The Fed's preferred measure of US inflation cooled last month, while consumer spending made a strong recovery; meanwhile, the collapse of a major bridge in Baltimore will cause transportation disruptions in the region, and the yen weakened in Japan to levels last seen in 1990.

Former finance minister Miftah Ismail believes that Pakistan's economy is improving and will continue to grow if the country's talks with the IMF in April result in a favorable loan programme; however, he emphasized the need for important reforms and an increase in the tax base to ensure progress.

Italy's inflation rate rose to 1.3% in March, slower than expected, indicating a successful soft landing for the economy as it balances decelerated growth with controlled inflation.

Japanese exporters have become less willing to convert overseas earnings into yen, resulting in a decrease in yen buying during Tokyo trading hours and contributing to the yen's decline against the dollar and other currencies.

The Indian rupee is expected to appreciate in the long term due to India's strong services and goods export buffers, making it a special case among emerging market currencies, despite risks posed by a weaker Chinese yuan and higher US rates, according to Patrick Law, head of Asia-Pacific fixed income, currencies, and commodities trading at Bank of America.

China, India, and the United States are the top three countries with the most billionaires in 2024, with China experiencing a decline in billionaires due to economic distress and property market crisis.

Rising grocery prices in the US have left consumers frustrated, with statistics showing a 25% increase since the start of the pandemic, leading supermarkets and big box stores to scramble and retail chains like Walmart and Ikea to cut prices on certain items; however, analysis shows that wholesale food prices have risen by an estimated 22.4% since January 2020, with processed food prices up 22%, the second-highest in the last 20 years.

:max_bytes(150000):strip_icc()/Whats-Really-Going-on-With-Food-Prices-FT-BLOG0324-02-b2a25858f5b54e4190a0bdd96e2e0974.jpg)

Initial filings for unemployment benefits in Alabama decreased last week, with new jobless claims declining to 1,894, according to the U.S. Department of Labor.

Pakistan's IT sector is seen as a key component of the country's economic revival, with the establishment of special technology zones and software technology parks aimed at attracting businesses and generating exports, but a robust digital trade policy and digital trade agreements are needed to sustain growth and create opportunities for the tech entrepreneurs.

The Finance Minister of Pakistan, Muhammad Aurangzeb, expressed hope for reaching an agreement with the IMF by the end of the fiscal year and reported good progress on privatising PIA and outsourcing airports, while also encouraging the development of equity and debt markets to fund infrastructure projects.

Nigerian Economy Shows Signs of Progress Amid CBN Policies to Strengthen Naira and Control Inflation

The Central Bank of Nigeria has announced that over $1.5bn has entered the Nigerian economy, indicating the effectiveness of its monetary policy efforts.

Many households will see their budgets stretched further due to rising bills, including phone and broadband costs, water bills, council tax, TV and car fees, and dental charges, but there is some good news with falling energy prices.

Federal Reserve Chair Jerome Powell asserts that there is no reason to believe that the U.S. economy is heading towards a recession, citing strong growth and a favorable labor market.

The top 1% of Americans now have a combined net worth above $44 trillion, with gains mainly driven by the booming stock market, while the value of top earners' privately held businesses declined; the total yearly net worth of all Americans reached a record $156.2 trillion, largely due to increased equity allocations over the past 40 years, according to data from the Federal Reserve.

The text describes the live shows and schedule on Fox News, including shows hosted by Jesse Watters, Hannity, Gutfeld!, and Fox News @ Night.

Inflation is impacting Easter celebrations in the U.S. as prices for goods have risen 18.5% since President Biden took office, with prices for Easter-related items increasing at a faster rate, including eggs, candy, and poultry. The rise in prices is attributed to factors such as bad weather in Western Africa affecting cocoa production, labor disputes, and global trade disruptions.

Republican Representative Nancy Mace claims that crime has skyrocketed since President Joe Biden took office, attributing it to border control policy and equating immigration status with criminality, despite evidence showing that undocumented immigrants do not commit more crime. Critics argue that Mace's statement lacks statistical evidence and point to data indicating a decline in homicides and other crimes during the COVID-19 pandemic.

US inflation data is in line with expectations and does not warrant an overreaction, according to Federal Reserve Chair Jerome Powell, indicating that the central bank's baseline for interest rate cuts remains unchanged.

Federal Reserve Chair Jerome Powell asserts that the latest inflation report is in line with expectations, emphasizing that the central bank still sees inflation as on a "bumpy path" to reaching their target of 2%.

Federal Reserve Chair Jerome Powell stated that the strong economic growth allows the central bank to be patient and emphasized their political independence.

Former finance minister Seth Terkper was a more capable manager of the Ghanaian economy than his successor Ken Ofori-Atta, according to Franklin Cudjoe, the Founding President of IMANI Africa.

