### Summary

The current account deficit in Pakistan reduced by 36% in July FY24 compared to the previous year, but July saw a deficit for the first time in four months.

### Facts

- 💸 The current account deficit decreased by 36% to $809 million in July FY24.

- 💰 July's current account was in deficit for the first time in four months, with June having a surplus of $504 million.

- 📉 FY23 successfully reduced the current account deficit to $2.387 billion from $17.481 billion in FY22.

- 🌍 The large current account deficit in FY23 led to a risk of sovereign default, which was addressed with assistance from the IMF, Saudi Arabia, and the UAE.

- 📉 Goods exports in July decreased by $101 million, while goods imports rose by 23.5% to $4.220 billion.

- 💼 Pakistan's services imports were $811 million, higher than services exports of $538 million in July, resulting in a net decline of $273 million.

- 📉 The trade deficit in FY23 reduced by 42.9% to $27.59 billion.

Source: [Dawn](https://www.dawn.com/news/1651754/)

### Summary

Bangladesh's foreign currency reserves have decreased to the point where it can only cover four months' worth of import costs, compared to 12 months in mid-2020.

### Facts

- 💰 Bangladesh's foreign currency reserves can now cover four months' import cost, the lowest in the past six years.

- 📉 The coverage capacity has declined from 12 months in mid-2020.

- 💸 Post-pandemic challenges such as high inflation, fixed volatility, and a higher debt burden have impacted emerging markets, especially those with twin deficits.

- 💵 Bangladesh is facing a dollar crisis in the short term.

- 🌍 The country's export and remittance sectors are performing well, but the financial account is in deficit.

- 💸 The government has printed money to meet the cost, as ratios like tax-to-GDP, export-to-GDP, import-to-GDP, and remittance-to-GDP are not heading in the right direction.

