Metro Atlanta consistently outperforms national averages in growth and productivity, but still lags behind some other Southern cities, according to a recent analysis by Fifth Third Bank and the Kenan Institute at the University of North Carolina. Despite its strong performance, Atlanta falls behind Charlotte and Dallas in the analysis, but continues to draw transplants, immigrants, and corporate headquarters, contributing to its economic strength.

Presidential candidates are debating over the state of the economy, but this analysis aims to compare the current economic conditions to those of the past three decades.

Replacing existing power lines with advanced reconductoring cables made from state-of-the-art materials could significantly increase the capacity of the US electric grid, making it easier to integrate more renewable energy sources like wind and solar power. However, the adoption of advanced reconductoring has been slow due to unfamiliarity with the technology, regulatory hurdles, and the fragmented nature of the US electricity system.

Iowa's economy is improving, but the lack of available workers continues to be a major challenge for businesses in the state, with 68% of Iowa Business Council members citing it as their primary obstacle; Iowa may need to focus on marketing to attract employees from outside its borders and consider rehabilitating prisoners as a potential solution to the worker shortfall.

Global shares were mixed as investors awaited U.S. inflation data and the European Central Bank meeting, while industrial metals prices rose on expectations of a worldwide manufacturing rebound.

Startups in Finland are concerned about government plans to impose stricter regulations on unemployed foreign specialists, which would require them to leave the country after six months if they fail to find a job, potentially hindering efforts to attract skilled workers and entrepreneurs.

Mexico's billionaires, who were once targeted by President Andres Manuel Lopez Obrador, have actually seen their fortunes double under his administration, thanks to a strong peso, fiscal austerity, and little action taken against them.

State Street Global Advisors believes that the Federal Reserve will cut interest rates by 50 basis points in June and expects a total reduction of 150 basis points by the end of the year, despite the recent shift in market consensus towards a more hawkish stance.

France had a trade deficit of €6 billion in February 2024, and with the Bank of America warning of potential excessive deficit procedures for France, the country may face stricter monitoring and implementation of consolidation efforts from 2025 onwards.

Rising Costs of Housing, College, Cars and Travel Puts Major Purchases Out of Reach for Middle Class

Rising costs of housing in major cities, out-of-state and private college tuition, luxury vehicles, retirement savings, and leisure travel are making these aspects of middle-class life increasingly unaffordable, potentially reshaping the fabric of everyday life for the middle class if current inflation trends persist.

President Biden's approval rating on handling the economy remains low despite strong economic growth, low unemployment, and low inflation, and there are several theories, including perceptions about consumer prices, lags in perception catching up with reality, and subjective feelings about the economy being disconnected from facts, that help explain this disconnect between economic performance and public opinion.

Small business optimism in the US declined in March to its lowest level since December 2012, with inflation and labor costs emerging as top concerns, according to a report from the National Federation of Independent Businesses (NFIB).

Russia's resilient economy creates a successful strategy to control inflation, improve wages, and evade tough sanctions, while Britain demonstrates its ability to assimilate immigrants despite political rhetoric.

China's Premier Li Qiang discusses the need for sustainable economic growth, addressing issues such as lack of demand, domestic hurdles, and external uncertainties ahead of the release of first-quarter data, aiming to keep China's GDP growth at around 5%.

Some states in the US already have higher inflation rates than the national average, while others are struggling to reach the benchmark, with Florida having the highest inflation at about 4% and Pennsylvania having the lowest at about 1.8%, according to an analysis by Moody's Analytics.

The "misery index," a widely-followed economic gauge that assesses the state of an economy, may no longer be a reliable tool for evaluating presidents as cooling inflation and a steady job market under President Biden have led to a decrease in the index, despite a low approval rating for the president's handling of the economy.

High interest rates are driving inflation, prompting calls for the Federal Reserve to start easing in order to stabilize prices and alleviate the pressure on shelter costs.

Investors initially expected the Federal Reserve to cut rates sharply in 2024, but stubborn inflation and strong economic growth have raised doubts about that outcome.

Lawyer Godwin Edudzi Tameklo, head of the legal team of the National Democratic Congress, has urged Vice President Dr Mahamudu Bawumia to take responsibility for what he believes is the mismanagement of Ghana's economy, citing the depreciation of the cedi and a reduction in the country's credit rating as evidence of this mismanagement.

Generation Z is planning to spend more on travel and entertainment than other generations, even though the cost of fun is higher than ever, with 44% of Gen Zers planning to spend more on travel this year compared to 2023, according to a survey by Bankrate.

