The majority of economists polled by Reuters predict that the U.S. Federal Reserve will not raise interest rates again, and they expect the central bank to wait until at least the end of March before cutting them, as the probability of a recession within a year falls to its lowest level since September 2022.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KHWVCX7RHBL3VJIGJ3MIXTN25M.jpg)

Apple has lost $200 billion in market capitalization as tensions between the U.S. and China escalate, with reports emerging of an iPhone ban for Chinese state employees, placing significant pressure on Apple as China is its largest international market.

Dow Jones futures, along with S&P 500 futures and Nasdaq 100 futures, were higher ahead of Tuesday's open as the stock market rally attempt continues, with upcoming earnings reports and economic data in focus.

Stocks opened higher on Friday, with the Nasdaq rebounding from Apple's slide, following hints that the Federal Reserve may delay interest rate hikes in September.

Stocks were mixed on Friday after the US unemployment rate rose unexpectedly, despite the economy adding more jobs than forecasted, while manufacturing data from China provided hope for its economic recovery from COVID-19.

The US dollar is experiencing its longest winning streak in almost nine years, gaining 5% since mid-July due to positive economic data and expectations that the Federal Reserve will maintain higher interest rates for longer, while concerns over the economic situations in China and Europe deepen.

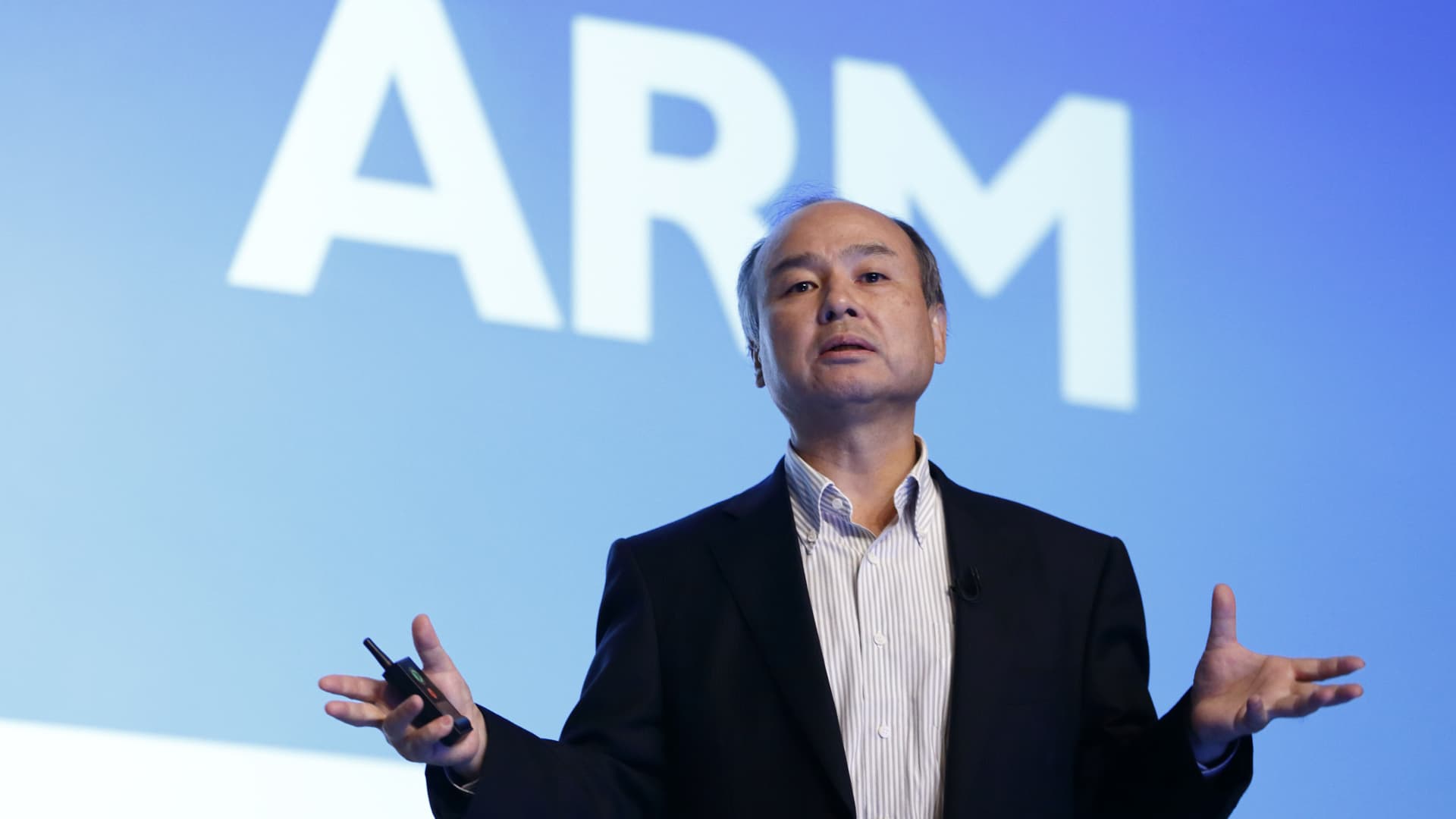

The tech IPO market may be reawakening after a two-year lull, with Arm Holdings and Instacart expected to go public and test investor appetite for technology IPOs, although the bar for startups has become higher since 2021, leading to fewer IPOs and a need for companies to show profitability within six quarters of listing.

Equity markets rise as investors focus on upcoming economic data following Powell's speech.

Nasdaq has received approval from the SEC to launch the first artificial intelligence-driven order type, the dynamic midpoint extended life order (M-ELO), which aims to increase trading efficiency and minimize market impact.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KSAUD4ZTTZN6HCH6UO4CVKRTHA.jpg)

The 10-year Treasury bond is on course for a third consecutive year of losses, which is unprecedented in 250 years of U.S. history, as the bond's return stands at negative 0.3% so far in 2023 after significant declines in the past two years, due to factors such as rising inflation and interest rate hikes by the Federal Reserve.

U.S. Household Wealth Hits Record High as Stock Market and Home Values Rise, But Debt Also Increases

The surging stock market and rebounding property values have driven U.S. household wealth to a record high of over $154 trillion in the second quarter, fully recouping losses from last year's bear market, according to Federal Reserve data.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MGYLELC5ENPEVFS7YOT2XRQHBM.jpg)