### Summary

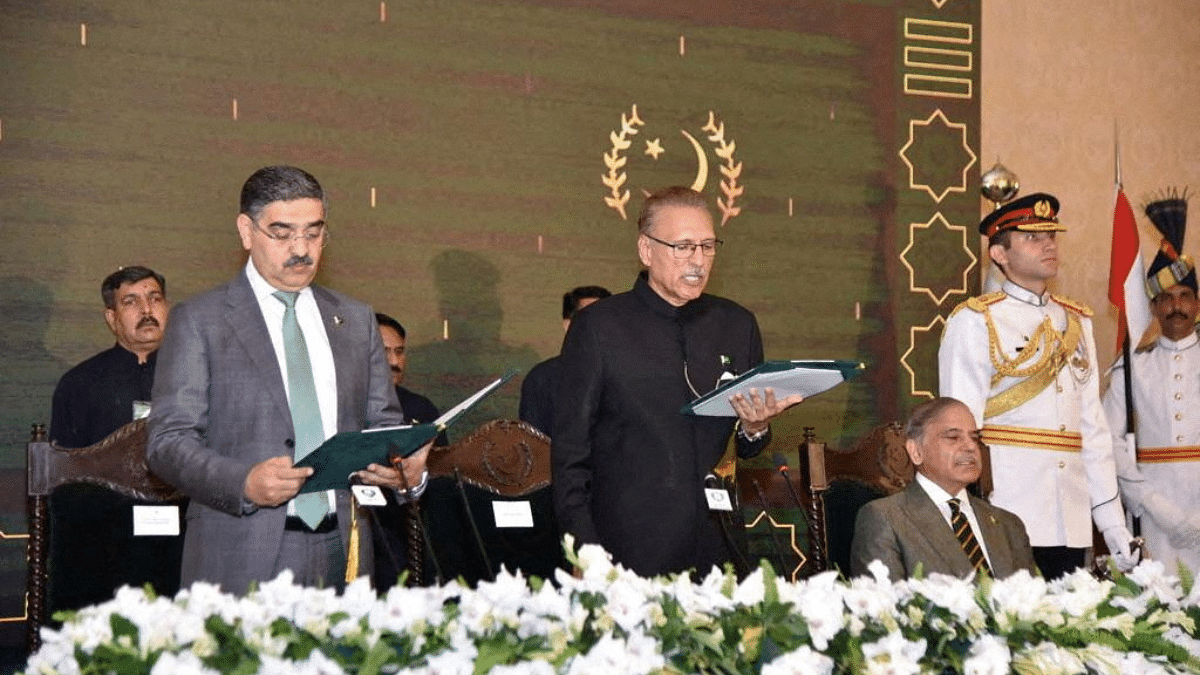

The caretaker government in Pakistan has several key challenges to address, including managing the economy, stabilizing the currency, ensuring energy security, and attracting foreign investments.

### Facts

- 📉 The transition period until the next elections is expected to last five to six months, and the caretaker government must not be complacent in addressing economic issues.

- 🧱 A capable team, including a central banker, a veteran bureaucrat, and an expert planning commissioner, has been appointed to lead the Special Investment Facilitation Council (SIFC) and tackle political interference.

- 💱 The depreciation of the Pakistani rupee against the US dollar is a concern, and measures should be taken to discourage hoarding and build up net international reserves.

- ⚡️ Energy security is critical, and immediate actions should be taken to ensure full recovery of costs in the gas and power sectors. Direct cash transfers and full recovery of taxes in the electricity and fuel prices may be necessary.

- 💸 Negotiating a new IMF program is expected after the current program expires, and efforts should be made to attract investments from friendly Arab countries under the SIFC.

- 📊 Improving the fiscal side of the economy is essential, including widening the tax net, targeting untaxed income, and digitizing the tax collection process.

- 🗳 The caretaker government should focus on effective governance and decision-making, setting an example for the next government. The cabinet's performance will be judged on how well they manage the economy.

- 🌍 Restoring confidence in Pakistan's economy and addressing key indicators such as investments, inflation, fiscal prudence, and circular debt are essential for a stable future.

Note: The text provided contains a mention of the publication date (August 21st, 2023). Since it is already past this date, some information may be outdated.

The Pakistani rupee has hit a historic low against the US dollar due to increased demand for the dollar following eased import restrictions and political uncertainty ahead of the general elections.

Pakistan's rupee dropped to a record low due to the easing of import restrictions, which has increased demand for the dollar.

The depreciating exchange rate of the Pakistani rupee against the US dollar is leading to a potential economic disaster, with increased inflation, higher prices for petroleum and fuel, and a rise in poverty and unemployment.

The foreign exchange reserves of the State Bank of Pakistan fell below $8 billion for the first time in five weeks, dropping to $7.93 billion, which may pose challenges as the country faces significant debt servicing payments.

The Pakistani rupee weakened further against the US dollar in the interbank market due to higher demand and uncertainty, while the open market remained stable; however, insiders noted that currency dealers were selling the dollar at higher rates in the open market.

The rupee's decline against the US dollar is being attributed to the powerful influence of the grey market and the International Monetary Fund's involvement in Pakistan's financial system, leading to a loss of control over the exchange rate and economic uncertainties.

The article highlights the economic crisis in India in 1991 and draws parallels to the current state of Pakistan's economy, emphasizing the importance of focusing on economic growth and addressing the needs of the deprived sections of society.

Pakistan's external vulnerabilities are set to worsen due to shrinking dollar inflows and increasing debt servicing, putting pressure on foreign exchange reserves and potentially leading to their depletion.

The Pakistani rupee has fallen below 300 to a US dollar due to factors such as the rise of the dollar, uncertainty surrounding general elections, and a political/judicial/constitutional crisis, resulting in eroded business confidence, increased inflation, and reduced industrial output.

The Indian rupee weakened against the U.S. dollar due to demand from state-run banks and the potential impact of U.S. GDP data.

The consistent devaluation of the Pakistani rupee is causing inflation and forcing the central bank to raise interest rates, leading to concerns about the economy and market confidence.

