Shipments of diesel from India to Europe have dropped significantly this month due to ongoing Houthi attacks and higher freight costs, prompting more cargoes to be sent to Asia instead.

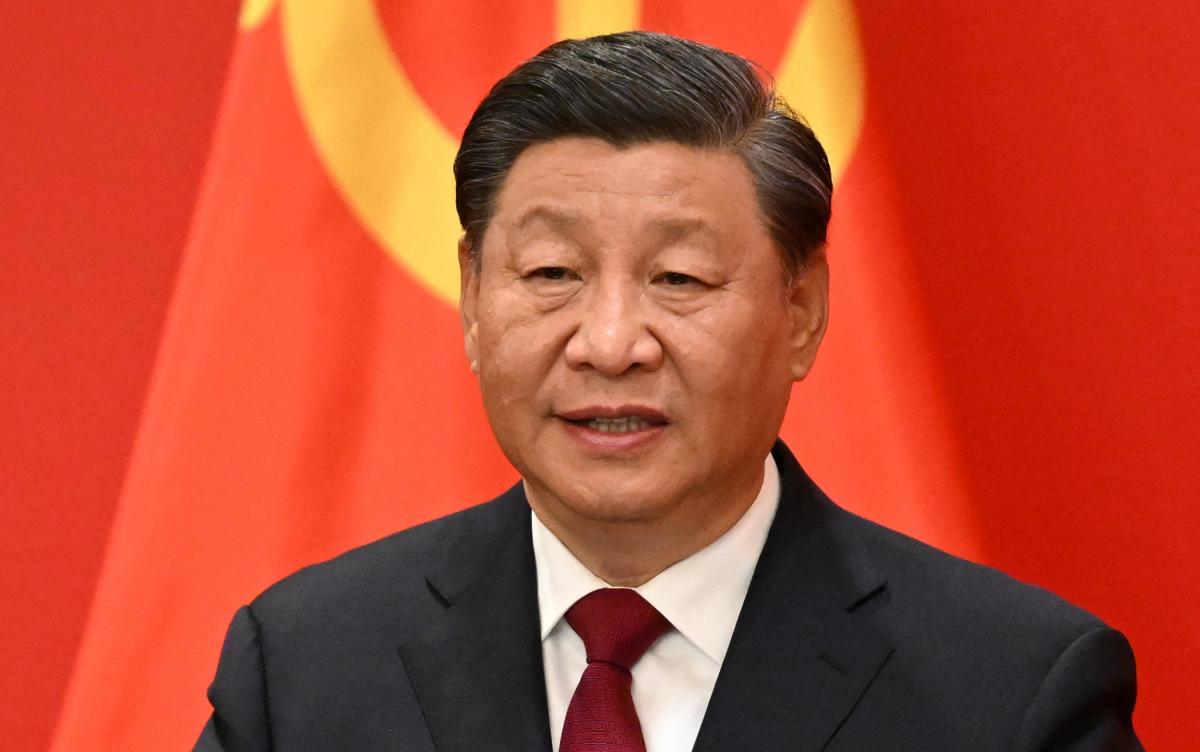

China has made its largest cut to the key mortgage rate since 2019 in an attempt to stabilize the property market and boost the national economy, with the five-year loan prime rate lowered to 3.95%; however, analysts believe that more aggressive fiscal policy easing is needed to address deflation and drive economic growth.

President Joe Biden's statement that inflation has been at the pre-pandemic level of 2% over the last half-year is only half true, as using the most basic form of the two main metrics, inflation has ranged from 2.6% to 3% over the past six months.

Kenya's public debt increased by Sh1.93 trillion in 2023, reaching a new high of Sh11.14 trillion, with the depreciation of the shilling accounting for 73% of the increase.

China's central bank, the People's Bank of China, has cut its five-year mortgage benchmark by the largest margin to date in an effort to stimulate the economy amidst pressures from the distressed property sector and weak business confidence.

The People's Bank of China unexpectedly cuts its five-year benchmark loan prime rate in order to support the slowing economic recovery in the country.

