Credit card balances in the US reached a record-breaking $1 trillion in the fourth quarter of 2023, with subprime balances growing by 32% to $105 billion, despite interest rates exceeding 27%; meanwhile, personal loan debt also increased, indicating a potential opportunity for lenders if interest rate cuts occur in 2024.

Flair Airlines CEO still hopes to add Lynx Air planes to the fleet despite the shutdown, gold climbs to a record high due to speculation over a Federal Reserve pivot, Equifax reports an increase in missed payments in Ontario and British Columbia, Bitcoin briefly reaches an all-time high before retreating, tech giants drag down US stocks, Dartmouth men's basketball team votes to unionize, Edmonton Oilers place Sam Gagner on waivers, Toronto home prices increase for the first time in seven months, Canadian dollar weakens as investors anticipate a "dovish" Bank of Canada, Canada's federal budget to be presented on April 16, TSX futures drift higher as gold prices climb, and the Bank of Canada is expected to hold interest rates with potential rate cuts in the future.

George Galloway is sworn in as the new Member of Parliament for Rochdale, Nigel Farage expresses fear of extreme Islam, and Rishi Sunak claims that the UK's democracy is being deliberately undermined.

New orders for U.S.-manufactured goods fell more than expected in January, primarily due to a decline in orders for commercial aircraft, but there was an increase in demand for computers and electronic products.

Relocation packages offered by smaller cities and towns in the US are becoming popular incentives for workers, with cash carrots and other perks like free gym memberships and co-working spaces being offered to attract new residents. The number of cities offering such incentives has more than doubled in recent years, but these programs can lead to discontent among local residents and potentially increase the cost of living for long-term residents. However, there are still plenty of active programs accepting applications, such as Tulsa Remote, Ascend West Virginia, and Choose Topeka, among others.

Trade restrictions are a major hurdle for both US and Chinese automakers in capturing the global electric vehicle market, as they struggle to balance protecting domestic automakers and fostering technological advancement.

The Institute for Supply Management's service-sector Purchasing Managers' Index (PMI) fell to 52.6% in February, indicating a bigger decline than expected and adding pressure to the Federal Reserve's caution over interest rate cuts.

Russia's income from oil and gas sales increased by over 80% in February, surpassing $10 billion, despite Western sanctions and a drop in oil prices.

Sri Lanka aims to restructure its debt with creditors, including India, Japan, and France, by June 2024 in order to settle its debt restructuring process and ensure debt sustainability as part of its bailout package from the IMF. China, the country's largest bilateral creditor, has been reluctant to take a haircut on its loans and prefers to extend loan tenures and adjust interest rates instead. The debt restructuring framework is expected to be implemented within the first six months of 2024, and a Presidential election is scheduled for September-October 2024. India has played a significant role in aiding Sri Lanka's economic recovery during the financial crisis.

Consumers beware: "shrinkflation" is a trend in which companies reduce the size of their products while maintaining the same price, prompting complaints from Cookie Monster and calls from politicians to stop the practice.

Cookie Monster expresses his dislike for "shrinkflation," where consumer goods are downsized without a decrease in price, highlighting the impact of high prices and an elevated cost of living on consumers.

Relocation packages offered by smaller US cities and towns are becoming popular as a way to attract new residents, with cash incentives, perks, and homebuyer incentives being offered; however, these programs can lead to discontent among local residents and potentially increase the cost of living for long-term residents.