The relentless surge in pressure on the exchange rate and price level in Pakistan over the past two and a half years can be attributed to serious malfunctions on the balance of payments and fiscal accounts, which have thrown the monetary aggregates far from their projected path to stability. This has led to inflation and exchange rate pressure, and traditional IMF-mandated adjustments alone may not be enough to resolve the situation.

Pakistan's inflation rate remained above target in August at 27.4%, driven by reforms linked to an IMF loan that have fueled price pressures and declines in the rupee currency.

Pakistan's economy has experienced a slowdown in its structural transformation, with a significant decrease in the share of agriculture and a lack of growth in the industry sector, indicating a premature de-industrialization contrary to successful developing nations, emphasizing the need for policies to boost industrialization and address taxation inequities.

The recent bloodbath in the stock market and worsening economic conditions in Pakistan are attributed to electoral uncertainty, depreciating rupee, and concerns over inflation and interest rates.

Pakistan's economic crisis is worsening under the caretaker government, as LPG prices increase by 20% and the rupee continues to fall.

The Pakistani rupee is expected to trade within a narrow range against the dollar in the upcoming week following its recent sharp depreciation, although some analysts anticipate continued pressure on the currency due to capital withdrawals, political unrest, and economic uncertainty.

The current economic crisis in Pakistan is driven by high inflation, mismanaged policies, and failure to ensure price stability, leading to a weakened currency and a struggling middle class, but implementing radical reforms such as demonetization and swapping out foreign currency debt can potentially alleviate the situation and revive the economy.

The rupee rebounded in the open market as a crackdown on the informal currency market helped narrow the gap between interbank and open-market rates, bringing it closer to the IMF's target of 1.25%. The State Bank of Pakistan has also introduced structural reforms for exchange firms and increased the minimum capital requirement, while ordering banks to set up separate entities for forex transactions.

Millions of Pakistanis are facing the devastating consequences of an unprecedented economic crisis, with rising inflation, soaring fuel and electricity prices, and a weakening currency, leaving low-income households struggling to make ends meet.

Gold prices in Pakistan continued to decline for the fourth consecutive day, in line with international rates, as the domestic price of 24 karat gold fell by Rs5,800 per tola and Rs4,972 per 10 grammes to settle at Rs216,500 and Rs185,614 respectively, while the price of silver 24 karat dropped by Rs50 per tola and Rs42.87 per 10 grammes to settle at Rs2,650 and Rs2,271.94 respectively; meanwhile, the rupee gained Rs2.03 against the US dollar in the interbank trading, closing at Rs304.94.

Pakistan's interim government is prioritizing economic revival and fulfilling international obligations, including agreements with the International Monetary Fund (IMF), to address the stagnant economy and financial issues. They aim to improve the overall business and investment environment, increase inflow of dollars from multilateral institutions, and reduce expenditures while upholding international agreements.

The Pakistani rupee's rise against the dollar is attributed to a crackdown on hoarding and illegal outflows of the greenback as well as increased vigilance in the Afghan transit trade.

Pakistan's central bank is expected to increase interest rates in order to address high inflation and bolster foreign exchange reserves, which have led to a record low value for the rupee. A Reuters poll shows that 15 out of 17 analysts are forecasting a rate hike, with some expecting an increase of at least 150 basis points. The country's economic recovery is being challenged by IMF loan conditions, import restrictions, and subsidies removal, which have caused spikes in energy prices and elevated food inflation.

The Pakistani military's crackdown on the black market has led to a significant influx of dollars into the interbank and open markets, resulting in the recovery of the Pakistan rupee and its strengthening beyond the official rate, with the campaign being credited to army chief General Asim Munir.

The State Bank of Pakistan has announced that it will maintain its key policy rate at 22%, citing a continuing declining trend in inflation, improved agricultural outlook, and recent administrative and regulatory measures to address supply constraints and illegal activity. The bank hopes that inflation will subsequently decline in October.

