- The Bank of England raised its benchmark interest rate to 5.25% despite a slowdown in consumer-price rises, leading to speculation about when the central bank will end its monetary tightening.

- House prices in Britain fell by 3.8% in July compared to the same month last year, the sharpest decline since July 2009, but the average house price was still higher than earlier this year.

- The Bank of Japan raised its cap on the yield of Japanese ten-year government bonds from 0.5% to 1%, causing the yield to soar to nine-year highs.

- Turkey's annual inflation rate increased to 47.8% in July, the first rise since October, due in part to a new tax on fuel.

- The euro area's economy grew by 0.3% in the second quarter, with much of the growth attributed to changes in intellectual property shifting by multinationals based in Ireland for tax purposes. Germany's GDP growth rate was zero, and Italy's fell by 0.3%.

U.S. economic growth may be accelerating in the second half of 2023, defying earlier recession forecasts and leading to a repricing of long-term inflation and interest rate assumptions.

German business activity, particularly in the services sector, experienced its sharpest decline since May 2020, leading to concerns about the country's outlook for the remainder of the year and potential stagflation, as both manufacturing and services sectors are contracting.

Germany's business activity has seen a sharp decline, leading to concerns of a recession, as the country's Purchasing Managers' Index (PMI) dipped to its lowest level in over three years. This decline in activity is impacting the wider eurozone economy as well, with the region at risk of slipping into recession. This economic downturn is accompanied by a worrying uptick in inflation and slow growth, particularly in Germany.

The UK and eurozone economies are at risk of recession due to a significant slowdown in private sector activity, with the UK experiencing its poorest performance since the Covid lockdown and Germany being hit particularly hard; the US is also showing signs of strain, with activity slowing to near-stagnation levels.

Germany, once known as the "sick man of Europe," is facing a new economic downturn characterized by sticky inflation, falling output, and structural issues such as an aging population and high corporate tax rate, prompting concerns of a prolonged recession; however, the country's strong employment levels, record public finances, and adaptability through its Mittelstand of small and medium-sized businesses provide hope for recovery.

The Swedish economy is expected to experience a downturn over the next two years, with GDP forecasted to shrink in 2023 and 2024 due to low domestic demand and a slowdown in export growth, making it one of the worst-performing economies in the EU; however, there is uncertainty and the possibility of a milder downturn depending on the resilience of the economy. Furthermore, the Swedish krona is expected to continue weakening until mid-2024, and household incomes are projected to fall until 2025, but households are strengthening their financial positions and reducing debt.

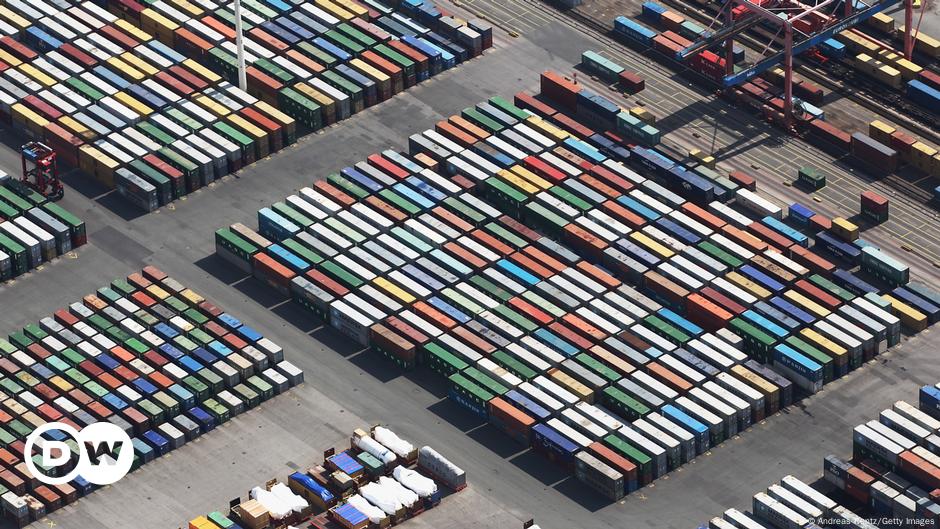

The contraction in euro area business activity has intensified, particularly in Germany, leading to expectations that the European Central Bank will pause its interest-rate hike campaign; US mortgage applications for home purchases have hit a three-decade low due to rising borrowing costs; South Korea's exports continue to decline, indicating lackluster global trade; Turkey's interest-rate increase has triggered a rally in the country's assets; shrinking water levels at the Panama Canal due to climate change may cause delays in restocking inventories before Christmas.

The US economy is expected to slow in the coming months due to the Federal Reserve's efforts to combat inflation, which could lead to softer consumer spending and a decrease in stock market returns. Additionally, the resumption of student loan payments in October and the American consumer's credit card addiction pose further uncertainties for the economy. Meanwhile, Germany's economy is facing a contraction and a prolonged recession, which is a stark contrast to its past economic outperformance.

Germany's opposition party claims that the country's recession is a result of the bureaucracy surrounding its green energy policies, which are led by The Greens in coalition with the Social Democrats, and warns that the situation will worsen if the excessive bureaucracy and high energy prices are not addressed.

