Prominent money managers who bet on government bonds in anticipation of a recession in the US are now facing subpar returns as Treasury yields reach a 15-year high, although some remain firm in their strategy and continue to buy dips in bond prices.

Surging U.S. Treasury yields are causing concern among investors as they wonder how much it will impact the rally in stocks and speculative assets, with the S&P 500, technology sector, bitcoin, and high-growth names all experiencing losses; rising rates are making it more difficult for borrowers and increasing the appeal of risk-free Treasury yields.

The Chinese bond market is experiencing a significant shift due to concerns over China's economic growth prospects, including a bursting property bubble and lack of government stimulus, leading to potential capital flight and pressure on the yuan, which could result in increased selling of US Treasuries by Chinese banks and a rethink of global growth expectations.

The recent spike in U.S. bond yields is not driven by inflation expectations but by economic resilience and high bond supply, according to bond fund managers, with factors such as the Bank of Japan allowing yields to rise and an increase in the supply of U.S. government bonds playing a larger role.

Stocks are giving back their gains as bond yields rise due to fears that the Federal Reserve will keep interest rates high for a longer period of time.

Hiking interest rates can discourage innovation and curtail long-term economic growth potential, according to a study presented at the Federal Reserve's annual conference. A percentage point increase in interest rates could lead to a 5% reduction in economic output, suggesting the need for increased government funding for innovation to offset rate increases. Higher interest rates make borrowing more expensive, reducing consumer and business demand and hindering the development of new offerings and efficiency-increasing innovations. Additionally, research and development spending, venture capital investment, and patents all decline with rising interest rates. However, the study does not advocate for refraining from raising rates if needed to control inflation.