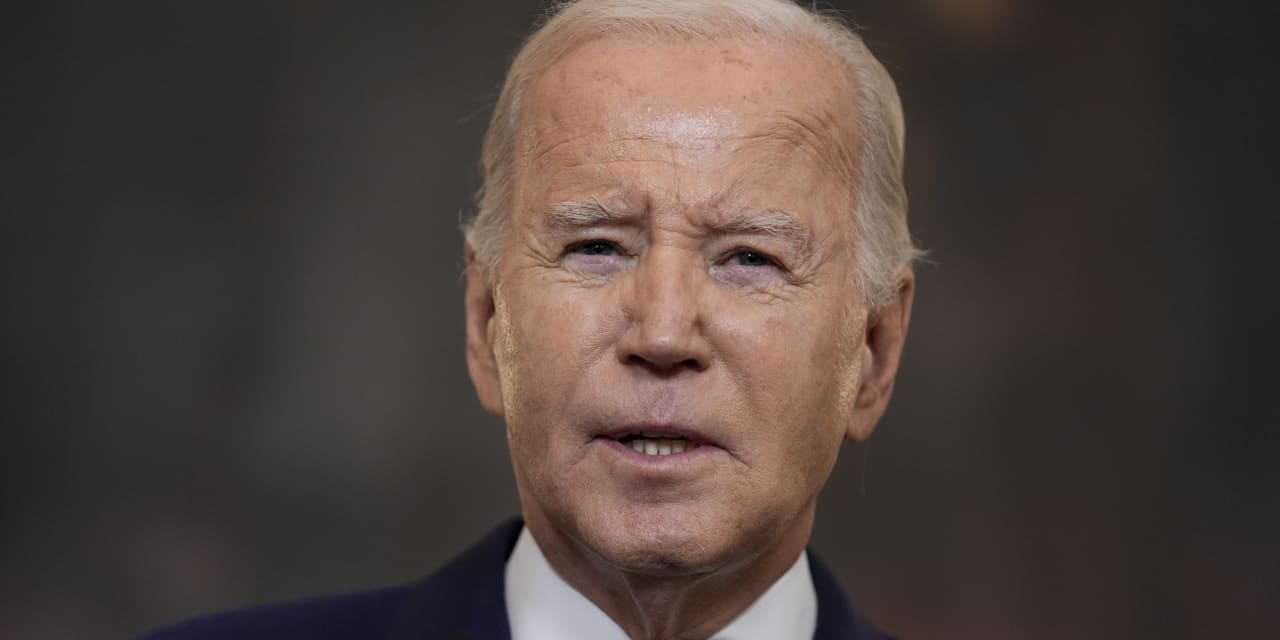

Despite U.S. inflation being attributed to a variety of factors including supply chain disruptions and excessive stimulus spending, President Joe Biden takes all the blame for the 18% increase in prices during his tenure, leading to widespread disapproval among voters.

US households are now paying roughly as much interest on non-mortgage debt, such as credit cards and student loans, as they are on their mortgages, a trend that is concerning economists and investors.

Joe Biden and Donald Trump's rematch in the upcoming election will bring existential issues to the forefront, including the future of reproductive rights, climate change action, support for Ukraine, and the fate of democracy in the US.

China's Premier Li Qiang addressed concerns of foreign and private businesses during the National People's Congress, promising removal of restrictions on foreign investment and better business conditions, but analysts stress the need for concrete actions to regain trust and stimulate economic recovery.

