The Central Bank of Turkey is expected to continue its policy tightening, but doubts remain as to whether the pace of tightening will be sufficient, given the high inflation rate; meanwhile, the focus in the US is on the jobs market and the unemployment rate's impact on inflation, and pessimism reigns for the euro due to concerns about the ECB's ability to raise interest rates.

Federal Reserve Bank of Philadelphia President Patrick Harker does not believe that the U.S. central bank will need to increase interest rates again and suggests holding steady to see how the economy responds, stating that the current restrictive stance should bring inflation down.

The president of the Federal Reserve Bank of Philadelphia believes that the US central bank has already raised interest rates enough to bring inflation down to pre-pandemic levels of around 2%.

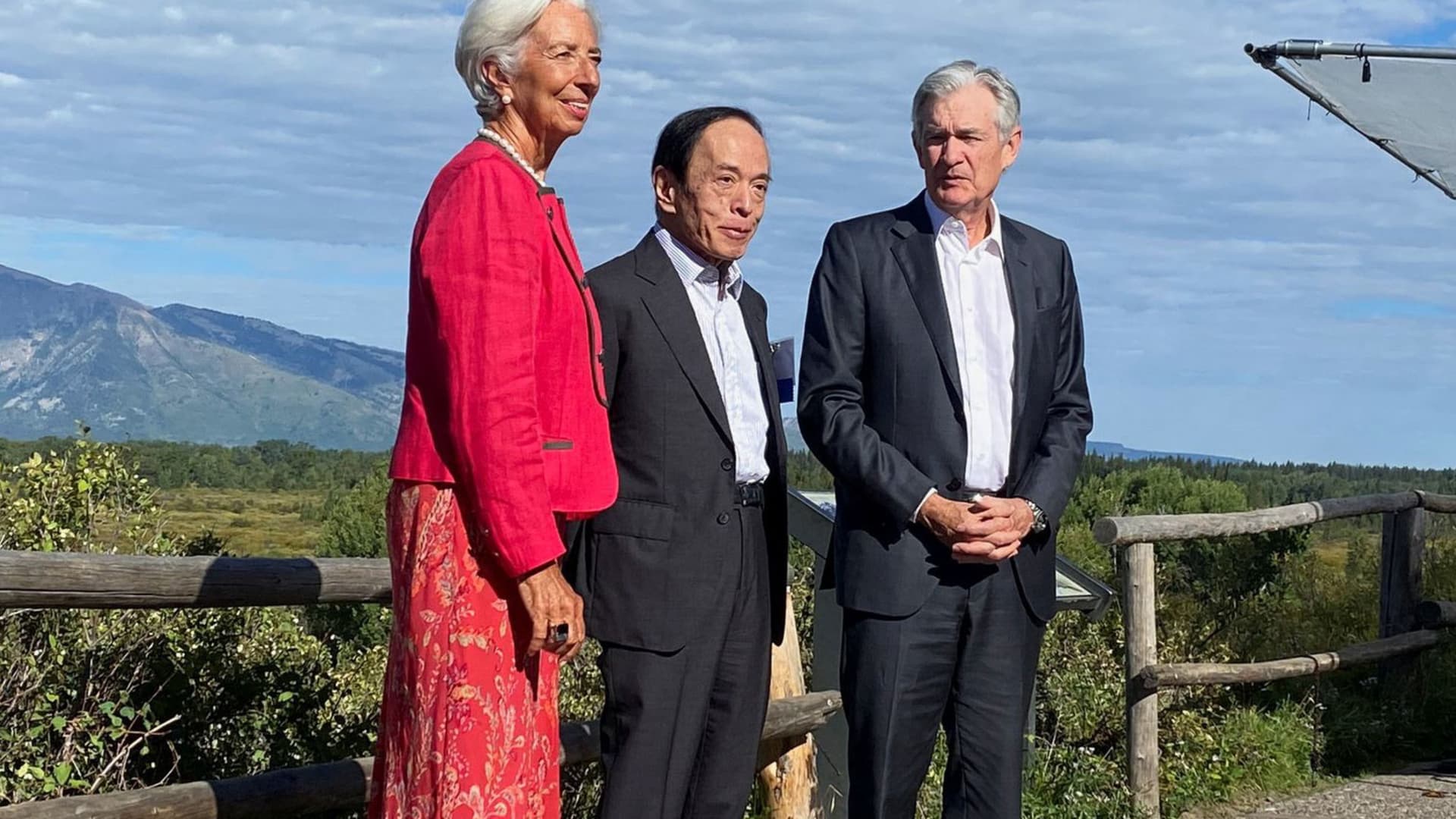

Christine Lagarde, President of the European Central Bank, stated that interest rates in the European Union will need to remain high for as long as necessary to combat persistent inflation, despite progress made, at an annual conference of central bankers in Jackson Hole, Wyoming.

