Main Topic: China's inflation data for July

Key Points:

1. Consumer price index (CPI) fell by 0.3% in July from a year ago, but was up by 0.2% compared to June.

2. Producer price index (PPI) fell by 4.4% in July from a year ago, better than the decline in June.

3. Both CPI and PPI are in deflation territory, indicating weakening economic momentum and lacklustre domestic demand.

### Summary

The blog emphasizes that the war on inflation has been won, with the Consumer Price Index (CPI) showing a 12-month inflation rate of +3.3%. However, BLS's imputation of shelter costs using lagged data means that the CPI would be significantly below the Fed's target of 2%. The market believes that the current Fed Funds rate will remain unchanged for the rest of the year.

### Facts

- The economists at three Regional Federal Reserve Banks believe that a recession is coming, despite the official forecast of "no recession" from the Fed. The probability of recession is higher than during the last two recessions.

- The Conference Board's Leading Economic Indicators (LEI) have been negative for 16 consecutive months, which has a 100% track record in predicting recessions.

- The freight industry is experiencing a recession, with the Cass Freight Index down -8.9% over the year. Housing is also struggling, with mortgage loan applications at 30-year lows and significant declines in new and existing home sales.

- Seasonally adjusted retail sales for July were +0.7%, but the actual raw data fell -0.4% from June to July. The weak data suggests a different story than what the seasonally adjusted numbers portray.

- Home Depot, Target, and Walmart reported lower Q2 revenues, with general merchandise sales at Walmart contracting.

- Industrial Production rose 1.0% in July, driven by utility output and auto production. However, the seasonal adjustment may be questionable.

- Inflation rates in developed countries are just above 2%, with China experiencing deflation. One-year inflation expectations are rapidly falling, which is positive for controlling inflation.

