### Summary

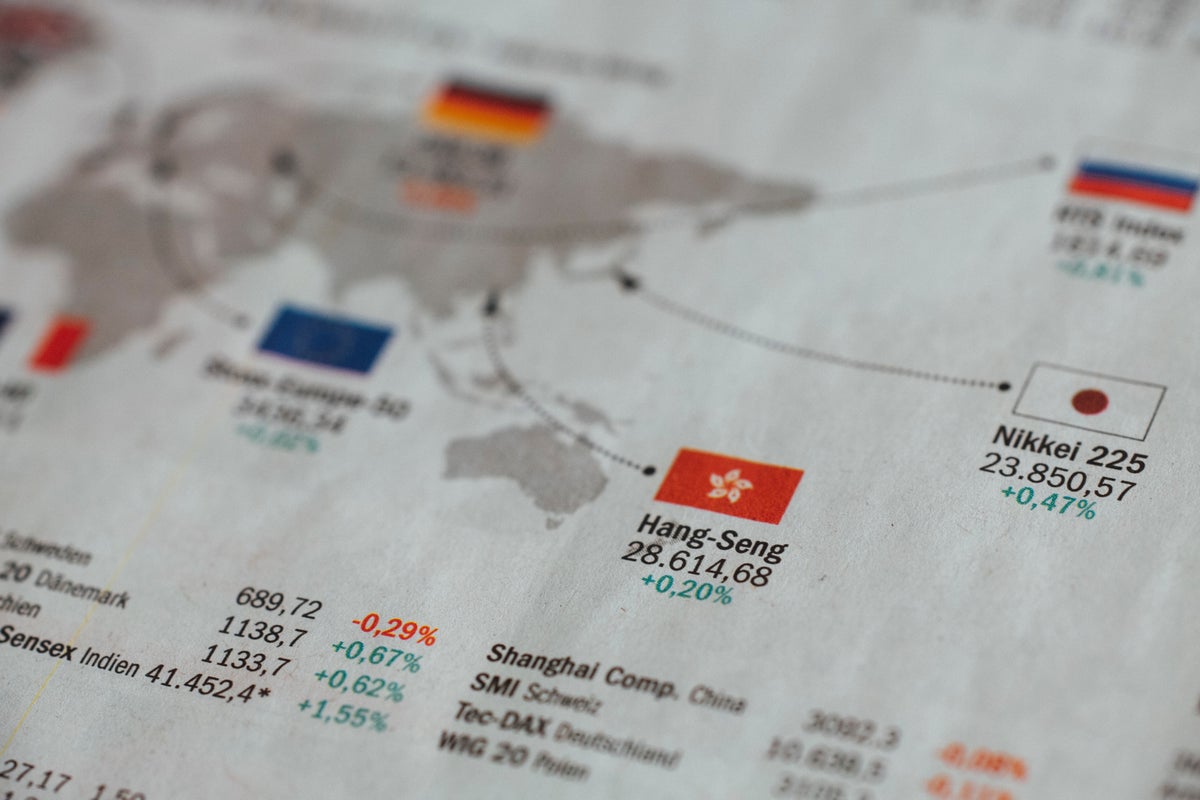

Asian stocks were mixed as traders awaited the Federal Reserve's summer conference to determine if more interest rate hikes are necessary to deal with inflation.

### Facts

- 📉 Shanghai and Hong Kong stocks retreated, while Tokyo and Seoul stocks advanced.

- 📉 The Hang Seng in Hong Kong lost 1.1%.

- 📈 The Nikkei 225 in Tokyo advanced 0.6%.

- 📈 The Kospi in Seoul gained 0.6%.

- 📊 The S&P 500 index ended the week lower by 0.1%.

- 💵 Some investors are shifting money to bonds as higher interest rates make their payout bigger and less risky.

- 💹 Tech and other high-growth stocks are some of the biggest losers due to higher rates.

- 📉 Ross Stores jumped 5% after reporting stronger-than-expected results, while Estee Lauder fell 3.3% despite reporting stronger profit and revenue than expected.