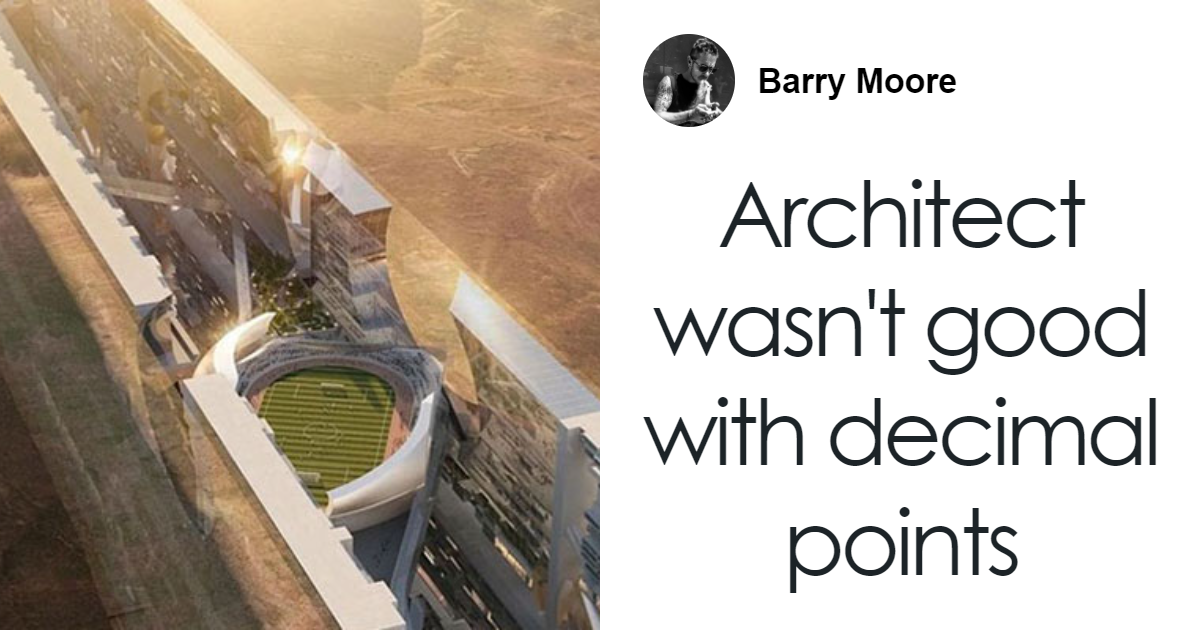

Saudi Arabia is scaling back its NEOM desert development project, with plans for fewer residents and reduced completion expectations by 2030 due to financial concerns and budget uncertainties.

India Ratings and Research (Ind-Ra) predicts that eight states in India, including Maharashtra, Karnataka, and Gujarat, are expected to achieve economies above $1 trillion each by 2047 as the country strives to become a developed nation.

China's property crisis is causing small banks in low-growth provinces to suffer from increased bad debts to developers, putting pressure on their finances.

China has revived two financial tools to provide $69 billion in credit support for tech innovation and equipment upgrades, signaling the country's commitment to these economic priorities and raising questions about monetary loosening.

Jamie Dimon, CEO of JPMorgan Chase, emphasizes the need for increased military spending, diversity and inclusion initiatives, and growth for banks in his annual shareholder letter, highlighting the importance of America's global leadership role and its founding principles.

Nigeria is set to receive a $1.05bn syndicated loan backed by oil from the African Import Export Bank next month, aimed at reviving the country's struggling economy and increasing the availability of hard currency in the local foreign exchange market.

The Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL) passed in the US have led to increased investments in clean energy technologies, such as solar, electric vehicles, batteries, and emerging climate technologies like clean hydrogen and carbon dioxide capture. However, wind and heat pump investments have not seen the same boost. The laws are incentivizing private investment and creating a foundation for a cleaner economy, but their fate may be uncertain depending on the outcome of the November elections.

Goldman Sachs economists are predicting "much stronger" GDP growth, a significant drop in inflation, and three interest rate cuts from the Federal Reserve in 2024, despite concerns from other Wall Street peers about inflation and recession.

South Korea's health care system is facing a crisis as hospitals refuse care to patients and the country struggles with a shortage of physicians, prompting calls for reforms and increased medical school enrollment.

