Despite a slight increase in Canada's inflation rate last month, the Bank of Canada remains determined to bring it down to 2%, with the possibility of another rate hike being considered in September. However, some economists believe that the positive overall figures may allow the Bank to pause on rate increases without a significant negative impact.

The spike in retail inflation has raised uncertainty for investors and savers, with expectations of interest rate cuts being pushed to the next fiscal year and the possibility of a rate hike. The Reserve Bank of India projects inflation to stay above 5% until the first quarter of 2024-25, and food price pressures are expected to persist. While inflation may impact stock market returns, gold and bank deposit rates are expected to remain steady.

Short-term inflation in Pakistan increased by 25.34% on a year-on-year basis due to a surge in prices of kitchen items, although it decelerated from the previous week's rate of increase.

The Pakistani rupee is expected to continue its decline against the US dollar, with analysts predicting an interest rate hike by the central bank in an attempt to prevent further depreciation.

The Bank of Japan will maintain its current monetary policy approach as underlying inflation remains below the 2% target, despite core consumer inflation staying above target for the 16th straight month in July, according to BOJ Governor Kazuo Ueda.

The Bank of Canada is expected to keep its key interest rate steady at 5.00% and maintain that level until at least the end of March 2024, despite rising inflation and a revival in the housing market, according to economists in a Reuters poll.

The consistent devaluation of the Pakistani rupee is causing inflation and forcing the central bank to raise interest rates, leading to concerns about the economy and market confidence.

The relentless surge in pressure on the exchange rate and price level in Pakistan over the past two and a half years can be attributed to serious malfunctions on the balance of payments and fiscal accounts, which have thrown the monetary aggregates far from their projected path to stability. This has led to inflation and exchange rate pressure, and traditional IMF-mandated adjustments alone may not be enough to resolve the situation.

Pakistan's inflation rate remained above target in August at 27.4%, driven by reforms linked to an IMF loan that have fueled price pressures and declines in the rupee currency.

The Reserve Bank of Australia is expected to keep its key interest rate unchanged at 4.10% as inflation slows, but economists anticipate a final hike in the next quarter.

The Bank of Israel is expected to maintain its interest rate at 4.75% due to decreasing inflation and indications of modest economic growth, despite concerns about the slowdown in the hi-tech industry and reduced demand for workers; meanwhile, interest rates in Israel are influenced by expectations of lower rates in the United States and the recent drop in the shekel's value.

Bank Negara Malaysia (BNM) is expected to maintain its key policy rate at 3.00% as the central bank adopts a no-change stance due to moderating economic growth and cooling inflation, according to a Reuters poll of economists.

The Bank of Canada has decided to keep its key overnight interest rate at 5% due to weaker economic growth, but stated that it may raise borrowing costs if inflationary pressures persist.

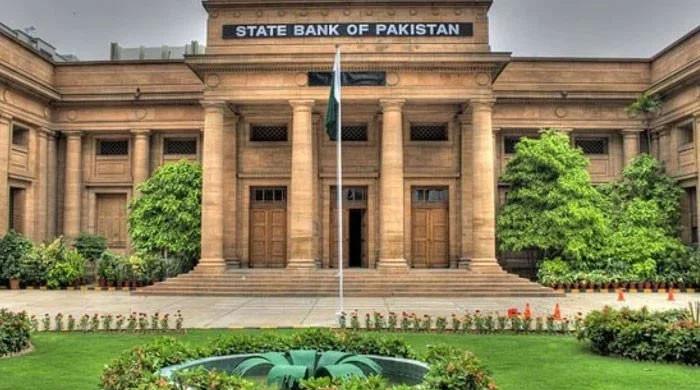

Pakistan's central bank is expected to raise interest rates to address inflation and bolster foreign exchange reserves, following a series of rate hikes earlier this year in response to economic and political crises.

The Federal Reserve should consider cutting its policy rate within the next six months to stabilize real rates and avoid tipping the economy into a recession, as financial stress in the real economy is rising despite slower hiring and inflation cooling, according to economist Joseph Brusuelas.

The Pakistani rupee has depreciated significantly in the first three weeks of the interim government's tenure, reaching a record low and making it the worst-performing Asian currency this quarter, due to factors such as a change in government and high inflation. The State Bank of Pakistan is implementing measures to address the economic challenges, including reforming the exchange rate and modernizing the banking system.

The Federal Reserve is expected to maintain interest rates for now but keep the option open for future rate hikes to address inflation concerns.

The U.S. Federal Reserve kept interest rates steady but left room for potential rate hikes, as they see progress in fighting inflation and aim to bring it down to the target level of 2 percent; however, officials projected a higher growth rate of 2.1 percent for this year and suggested that core inflation will hit 3.7 percent this year before falling in 2024 and reaching the target range by 2026.

The Sindh governor claims that the Pakistani rupee will further decline against the US dollar, with petrol prices expected to fall on October 1 due to the appreciation of the rupee and the government's crackdown on currency smugglers, hoarders, and black marketers.

Pakistan is facing a major economic crisis with high inflation, insufficient public resources, and policy decisions influenced by vested interests, according to the World Bank. The country needs to make hard choices and prioritize coordinated, efficient, and adequately financed service delivery to improve human development outcomes. Additionally, the Pakistani Rupee has reached a record low against the US dollar.

The Reserve Bank of India is expected to maintain its policy rates at the upcoming monetary policy review meeting due to high retail inflation and the US Federal Reserve's hawkish stance.

Thailand's central bank raises policy rate to 2.5% in order to control inflation, going against market expectations.

An obsession with controlling the rupee-dollar exchange rate in Pakistan has led to ineffective administrative measures and failed attempts at stabilization, as the country's heavy dependence on imports and mounting external debt hinder economic restructuring and contribute to the rupee's depreciation. The need for a long-term plan focused on increasing exports, investment, and macroeconomic stability is emphasized.

The Reserve Bank of India (RBI) is expected to keep the benchmark interest rate unchanged at 6.5% in its upcoming monetary policy review due to elevated inflation and global economic factors.

Pakistan's inflation rate rose to 31.4% year-on-year in September, and the Ministry of Finance expects inflation to remain high in the coming months, with a predicted range of 29-31%.

Federal Reserve officials indicate that monetary policy will remain restrictive for a while to bring inflation back to 2%, but there is ongoing debate over whether to increase rates further this year.

The Reserve Bank of India (RBI) expects consumer price index (CPI) inflation to ease below 4 percent in fiscal 2024-25 if there are no further shocks and a normal monsoon, with the central bank rethinking rate cuts only if CPI inflation remains at or below 4 percent on a durable basis.

The International Monetary Fund (IMF) expects Pakistan's economy to perform better than expected, with a growth of 2.5% this year and 5% in the next fiscal year, despite macroeconomic challenges, surpassing projections from other multilateral agencies. The IMF also maintains a global growth forecast of 3% for this year but warns of high inflation and downgrades outlooks for China and Germany.

The Monetary Authority of Singapore (MAS) has decided to keep its exchange rate-based monetary policy unchanged, maintaining the prevailing rate of appreciation of the Singapore dollar, due to an uncertain global economic outlook and projections of declining core inflation. MAS also expects Singapore's economic growth to improve gradually over 2024, although it forecasts growth to be at the lower end of the 0.5 to 1.5 percent range. MAS will now announce its monetary policy on a quarterly basis starting from 2024.