- ⛽ Benchmark U.S. crude gained 73 cents to $81.39 per barrel, while Brent crude reached $85.55 per barrel.

- 💲 The dollar slightly edged up to 145.35 yen, while the euro rose to $1.0882.

(Source: AP News)

Stock indices finished the trading session mixed, with the Dow Jones Industrial Average (DJIA) falling while the Nasdaq 100 (NDX) and the S&P 500 (SPX) gained. Additionally, auto loan delinquencies are increasing as car prices become unsustainable, and gas prices are on the rise.

Summary: U.S. markets end mixed with Nasdaq up over 1% due to the surge in technology stocks, Asian markets show positive gains with Japan's Nikkei 225 rising 1.05%, and European markets are higher as the tech sector gains ahead of the U.S. Federal Reserve's Jackson Hole gathering, while crude oil prices decrease slightly.

Most stock markets in the Gulf ended lower due to a slightly hawkish outlook from the US Federal Reserve, with Abu Dhabi, Qatar, and Saudi Arabia experiencing declines.

Stock indices finished the trading session in the green, with gains seen in the Nasdaq 100, S&P 500, and Dow Jones Industrial Average. However, Texas manufacturing experienced a downturn in August, and gas prices have slipped across the country. U.S. stock futures are trending higher, and traders are awaiting key economic releases and earnings reports this week. In Asian markets, indices ended higher, but Evergrande Group's shares plunged while Xpeng's shares rallied.

Global markets show mixed performance, with Japan, China, Hong Kong, India, and Australia experiencing modest gains, while the US markets closed higher fueled by optimism over a possible pause in interest-rate hikes, as oil prices extend gains and gold prices remain near three-week highs.

The US dollar experienced a major technical reversal due to a weaker JOLTs report, leading to a drop in US interest rates, while market positioning played a role in the price action; the focus now shifts to personal consumption figures and US jobs data, with the euro and sterling firm but most other G10 currencies softer, and emerging market currencies mixed. In Asia, most large bourses advanced, but Europe's Stoxx 600 fell after rallying in previous sessions, while US index futures traded softer; European bonds are selling up, gold is consolidating, and oil prices are firm. Australia's CPI slowed more than expected, China is expected to release the August PMI, and Japan reports July retail sales. The US dollar has seen no follow-through selling against the yen, yuan, or Australian dollar, while the euro and sterling staged impressive price action. The JOLTS report saw the dollar and US rates reverse lower, and today the US reports advanced merchandise trade figures for July, with the Canadian dollar as the worst performing G10 currency yesterday.

Summary: U.S. stock markets closed mixed as the key inflation data for July showed steady price increases, with the Nasdaq up 0.1% and extending its winning streak to five days, while the S&P 500 closed down 0.2% and the Dow Jones Industrial Average fell 0.5%.

Most stock markets in the Gulf ended lower as investors grew cautious due to volatile oil prices and awaited monetary policy decisions by the US Federal Reserve.

Summary: The US markets ended mixed after the release of the latest jobs report data, with the economy adding 187,000 jobs in August but seeing an increase in unemployment, while in Asia, Japan's Nikkei 225 closed higher, Australia's S&P/ASX 200 was down, and China's Shanghai Composite and Shenzhen CSI 300 declined. Additionally, European markets saw declines, and commodities such as crude oil, natural gas, gold, silver, and copper experienced varying price movements.

U.S. stocks slipped as worrying data out of China and a spike in oil prices following the extension of Saudi Arabian production cuts weighed on the market. The Dow Jones Industrial Average fell 0.6%, while the S&P 500 lost 0.4% and the Nasdaq dipped 0.1%.

Asia-Pacific equity markets finished mixed, with Australia's ASX All Ordinaries and South Korea's KOSPI falling, while Taiwan's TAIEX and Hong Kong's Hang Seng declined slightly; European markets are flat to lower, and U.S. equity futures point to a lower open.

Global equity markets closed mostly lower, with the exception of India and South Korea, as concerns about inflation and uncertainty around Fed rate actions weighed on investor sentiment. The Japanese Nikkei closed 1.16% lower due to lower-than-expected GDP growth and China's ban on iPhones. Officials at the Hong Kong Exchange halted trading after major flooding from storms. European markets were also lower, and US equity futures indicate a lower open.