The beleaguered yen is approaching a key level and a 34-year low, but Japanese authorities are expected to wait for US inflation data before intervening to support the currency.

A Bankrate survey reveals that Republicans are more likely than Democrats to say their financial situation has worsened in the past three years amid pandemic-era inflation, with 86% of Republicans, 59% of Democrats, and 80% of political independents reporting increased cost of living.

India's household debt levels are at an all-time high of 40% of GDP, while net financial savings have dropped to their lowest level at around 5% of GDP, according to a report from Motilal Oswal, which attributes the decline in savings to weak income growth and increased consumption and physical savings.

Futures traders have reduced bets on the Federal Reserve cutting rates this year to the lowest level since October, reflecting the continued strength of the US economy.

Israel's deficit has increased in March compared to the previous year, reaching NIS 15 billion, while the Bank of Israel has decided to keep its interest rate unchanged due to growing geopolitical uncertainty.

The March 2024 Consumer Price Index (CPI) report is expected to show a slight increase in overall inflation, but a moderation in inflation when volatile food and energy costs are excluded, due to falling car and airfare prices, which will impact the outlook for Federal Reserve interest rate cuts this year. Economists anticipate a 0.3% monthly increase in consumer prices, with an expected rise in the annual inflation rate to 3.4%, but the possibility of the Fed not cutting rates this year is being discussed if inflation remains high.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

The states with the fastest inflation are Florida, Tennessee, Virginia, South Carolina, and Alabama, while the states with the slowest inflation are Pennsylvania, Maine, New Hampshire, Vermont, and Connecticut.

Consumer expectations of tighter lending standards remain high, potentially leading to slower loan growth and economic downturn, according to two surveys.

Wiping out $169 million in medical debt for 83,401 individuals did not improve their mental health or credit scores on average, according to a study conducted in partnership with the nonprofit RIP Medical Debt.

U.S. Treasury Secretary Janet Yellen expressed concern about Chinese industrial policies, including subsidies and manufacturing overcapacity, which have resulted in a flood of cheap clean-energy exports, pushing foreign companies out of business and prompting the need for protections to ensure American companies and workers benefit from the clean energy transition.

The Dow edges up after its worst week in a year as the 10-year yield rises.

Remittances from overseas Pakistani workers increased by 31.27% in March 2024 due to higher inflows during Ramadan, reaching $2.95 billion, the highest monthly inflows since April 2022.

The International Monetary Fund warns that the rapid growth of the private credit industry could pose a risk to financial stability due to opaque lending practices and unclear credit quality.

Israel's foreign exchange reserves increased by $6.947 billion in March 2024, reaching a record high of $213.768 billion, driven by the government's foreign exchange activities and revaluation.

Actor Jonathan Majors avoids jail time for assaulting his ex-girlfriend, as he is ordered to complete a counseling program instead. Health Canada warns against using certain henna products due to safety concerns. Royal Bank of Canada terminates CFO Nadine Ahn following an investigation into a personal relationship with another employee. United Airlines delays flights on two new routes amid FAA safety probe. The deportation hearing for the truck driver involved in the deadly Humboldt Broncos bus crash is scheduled for next month.

The upcoming CPI report is expected to show a rise in both headline and core inflation, indicating that the disinflation process has stalled and suggesting an unexpected uptick in inflation. This could lead to fewer rate cuts and a stronger dollar against other currencies.

India's sustained GDP growth surpassing that of China reflects its emergence as a powerful economic force globally, driven by ambitious infrastructure projects and a comprehensive economic strategy, according to a European Parliament think tank expert. India's young demographic profile and its increasing diplomatic importance in the Indo-Pacific region also hold profound implications for the European Union and the wider international community.

HSBC Global Chief Investment Officer for Private Banking and Wealth Management, Willem Sels, predicts three Federal Reserve rate cuts this year, citing progress in inflation and strong economic activity as reasons for easing rates.

The US unemployment rate decreased slightly to 3.8% in March, with 303,000 jobs added, while inflation increased by 0.4% and housing remains unaffordable despite rising incomes, according to reports from the Bureau of Labor Statistics.

Americans' outlook for inflation is mixed, with expectations for higher prices on key goods and services, as concerns about missed debt payments grow, according to a report from the Federal Reserve Bank of New York.

Americans anticipate high inflation to persist over the next few years, with expectations of a 3% inflation rate one year from now, according to a survey by the Federal Reserve Bank of New York, suggesting that sticky inflation may be a long-term issue.