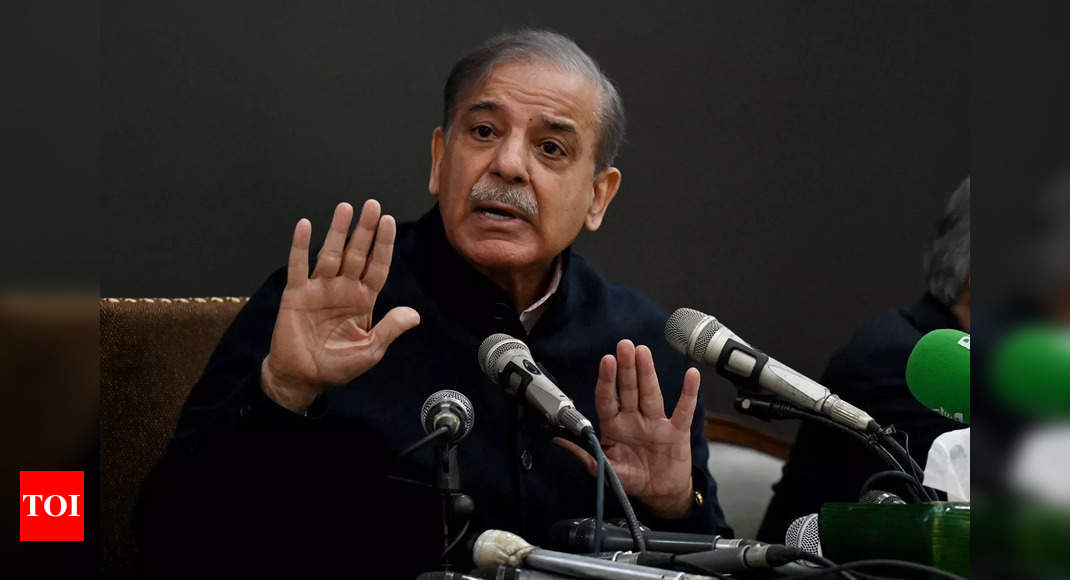

Pakistan's newly-appointed Prime Minister, Shehbaz Sharif, has prioritized improving the country's economic state by engaging in talks with the IMF for an extended fund facility and implementing measures to revive the economy, such as privatizing government-owned enterprises and reducing the size of the government.

The state of the U.S. economy and economic problems, including inflation and high cost of living, are the top concerns for about one-third of American voters heading into the primary election.

Voters have a slightly better perception of the economy as inflation recedes, but partisan divides remain deep, according to a Times/Siena poll.

Half of Americans who applied for loans in the past two years were denied, as banks have been tightening lending rules due to increased interest rates and inflation, making it more difficult and expensive for individuals to borrow money.

U.S. stocks are falling from their records as the S&P 500 and Dow Jones Industrial Average are both down, largely due to Apple's drop in stock price and concerns about sluggish iPhone sales in China, while Bitcoin continues to surge towards its record high.

Several African nations, including Central African Republic, Zimbabwe, and Senegal, experienced an increase in fuel prices, leading to budgetary challenges and potential inflation.

The scarcity and high cost of yuan financing in Russia is limiting foreign capital access for companies, piling on top of already higher domestic interest rates and an impending wave of debt.

China plans to issue 1 trillion yuan ($139 billion) of ultra-long special central government bonds this year as part of increased fiscal stimulus measures to support the country's economy.

China has set an ambitious economic growth target of "around 5%" for 2024, as it aims to transform its growth model despite significant challenges, including a troubled property sector, deflationary pressures, and an exodus of foreign capital.

Japan is seeing early signs of achieving a positive cycle of rising inflation and wages, as the government focuses on boosting profits of smaller firms to increase wages and combat rising inflation.

Annual inflation in the EU and eurozone is easing, with January figures showing a decrease in 15 EU countries, but 11 countries recorded a rise. Inflation in the EU has been steadily falling since its peak at 11.5% in October 2022, with January 2024 seeing an annual inflation rate of 3.1% in the EU and 2.8% in the eurozone.

The UK spends less on low-carbon energy policy than other major European economies, despite evidence suggesting that such spending could lower household bills and increase economic growth more effectively than tax cuts. Italy, Germany, France, and Spain all outspent the UK in low-carbon expenditures between April 2020 and April 2023, with Italy leading the pack. The UK also spent more on energy affordability measures than on low-carbon initiatives, resulting in lower per capita spending compared to its European counterparts.

Inflation in the US rose to 3.1% year over year in January, lower than December's 3.4% but higher than the Federal Reserve's target rate of 2%, raising questions about potential interest rate cuts.

China aims for 5% economic growth in 2024, plans to create 12 million jobs and maintain urban unemployment rate at 5.5%. The government will continue a proactive fiscal policy, increase government deficit by 180 billion yuan, and issue special-purpose and ultra-long treasury bonds for key national strategies.