Former Pakistani Prime Minister Nawaz Sharif criticized his country's poor economic condition, comparing it to India's success in reaching the moon and stating that Pakistan has been reduced to begging for dollars while India's economy has prospered. Sharif also claimed that the Indian government had copied his economic reform order from 1990 during their own reforms in 1991. He blamed Pakistani generals for the country's plight and labeled them as the worst enemies of Pakistan.

The Sindh governor claims that the Pakistani rupee will further decline against the US dollar, with petrol prices expected to fall on October 1 due to the appreciation of the rupee and the government's crackdown on currency smugglers, hoarders, and black marketers.

The Pakistani rupee has gained significantly against the US dollar due to administrative measures taken by the interim government, leading to a possible reduction in petroleum prices in the upcoming review.

Pakistan is facing a major economic crisis with high inflation, insufficient public resources, and policy decisions influenced by vested interests, according to the World Bank. The country needs to make hard choices and prioritize coordinated, efficient, and adequately financed service delivery to improve human development outcomes. Additionally, the Pakistani Rupee has reached a record low against the US dollar.

Pakistan is facing a deep economic crisis that has negatively impacted living standards, the private sector, and the environment, and the World Bank argues that urgent policy shifts are needed to address low quality basic services, improve fiscal management, create a more dynamic and open economy, and address failures and distortions in the agri-food and energy sectors.

Stefan Dercon, a visiting professor at Oxford University, says that Pakistan's elite must change in order to revive the economy and reduce dependence on foreign currency inflows, as maintaining the status quo will not provide a solution, and the IMF and other bilateral donors will not rescue the ailing economy.

Pakistan's consumption-oriented growth model, heavily reliant on foreign currency loans and imports, is not sustainable for long-term economic growth, and a shift towards investment-led growth and increasing the investment-to-GDP ratio is necessary to generate foreign currency and achieve sustainable growth.

The Pakistani rupee strengthened against the US dollar in the interbank market due to the government's crackdown on the money market.

The Pakistani rupee has continued to rise against the US dollar, trading below Rs290, due to a crackdown on the money market, but analysts warn that the gains may only be short-term.

The author argues that there are underlying pressures responsible for an ongoing spiral of devaluation in Pakistan's economy, and these pressures make it difficult to sustain recent gains in the value of the rupee.

The Pakistani government has issued new debt of over Rs2.5 trillion in the first three months of the current financial year to address its rising fiscal deficit, indicating a reliance on domestic sources as external financing decreases and revenues decline.

An obsession with controlling the rupee-dollar exchange rate in Pakistan has led to ineffective administrative measures and failed attempts at stabilization, as the country's heavy dependence on imports and mounting external debt hinder economic restructuring and contribute to the rupee's depreciation. The need for a long-term plan focused on increasing exports, investment, and macroeconomic stability is emphasized.

Pakistan's annual inflation rate increased to 31.4% in September, driven by high fuel and energy prices, as the country faces challenges in its economic recovery under a caretaker government following an IMF bailout program that imposed conditions complicating inflation control efforts.

The Pakistani rupee has strengthened against the US dollar for a month due to a military-backed crackdown on currency smugglers, with analysts expecting the rupee to reach 280 to the dollar in the near future.

The Pakistani rupee is expected to strengthen further, potentially falling below 280 against the US dollar, due to factors such as the anticipation of the IMF's next tranche, improved balance of payments, and government actions against illegal dollar trade.

Illegal activities such as black market currency trade, gold smuggling, and oil smuggling are costing Pakistan's economy USD 23 billion per year, leading to currency devaluation, inflation, and a loss of government revenue.

Pakistan's economy is in dire straits, heavily reliant on external assistance and loans, with rising inflation, high poverty rates, and a plummeting Human Development Index, yet the country's military-owned enterprises continue to thrive, maintaining extraordinary financial control and leveraging their autonomy for corruption and lack of accountability.