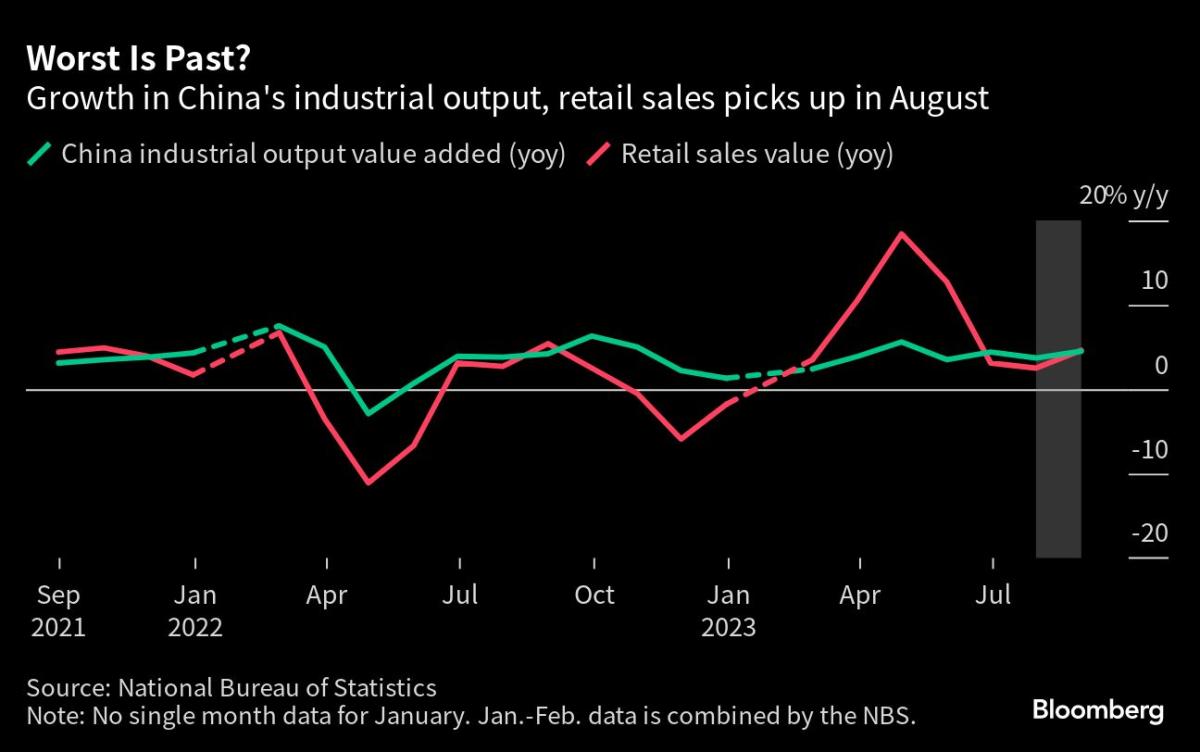

- China's economy is faltering, with industrial production and retail sales declining. Q2 real GDP growth is anemic, and the crisis in the real estate sector is worsening. China's struggles will have a negative impact on the global economy and its major trading partners.

### Emoji

- 📉: Recession

- 📊: Economic indicators

- 🚂: Freight industry

- 🏘️: Housing market

- 🛍️: Retail sales

- 🏭: Industrial production

- 💰: Inflation

- 🇨🇳: China's economy

- 📉💼: Global economy

### Summary

The upcoming Jackson Hole Symposium is expected to deliver a hawkish but cautious message from the Fed chair, with a focus on the strong US economy, resilient US consumer, and persistent inflation.

### Facts

- 📉 Last year, the markets experienced a major selloff following the Fed chair's unexpectedly hawkish speech at Jackson Hole.

- 💪 This year, the markets are pessimistic due to the strong US economic numbers, including a predicted 5.8% growth for Q3.

- 🎙️ The Fed chair will likely discuss the possibility of a November rate hike but may roil the markets if he mentions further rate hikes.

- 🌐 The slowdown of China's economy is a concern as it is the second-largest economy globally, and reduced outlooks for Chinese GDP are being reported by major institutions.

- 💼 China's high levels of local government debt and shadow banking pose a risk of contagion, with real estate and shadow bank crises being the main focus.

- 📉 A selloff in China could lead to an emerging market selloff, but India may experience a heavier selloff due to the significant amount of money investors have made there.

- 🌍 The opaque nature of China's government and lack of data make it challenging to fully understand the depth of the country's economic issues.

### Summary

JD.com, China's biggest ecommerce retailer, reported a 50% surge in net income and 7.6% increase in revenue, beating expectations, due to its low-cost strategy attracting customers during China's economic downturn and increased competition.

### Facts

- 💹 JD.com's net income rose 50% to 6.6 billion yuan ($0.9 billion) and revenue increased 7.6% to 287.9 billion yuan ($39.7 billion), exceeding projections.

- 📈 The company gained market share from rivals including Baidu, Alibaba, and Pinduoduo.

- 💰 Service revenue jumped 30% to 54.1 billion yuan ($7.5 billion).

- 🛒 JD.com attracted more vendors and customers with its low-cost strategy and "10 billion yuan" subsidy program.

- 🗣️ CEO Sandy Xu attributed the solid performance to the company's enhanced business structure and supply chain capabilities.

### China's Economic Woes

- 🇨🇳 China's economy has faced challenges including slowing growth, rising debt, a property bubble bust, and weak domestic demand.

- 📉 Gross domestic product (GDP) rose only 3% last year, the slowest pace in decades.

- 🛍️ Retail sales fell 8% month-over-month in July, with deflation of 0.3% year-over-year, reflecting weak domestic demand.

- ⬇️ Deflation can harm economies by discouraging spending and borrowing, leading to a slowdown in economic activity.

### Summary

The Chinese economy has slipped into deflationary mode, with retail sales, industrial production, and exports all missing forecasts. Shrinking domestic demand and a debt-fueled housing crisis are the main causes behind this slowdown.

### Facts

- 📉 Retail sales in July grew by 2.5% year-on-year, compared to 3.1% in June.

- 🏭 Value-added industrial output expanded by 3.7% y-o-y, slowing from 4.4% growth in June.