China must focus on better implementing and coordinating economic reforms to address long-standing issues and stimulate growth, according to state media, emphasizing the need for effective and targeted measures to invigorate the economy. These calls come ahead of the delayed third plenum, where new policies on further reform are expected to be announced. The country's recovery has been uneven, and challenges such as job uncertainty, geopolitical tensions, and deflation concerns continue to dampen market sentiment. State media warns against wasting the opportunity for reform and urges officials to adopt creative and trendsetting approaches.

Mainland Chinese customers spent $7.6 billion on Hong Kong insurance policies in 2023, but sales are expected to decline as pent-up demand fades.

The Economic Development Partnership of North Carolina is managing 248 projects that could potentially create 75,000 jobs and over $66 billion worth of investments, with a focus on blue collar, industrial jobs rather than office jobs.

Former President Trump's fortune took a hit from two lawsuits, but it is unlikely that he will personally file for bankruptcy as he would have to prove the damage is greater than his total net worth; if the Trump Organization files for bankruptcy, he would still be responsible for paying the judgments.

Foreign businesses' direct investment in China was at its lowest level since the early 1990s, highlighting the challenges faced by the nation in attracting overseas funds due to Covid lockdowns, weak recovery, geopolitical tensions, and higher interest rates in advanced economies.

Staten Island twins gain social media fame by hilariously ranting about the rising cost of living in America, aiming to shed light on the financial struggles faced by people across the country.

China's economic growth is at risk due to formalism, bureaucracy, and a lack of substance, leading to societal stagnation, warns a scholar from Wuhan University.

Asian markets are expected to return to normal trading activity on Tuesday, with focus on China's stocks and Japan's stocks and currency reaching new highs, while investors also await China's interest rate decision and Australia's central bank minutes.

Paraguay's central bank has cut its benchmark interest rate to 6.25% as inflation remains below 4% following the post-pandemic surge.

IT salary packages in India have fallen by 30-40% due to global economic headwinds and an IT sector slowdown, resulting in lower pay becoming the norm, with mass hiring during the COVID-19 pandemic exacerbating the situation.

Nigeria is facing a severe economic crisis, with surging inflation and a plummeting currency, leading to protests and hardship for its citizens.

Argentina's President Javier Milei is considering dollarizing the country's economy, following in the footsteps of Panama, Ecuador, and El Salvador, as the devaluation of the peso and high inflation continue to impact the national currency. However, adopting the dollar presents challenges for a larger economy like Argentina, including the need for significant foreign exchange reserves and higher savings rates.

Mexico's inflation rate is expected to ease in the first half of February, potentially leading to a rate cut by the country's central bank for the first time since 2021.

Tata Group, with a market capitalization of $365 billion, is now larger than Pakistan's entire economy, estimated at $341 billion, with Tata Consultancy Services alone accounting for roughly half of Pakistan's GDP.

Venezuela's consumer price increase for January was the smallest in over a decade, as the government's strategy of tight monetary and fiscal restrictions, along with increased dollar supply, helped rein in inflation.

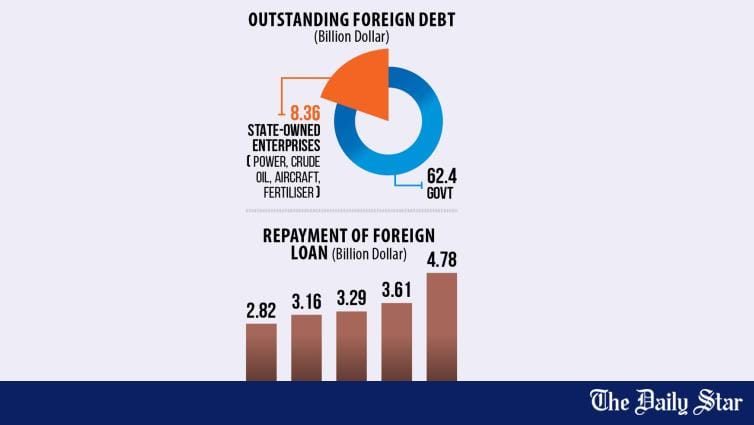

Foreign loan repayment in Bangladesh reached a record high of $4.78 billion in fiscal year 2022-23, driven by high interest payments and short-term loans in the power and energy sector, with further increases expected due to exchange rate volatility and rising interest rates.