China's annual legislative sessions will discuss the country's economy, trade, and military plans, as well as its ambition to surpass the United States in terms of GDP, although the widening economic gap and challenges such as the US-led tech controls and trade disputes may pose obstacles to China's goal.

Hong Kong stocks retreat as investors worry about China's economic growth and the modest fiscal policy support unveiled at China's annual parliamentary meeting.

China's services activity grew at a slower pace in February, with business confidence moderating and firms cutting staff numbers for the first time since November, indicating challenges in the vital sector.

The depreciation of the Nigerian naira against the US dollar has led to a significant increase in Nigeria's external debt, which has risen by N28tn ($41.5bn) according to the country's Debt Management Office.

China signals a robust goal of 5 percent economic growth despite challenges in the housing market and consumer skepticism.

Mohsin Issa, one of the owners of Asda, plans to step back from running the supermarket chain.

Former President Olusegun Obasanjo suggests that Nigeria should seek advice from Zimbabwe to address the country's high inflation, as Zimbabwe has successfully tackled a similar issue in the past. Obasanjo also emphasizes the importance of dialogue and peaceful resolutions in resolving conflicts on the African continent.

Asian equity markets face pressure as investors focus on China's economic growth target and measures to boost confidence, resulting in selling in Chinese stocks and a weak sentiment in the country's stock market, while Australian shares remain flat and Japanese equities open lower after the Nikkei 225 breached 40,000 index points.

Some of the hopes and concerns of various individuals regarding the upcoming Budget include more cost-of-living help, raising income tax thresholds, supporting a 99% mortgage scheme for first-time buyers, making child benefit fairer based on household income, and extending Healthy Start vouchers for older children.

The National People's Congress and Chinese People's Political Consultive Congress in China need to address the issue of deflation in the country, which has contributed to slow economic growth and weakened consumer and investor confidence, according to Shang-Jin Wei, a professor at Columbia University. He suggests that both fiscal and monetary policies should be adopted to combat deflation.

Retailers are reporting mixed quarterly results, with a focus on value performing well while apparel and discretionary categories struggle due to consumer emphasis on essentials and budget stretching amidst inflation concerns.

Cookie Monster expresses his dislike for "shrinkflation," the downsizing of certain consumer goods without a decrease in price, as high prices and an elevated cost of living affect the US economy.

Global Stocks Hit New Highs as Investors Eye China Growth Targets, Busy Week for Asian Economic Data

Asian markets are expected to remain stable despite potential market-moving events, as momentum from the recent rally in world stocks and risky assets continues to drive equities and risk assets upward.

Despite positive economic indicators such as record-high stock market numbers and high employment rates, a significant portion of Americans view the economy as poor due to factors like inflation, unaffordable housing, unsatisfying job conditions, and a feeling of not receiving what they deserve, indicating a disconnect between economic reality and public perception.

India has become a net importer of steel, with imports exceeding exports by over 30%, prompting concerns and calls for corrective measures such as tariffs and non-tariff barriers.

China's economic situation is too weak for a large fiscal stimulus package to be effective in steering the economy towards prosperity, leading to a need to revise the assumption that the Chinese government can control economic outcomes.

Canadians' sentiments about the economy are at odds with positive economic indicators due to growing socio-economic divide, debt servicing burdens, high housing costs, impact of inflation, growing corporate concentration, mental health struggles, long COVID effects, higher education funding cuts, and youth struggles.

China's efforts to boost confidence in its slowing economy are a top priority, but challenges remain as the workforce ages, relations with the US are strained, and the housing construction sector is in crisis.

Sen. Sherrod Brown and the Cookie Monster have expressed frustration over "Shrinkflation," where corporations reduce product size without reducing prices, prompting calls for accountability and action.

The UK government's decision to sell over half of the nation's gold reserves in 1999, which was intended to diversify its reserves, turned out to be a major financial blunder as it occurred at the lowest point in the gold market, costing the Exchequer billions of pounds in lost profits and damaging the UK's reputation.