Summary: Despite a slight rise in US markets on Friday, major indexes finished the week lower, with Europe's Stoxx 600 index also experiencing losses, while the G20 nations released a joint communique addressing Russia's war in Ukraine, omitting overt criticism from last year's statement. Elsewhere, Instacart plans to go public at a lower valuation, SpaceX's Starship Super Heavy rocket remains grounded, and the upcoming consumer price index report could impact the Federal Reserve's monetary policy decisions.

Asian markets experienced mixed results, with Australia's S&P/ASX 200 falling and Hong Kong's Hang Seng index dropping by about 1%, while Japan's markets were marginally positive; tech investor Paul Meeks plans to buy tech stocks after the correction, and Federal Reserve officials are feeling less urgency for another interest rate hike due to improved inflation data. Additionally, Apple shares fell amid China concerns but an analyst is holding off on shorting the stock, Morgan Stanley upgraded Tesla stock due to its autonomous driving supercomputer, HSBC revealed its "must see stocks" in the UK, and consumer discretionary stocks gave the S&P 500 an upward push.

Global markets ended higher as energy stocks climbed supported by Saudi Arabia and Russia's decision to extend supply cuts, while Wall Street's key indexes saw weekly declines due to investor concerns over interest rates and anticipation of upcoming U.S. inflation data. In Asian markets, Japan's Nikkei 225 ended down, Australia's S&P/ASX 200 was up, and Chinese shares rose following improved data on consumer price inflation. The Eurozone's economic growth outlook has been downgraded by the European Commission, and crude oil prices fell.

Stock indices closed in the red, with the Nasdaq 100, S&P 500, and Dow Jones Industrial Average all experiencing declines, while the technology sector underperformed and the energy sector led the session. The U.S. 10-Year Treasury yield dropped, while the Two-Year Treasury yield increased. The Small Business Optimism Index for August decreased, with inflation cited as a major concern among small business owners. Stocks opened lower on Tuesday, and U.S. futures trended lower as well. This week's focus will be on the Consumer Price Index and Producer Price Index data, which could impact the Federal Reserve's decision on rate hikes. Oracle's stock fell after missing sales estimates, while Casey's General and Tesla saw gains. JPMorgan's CEO criticized new Basel III regulations, and European indices traded in the green. In Asia-Pacific, markets ended mixed as traders await U.S. inflation data.

European markets were mixed as investors awaited the U.S. Federal Reserve's monetary policy meeting and assessed the central banks' stance on inflation, with retail stocks making the biggest losses while autos and oil and gas were up.

U.S. stock markets closed lower amid risk-off sentiment as the Federal Reserve began its two-day monetary policy meeting, while Asian markets, including Japan's Nikkei 225 and Australia's S&P/ASX 200, experienced declines; however, European markets, including Germany's DAX and the U.K.'s FTSE 100, traded higher.

European markets were slightly lower as concerns over higher interest rates emerged from recent central bank decisions, with the pan-European Stoxx 600 index down 0.1%, while construction and material stocks dropped 0.9% and mining stocks added 0.9%.

Asia-Pacific equity markets closed mixed, with Japan's Nikkei and Taiwan's TAIEX rising, while South Korea's KOSPI and China's Shanghai Composite fell; European markets are lower across the board in midday trading, and U.S. equity futures point to a flat to lower open.

Stock indices are mixed in today's trading session, with the Texas Manufacturing Outlook Survey reporting a decline in factory activity and U.S. stock futures trending higher due to concerns over high interest rates, rising bond yields, increasing oil prices, and possible government shutdown, while European indices have turned red and Asia-Pacific markets end mixed.