- 📉 China's exports fell by 14.5% in July compared to the previous year, and imports dropped 12.4%.

- 💼 Overall unemployment rate rose to 5.3% in July, with youth unemployment at a record 21.3% in June.

- 📉 Consumer Price Index-based inflation dropped to (-)0.3%, indicating a deflationary situation.

- 🏢 China's debt is estimated at 282% of GDP, higher than that of the US.

### Causes of the slowdown

- The debt-fueled housing sector collapse, which contributes to 30% of China's GDP.

- Stringent zero-Covid strategy and lockdown measures that stifled the domestic economy and disrupted global supply chains.

- Geopolitical tensions and crackdowns on the tech sector, resulting in revenue losses and job cuts.

### Reaction of global markets

- The S&P 500 fell 1.2% following the grim Chinese data.

- US Treasury Secretary warns China's slowing economy is a risk factor for the US economy.

- Japanese stocks and the Indian Nifty were also impacted.

- China's central bank cut its benchmark lending rate, but investors were hoping for more significant stimulus measures.

### Global market concerns

- China's struggle to achieve the 5% growth target may impact global demand.

- China is the world's largest manufacturing economy and consumer of key commodities.

- A slowdown in China could affect global growth, with the IMF's forecast of 35% growth contribution by China seeming unlikely.

### Impact on India

- India's aim to compete with China in the global supply chain could benefit if Chinese exports decline.

- However, if China cuts back on commodity production due to slowing domestic demand, it may push commodity prices higher.

### Summary

China's fiscal revenue rose 11.5% in the first seven months of 2023, but at a slower pace than the previous six months, indicating a loss of economic momentum.

### Facts

- 💰 China's fiscal revenue increased by 11.5% in the first seven months of 2023.

- 💸 Fiscal expenditure grew by 3.3% to 15.2 trillion yuan ($2.10 trillion).

- 📉 In July, fiscal revenue only rose 1.9% year on year, slower than the previous month's increase.

- 📉 Fiscal expenditure fell 0.8% in July, narrowing the decline compared to the previous month.

- 🌍 China's economy grew at a sluggish pace in the second quarter due to weak demand domestically and internationally.

- 📉 The consumer sector in China experienced deflation in July, with analysts predicting persisting price stagnation for the next six to 12 months.

China is facing a severe economic downturn, with record youth unemployment, a slumping housing market, stagnant spending, and deflation, which has led to a sense of despair and reluctance to spend among consumers and business owners, potentially fueling a dangerous cycle.

China's economy, which has been a model of growth for the past 40 years, is facing deep distress and its long era of rapid economic expansion may be coming to an end, marked by slow growth, unfavorable demographics, and a growing divide with the US and its allies, according to the Wall Street Journal.

Main financial assets discussed:

1. Country Garden (private real estate developer)

2. Shanghai Stock Exchange Composite Index (SSEC)

3. Hang Seng Index (HSI)

4. KraneShares MSCI All China Index ETF (KALL)

Top 3 key points:

1. China's real estate sector is facing significant challenges, with property prices and land prices cooling off and a rise in foreclosures due to affordability concerns and drop in incomes.

2. The jobless rate among the 16-24 age range in China is high, indicating an affordability crisis and potential economic challenges for the country.

3. The performance of Chinese stock indices, including the SSEC and HSI, has been under par in recent years, suggesting potential challenges for the Chinese economy.

Recommended actions:

Based on the information provided, it is recommended to **sell** or **hold** investments in Chinese real estate assets, as the sector is facing significant challenges including affordability concerns and a rise in foreclosures. The performance of Chinese stock indices has also been under par, suggesting potential challenges for the Chinese economy. Investors may consider diversifying their investments beyond China and conducting diligent research to identify other investment opportunities.

China's economic slump is worsening due to the prolonged property crisis, with missed payments on investment products by a major trust company and a fall in home prices adding to concerns.

China's economic slowdown, marked by falling consumer prices, a deepening real estate crisis, and a slump in exports, has alarmed international leaders and investors, causing Hong Kong's Hang Seng Index to fall into a bear market and prompting major investment banks to downgrade their growth forecasts for China below 5%.