African Economic Boom: 5 African Nations Predicted to Have World's Fastest Growing Economies by 2024

African countries, including Niger, Senegal, Ivory Coast, DRC, and Rwanda, are predicted to be the top growth drivers in Africa's economy for 2024, with the continent as a whole expected to see significant growth in the coming years, primarily supported by net exports, private consumption, and gross fixed investment, according to a report by the Economic Commission for Africa. However, the region still faces challenges such as climate catastrophes, geopolitical instability, and debt sustainability risks.

The mortgage market in the UK is showing signs of recovery with increased activity and demand, and there is hope that further rate cuts will stimulate the market and benefit borrowers. However, there are no guarantees that rates will significantly decrease, and it is advised for potential buyers to become 'mortgage ready' by consulting with a mortgage adviser. Additionally, there is a call for innovation in the industry to provide opportunities for renters to transition to homeownership.

The Central Bank of Nigeria has announced that it received an inflow of over $1.5 billion into the economy, indicating positive results from its monetary policy efforts.

Despite positive economic indicators such as growth, low unemployment, and increased wages, Americans remain unhappy with the state of the economy as they perceive that inflation is still high, a perception supported by a recent study suggesting that the current method used to estimate inflation may underestimate its true level.

Federal Reserve Chair Jerome Powell will update his views on U.S. inflation and the economy after data showed price increases running faster than anticipated, despite some improvement in aspects of inflation that the Fed considers important.

Investors should wait for a recession and rate cuts before investing more in stocks, according to market strategist Tony Dwyer, who describes the US economy as a "zombie" that needs to be killed before a recovery can begin. Dwyer believes that a downturn is a buying opportunity for investors, but only if interest rates are lowered and inflation is reduced, setting the stage for an early cycle recovery.

China's central bank is expected to take a cautious approach in resuming the trading of central government bonds, despite President Xi Jinping's instructions, to avoid inflation and exchange rate volatility.

Ark Invest CEO Cathie Wood expressed concern about deflation in a recent shareholder letter, stating that the Federal Reserve's fears about inflation are misplaced and that deflation should be the primary concern. Wood argues that falling prices lead to decreased spending and can have negative economic effects. While some question the validity of Wood's claims, it is important to monitor both inflation and deflation in assessing the state of the economy.

Franklin Cudjoe, Founding President of IMANI Africa, believes that former finance minister Seth Terkper was a better manager of the Ghanaian economy than his successor, Ken Ofori-Atta, due to Terkper's forward-thinking decisions despite his love for Value Added Taxes.

Canada's economic future is predicted to be bleak, with young people being profoundly affected by it, according to a secret report by the Royal Canadian Mounted Police (RCMP), which also highlights the impact of climate change and the decline in living standards for younger generations. The report suggests that the economic troubles will worsen the already challenging affordability conditions for home ownership in cities like Vancouver, Toronto, and Victoria. Moreover, it implies that the election of President Trump marked the beginning of political polarization and mistrust in democratic institutions.

Zambia has reached an agreement with private creditors to restructure its $3.5 billion Eurobond, which observers believe will help resolve the country's debt crisis and provide hope for other African nations seeking debt restructuring.

The Federal Reserve's preferred inflation measure, the personal consumption expenditures price index, has risen according to the latest report, and Fed Chair Jerome Powell assures that there are no surprises in the data and inflation risks are not elevated.

US inflation rose in February, with the annual consumer price index increasing to 2.5%, indicating that the Federal Reserve may be cautious about cutting interest rates too soon. Household spending also surged, potentially maintaining higher inflation levels, while the core PCE inflation rate remained above the Fed's 2% target.

China's overcapacity in the clean energy sector will only be temporary, as long as there is global demand for green transitions, according to former Chinese economic officials, who believe that exploring more market opportunities through the Belt and Road Initiative is crucial.

French inflation has dropped below 3% for the first time in 2.5 years, and Italy has reported a lower-than-expected reading, signaling a trend that may lead to the European Central Bank cutting interest rates.

Mortgage rates have slightly declined, with the average interest rate for 30-year fixed-rate mortgages at 6.79%, providing some relief for prospective homebuyers, although mortgage applications have decreased and it is now cheaper to rent than to buy in many major metro areas in the US.

The coronavirus pandemic has led to a shift in American spending habits, with less emphasis on saving and more on experiencing life through travel, concerts, and other activities. Despite concerns about financial stability, people are prioritizing enjoying the present moment and creating memorable experiences.

The Federal Trade Commission (FTC) is calling for further analysis into the profit margins of the grocery sector, noting that the increasing profits are contributing to inflation and casting doubt on the idea that rising prices are solely the result of retailers' costs.

Federal Reserve Chair Jerome Powell is not becoming more tolerant of higher inflation, but he faces challenges in reconciling economic risks, a divided group of policymakers, and public expectations of interest rate cuts starting in June. The Fed may proceed with a June rate cut by framing it as a one-off adjustment, even if inflation remains persistent, to hedge risks and address concerns of both sides. Upcoming data will play a crucial role in determining the future course of action.

The United States is facing a significant increase in electricity demand due to factors such as AI, cryptocurrencies, and the pursuit of a green economy, but the Biden administration is not adequately prepared to meet this demand, requiring a combination of natural gas power, nuclear power, and some green energy.

