China is facing a severe economic downturn, with record youth unemployment, a slumping housing market, stagnant spending, and deflation, which has led to a sense of despair and reluctance to spend among consumers and business owners, potentially fueling a dangerous cycle.

China's major state-owned banks are actively buying offshore yuan in an attempt to stabilize the currency amid a darkening economic outlook and strain in the property sector, raising the cost of shorting the Chinese yuan and leading to a rally in the currency's value.

China's economic slump is worsening due to the prolonged property crisis, with missed payments on investment products by a major trust company and a fall in home prices adding to concerns.

Asian currencies against the dollar had minor fluctuations, with the Japanese yen, Singapore dollar, and Taiwanese dollar showing slight gains, while the Chinese yuan experienced a slight decline; overall, there were small changes compared to the end of 2022.

The US dollar remains strong against major peers and the yen, as Treasury yields rise amid expectations of high US interest rates for a longer period, while China's central bank sets a stronger-than-expected daily midpoint for the yuan to counter mounting pressure on the currency.

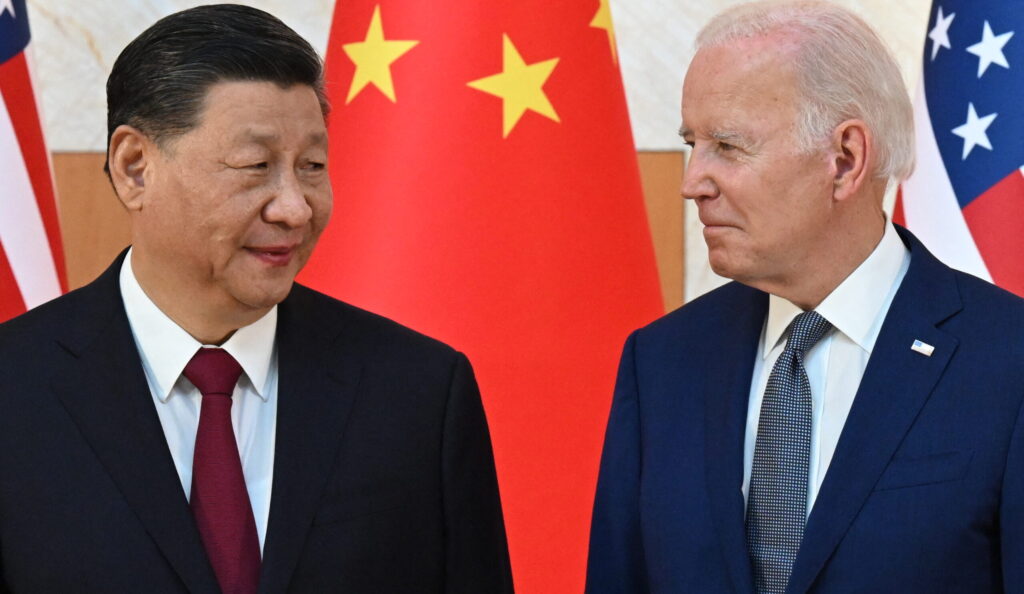

China's weak economy, including an unstable property market and weak consumer demand, is posing risks to global markets and economies like the US, according to experts.

An economic crisis in China is unlikely to have a major impact on the US due to limited exposure in terms of investments and trade, and it may even benefit the US by lowering inflation, according to economist Paul Krugman.

China's stuttering economy poses a major threat to global commodities demand, as economic activity and credit flows deteriorate, and structural challenges and weaknesses in various sectors, including base metals, iron & steel, crude oil, coal & gas, and pork, affect the market.

China's economic challenges, including deflationary pressures and a slowdown in various sectors such as real estate, are likely to have a global impact and may continue to depress inflation in both China and other markets, with discounting expected to increase in the coming quarters.

China's recent sale of its US Treasurys is a reflection of economic weakness and an attempt to prop up its weakening currency, not a sign of strength, according to Carson Group.

The combined footprint of Japan and China in the US Treasury market is at its lowest on record, leading to speculation that they may sell dollars and liquidate US Treasuries to support their currencies without causing significant market disruption.

China's economic weakness will pose challenges for developing economies and regions that rely on it for growth, but the U.S. economy is well-positioned to withstand the resulting headwinds, according to U.S. Deputy Treasury Secretary Wally Adeyemo.

The US dollar will remain dominant in global trade, but China's yuan is gaining popularity among developing countries such as Russia, Brazil, India, and South Africa.

China's economic model, driven by industrialization and exports, is showing weaknesses with an imbalanced economy, low demand, slumping trade, and a struggling property sector, highlighting the need for structural reforms to boost domestic consumption and confidence.

The US Dollar performed well against major currencies, with the British Pound, Euro, and Canadian Dollar underperforming, while the Chinese Yuan and Australian Dollar fared better; the Federal Reserve's indication of a higher terminal rate and potential further borrowing cost increases contributed to the market sentiment, leading to lower US equity markets; upcoming economic data includes consumer confidence, inflation gauges from key European countries, and manufacturing PMI gauges from China.

Global investors are skeptical of China's ability to stabilize its financial markets, with many predicting that economic pressures will cause the offshore exchange rate of the yuan to reach record lows.

China's economic slowdown is causing alarm worldwide, with countries experiencing a slump in trade, falling commodity prices, and a decrease in Chinese demand for goods and services, while global investors are pulling billions of dollars from China's stock markets and cutting their targets for Chinese equities.