Asia-Pacific markets mostly decreased despite a rebound on Wall Street, with Japan's Nikkei 225 and Australia's S&P/ASX 200 experiencing losses, while the Kospi in South Korea and the Kosdaq in Hong Kong saw mixed results; in European luxury sectors, Bank of America upgraded three stocks that are deviating from negative trends; Moody's warns that a U.S. government shutdown would have a negative impact on credit; analysts have mixed opinions on the investment potential of tech giant Meta; Amazon's shares increased by 1.2% following its announcement of a major investment in AI startup Anthropic; the Federal Reserve suggests that interest rates may soon stabilize but at a higher level than expected; Chevron's CEO predicts that oil prices could reach $100 per barrel.

Asia-Pacific markets fell ahead of China's industrial data and Australia's inflation figures, while the US experienced a sell-off after disappointing economic data, causing the Dow Jones Industrial Average to fall below its 200-day moving average for the first time since May. Additionally, oil prices continue to rise, putting crude on track for its best quarter in over a year, and Tesla shares dropped after reports of an EU investigation into whether the company and other European carmakers are receiving unfair subsidies for exporting from China.

The US stock markets broke a four-day losing streak with gains in energy and materials sectors, while the Asian markets saw losses with technology stocks declining and concerns about China's property market stability. European markets opened in the red, awaiting economic data and earnings reports. Crude oil and natural gas prices decreased, while gold, silver, and copper prices fell. US futures and the US dollar index were down.

Stock markets end mixed as investors oscillate between bargain hunting and concerns over increased Treasury yields and interest rate uncertainties, with Asia markets seeing declines driven by worries about U.S. monetary tightening and selling off stocks, while European stocks decline for the sixth day and investors await Germany's inflation data.

Stocks ended the day higher as the surge in oil, the dollar, and Treasury yields slowed down, with the Nasdaq rising 0.8%, the S&P 500 gaining 0.6%, and the Dow Jones Industrial Average rising 0.4%.

U.S. stocks showed mixed performance as Treasury yields rose and a government shutdown was averted, with the Dow Jones Industrial Average down 0.6%, the S&P 500 down 0.3%, and the Nasdaq Composite up 0.4%.

The major stock indexes are expected to open lower as the 10-year Treasury yield hits a 16-year high, with investors monitoring employment data for potential impact on interest rates; meanwhile, stock futures in Asia and Europe slumped as the Federal Reserve's message of higher interest rates reverberates worldwide.

Asia-Pacific equity markets closed lower, with India's SENSEX, Taiwan's TAIEX, Australia's ASX All Ordinaries, Japan's Nikkei, and Hong Kong's Hang Seng all declining, while European markets are down in midday trading and U.S. equity futures point to a flat to positive open as investors remain focused on the 10-year Treasury yield and await comments from Fed officials later in the week.

The U.S. stock market ended mixed, with the S&P 500 remaining unchanged, while the Nasdaq saw gains due to Nvidia's shares jumping following Goldman Sachs' endorsement, and global markets experienced losses, including Japan's Nikkei 225, Australia's S&P/ASX 200, and Hong Kong's Hang Seng index.

Stock indices finished in positive territory, with the Nasdaq 100, S&P 500, and Dow Jones Industrial Average all posting gains, while the energy sector experienced losses; meanwhile, the U.S. 10-Year Treasury yield decreased and the Two-Year Treasury yield also saw a decline. The Factory Orders report showed an increase in new purchase orders placed with manufacturers, beating expectations. The ISM Non-Manufacturing Purchasing Managers' Index indicated a slight contraction in the non-manufacturing sector, and the ADP jobs growth data showed a slowdown in job growth and wages. U.S. Futures opened lower following higher-than-anticipated JOLTs jobs opening data. Asian markets ended mixed, while European indices traded in the red.

Stocks slip as U.S. crude futures drop and mortgage rates climb, while investors await payroll data for signs of a slowing job market; electric vehicle stocks like Rivian and Lucid are making moves, and the U.S. Dollar Index rises for its 12th consecutive week. European stocks close mixed, and utilities stocks see their worst year in over a decade due to higher bond yields.