Barchart.com provides users with relevant market information quickly, accurately, and on time through their platform, Barchart Plus.

Walmart's updated pay structure, which reduces the starting wage for certain entry-level positions, suggests a shift in the labor market and may have implications for other retailers.

Dell shares surged 22% on Friday, achieving their best day since the company went public in 2018, following better-than-expected earnings driven by strong revenue beats and an increase in the company's full-year sales forecast. Morgan Stanley also named Dell as its top IT hardware pick, citing its emergence as an early Generative AI winner.

Billionaire investor Ken Fisher emphasizes the importance of patience in navigating the stock market, assuring investors that the current bull market still has room to grow; two stocks in Fisher's portfolio, Charles Schwab and Intuitive Surgical, are considered strong buys by analysts.

SoftBank-owned Arm has filed for its initial public offering (IPO), which will be a major test for the IPO market that has been stagnant due to rising interest rates, and is a significant move for SoftBank as it pivots its focus to artificial intelligence. Arm's chip designs are found in almost all smartphones globally, and the company's listing has implications for SoftBank's rebound strategy.

US stock futures are higher as Treasury yields back up slightly after reaching a 16-year high, with the Dow and S&P 500 both up and Nasdaq futures leading with over 0.7% as investors await results from Nvidia and a speech from Fed Chair Jay Powell.

The cryptocurrency market has experienced a notable downturn, with the total market capitalization falling by 10% and triggering significant liquidations on futures contracts, attributed to factors such as rising interest rates, inflation, delays in approving a Bitcoin exchange-traded fund (ETF), financial difficulties within the Digital Currency Group (DCG), regulatory tightening, and a strengthening US dollar.

The US dollar was cautious as traders awaited economic data, while the yen struggled near intervention levels as the dollar remained strong.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FH7EYAOX4ZLR3CRL3KMYMNRUDU.jpg)

Shares of Netflix Inc. dropped 0.08% to $442.80, marking the stock's third consecutive day of losses, while the S&P 500 and Dow Jones Industrial Average experienced gains in a positive trading session.

Barchart.com is a platform that provides relevant market information quickly and accurately through its Barchart Plus service.

Dow Jones futures, S&P 500 futures, and Nasdaq futures will open Sunday evening, with Apple and Oracle having significant news ahead and several stocks like Tesla, Roku, and Shopify being big Cathie Wood holdings near buy points; however, the stock market has had a tough week with major indexes falling below their 50-day lines and weak market breadth.