It may be too early for the European Central Bank to pause interest rate hikes now as an early stop in the fight against inflation could result in more pain for the economy later, according to Latvian policymaker Martins Kazaks.

Cleveland Federal Reserve Bank President Loretta Mester believes that beating inflation will likely require one more interest-rate hike in the U.S. and then pausing for a while, although she may reassess her previous view of rate cuts starting in late 2024, and she aims to set policy so that inflation reaches the Fed's 2% goal by the end of 2025 to prevent further economic harm.

The Bank of England may have to increase interest rates if the US Federal Reserve decides to raise rates to cut inflation, in order to prevent the pound from weakening and inflation from rising further.

German inflation beats forecasts, complicating the ECB's task, while US labor data eases and GDP is revised lower, causing the dollar to weaken and the euro to strengthen.

Euro zone growth is weaker than predicted, but the need for more rate hikes by the European Central Bank is not automatically voided, according to ECB board member Isabel Schnabel, who raised concerns about investors undoing the ECB's past work and the decline in real risk-free rates counteracting efforts to bring inflation back to target.

Euro zone inflation holds steady in August, but underlying price growth falls, complicating decisions for the European Central Bank as it considers a pause in rate hikes amid a slowdown in economic growth.

Eurozone inflation remains at 5.3%, leading analysts to speculate that the ECB may consider pausing its interest rate hikes in light of a slowing economy.

The Federal Reserve's preferred inflation gauge increased slightly in July, suggesting that the fight against inflation may be challenging, but the absence of worse news indicates that officials are likely to maintain interest rates.

The Federal Reserve is expected to hold interest rates steady this month, but inflation could still lead to additional rate increases.

The U.S. is currently experiencing a prolonged high inflation cycle that is causing significant damage to the purchasing power of the currency, and the recent lower inflation rate is misleading as it ignores the accumulated harm; in order to combat this cycle, the Federal Reserve needs to raise interest rates higher than the inflation rate and reverse its bond purchases.

The Federal Reserve is considering whether to raise interest rates even higher to combat inflation, but some policymakers, like Raphael Bostic, believe it is unnecessary and advocate for keeping the rates at their current level until 2024.

The ECB expects core inflation to come down throughout the autumn as strong price increases from a year ago fall out of the data; however, energy and food prices are expected to remain bumpy, with inflation standing at 5.3% overall. The ECB emphasizes the need to contain the second-round effects of inflation and to make it clear that the current inflation episode is temporary. Additionally, the central bank does not believe that strategic price controls are the best way to fight inflation. The ECB's modeling approach is focused on assessing what is going on and using models to understand how it will play out, with the understanding that there are limitations to all models. Climate change and demographic transitions have implications for monetary policy, but the net impact on inflation is relatively contained. The ECB has managed to avoid peripheral spreads widening through its policy responses, including the pandemic emergency purchase program and pooled fiscal resourcing. In the future, short-term rates are expected to remain high for a while but come down in the later part of the decade, which helps contain spreads.

Wall Street banks are revising their outlooks for Turkish interest rates as inflation rises faster than expected, with JPMorgan, Morgan Stanley, and Bank of America suggesting that borrowing costs may need to rise higher or quicker in response to the surge in price growth.

The Organisation for Economic Co-operation and Development (OECD) has stated that the European Union (EU) needs to strengthen the single market and maintain a restrictive monetary policy to address inflation and enhance the resilience of the European economy in the post-pandemic recovery. The OECD recommends that the European Central Bank (ECB) should raise interest rates to achieve its 2% inflation target, while also emphasizing the importance of protecting the single market, simplifying labor mobility, and avoiding further relaxation of state aid rules. Additionally, the OECD highlights the need for the EU to focus on green transition, combat financial crime, and accelerate the integration of electricity markets.

The European Central Bank is expected to maintain interest rates on September 14, although nearly half of economists anticipate one more increase this year in an effort to reduce inflation.