China's economic challenges, including deflationary pressures and a slowdown in various sectors such as real estate, are likely to have a global impact and may continue to depress inflation in both China and other markets, with discounting expected to increase in the coming quarters.

China's economic problems are beginning to resemble Japan's long-lasting issues, as a real estate crisis, an aging population, surging youth unemployment, and high local government debts create a crisis of confidence, potentially leading to a "lost decade" of economic stagnation and deflation, while Japan shows signs of climbing out of its decades-long economic nightmare with rising inflation and a potentially optimistic outlook.

China's currency, the yuan, is at its lowest level against the dollar since the 2008 financial crash, which raises concerns about the country's economic stability and its ability to boost domestic consumption.

Falling prices in China, driven by a weakened economy, could benefit countries with elevated inflation such as the U.S., India, Germany, and the Netherlands.

Fears about the health of the global economy have intensified as service sector activity in China, the eurozone, and the UK shows signs of weakness, leading to a drop in share prices in Asia and a decline in the pound against the US dollar.

China's consumer price index rebounded in August after slipping into deflation in July, indicating a post-Covid economic recovery, despite sluggish domestic consumption and concerns of a relapse into deflation in the coming months.

Chinese stocks have passed the worst of the selling pressure and are still attractive to investors due to their cheap valuation and potential for growth, according to CLSA. However, Beijing needs to address concerns and risks in the economy. The MSCI China Index has fallen this year, but a pause in the Federal Reserve's tightening policy is expected to reverse market pessimism.

Chinese economic data showing strength in consumer spending and manufacturing activity boosted Asian markets, with Hong Kong's Hang Seng Index rising 0.8% and Tokyo's Nikkei 225 surging 1.1%, despite concerns about a slowdown in China's economy.

The price of rice has reached its highest level since 2008, causing concerns of a potential food crisis in Asia, as the continent is responsible for consuming 85% of global rice production; factors contributing to the price increase include irregular rainfall, drought, and disruptions in the supply chain, while export restrictions imposed by major rice-producing countries have further exacerbated the situation.

The outlook of U.S. companies on China's markets in the next five years has hit a record low due to factors such as political tensions, tariffs, slow Covid recovery, and issues in the real estate market; however, complete decoupling between the two economies is unlikely.

Asia-Pacific markets fell ahead of China's industrial data and Australia's inflation figures, while the US experienced a sell-off after disappointing economic data, causing the Dow Jones Industrial Average to fall below its 200-day moving average for the first time since May. Additionally, oil prices continue to rise, putting crude on track for its best quarter in over a year, and Tesla shares dropped after reports of an EU investigation into whether the company and other European carmakers are receiving unfair subsidies for exporting from China.

China's economy is on the brink of a potential "apocalyptic" collapse that could have disastrous effects on global stock markets, as the country's economic indicators continue to plummet and financial experts warn of an imminent crash.

China's consumer price index remained flat in September, indicating the ongoing risk of deflation and the need for policy support to sustain economic recovery. The decline in food price inflation and energy price deflation were identified as the main factors contributing to the flat CPI. Additionally, China's producer price index fell by 2.5% in September, marking the 12th consecutive month of decline, but the deflationary pressure eased due to a pickup in global oil and commodity prices. Core inflation remained steady, while policy support is expected to be necessary to maintain recovery momentum.

The U.S. economy is surpassing China's growth as U.S. retail and industrial data continue to exceed expectations, leading to concerns about inflation and potential interest rate hikes by the Federal Reserve, while energy prices soar and tensions rise in the Gaza-Israel conflict.

China's real estate market is declining, debt deflation is a concern, its workforce is shrinking, and GDP growth is slowing, leading to warnings of "Japanisation" and prolonged economic malaise, worsened by President Xi Jinping's autocratic rule and economic imbalances far worse than Japan's in 1990.

The fear and anxiety in China's stock market is currently at its highest level in a year, with the Fear and Greed indicator for the Shanghai Composite index falling to its lowest level since October 2022.