Foreign executives are cautious about increasing corporate investment in China due to concerns about economic recovery, regulation, government ties of Chinese companies, and relations with the United States, despite the Chinese government's efforts to attract foreign investment.

Japan's Nikkei share average ended higher driven by chip-related heavyweights and posted a record fiscal-year gain, supported by foreign buying and a weaker yen.

India's exports have reached an all-time high due to bilateral agreements, free trade agreements, and expansion into new markets like Africa, Latin America, and Central Asia, resulting in a surge in exports of various sectors including precious metals, minerals, automobiles, electronics, pharmaceuticals, and defense equipment.

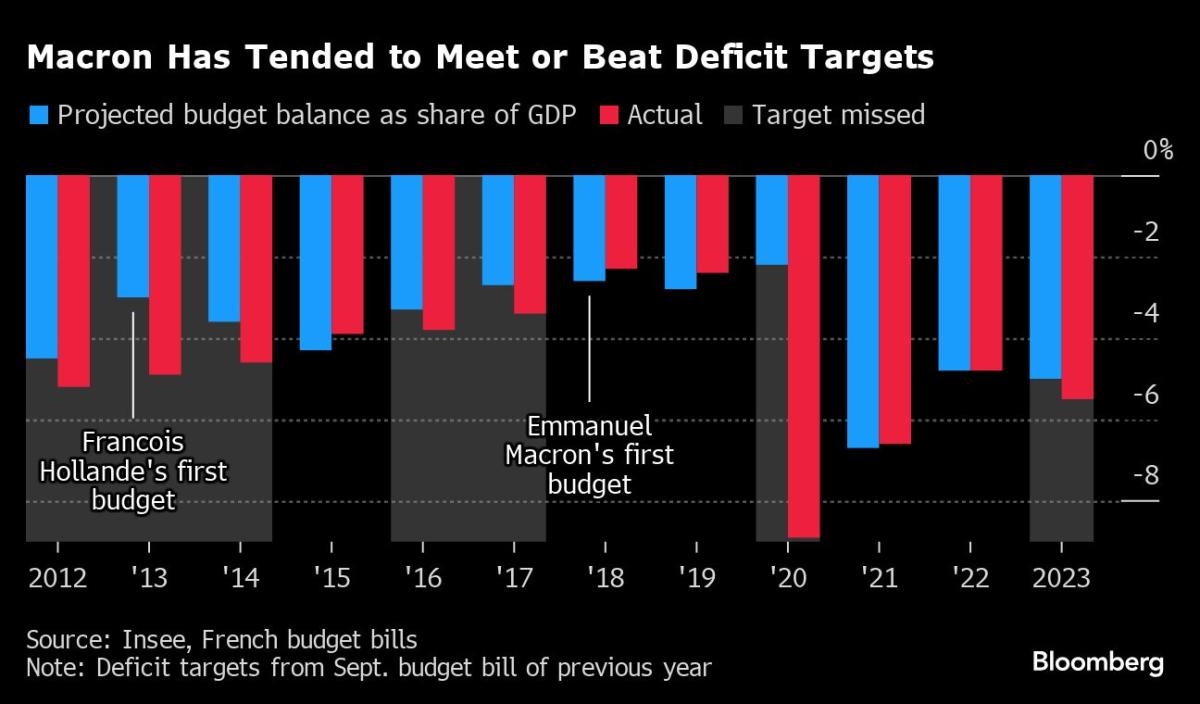

Some major European economies are on an unsustainable economic path due to growing debt, but there are examples of success such as Poland's economic miracle and Sweden's pension system, indicating that economic growth is possible within the EU. However, the decline in larger economies like France and Germany, caused by internal issues, needs to be addressed through measures like reducing bureaucracy, raising retirement ages, and incentivizing work. Overall, Europe must make necessary reforms to avoid a future financial crisis.

Spain's economy is thriving, outperforming its European counterparts with strong growth driven by domestic consumption and investment, resulting in high employment rates, increased house prices, and positive outlook for the future.

Pakistan's Finance Minister, Ishaq Dar, has indicated that the new government is considering resuming trade with India, a move that would benefit both countries economically and potentially lead to greater stability in the region.

China's first-generation of migrant workers, who played a vital role in the country's economic growth, are struggling to find jobs as they grow older in a slowing economy, with limited pensions and health insurance, forcing many to continue working beyond the age of 60.

Australia aims to increase its role in the rare earths supply chain with a new mine and processing facility, but faces challenges due to China's dominance in the sector.

Easter processions take place in Spain; orphaned boy in Gaza hopes to be reunited with family in Canada; Australia aims to improve Chinese export hurdles for beef and lobsters; Jake Allen traded to New Jersey Devils; Jordanians protest against peace treaty with Israel; another N.B. Tory dissents against Premier Higgs; Brazil's Bolsonaro requests court permission to visit Israel; Obama strategizes with Biden campaign; Trump argues lies help uncover truth.