The European Central Bank is expected to see inflation in the euro zone remain above 3% next year, which strengthens the case for an interest rate increase.

The European Central Bank is expected to maintain steady rates as economic activity in the euro area decelerates and inflation erodes disposable income, with uncertainty surrounding the impact of weaker growth on inflation.

The European Central Bank is facing a dilemma on whether to raise its key interest rate to combat inflation or hold off due to economic deterioration, with investors split on the likelihood of a rate hike.

The European Central Bank (ECB), with its expanding responsibilities in areas such as geopolitics and climate change, faces the question of whether it knows when to stop and avoid overreaching its mandate, as it operates independently from any political or fiscal oversight.

The European Central Bank is expected to raise interest rates, but traders believe that any immediate risk to the euro is likely to be on the downside, and if there is a hike, it will likely be the last.

The latest reading of inflation suggests that interest rates may start to normalize soon, with economists discussing the need for rates to be high enough to control inflation without causing damage to the economy. The key is to maintain long durations at current levels of inflation and interest rates with no surprises.

The European Central Bank has implemented its 10th consecutive interest rate increase in an attempt to combat high inflation, although there are concerns that higher borrowing costs could lead to a recession; however, the increase may have a negative impact on consumer and business spending, particularly in the real estate market.

The European Central Bank has raised key interest rates by 0.25 percentage points to help bring down inflation, although the economy is expected to remain weak for a while before slowly recovering in the coming years.

The European Central Bank has raised its main interest rate for the 10th consecutive time to tackle inflation, but indicated that further hikes may be paused for now, causing the euro to fall and European stocks to rally.

The European Central Bank (ECB) has raised its benchmark deposit rate to 4% in an attempt to combat high inflation, despite concerns that higher borrowing costs could lead to a recession.

Following the European Central Bank's record high interest rate hike to 4%, there is speculation about how long rates will remain at this level, with analysts predicting a 12-month pause before any cuts are made, while also considering the impact of rising oil prices on inflation expectations in Europe and the US. The Federal Reserve is expected to hold rates steady in September, but there are divided opinions on whether another hike will be delivered this year, with markets anticipating rate cuts in 2024. Similarly, the Bank of England is anticipated to make one final hike in September as it assesses inflation and economic indicators.

The European Central Bank's handling of monetary policy under Christine Lagarde, including unnecessary interest rate hikes, risks pushing the Eurozone into a recession.

The Federal Reserve is expected to keep interest rates unchanged as it faces economic and political risks while trying to combat inflation.

The Federal Reserve is expected to keep its benchmark lending rate steady as it waits for more data on the US economy, and new economic projections suggest stronger growth and lower unemployment; however, inflation remains a concern, leaving the possibility open for another rate increase in the future.

The Swiss National Bank keeps interest rates unchanged at 1.75% and hints that further tightening may be necessary to ensure price stability, while also warning of a possible global economic slowdown and addressing the risk of energy shortage in Europe.

The Federal Reserve has indicated that interest rates will remain "higher for longer," potentially for at least three more years, in order to sustain economic growth and combat inflation.

Central banks, including the US Federal Reserve, European Central Bank, and Bank of England, have pledged to maintain higher interest rates for an extended period to combat inflation and achieve global economic stability, despite concerns about the strength of the Chinese economy and geopolitical tensions.

Central banks around the world may have reached the peak of interest rate hikes in their effort to control inflation, as data suggests that major economies have turned a corner on price rises and core inflation is declining in the US, UK, and EU. However, central banks remain cautious and warn that rates may need to remain high for a longer duration, and that oil price rallies could lead to another spike in inflation. Overall, economists believe that the global monetary policy tightening cycle is nearing its end, with many central banks expected to cut interest rates in the coming year.

The euro zone economy is expected to contract this quarter and remain in recession as the impact of central banks' interest rate rises hampers growth, according to a survey by HCOB's flash euro zone Composite Purchasing Managers' Index (PMI), with Germany and France experiencing significant declines in business activity.

Federal Reserve policymakers Governor Michelle Bowman and Boston Fed President Susan Collins expressed the need to keep interest rates elevated to combat inflation, with Bowman suggesting further rate hikes will likely be needed to bring inflation down to the Fed's 2% target and Collins stating that further tightening is not off the table as progress in battling inflation has been slow.