China's economy is struggling due to an imbalance between investments and consumption, resulting in increased debt and limited household spending, and without a shift towards consumption and increased policy measures, the economic slowdown may have profound consequences for China and the world.

Concerns arise that the struggling Chinese economy and volatility in the stock market may negatively impact Bitcoin's price and hinder its role as an alternative store of value in the face of a strengthening U.S. dollar.

China's economy will struggle with low growth under 5% through 2024, leading to a "structural hard landing" due to tight monetary policy, disappointing economic reopening, and challenges in real estate and stock markets, according to TS Lombard strategists.

The dollar's status as a global reserve currency is facing challenges as countries like China and India promote trade in their own currencies, digital currencies gain popularity, and geopolitical conflicts threaten the international monetary system dominated by the dollar.

Falling prices in China, driven by a weakened economy, could benefit countries with elevated inflation such as the U.S., India, Germany, and the Netherlands.

The dollar has reached a five-month high as investors anticipate the need for elevated interest rates due to the strong US economy, with factors such as weak growth in China and Europe, rising US yields, and falling equity prices further supporting the case for dollar strength.

Gold and silver prices are lower due to a strong U.S. dollar and rising U.S. Treasury yields, while trader and investor risk appetite is downbeat with downbeat economic data from China and Asian stock markets mostly lower.

Asia stocks fall as weak economic data in China and Europe raise concerns over global growth, while the dollar strengthens as investors assess the outlook for U.S. interest rates.

China's economy risks falling into a vicious cycle of debt and deflation, but economist Shang-Jin Wei suggests that launching an aggressive bond-buying campaign and allowing the yuan to lose value may be necessary to avoid this trap.

Emerging market currencies are expected to struggle to recover from their losses this year due to high U.S. Treasury yields, safe-haven demand, and a slowing Chinese economy, keeping the dollar strong, according to a Reuters poll of FX analysts.

The dollar strengthens against the yen and keeps the euro and sterling near three-month lows as investors rely on the resilience of the U.S. economy, while China's onshore yuan hits a 16-year low due to a property slump and weak consumer spending.

The Chinese yuan has dropped to a 16-year low against the dollar due to concerns over a deepening economic slowdown in China, with data showing a decline in exports for the fourth consecutive month.

China's yuan finished the domestic session on Friday at its weakest since the global financial crisis, impacted by capital outflow pressures and a growing yield gap with other major economies, leading to expectations of further selling pressure in the near term but likely measured losses.

China is showing signs of a balance-sheet recession similar to Japan's, with accumulating debt and falling house prices, but there are key differences that suggest it may not face the same fate. State-owned enterprises and property developers account for much of China's debt, and households have low debt relative to their assets. However, the Chinese government's reluctance to increase spending could prolong the recession.

The US Dollar performed strongly against major currencies, with the Euro experiencing its 8th consecutive weekly loss and the Chinese Yuan performing poorly, while global market sentiment was negative and stock markets weakened. In the coming week, market focus will be on the US inflation report, UK employment and GDP data, Australian employment data, and the ECB rate decision.

The Chinese yuan bounces back from a 16-year low as the central bank vows to stabilize the currency and take necessary actions to correct market moves.

China's economy is at risk of a financial crash due to its property bubble and soaring debts, according to market veteran Ruchir Sharma.

China's offshore yuan weakened after the country's central bank announced a cut in banks' reserve requirement ratio, which aims to support the economy but could further worsen the decline of the yuan.

China's currency, the yuan, has depreciated over 8% against the dollar as the Chinese economy grows less than expected, making it harder to reach its growth target of 5% for 2023, and worries about the economy have intensified due to issues in the real estate sector and financial health of local governments, causing concerns about the future of the yuan which may experience a slow but steady depreciation in the face of a weak dollar and a desire to maintain a trade surplus.

China's macroeconomic challenges, including deflationary pressures, yuan depreciation, and a struggling property sector, could have broader implications beyond its borders, impacting global metal exporters, trade deals, and global inflation; however, investing in China's stocks may offer compelling valuations despite the current downturn.

The dollar remains stable in Asia, while the yuan strengthens due to positive economic data from China.

China is unlikely to devalue its currency, the yuan, despite concerns that it could do so to boost exports, as such a move would risk intensifying capital flight and tightening financial conditions, according to the Institute of International Finance. Instead, the focus will be on domestic easing measures to maintain steady growth, although there is the challenge of balancing the yuan's stability against the strengthening US dollar and other major currencies.

China is experiencing a significant outflow of capital, putting pressure on the yuan and raising concerns for authorities as the currency weakens and financial markets become destabilized.

China experienced its largest capital outflow since 2015, with $49 billion leaving the country, as economic concerns prompt investors to withdraw; of this, $29 billion was withdrawn from securities investments, including bonds. The outflow was compounded by a record-high $12 billion in mainland-listed stocks being dumped by foreign investors and a $16.8 billion deficit in direct investment, the largest since 2016. The decline in the capital account was exacerbated by the tourism season, with outbound travel negatively impacting the services sector, while inbound travel remained suppressed, causing a continued deficit in the services trade. Efforts by Beijing, such as reducing the foreign currency reserves held by banks, have aimed to support the yuan but have been unable to prevent a significant decline in the offshore yuan. Weak exports and the allure of US yields have also contributed to the yuan's decline, further complicating China's capital flight situation, as doubts about the country's ability to achieve its 5% GDP target for the year grow.