese and US factories leading the way, resulting in an economic upturn that is spreading internationally and improving economic outlooks.

The State Bank of Pakistan has repaid $1 billion against euro bonds, boosting the bonds' future prospects, while the bank's reserves will decrease to around $7 billion.

Prime Minister Liz Truss faced turmoil and opposition following the unveiling of her tax-cutting mini-Budget, as markets reacted negatively, the pound fell, and government borrowing costs increased. Truss blamed the economic establishment, lack of support from Conservative MPs, and a financial tinderbox in the pension funds for the failure to implement the mini-Budget.

The UK has experienced a significant increase in inflation over the past two years, with consumer prices for products and services rising by 35% to 50%, driven by factors such as the Russian invasion of Ukraine, climate change affecting food prices, Brexit-related supply issues, and labor shortages. This has resulted in higher costs for groceries, energy bills, broadband and mobile phone contracts, housing, car insurance, and train fares.

The latest U.S. consumer price index shows a 3.5% increase for March on an annual basis, indicating that inflation is rising and putting pressure on the troubled U.S. and European economies, which may be worsened by higher oil prices and a potential oil supply deficit.