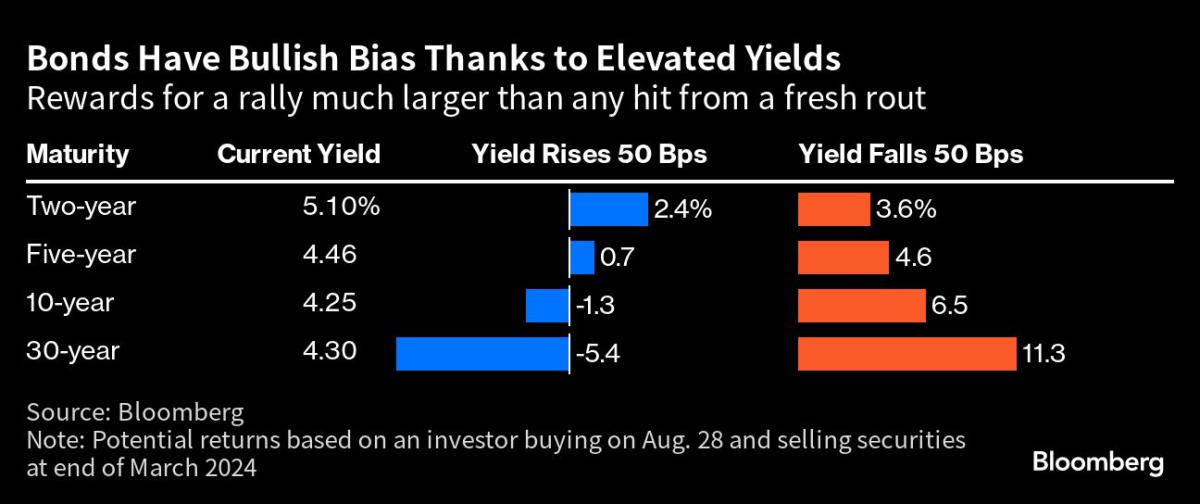

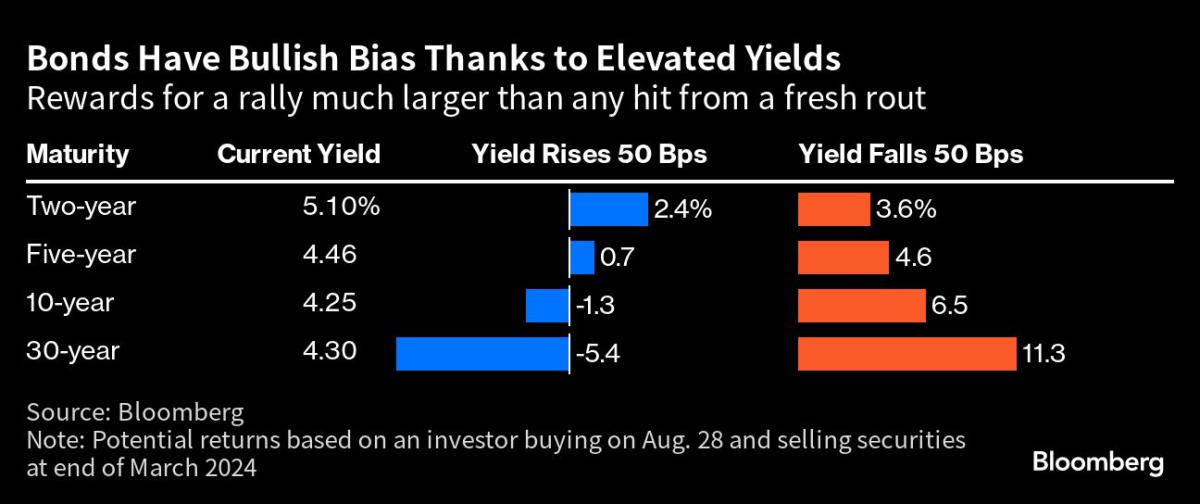

The recent sell-off in US bonds has led to a rise in the yield-to-duration ratio, indicating that yields would need to increase significantly to generate losses, providing a potential floor for the struggling market.

Investors should consider moving into longer-dated bonds as historical data shows that the broader U.S. bond market typically outperforms short-term Treasurys at the end of Federal Reserve rate hiking cycles, according to Saira Malik, chief investment officer at Nuveen.

Despite the appearance of a "Goldilocks" economy, with falling inflation and strong economic growth, rising yields on American government bonds are posing a threat to financial stability, particularly in the commercial property market, where owners may face financial distress due to a combination of rising interest rates and remote work practices. This situation could also impact other sectors and lenders exposed to commercial real estate.

U.S. Treasury yields rise as investors await jobs report for insight into the economy and Fed's monetary policy decisions.

Traders believe that the US Federal Reserve will not raise interest rates further this year, as the latest jobs report showed an increase in unemployment and a cooling wage growth, prompting the Fed to potentially halt rate hikes and keep policy on hold.

Treasury yields are on the move and investors should pay attention to where they might be headed next.

Bank of America Securities' Savita Subramanian sees the recent jump in Treasury yields as a positive signal for the economy, with companies focusing on efficiency and productivity rather than leveraging buybacks and cheap financing costs, driving the next leg of the bull market.

A surge in bond issuance by U.S. investment-grade-rated companies is putting pressure on long-end U.S. Treasuries as investors opt for higher-yielding corporate debt over government bonds.

Federal Reserve policymakers are not eager to raise interest rates, but they are cautious about declaring victory as they monitor data such as inflation and job growth; most do not expect a rate hike at the upcoming policy-setting meeting.

Soaring interest rates have increased the popularity of fixed-income investments like bonds and money market funds in the U.S., but investors should be prepared for higher taxes on the income generated from these assets.

Investors are growing increasingly concerned about the ballooning U.S. federal deficit and its potential impact on the bond market's ability to finance the shortfall at current interest rates, according to Yardeni Research.

The Federal Reserve is expected to hold off on raising interest rates, but consumers are still feeling the impact of previous hikes, with credit card rates topping 20%, mortgage rates above 7%, and auto loan rates exceeding 7%.

The Federal Reserve is expected to signal that another rate hike may be necessary due to strong economic growth and inflation metrics, creating a difference of opinion between the equity and bond markets.

The positive momentum surrounding Bitcoin's price is fueled by expectations that the Federal Reserve will not hike rates again this year, while market participants remain optimistic despite the strength of the United States Dollar Index.

Foreign holdings of U.S. Treasuries increased for a second consecutive month in July, reaching $7.655 trillion, despite uncertain interest rates and mixed economic data, with China's holdings dropping to the lowest level since 2009, potentially due to pressure to defend its weakening currency.

The Federal Reserve is expected to keep interest rates steady and signal that it is done raising rates for this economic cycle, as the bond market indicates that inflation trends are moving in the right direction.

The Federal Reserve's continued message of higher interest rates is expected to impact Treasury yields and the U.S. dollar, with the 10-year Treasury yield predicted to experience a slight increase and the U.S. dollar expected to edge higher.

Treasury yields rise and stocks fall as traders anticipate longer-lasting higher rates to prevent inflation, while Brent oil briefly surpasses $95 a barrel; the Federal Reserve's decision on interest rates is eagerly awaited by investors.

U.S. Treasury yields dip slightly as investors await the Federal Reserve's interest rate decision and guidance, while the 10-year yield remains near 16-year highs.

Investors are expected to gravitate towards funds focused on innovative themes as the Federal Reserve cuts interest rates, according to Cathie Wood, founder of ARK Investment Management.

Consumers can benefit from higher interest rates through increased savings rates, with some high-yield savings accounts now offering returns higher than the national inflation rate, providing a low-risk option for those seeking a lower-risk return.

Despite the recent increase in bond yields, investors are advised to continue buying Treasury yields as they are expected to rise further in the coming months.