The German central bank, the Bundesbank, warns of a possible technical recession by the end of the first quarter of 2024 due to recent strikes and their impact on infrastructure, but believes the recession would be shallow and short-lived and not a widespread and lasting contraction. The bank cites improving personal finances, positive prospects for consumption, and falling inflation as factors that could mitigate the impact. However, it also warns of cautious consumer behavior and reduced demand for German exports. Industry leaders call for more public investment to boost economic activity.

Consumer spending on retail and food services increased in January 2024, contributing to rising household debt, while mortgage balances reached over $12 trillion, driven by higher rates and listing prices.

Chinese officials are preparing to update President Xi Jinping on measures to stabilize the stock market and restore investor confidence as the market continues to decline, negatively impacting China's economy, particularly the real estate sector, which has faced significant challenges and defaults. China's economic challenges are multifaceted, with doubts arising about the sustainability of its growth model. The government aims to boost domestic demand and implement stimulus measures, but skepticism remains, highlighting the need for transparent and effective policy communication. Furthermore, Xi's centralized control over economic policy and regulatory crackdowns have raised concerns among investors. The focus now shifts to finding new drivers of economic growth, such as the electric vehicle and green energy sectors, while Beijing aims to shift towards innovation-driven development and navigate a turbulent global landscape.

Ursula von der Leyen, the President of the European Commission, has been a disaster for the European economy due to her expensive borrowing, de-industrialization strategies, growth-destroying regulations, and mismanagement, resulting in Europe falling behind the rest of the world and slipping into recession.

Former chief economist of the Bank of England, Andy Haldane, warns that keeping interest rates at current levels could worsen the UK's recession.

The price of groceries is rising while the portion sizes are getting smaller, a phenomenon known as shrinkflation, which companies use as a strategic response to maintain profitability; however, the difference in grocery prices between the US and Russia has been highlighted, with groceries being much cheaper in Russia.

Pakistan's debt crisis is worse than anticipated, with the possibility of an inevitable default and devastating economic consequences, prompting urgency for an immediate IMF bailout and proposing innovative solutions like debt-for-nature swaps to address the crisis and environmental needs.

There are several television shows airing on Fox News Channel and Fox Business Channel, as well as a live stream on Fox News Radio, featuring discussions on various topics.

Foreign investment in China grew at its slowest pace in three decades last year, largely due to Beijing's zero-covid policies and an ongoing property slump, highlighting the damage caused by these factors and rising tensions between China and the West.

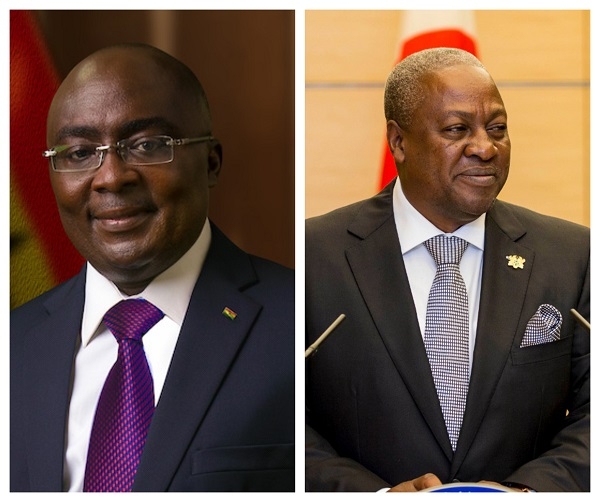

A poll conducted by Global InfoAnalytics revealed that the 24-hour economy policy proposal of former President John Dramani Mahama is more popular among Ghanaians compared to the digitalisation proposal by his opponent Vice President Dr. Mahamudu Bawumia in the upcoming 2024 election. The study also indicated that Mahama's policy has more support from voters of all age groups.