The euro falls to a more than two-month low as weaker than expected euro zone data weighs on the currency, while world stocks rebound amid anticipation for Nvidia's earnings results and Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole summit.

Federal Reserve Chairman Jerome Powell reiterated the central bank's commitment to raising interest rates and bringing inflation down, while also closely monitoring economic data and signaling the possibility of further rate hikes in the coming months.

The article highlights four top-tier growth stocks, including Amazon, PubMatic, AstraZeneca, and Starbucks, that investors may regret not buying following the Nasdaq bear market dip.

The aging population in America, particularly the boomers, is driving up housing demand and prices, leading to an affordability crisis and locking out middle-income buyers in the market.

The used car market is experiencing a volume crunch and higher pricing due to a shortage of near-new vehicles and disruptions in the supply chain, leading to a decrease in the availability of vehicles and increased prices, while economic pressures and spiked interest rates further complicate the market.

U.S. stock investors are closely watching next week's inflation data, as it could determine the future of the current equity rally, which has been fluctuating recently due to concerns over the Federal Reserve's interest rate hikes and inflationary pressures.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZVBOIJ6J2ZLKDFQ6OCW34F3R4A.jpg)

The S&P 500 has had a strong performance this year, but reaching a new record high seems unlikely at this point.

The insurance-linked securities market experienced a record-breaking influx of new issuances in the first half of 2023, surpassing the total issuance of 2022, according to Swiss Re's ILS Market Insights Report. The report also highlighted the significant activity in the cat bond market and the remarkable success of the Swiss Re Global Cat Bond Total Return Index.

Nvidia stock rises ahead of quarterly earnings report as analysts expect strong results due to high demand for AI products and services.

A 5-minute bar chart for Comex gold futures is a useful tool for active intra-day traders, providing key moving averages and support and resistance levels for buy and sell signals.

China stocks rise as investors welcome Beijing's efforts to support the market, while bonds rally and the dollar dips on possibly softening U.S. data.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Y25BVSCEH5MARKF3FMPEDCV7UE.jpg)

The global Bitcoin Bank market is expected to experience significant growth between 2023 and 2030, with the market value projected to reach multimillion dollars by 2030.

A new report by WalletHub ranks four cities in North Carolina, including Cary, Durham, Raleigh, and Charlotte, among the top 25 real estate markets in the US, with Texas dominating the top spots, and the Piedmont Triad falling behind. The report also highlights rising mortgage rates and home values, making it a challenging time for buyers, while experts offer differing opinions on whether it is a good time to buy.

Vietnamese electric vehicle maker VinFast has become the third-largest automaker globally in terms of market capitalization, following Tesla and Toyota.

Cryptocurrency exchange FTX is expected to receive court approval to liquidate $3.4 billion in cryptocurrencies, causing concern among stakeholders and potentially impacting Ethereum, Solana, and altcoins.

Gold price is aiming to sustain above $1,920.00 as pressure builds on the US Dollar and Treasury yields, with the upcoming labor market data playing a crucial role in guiding the Federal Reserve's policy action.

Apple's market value has dropped by 10% due to factors such as China's ban on the iPhone for government employees and competition from a Chinese rival, leading to concerns about slowing growth and the need for new products with high growth potential.

Inflation is expected to rise in August as oil and gasoline prices increase, putting pressure on the economy and potentially leading to higher interest rates and a stronger dollar.

Thailand's economy grew at a slower-than-expected pace in Q2 2023 due to weak exports and slower investment, prompting the government to downgrade its 2023 growth forecast to 2.5-3.0%, leading to speculations that the central bank may not raise rates again this year.

Broadcom, a significant player in the semiconductor industry, is a promising investment option due to its strong performance, focus on artificial intelligence (AI), consistent growth, and attractive valuation. The stock's technical analysis suggests a bullish trend and potential buying opportunities, although there are risks associated with competition, market volatility, supply chain disruptions, and economic uncertainties. However, investors may consider buying the stock during price dips or a surge beyond its record high to capitalize on Broadcom's growth and industry relevance.

The surge in mortgage rates has caused housing affordability to reach the lowest level since 2000, leading to a slow fall in the housing market and a potential dip in home prices, although the current market differs from the conditions that preceded the 2008 crash, with low housing inventory and a lack of risky mortgage products, making mortgage rates the key lever to improve affordability.