The U.S. economy expanded at a 2.1% annual pace in the second quarter, downgraded from the initial estimate of 2.4%, but still demonstrating resilience in the face of higher borrowing costs and inflation concerns.

Germany's economic model and banks are struggling, with forecasts showing low growth and poor profitability, highlighting issues such as politicized governance, diminished private sector, and outdated funding methods.

The UK's Office for National Statistics has revised its estimate for the size of the economy at the end of 2021, suggesting a stronger recovery from the COVID-19 pandemic than previously thought, with the economy in the fourth quarter being 0.6% larger than in the final quarter of 2019.

Germany, once hailed as Europe's economic powerhouse, is now facing structural problems and could be on the verge of decline, according to experts, with factors such as stagnant GDP, high inflation, an aging population, overdependence on exports, and underinvestment contributing to its current predicament.

The German government has presented its 2024 budget, aiming to end years of government spending on managing crises such as COVID-19 and the war in Ukraine, with significant cuts across departments and limited social reforms, leading to controversy among coalition partners and opposition parties.

Despite recent optimism around the U.S. economy, Deutsche Bank analysts believe that a recession is more likely than a "soft landing" as the Federal Reserve tightens monetary conditions to curb inflation.

Germany is predicted to experience a prolonged recession this year, making it the only major European economy to contract in 2023, according to the European Commission, with its growth expectations also being cut for 2024; this is attributed to struggles following Russia's invasion of Ukraine and the need to end energy dependency on Moscow.

The European Commission has revised down its economic forecast, citing high prices for goods and services as a significant factor, leading to reduced growth projections for the European Union and the eurozone. Germany is expected to experience a downturn, while inflation is projected to exceed the European Central Bank's target. Weak consumption, credit provisions, and natural disasters are also contributing to the loss of momentum in the economy. However, the report highlights the strength of the EU labor market with a low unemployment rate.

The euro zone's economy is expected to grow slower than previously forecasted due to high inflation and Germany slipping into recession, according to the European Commission.

Germany's economy is expected to contract by 0.4% in 2023 due to higher inflation, rising interest rates, and weaker consumer spending, making it the worst-affected major country in the eurozone, according to the European Commission. The overall eurozone economy is expected to expand by 0.8% in 2023 and 1.3% in 2024, leading to a potential halt in the European Central Bank's tightening of policy. Inflation in the eurozone is projected to average 5.6% in 2023.

France's economic resilience and improved outlook, in contrast to Germany's weak performance and recession forecast, can be attributed to factors such as strong exports, tourism revival, and a rebound in Airbus orders, although France's growth prospects are expected to be modest in the future.

Goldman Sachs and J.P.Morgan have revised their full-year growth forecast for the UK's GDP due to a sharp contraction in the economy in July, with JPM now expecting 0.4% expansion and Goldman Sachs projecting 0.3% growth. Economists warn of the possibility of a recession as poor economic data continues to emerge, and GDP data indicates a weakening economy.

Germany's deep economic troubles, including three consecutive quarters of negative growth, could have significant global implications, especially considering its role as the main driver of economic growth in the euro zone and its high exposure to the Chinese economy.

Goldman Sachs warns that three factors - the resumption of student loan payments, the autoworkers' strike, and a potential government shutdown - could lead to a significant slowdown in US GDP growth during the fourth quarter of 2023.

The German economy is expected to contract this quarter due to a recession in the industry and lackluster private consumption, leading to four consecutive quarters of negative or flat growth.

The 40-year period of economic expansion in the U.S. from 1980 to 2020 is likely to be replaced by a more regular cycle of boom-bust cycles and frequent recessions, according to analysts at Deutsche Bank, due to factors such as higher inflation and increasing debt-to-GDP levels.

Germany is projected to be the most heavily impacted by the global economic slowdown due to higher interest rates and weaker global trade, according to the Organisation for Economic Co-operation and Development (OECD), with its economy likely to shrink this year alongside Argentina and experience a weaker 2024. The slowdown in China, inflationary pressures, and tightening monetary policy are among the factors affecting Germany's growth. The OECD also warned of persistent inflation pressures in various economies and called for central banks to maintain restrictive interest rates until underlying inflationary pressures subside.

Germany, once an economic powerhouse, is now the worst-performing major developed economy due to factors such as the loss of cheap Russian natural gas, a slowdown in trade with China, and government inaction on chronic problems, leading to concerns of deindustrialization and the need for urgent solutions.

Germany is facing an economic contraction due to challenges in the manufacturing sector, a disappointing China reopening boost, and higher energy costs, leading to a recession in Europe's largest economy. However, there are still some positive aspects, such as opportunities in Germany's small and mid-sized companies.

The euro zone economy is expected to contract this quarter and remain in recession as the impact of central banks' interest rate rises hampers growth, according to a survey by HCOB's flash euro zone Composite Purchasing Managers' Index (PMI), with Germany and France experiencing significant declines in business activity.

German housing prices experienced the largest decline since records began in the second quarter of 2023, due to high interest rates and rising materials costs, creating a crisis in the construction industry.