Presidential terms with the highest inflation rates and job growth have been identified, with Jimmy Carter, Richard Nixon/Gerald Ford, and Joe Biden ranking among the worst in handling the cost of living.

Israel's economy experienced a severe contraction in the final quarter of 2023, shrinking by 19.4%, largely due to the impact of the Hamas war, which disrupted businesses and led to the call-up of hundreds of thousands of reservists, resulting in manufacturing crashes and consumption jolts; however, the economy still expanded by 2% for the full year.

India's Foreign Affairs Minister, S Jaishankar, has confirmed that nearly 30 countries are ready to join the BRICS alliance, indicating a potential new round of expansion in 2024.

The given text provides a schedule of programs being aired on Fox Business Channel, Fox News Channel, and Fox News Radio, along with a live stream of Will Cain discussing the most important and worst presidents of all time.

Employment intentions in Australia are at their lowest level in at least a year, with businesses planning to retain current staff by offering higher wages, according to a survey by the Australian HR Institute. Despite the decrease in employment intentions, overall employment is expected to rise in the coming months, albeit at a slower pace. Few employers are considering mass lay-offs, although some HR professionals surveyed anticipated implementing redundancies. The survey also highlighted the barriers certain jobseekers face, with many employers excluding candidates with a criminal record, a history of drug or alcohol problems, long-term sickness, mental illness, or being neurodiverse.

Thailand has the highest proportion of fragile borrowers compared to other countries and is seeking debt assistance from the Bank of Thailand due to the impact of the pandemic, with a high household debt-to-GDP ratio and rising non-performing loans, particularly in the housing sector.

Canadian consumers are getting relief from high cellphone bills as cellular-service prices have plunged by 27% in 2023, according to Statistics Canada, although the extent of the decrease is likely overstated due to the index's method of measurement, which does not account for actual monthly spending or additional fees.

Former Chief Economist of the Bank of England, Andy Haldane, warns that if the central bank fails to cut interest rates soon, it risks worsening the UK's recession caused by high living costs, as the economy fell by 0.3% in the last quarter of 2021, following a decline in all main sectors and a sharp drop in retail sales during the Christmas season.

Kenyans in the diaspora sent a record amount of money home in January 2024, with remittance inflows increasing by 10.7% compared to the previous month and surpassing the highest amount ever seen in July 2023, attributed to the success of President Ruto's DhowCSD platform initiative and the weakening of the Kenyan shilling.

Israel's economy contracted by 19.4% in the last quarter of 2023, the first decline in nearly two years, due to the war with Hamas which has had a significant impact on the country's GDP.

German companies are investing a record amount of capital in the US, signaling their dissatisfaction with Germany's economy and concerns about its trading partnership with China.

Tata Group companies have achieved outstanding returns, leading to a market value that surpasses Pakistan's economy, highlighting the conglomerate's economic strength and dominance in the region.

Nigeria's Cement Producers' Association is willing to help the government lower cement prices within 30 days, citing the imbalance between demand and supply as the main cause, and urging the government to revisit a policy that granted licenses to importers.

French farmers' protests and their influence over government decisions jeopardize green goals and trade deals in the EU.

Pakistan's debt profile is deemed alarming and its borrowing and spending habits unsustainable, according to a report by Islamabad-based think tank Tabadlab, with the country's total debt and liabilities reaching $271.2 billion.

Ghana's minerals worth trillions of dollars are being plundered by foreign companies with the help of Ghanaian officials, according to Dr. John Kwakye, Director of Research at the Institute of Economic Affairs (IEA), who called on the Minister of Finance to prioritize the protection of the country's mineral resources.

Chinese consumers saw a surge in spending during the Lunar New Year holiday, surpassing pre-pandemic levels, but analysts remain cautious about the overall economic recovery due to weak consumer confidence and declining household income.

Nigeria is not expected to be one of the top 11 African countries projected to experience strong economic growth in 2024, according to the African Development Bank Group, while the continent as a whole is expected to have higher GDP growth rates than the global average.