Asia-Pacific markets are expected to have a positive start to the week, with Chinese markets returning from a week-long holiday and investors watching inflation readings and trade data from China and India, as well as a monetary policy decision from Singapore's central bank. In Australia, the S&P/ASX 200 is up after a five-day losing streak, while futures for Hong Kong's Hang Seng index point to a stronger open. However, the outbreak of war between Israel and Palestine has affected stock futures and led to higher oil prices. There is also an increased likelihood of the Federal Reserve raising interest rates by the end of the year, causing utilities stocks to sink as investors find short-term Treasuries more attractive.

U.S. stock markets closed higher on Friday due to strong job creation, leading to discussions about a potential Federal Reserve interest rate hike; Asian markets, including Japan, Australia, and China experienced mixed results; European markets were mostly positive; commodities such as crude oil and gold saw an increase in prices; and U.S. futures and forex showed a decline and mixed results respectively.

Financial markets trade mixed as investors monitor the Israel-Hamas conflict and pay attention to speeches from central bankers, while the US Dollar posts small recovery gains and US stock index futures remain unchanged; meanwhile, the heat map shows percentage changes of major currencies against each other and Wall Street's main indexes closed in positive territory despite escalating geopolitical tensions.

Dow Jones futures rose slightly while S&P 500 futures and Nasdaq futures fell; Treasury yields retreated and crude oil spiked as U.S. sanctions on Russian crude sales tightened; UnitedHealth, JPMorgan Chase, Wells Fargo, Citigroup, PNC Financial Services, and BlackRock reported their earnings; the stock market rally retreated after an inflation report and a poorly received Treasury auction; Apple and Microsoft stocks edged higher while Google and Meta Platforms fell; Dow Jones futures rose slightly; the 10-year Treasury bond yield fell; the stock market rally struggled at key levels; growth ETFs slumped; megacap stocks like Apple, Microsoft, Google, Meta, Nvidia, Amazon, and Tesla were down a fraction; investors should be cautious and ready to reduce or exit positions if necessary.

Stock indices finished mixed, with the Dow Jones gaining 0.12% while the S&P 500 and Nasdaq 100 fell 0.5% and 1.24% respectively; UBS analysts predict a "softish" landing for the US economy and have adjusted their S&P 500 price target down to 4,500 from 4,700, citing geopolitical and domestic financial developments.

U.S. stock markets closed mixed as declining consumer confidence and Middle East tensions overshadowed positive earnings from major banks, while Asian markets saw losses ahead of crucial inflation data, and European markets were mostly down.

Stock markets in the US closed higher, driven by optimism over earnings season, while Treasury yields rose due to concerns over the conflict between Israel and Hamas; Asian markets followed suit, with Japan's Nikkei 225 closing higher and Australia's S&P/ASX 200 recording gains, while European markets saw mixed results; in commodities, crude oil prices were relatively stable, while gold and silver prices increased slightly; and US futures indicated a slight decline.

Stock markets in the US closed mixed on Tuesday, with positive economic data and strong Q3 earnings suggesting a continued tight monetary policy by the Federal Reserve, while Asian markets saw a mix of gains and declines, with Japan's Nikkei 225 and Australia's S&P/ASX 200 closing higher, and China's Shanghai Composite and Shenzhen CSI 300 declining; European markets also saw declines, and commodities such as crude oil, gold, and silver saw gains.

The U.S. stock markets decreased due to rising Treasury yields and investor evaluations of corporate earnings, while Asian markets, including Japan's Nikkei 225 and Australia's S&P/ASX 200, also experienced declines; the European STOXX 600 index and Germany's DAX also decreased, while crude oil, gold, and silver prices fell.

Stocks opened lower as investors digest disappointing Big Tech earnings and rising bond yields, with the Nasdaq and S&P 500 dropping about 0.5% and 0.4%, respectively, while the Dow Jones Industrial Average remained flat. The US economy grew at its fastest pace in nearly two years, with a 4.9% increase in GDP, driven by strong consumer spending. Stock futures point to a continuation of the sell-off as investors anticipate more earnings releases.

Asian stocks were mixed as U.S. shares slumped due to poor corporate earnings, with Australian, South Korean, and Japanese shares falling while equity futures in China and Hong Kong rose; Indian benchmark stock indices declined and uncertainty from the Israel-Hamas conflict weighed on markets.